Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Argo Blockchain reduces its 2022 debt by 50%, bringing it to $75 million.

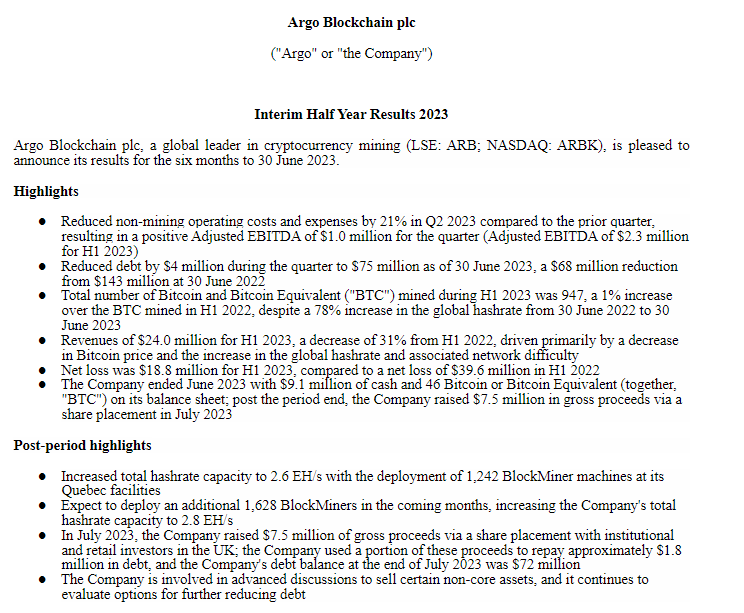

The Argo Blockchain mining firm, which is among several companies facing challenges due to adverse market conditions and a fiercely competitive mining landscape, reported net losses of $18.8 million for the first half of 2023, a reduction of over 50% from a net loss of $39.6 million in H1 2022.

Argo also indicated that it has decreased its debt by $4 million in 2023, bringing its total debt to $75 million. The company has successfully reduced its debt by $68 million, having had a debt of $143 million in June 2022.

Revenues fell by 31% compared to H1 2022, with Argo generating $24 million halfway through 2023, which it attributed to a decline in Bitcoin (BTC) value and an increase in the global hash rate along with the corresponding network difficulty.

Argo reported that it mined a total of 947 BTC during the first half of the year, reflecting a mere 1% increase in BTC mined compared to the same timeframe in 2022. It is important to note that 2023 has experienced a 78% rise in the global hash rate.

As of June 2023, Argo’s balance sheet shows $9.1 million in cash reserves and 46 BTC. The company commenced the second half of the year by raising $7.5 million in gross proceeds through a share placement in July 2022 aimed at institutional and retail investors.

Related: Argo Blockchain reports insufficient funds, ‘no assurance’ it can avoid Chapter 11 bankruptcy

Although the company had cautioned about the possibility of bankruptcy in late 2022, its interim results for the first half of 2023 suggest plans to enhance its total hash rate capacity to 2.8 exahashes per second (EH/s) by deploying approximately 1,628 BlockMiners at its mining facilities in Quebec.

Argo also disclosed that it is in advanced negotiations to divest “certain non-core assets” and is considering additional strategies to lower its overall debt.

Matthew Shaw, chairman of the Argo board, emphasized a “transformational series of transactions” with Galaxy Digital, which involved the sale of its Helios mining facility and property for $65 million in December 2022. Subsequently, Argo refinanced a new $35-million, three-year asset-backed loan with Galaxy.

“The transactions reduced total indebtedness by $41 million and allowed Argo to simplify its operating structure.”

Shaw noted that Argo’s capability to maintain a fleet of over 27,000 miners is vital for its ongoing operations, with around 23,600 Bitmain S19J Pro units functioning at the Helios site under a continuing hosting agreement with Galaxy.

Argo had previously indicated that it was encountering severe financial challenges in late 2022 before finalizing a deal with Galaxy for its Helios facility. In the months following the agreement’s closure, former Argo CEO Peter Wall announced his departure from the company.

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon