Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

A $28,000 Bitcoin is possible, but achieving it will require effort.

Bitcoin’s value experienced a decline for eight straight days leading up to May 13, resulting in a 9.4% correction. The last occurrence of such a losing streak was on June 14, 2022, following the suspension of withdrawals by the Celsius lending platform and the emergence of FUD — fear, uncertainty, and doubt — related to the liquidation of a loan by U.S. software company MicroStrategy at $21,000.

No comparable events transpired as Bitcoin (BTC) tested the $25,800 support level on May 12, aside from network congestion and rising transaction fees. Traders and analysts speculated that a coordinated effort was underway to induce network instability.

Bitcoin is under DoS attack. High transaction fees are the chosen pain point by the attacker, probably to make bitcoin unusable for smaller players. pic.twitter.com/0J56liNSGf

— iris.to/jogi (@proofofjogi) May 7, 2023

As noted by investor and Bitcoin advocate Jogi, elevated fees likely render the network impractical for smaller participants, but they also affect the functionality of layer-2 scaling solutions like the Lightning Network, as initiating and closing payment channels necessitates on-chain transactions.

The current FUD is rapidly diminishing

Regardless of the reasons behind the heightened demand for blockchain space, by May 12, the average transaction fee had already decreased by 83% to $5.10 from a peak of $31 on May 7, according to data from Blockchain.com. Additionally, it is noteworthy that the average transaction fee on the Ethereum network remained above $18 between May 5 and May 11, based on Blockchair data.

Traders are now questioning whether Bitcoin can recover above $28,000 amid the uncertainty surrounding crypto regulations. Data from Bitcoin futures and options indicate moderate weakness, yet a BTC price surge could occur as investors factor in increased probabilities of a U.S. government debt default.

The prevailing high-interest rate environment favors fixed-income trades, while the potential for an economic downturn poses challenges for riskier assets like Bitcoin. Traders should exercise caution, particularly if Bitcoin futures contract premiums turn negative or if there are rising costs for hedging via options.

Bitcoin futures remain neutral despite the price correction

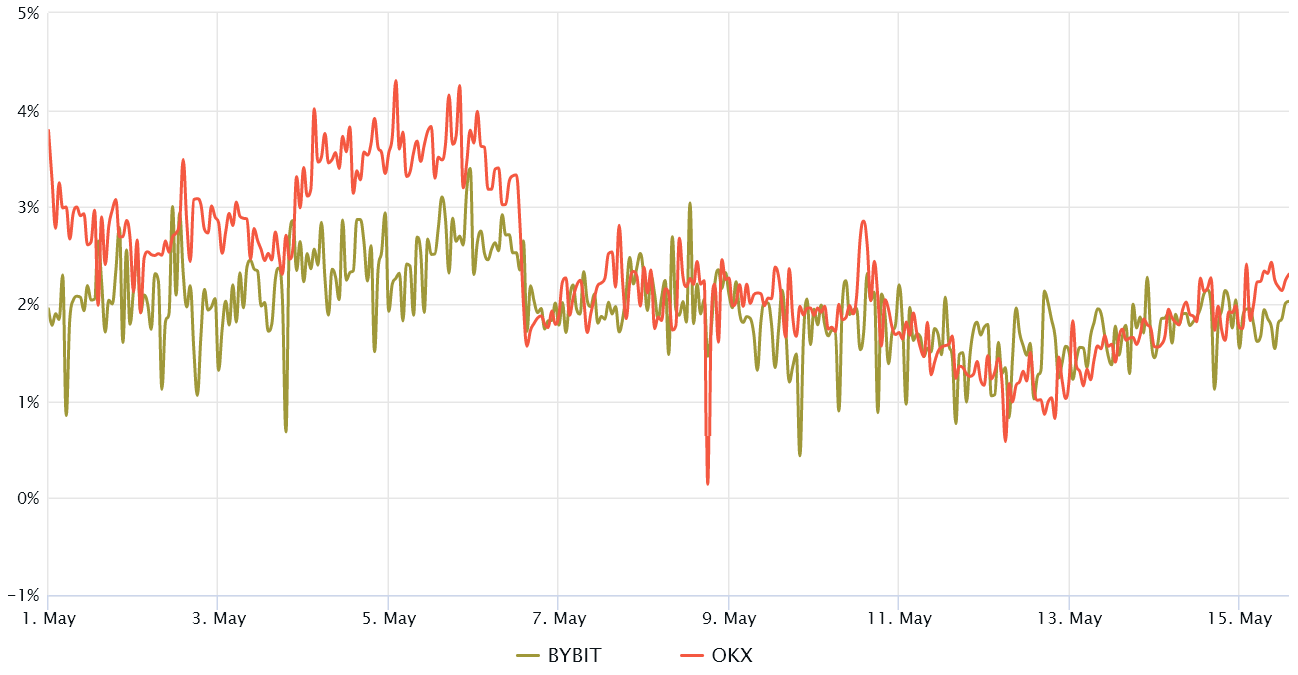

Bitcoin quarterly futures are favored by whales and arbitrage desks. However, these fixed-month contracts generally trade at a slight premium compared to spot markets, suggesting that sellers are demanding more to postpone settlement.

Consequently, BTC futures contracts in robust markets should trade at an annualized premium of 5 to 10% — a condition referred to as contango, which is not exclusive to crypto markets.

Bitcoin 2-month futures annualized premium. Source: Laevitas

Bitcoin 2-month futures annualized premium. Source: Laevitas

Bitcoin traders have exhibited significant caution over the past two weeks. Conversely, the BTC futures premium remained at 1% or higher even following the 12.7% seven-day correction that concluded with a low of $25,830 on May 12.

Bitcoin options risk metric remained neutral

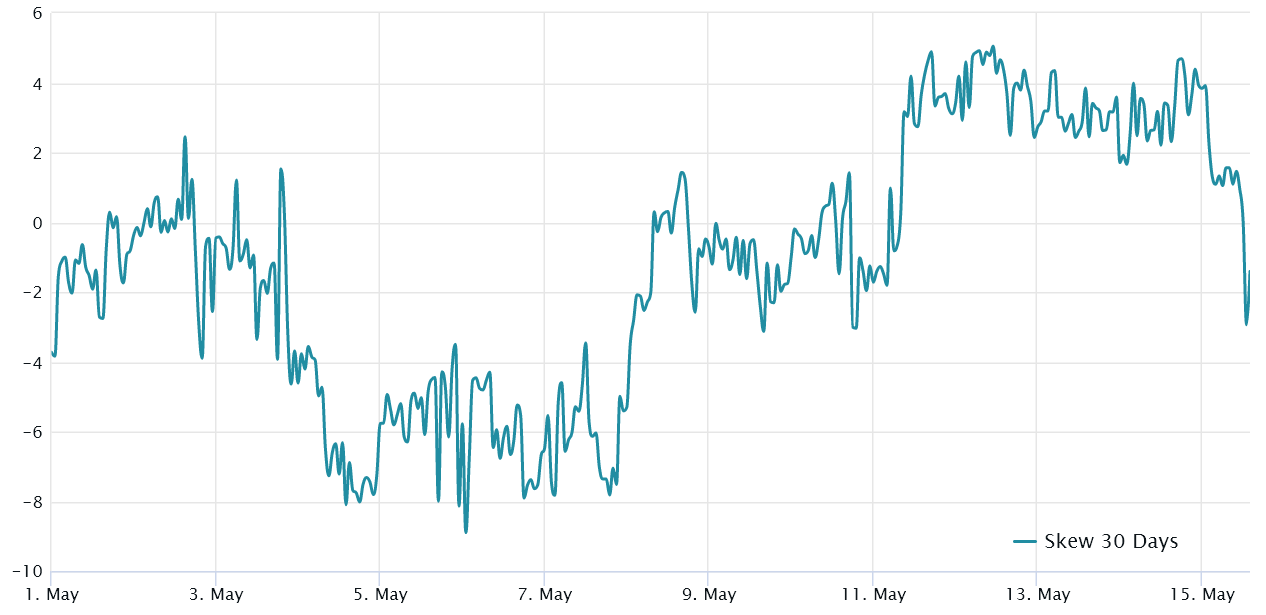

Traders should also evaluate options markets to determine if the recent correction has led to increased optimism among investors. The 25% delta skew serves as an important indicator of when arbitrage desks and market makers charge excessively for upside or downside protection.

In summary, if traders expect a decline in Bitcoin’s price, the skew metric will rise above 7%, while periods of enthusiasm typically exhibit a negative 7% skew.

Related: Bitcoin a top 3 asset in the event of US debt default: Survey

Bitcoin 30-day options 25% delta skew. Source: Laevitas

Bitcoin 30-day options 25% delta skew. Source: Laevitas

As illustrated above, based on the BTC options 25% delta skew, traders have grown increasingly bearish as the indicator surged to 4% on May 11. Although still in the neutral range, this marks a significant shift from the previous week, when the metric approached bullish sentiment at negative 8%.

Bitcoin options and futures markets indicate that professional traders are less confident, diminishing the likelihood of a swift recovery above $28,000. Nevertheless, one might interpret the overall movement as bullish since the 12.7% correction did not shift BTC derivatives metrics from neutral to bearish.

As a result, those anticipating a bull trap, suggesting a more profound Bitcoin price correction is forthcoming, may find themselves disappointed.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.