Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

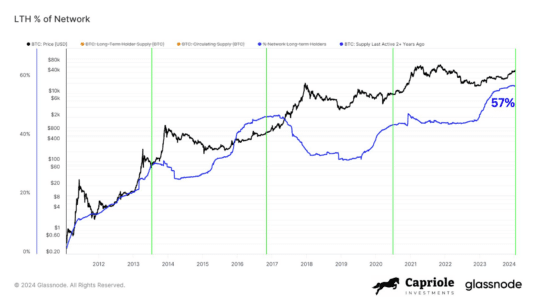

57% of Bitcoin (BTC) Remains Unchanged Over the Past Two Years

- On-chain data indicates that 57% of all Bitcoin (BTC) has remained inactive for at least two years.

As highlighted by Charles Edwards, founder of Capriole Investments, in a post on X, the BTC supply that has been dormant for a minimum of two years has recently been reaching new all-time highs (ATHs).

This metric is achieving all-time highs repeatedly. 57% of all Bitcoin is held by investors who haven’t moved it in over 2 years. This results in a significant supply squeeze for Bitcoin, which has historically preceded all bull markets.

But there’s more… pic.twitter.com/jTUs2fPzEW

— Charles Edwards (@caprioleio) January 11, 2024

Investors who have held BTC for this extended period represent a portion of the broader “long-term holder” (LTH) category. LTHs are defined as those who have retained their coins for at least 155 days.

Statistically, the longer holders keep their coins on the blockchain, the less probable it is that they will move them at any time.

For this reason, LTHs are viewed as the more resolute segment of the BTC market.

The segment of holders for over 2 years includes those investors who exhibit the most steadfast commitment among these HODLers, as their holding duration significantly exceeds 155 days.

Here is a chart illustrating the trend in the percentage of the total circulating Bitcoin supply held by this LTH segment throughout the history of the cryptocurrency:

Bitcoin Long Time Holders

Bitcoin Long Time Holders

The graph above shows that the supply held by these LTHs has been on an upward trend since the FTX collapse and has consistently set new ATHs.

Recently, the growth of this metric has slightly slowed, yet it continues to rise. Currently, approximately 57% of the Bitcoin supply is retained by these HODLers.

See Also: Bitcoin Is An Opportunity You Shouldn’t Miss: Andrew Tate To Crypto Investors

Edwards points out that this is resulting in a significant supply squeeze for the cryptocurrency.

The quant has also noted that a similar pattern has been observed leading up to all previous bull runs (indicated by the green lines in the chart).

With the US SEC having finally approved Bitcoin spot ETFs, Edwards explained that this could further deepen the supply shock since “the ETFs were only approved for CASH subscriptions (not in-kind). Therefore, every purchase removes more Bitcoin from the market.”

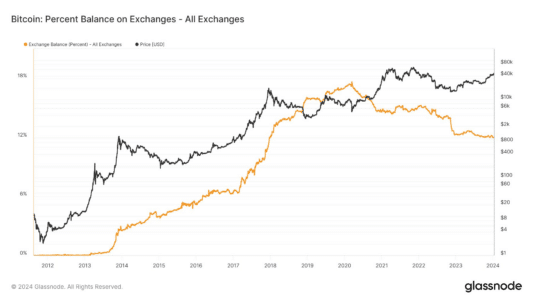

Chart analyst James V. Straten shared another perspective on a potential supply shock developing in the asset.

Bitcoin Supply In Crypto Exchanges

Bitcoin Supply In Crypto Exchanges

The graph above presents data on the percentage of Bitcoin supply held in the wallets of centralized exchanges.

This metric has been declining over the past few days, with only 12% of all BTC currently stored on these platforms.

The supply on exchanges is considerably more likely to be involved in trading activities (as that is the primary function of these platforms), so a decrease indicates that the effective trading supply of the asset is also diminishing.

BTC Price

At the time of this report, Bitcoin is trading at approximately $45,900, reflecting an increase of over 4% in the past week.

BTC Price Chart | Source: Coinstats

BTC Price Chart | Source: Coinstats

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

The post Did You Know That 57% Of Bitcoin (BTC) Hasn’t Moved In 2 Years? appeared first on BitcoinWorld.