Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

XRP’s value rises by 5% following Singapore licensing acquisition during a decline in the cryptocurrency market.

Ripple’s XRP has emerged as one of the few assets to gain value during a lackluster 24-hour period in the cryptocurrency market, where Bitcoin (BTC) and other leading digital currencies experienced declines.

According to data from CryptoSlate, XRP increased by roughly 5%, reaching $0.53018 at the time of reporting. This rise follows Ripple’s notable achievements during the reporting period, including obtaining licensing in Singapore and Judge Analisa Torres denying the U.S. Securities and Exchange Commission’s (SEC) request for an interlocutory appeal.

Ripple’s Licensing in Singapore

Earlier today, Ripple announced that its subsidiary, Ripple Markets APAC Pte Ltd, has obtained a “full” Major Payments Institution (MPI) license from the Monetary Authority of Singapore (MAS) to offer digital payment token services within the nation. The crypto payment firm received in-principle approval from the regulator in June.

The MPI license allows companies to operate without daily and monthly transaction limits. To be eligible, the business must be a Singapore-registered entity or branch, maintain a permanent business address for record-keeping, possess a minimum capital of $250,000, and appoint at least one director who is a Singaporean citizen or resident.

Ripple CEO Brad Garlinghouse characterized Singapore as a “progressive jurisdiction” that has “evolved into one of the leading fintech and digital asset centers, balancing innovation, consumer protection, and responsible growth.”

Additionally, Judge Torres’s ruling concludes the legal dispute between the company and the SEC for this year, with both parties set for trial by April 23, 2024.

Potential Selling Pressure Ahead

Despite this recent increase, XRP faces significant selling pressure as Ripple has recently released one billion tokens from its escrow system.

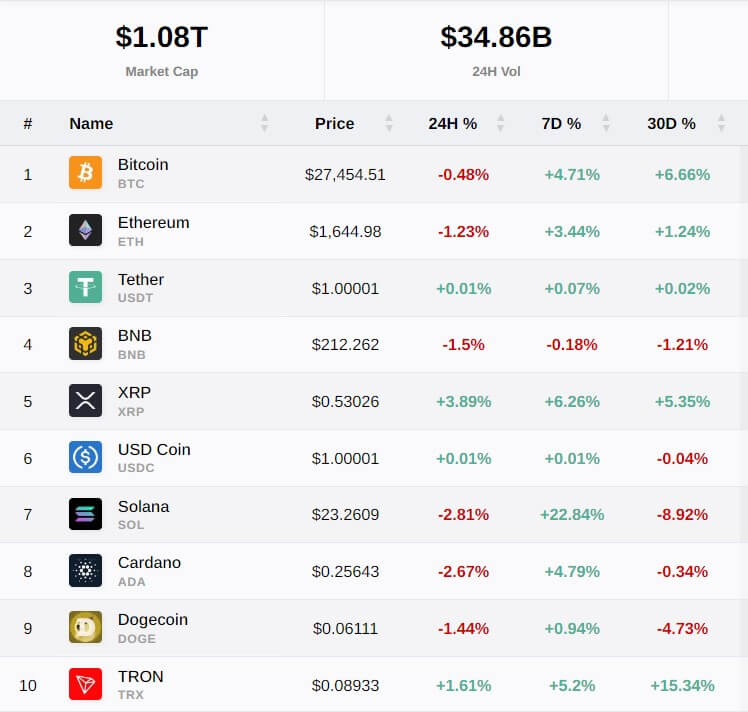

Top 10 Assets by Market Cap. (Source: CryptoSlate)

Top 10 Assets by Market Cap. (Source: CryptoSlate)

While the crypto payment firm promptly relocked 800 million XRP, the company still retains 200 million tokens that could introduce over $100 million in selling pressure to the market, potentially impacting the current upward trend of the asset.

The post Ripple’s XRP price jumps 5% fueled by Singapore licensing acquisition amidst crypto market downturn appeared first on CryptoSlate.