Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

US debt approaches $35 trillion, Bitcoin essential for weathering ‘catastrophic’ downfall – Voorhees

In a turbulent political atmosphere in the US, financial expert Michael A. Gayed recently noted that the escalating national debt, now surpassing $35 trillion, poses a greater danger to democracy than political figures. Gayed underscores that the rapid increase in debt outstrips both tax revenues and inflation, leading to a precarious fiscal landscape.

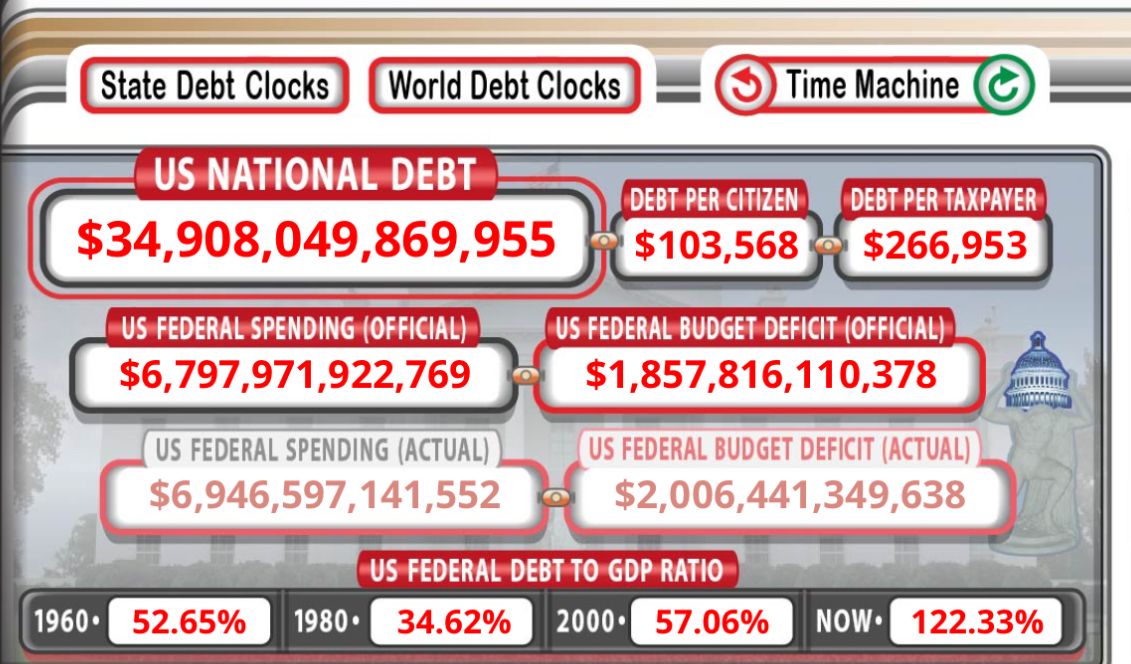

The ratio of US federal debt to GDP, which has surged from 52.65% in 1960 to 122.33% today, further exemplifies the unsustainable nature of the country’s fiscal strategies. The risk of a substantial economic downturn intensifies as the debt continues to rise unchecked.

The national debt of the United States has reached $34.9 trillion. Each citizen’s share of the debt is $103,568, while the debt burden per taxpayer has climbed to $266,953. The federal budget deficit is also considerable, with the official figure at $1.8 trillion and the actual deficit surpassing $2 trillion.

US national debt (Debt Clock)

US national debt (Debt Clock)

In response to Gayed’s comments, Erik Voorhees, founder of ShapeShift and a leading advocate in the cryptocurrency space, emphasized the seriousness of the situation. Voorhees claims that the growing debt, regardless of which presidential administration is in power, presents an unavoidable economic peril. He forecasts that the relentless rise in national debt will lead to a disastrous collapse of the bond market, resulting in widespread financial devastation.

Voorhees also asserts that the current political environment, embodied by figures like Trump and Biden, cannot alter this course. The anticipated annual debt increase of over $1 trillion under any plausible scenario underscores the bleak financial prospects. This unsustainable growth in debt, according to Voorhees, poses a greater threat to democracy than any individual political leader.

The ramifications of such an economic breakdown are significant. Voorhees imagines a situation where society might navigate this crisis with integrity and values, potentially emerging more prosperous. However, this would represent a significant departure from the 20th-century concept of large nation-states. He argues that Bitcoin or similar decentralized currencies are vital for this transformation. Through its intrinsic economic game theory, Bitcoin could avert the monetary debasement that fuels the expansion of large nation-states.

Bitcoin’s potential as a more enduring asset compared to fiat currencies, which has yet to be fully acknowledged, could play a crucial role in this transition. Voorhees believes that as Bitcoin is recognized as a more stable store of value over generations, it may restrict the growth of large nation-states by curtailing their capacity to inflate their currencies.

If Republicans achieve victory in November, Voorhees suggests that Trump and Vance are unlikely to materially decrease the debt, but they could create a conducive environment for cryptocurrency to flourish. This would allow the foundations of crypto to strengthen within the cultural and economic framework, potentially equipping them to endure the expected financial turmoil.

“The best thing Trump/Vance can do during their administration, since they cannot (and won’t) materially reduce the debt situation, is to create four years of permissive space in which crypto may thrive, unpersecuted.”

Voorhees’ viewpoint reflects a wider sentiment within the cryptocurrency community, which sees decentralized digital assets as a potential buffer against the economic volatility of substantial national debts. The cryptocurrency sector’s capacity to offer an alternative to conventional fiat systems may be essential in addressing future financial obstacles.

The post US debt nears $35 trillion, Bitcoin key to surviving ‘catastrophic’ collapse – Voorhees appeared first on CryptoSlate.