Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

U.S. regains leadership in Bitcoin market amid changes in supply.

Historically, the majority of cryptocurrency trading volume has originated from outside the U.S., with Asia recognized as the largest market for cryptocurrencies. Nevertheless, a significant change has occurred in recent months, with the U.S. reestablishing itself as the leading player in the Bitcoin market.

This transformation is apparent when examining the changes in Bitcoin’s price and supply distribution between Asia and the U.S.

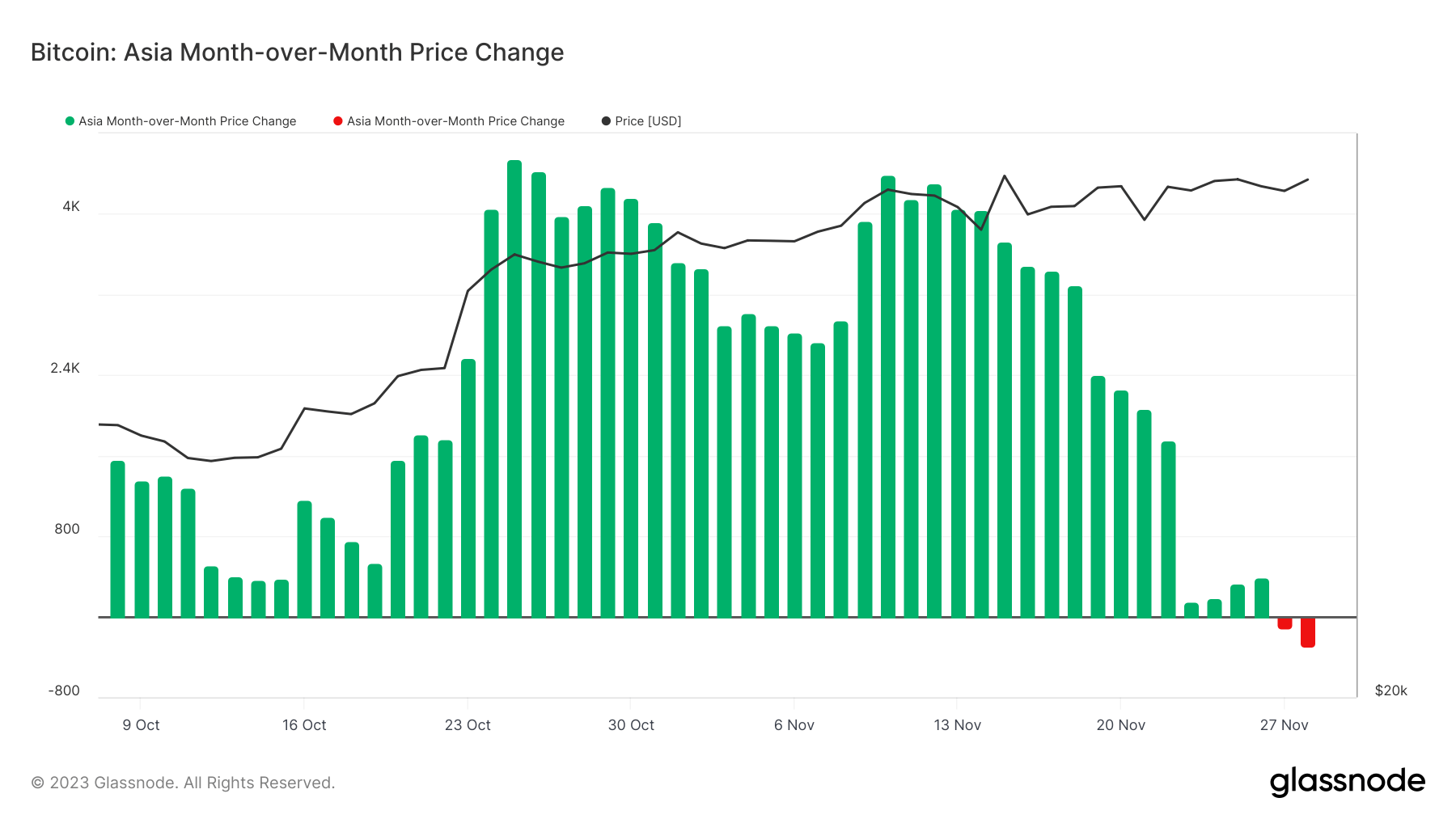

Analyzing the month-over-month price fluctuations of Bitcoin during Asian working hours reveals regional variations in Bitcoin’s price, which reflect the market’s reaction to various economic and political factors unique to Asia. The trends identified here highlight the level of market engagement and investor sentiment in the region, providing insight into how regional dynamics influence Bitcoin’s global pricing.

Data from Glassnode indicates a significant decline in the 30-day change in Bitcoin’s price recorded during Asian working hours in November.

Graph illustrating the month-over-month price change of Bitcoin during Asian working hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)

Graph illustrating the month-over-month price change of Bitcoin during Asian working hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)

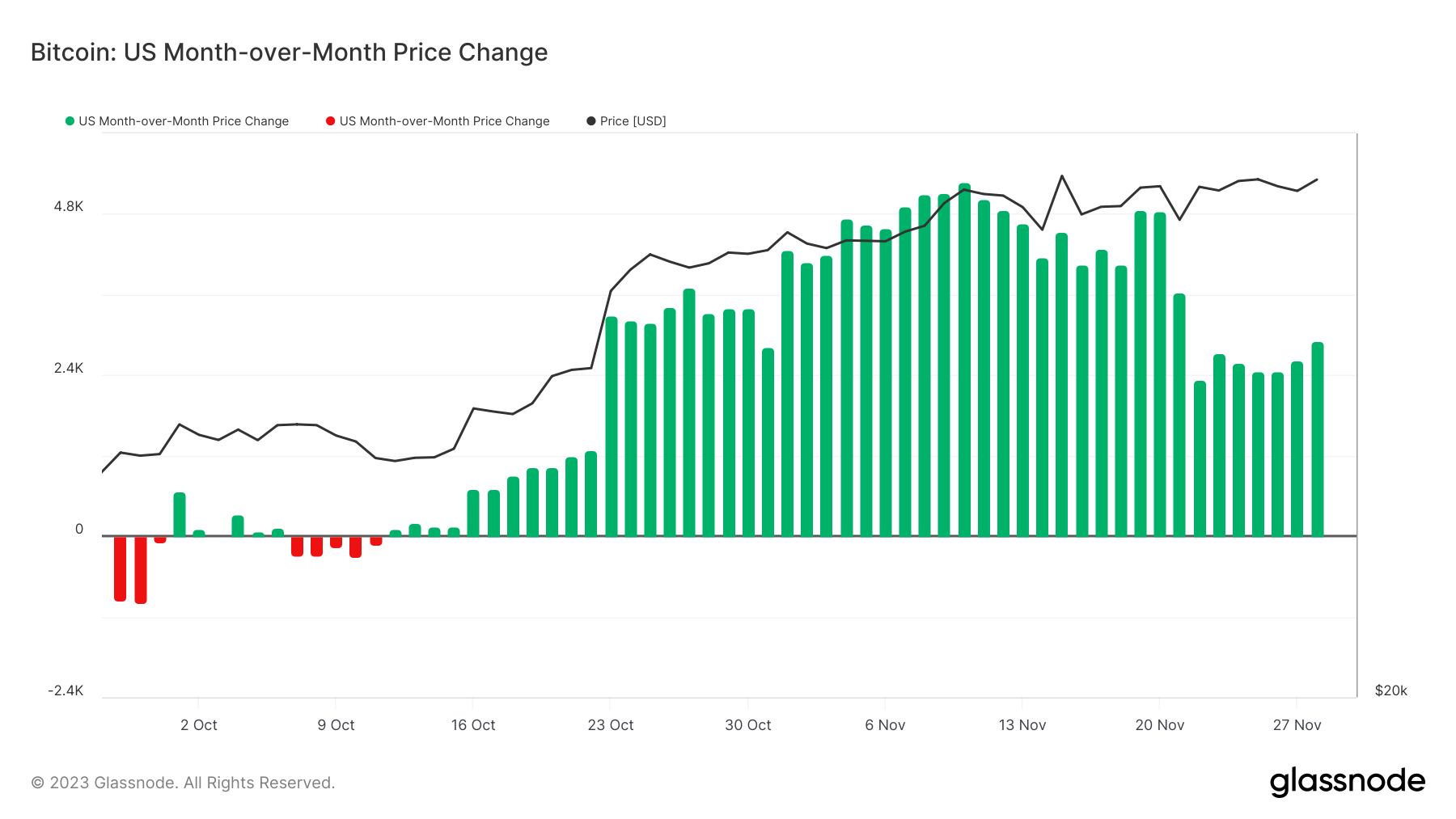

The month-over-month price change during U.S. working hours contrasts with the data from the Asian market, showcasing a different market behavior and investor sentiment. The U.S. market exerts a considerable influence on Bitcoin’s price, despite fluctuations in trading volumes and market participation compared to the Asian market.

Graph illustrating the month-over-month price change of Bitcoin during U.S. working hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)

Graph illustrating the month-over-month price change of Bitcoin during U.S. working hours from Oct. 1 to Nov. 28, 2023 (Source: Glassnode)

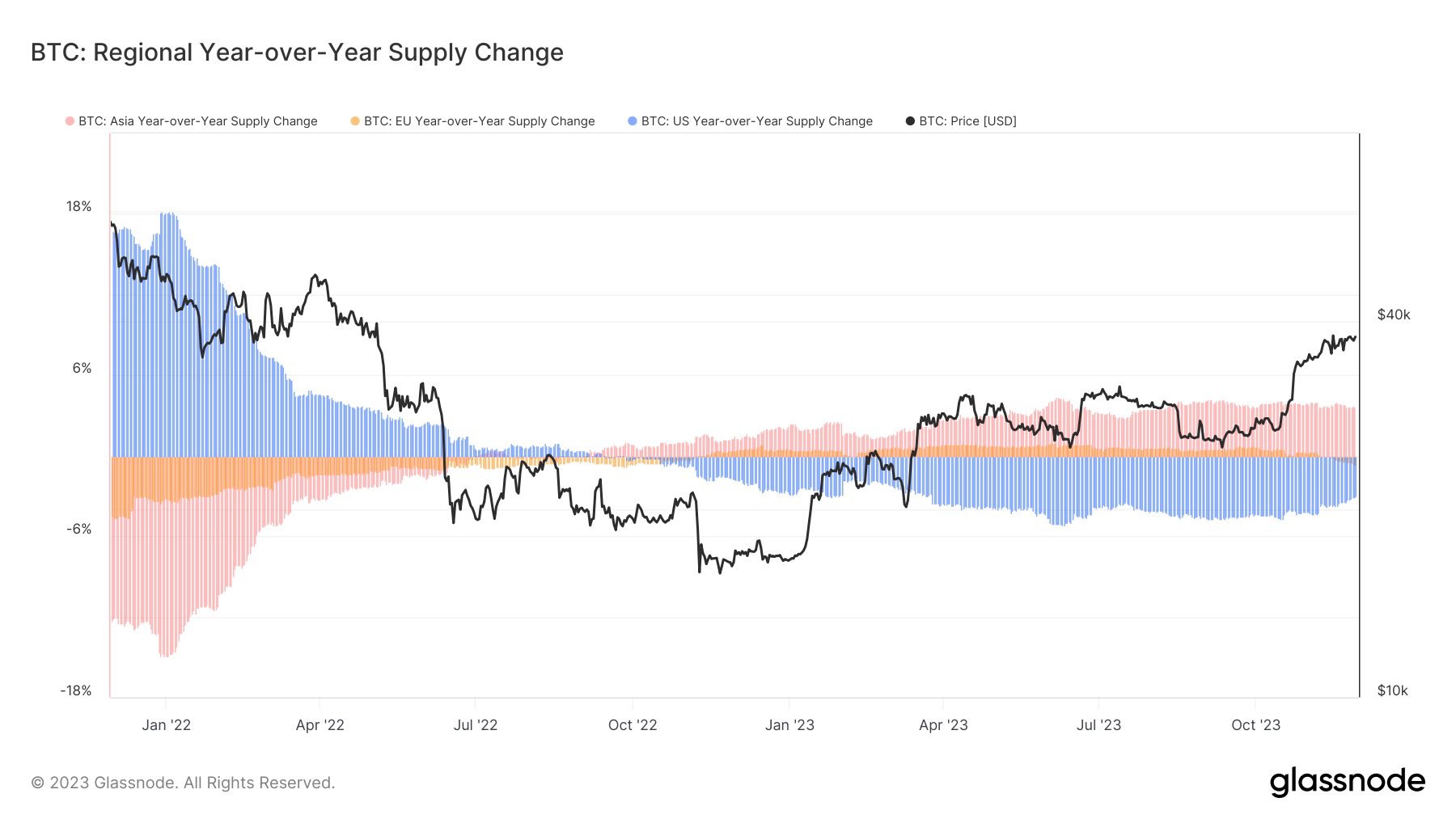

The year-over-year change in Bitcoin’s supply across various regions is essential for understanding the shifts in regional dominance or decline regarding Bitcoin holdings. A notable observation from this dataset is the trend in U.S. holdings, which have been on a downward trajectory since September 2022. Conversely, the supply held by investors in Asia has been on the rise, showing a 3.7% year-over-year increase as of Nov. 28.

Graph illustrating the year-over-year change in the share of Bitcoin supply held or traded in Asia, the U.S., and the E.U. from November 2021 to November 2023 (Source: Glassnode)

Graph illustrating the year-over-year change in the share of Bitcoin supply held or traded in Asia, the U.S., and the E.U. from November 2021 to November 2023 (Source: Glassnode)

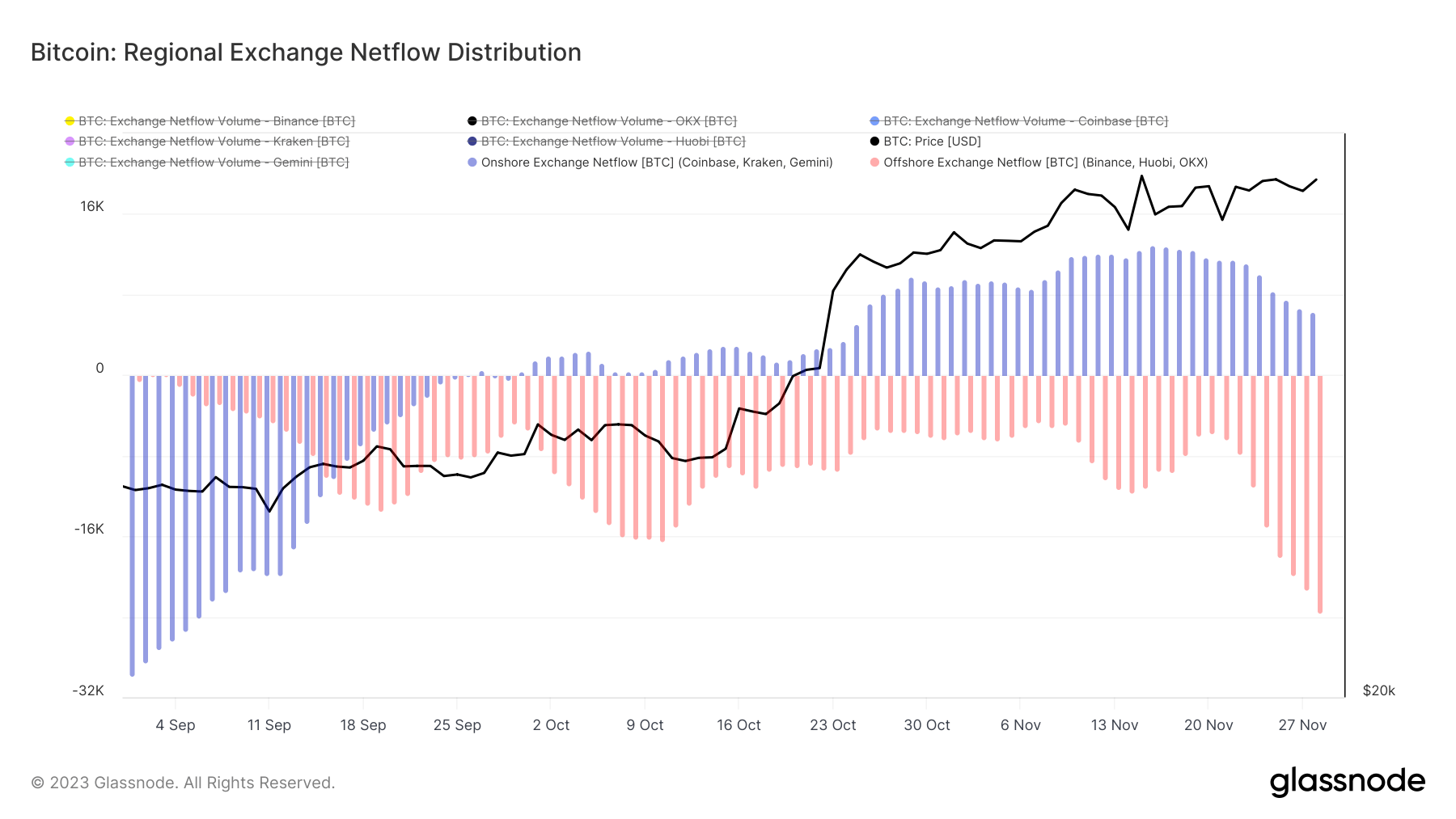

Additionally, the net flow of Bitcoin into and out of exchanges, both domestically and internationally, serves as a strong indicator of investor sentiment and market activity. For example, a net inflow may suggest a bullish market sentiment, with investors purchasing or holding Bitcoin. In contrast, a net outflow could signify bearish sentiment, characterized by selling or a prevailing lack of confidence.

Over the past two months, U.S. exchanges such as Coinbase, Kraken, and Gemini have experienced a substantial increase in inflows. Meanwhile, offshore exchanges like Binance, Huobi, and OKX have reported net outflows since early September.

Graph illustrating the net flow of BTC in and out of exchanges based on their location relative to the U.S. from Sep. 1 to Nov. 28, 2023 (Source: Glassnode)

Graph illustrating the net flow of BTC in and out of exchanges based on their location relative to the U.S. from Sep. 1 to Nov. 28, 2023 (Source: Glassnode)

Despite a decline in the year-over-year supply of Bitcoin in the U.S., the country’s impact on Bitcoin’s price remains significant. This situation suggests that the remaining Bitcoin supply in the U.S. may be held by influential market participants or institutions capable of substantially affecting market prices. This contradictory trend emphasizes the vital role of the U.S. market within the Bitcoin ecosystem. The diminishing supply could be linked to various factors, including regulatory conditions and strategic investment choices. At the same time, the increasing influence on price indicates a market where decision-making and power are concentrated among a select group of U.S.-based investors or institutions.

The post U.S. reclaims dominance in Bitcoin market despite supply shift appeared first on CryptoSlate.