Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Trading volumes on centralized exchanges reach annual low, while South Korean platforms defy the trend.

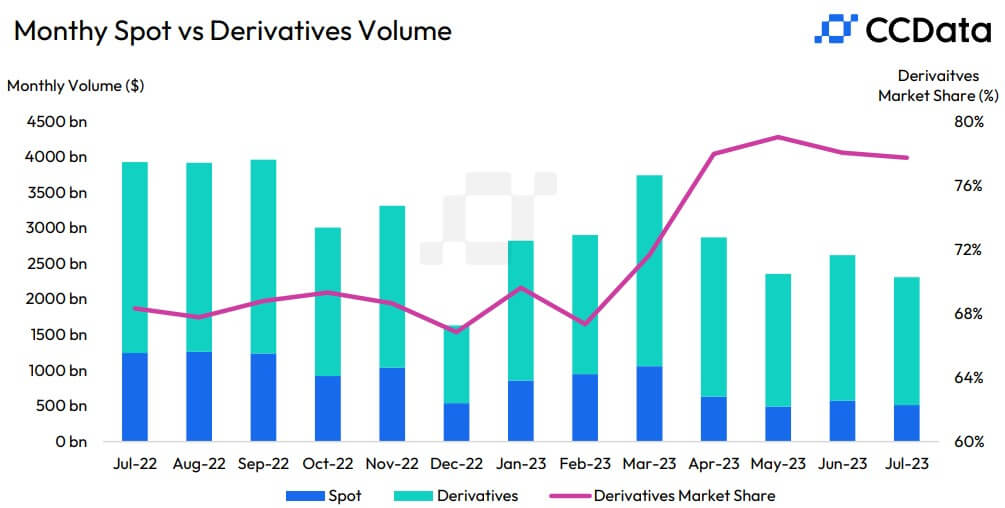

Trading in cryptocurrencies on centralized exchanges decreased by 12% to $2.36 trillion. This marks the lowest volume recorded since the start of the year, reflecting a notable decline in trading activity, as reported by CCData.

An analysis of these trading activities revealed that spot trading volume dropped 10.5% to $515 billion — the second-lowest figure since March 2019. Conversely, derivatives volume decreased by 12.7% to $1.85 trillion, which is the second-lowest level since December 2020.

The crypto research firm linked the reduced volume to the absence of price volatility in major crypto assets, such as Bitcoin (BTC) and Ethereum (ETH), which typically influence trading volumes. CryptoSlate Insight noted that BTC’s price fluctuations in July were “tightly constrained,” with the leading digital asset experiencing “virtually no change in its price” on certain days.

Source: CCData

Source: CCData

Binance’s market share continues to decline

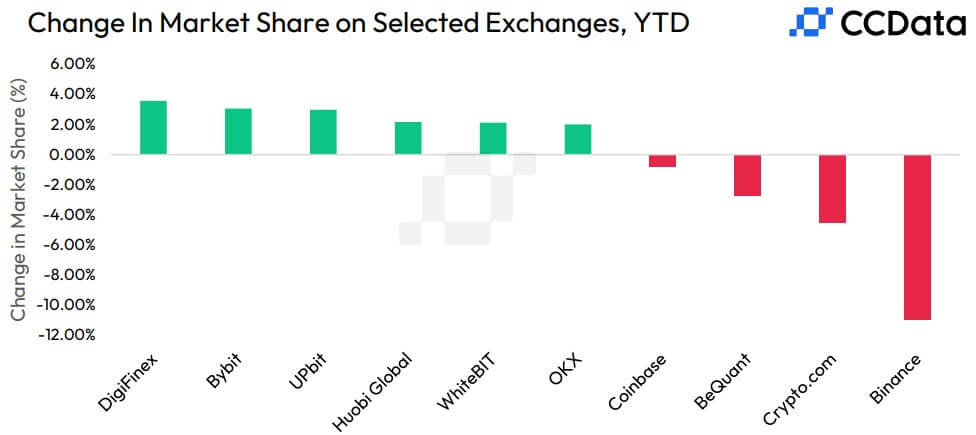

CCData indicated that Binance’s market share has decreased for the fifth month in a row, despite being the largest crypto exchange by trading volume.

The report stated that Binance recorded $208 billion in spot trading activities in July, significantly ahead of competitors such as Coinbase, Kraken, and UpBit. However, its market share fell to 40.4% in July, the lowest level since last August.

Source: CCData

Source: CCData

In July, Binance’s regulatory challenges became more evident as it withdrew from several European markets, including the Netherlands, Cyprus, Germany, and the U.K., due to its failure to obtain suitable licensing in these areas.

While the exchange achieved minor successes with recent regulatory approvals in Dubai and Japan, trust in the platform remains unsettled as the U.S. Department of Justice reportedly considers fraud charges against it.

South Korean exchanges gain prominence

CCData observed that South Korean exchanges, such as UpBit, Bithumb, and CoinOne, defied the overall decline trend by experiencing an increase in their volumes during the previous month.

According to the report, UpBit is now the second-largest exchange by trading volume after surpassing more established competitors like Coinbase and OKX during this period. The exchange’s volume surged by 42.3% to $29.8 billion, while its competitors’ volumes fell. This increase also indicates that the platform represents approximately 6% of the total trading volumes across centralized exchanges.

Furthermore, Bithumb and CoinOne reported volume increases of 27.9% and 4.72%, reaching $6.09 billion and $1.39 billion, respectively.

The post Centralized exchange trading volumes hit yearly low, though South Korean exchanges resist trend appeared first on CryptoSlate.