Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The evolving dynamics of Bitcoin futures and options exchanges

The present condition of Bitcoin’s options and futures markets is experiencing a significant transformation, mirroring a wider evolution in the cryptocurrency trading environment.

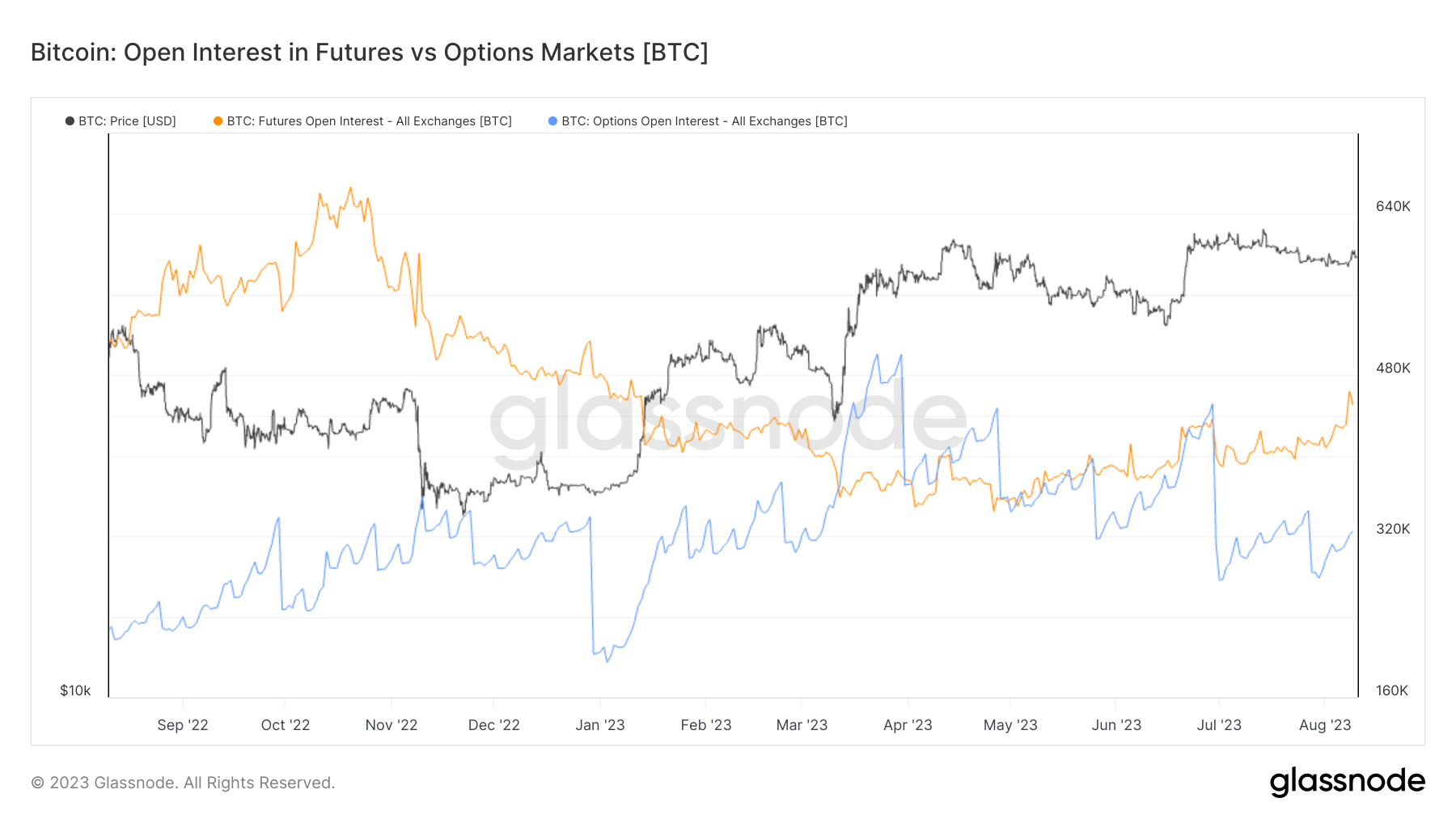

In the past year, Bitcoin options markets have observed a considerable increase in growth, with open interest more than doubling. This rise in options trading signifies a heightened interest in strategic financial instruments that provide flexibility and risk management features.

Options now compete with futures markets regarding the scale of open interest, indicating a change in trading tactics and potentially a sign of market maturation.

Conversely, futures open interest has been consistently declining since the downfall of FTX in November 2022.

This decrease may be seen as a sign of diminishing confidence in the futures market, raising issues about stability and risk management practices. Nevertheless, 2023 has recorded a slight uptick in futures open interest, suggesting a cautious re-entry of traders, although the overall trend remains unfavorable when compared to the options market.

The current open interest for Bitcoin futures stands at 420,000 BTC, while Bitcoin options have an open interest of 312,000 BTC.

Graph illustrating the open interest in Bitcoin futures and options from August 2022 to August 2023 (Source: Glassnode)

Graph illustrating the open interest in Bitcoin futures and options from August 2022 to August 2023 (Source: Glassnode)

The increase in Bitcoin options trading indicates a more strategic and risk-conscious approach to Bitcoin trading. Options, which grant the right but not the obligation to buy or sell an asset at a specified price, are preferred over futures, which require the buyer to purchase or the seller to sell the asset at a predetermined future date and price.

This transition has significant implications for market structure, regulation, and overall market dynamics. The growth in options trading could result in altered price behaviors, influencing the overall volatility of Bitcoin’s price.

Options offer leverage, which can magnify both profits and losses, drawing in more speculative trading. While this can enhance liquidity, it may also lead to increased short-term volatility as traders rapidly enter and exit positions.

However, it is crucial to recognize that options can also serve as a stabilizing element for the broader cryptocurrency market. Since options are frequently utilized as a hedging mechanism to guard against unfavorable price shifts, they can effectively establish a floor on potential losses, potentially alleviating sharp declines during market downturns.

The transition from futures to options may also alter the competitive landscape of exchanges that provide these products. Platforms that concentrate on options might experience growth, while those focused on futures could encounter difficulties.

The data may also indicate shifts in investor behavior, possibly reflecting increased institutional involvement in options as a risk management strategy and a potential decline in speculative trading in futures.

The post The changing landscape of Bitcoin futures and options markets appeared first on CryptoSlate.