Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The 10-2 Treasury yield gap: An indicator of potential economic decline?

Treasury yields serve as a crucial market driver and indicator. They represent the return an investor can expect from holding a government bond until maturity, offering insights into investor sentiment, anticipated future interest rates, and the overall economic condition of a country.

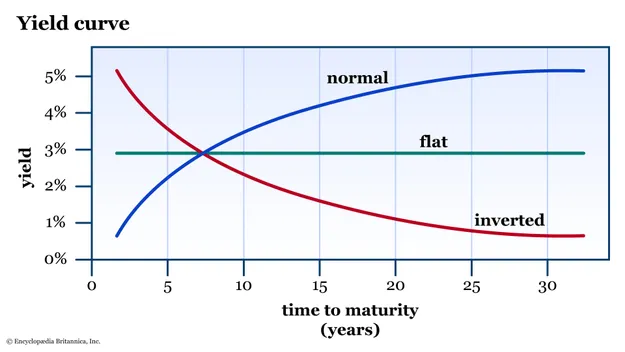

In the examination of Treasury yields, it is vital to differentiate between two primary yield movements — inversion and flattening.

A yield curve illustrates the yields of bonds that possess the same credit quality but have different maturities, providing a visual comparison of short-term yields against long-term yields. Typically, under normal economic circumstances, the curve ascends, indicating that bonds with longer maturities yield more. However, the curve is not fixed. Its shape changes in response to evolving economic conditions and investor sentiment, resulting in occurrences such as inversion and flattening.

Inversion takes place when short-term yields exceed long-term yields. This inversion reflects market participants’ negative outlook on short-term economic conditions.

Graph showing a normal, flat, and inverted yield curve (Source: Britannica)

Graph showing a normal, flat, and inverted yield curve (Source: Britannica)

On the other hand, a flattening yield curve signifies a diminishing gap between short-term and long-term yields. Both of these yield curve movements carry significant implications for the market, often serving as indicators of potential economic downturns.

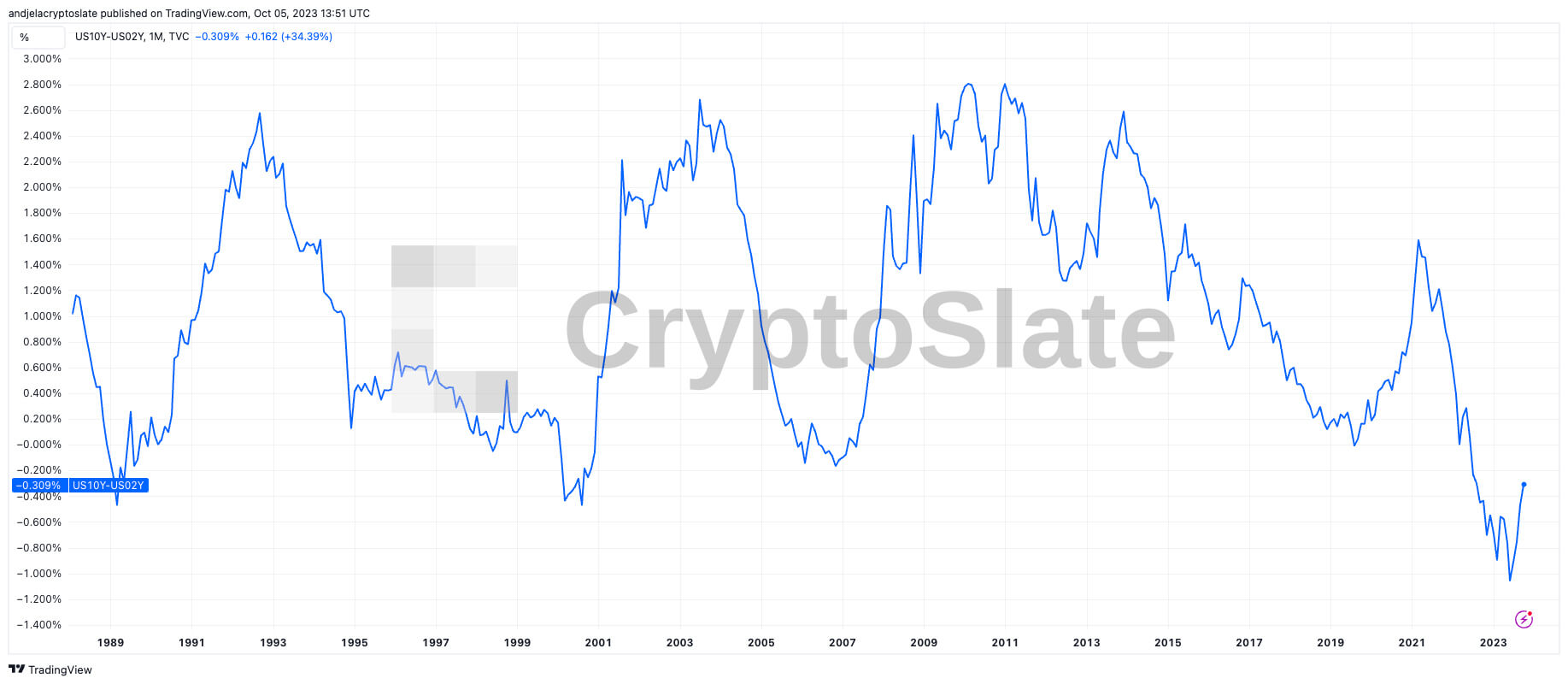

There are several methods to evaluate the health of the Treasury bill market and, by extension, the wider financial market, but the “10-2” spread is notable for its historical reliability in forecasting economic downturns.

The 2-year and 10-year Treasury notes rank among the most liquid and frequently traded U.S. government securities. The 2-year note reflects short-term economic expectations, while the 10-year note represents longer-term expectations. The difference between these two yields offers a clear depiction of the yield curve’s slope over a reasonable timeframe.

The 10-2 spread has historically proven to be a dependable indicator of impending recessions. When the yield on the 2-year note surpasses that of the 10-year note (resulting in a negative 10-2 spread), it signifies an inversion in this segment of the yield curve. Such inversions have preceded every U.S. recession in the last 50 years, although the duration between inversion and the onset of a recession can vary.

A positive 10-2 spread (where the 10-year yield exceeds the 2-year yield) typically indicates that investors anticipate robust economic growth and require a premium for committing their funds for longer durations. However, when a sharp increase follows a historical low in the spread, it suggests that investors expect an economic slowdown or recession in the near future. They may be more inclined to accept lower yields now for long-term bonds if they believe future returns will be even lower or if they are seeking safer, longer-term investments during uncertain times.

Recent trends in the 10-2 spread suggest an impending recession. As of Oct. 4, the gap between the 10-year and 2-year Treasury yield is currently at -0.29%. This represents a significant change from the -1.06% recorded on June 1, 2023, which was the lowest level the spread has reached since 1982.

Graph showing the spread between the 10-year Treasury yield and the 2-year Treasury yield from 1988 to 2023 (Source: TradingView)

Graph showing the spread between the 10-year Treasury yield and the 2-year Treasury yield from 1988 to 2023 (Source: TradingView)

Such notable declines in the spread have historically foreshadowed economic difficulties.

For example, in November 2006, the spread narrowed to a low of -0.17%, preceding the onset of the 2007 recession. Likewise, a drop to -0.47% in August 2000 signaled the subsequent dot-com crash and the ensuing recession. These historical instances, among others, reinforce the 10-2 spread’s reputation as an economic forecasting tool, offering early alerts of potential financial challenges ahead.

The current flattening and the related negative spread carry significant implications for the market. It indicates that investors expect lower returns, leading to a preference for longer-term bonds. Such behavior generally reflects apprehensions regarding future economic stability and growth prospects.

The post The 10-2 Treasury yield spread: A harbinger of economic downturn? appeared first on CryptoSlate.