Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Short-term investors face significant impact from Bitcoin’s price fluctuations.

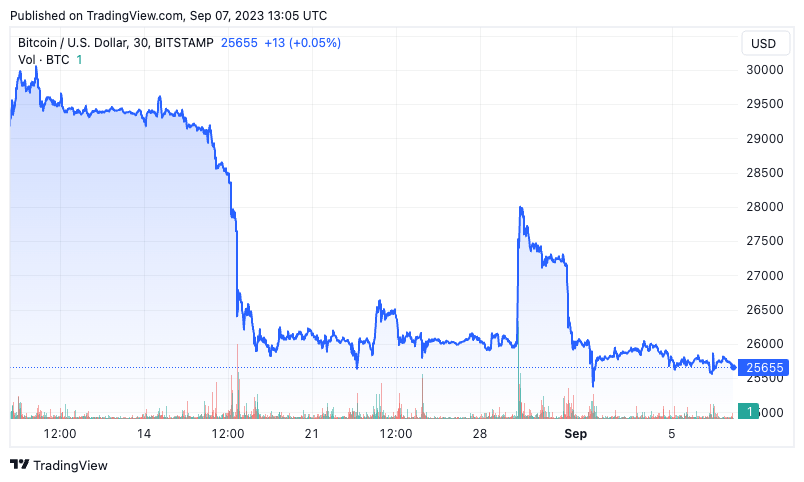

The decline of Bitcoin from $29,000 in mid-August has notably altered market conditions. Although there was a brief surge to $27,000 following Grayscale’s victory over the SEC, Bitcoin remains around $25,700.

Graph illustrating Bitcoin’s price from Aug. 1 to Sep. 7, 2023 (Source: CryptoSlate BTC)

Graph illustrating Bitcoin’s price from Aug. 1 to Sep. 7, 2023 (Source: CryptoSlate BTC)

A closer examination of on-chain metrics indicates that this downward trend is largely driven by short-term holders selling their assets.

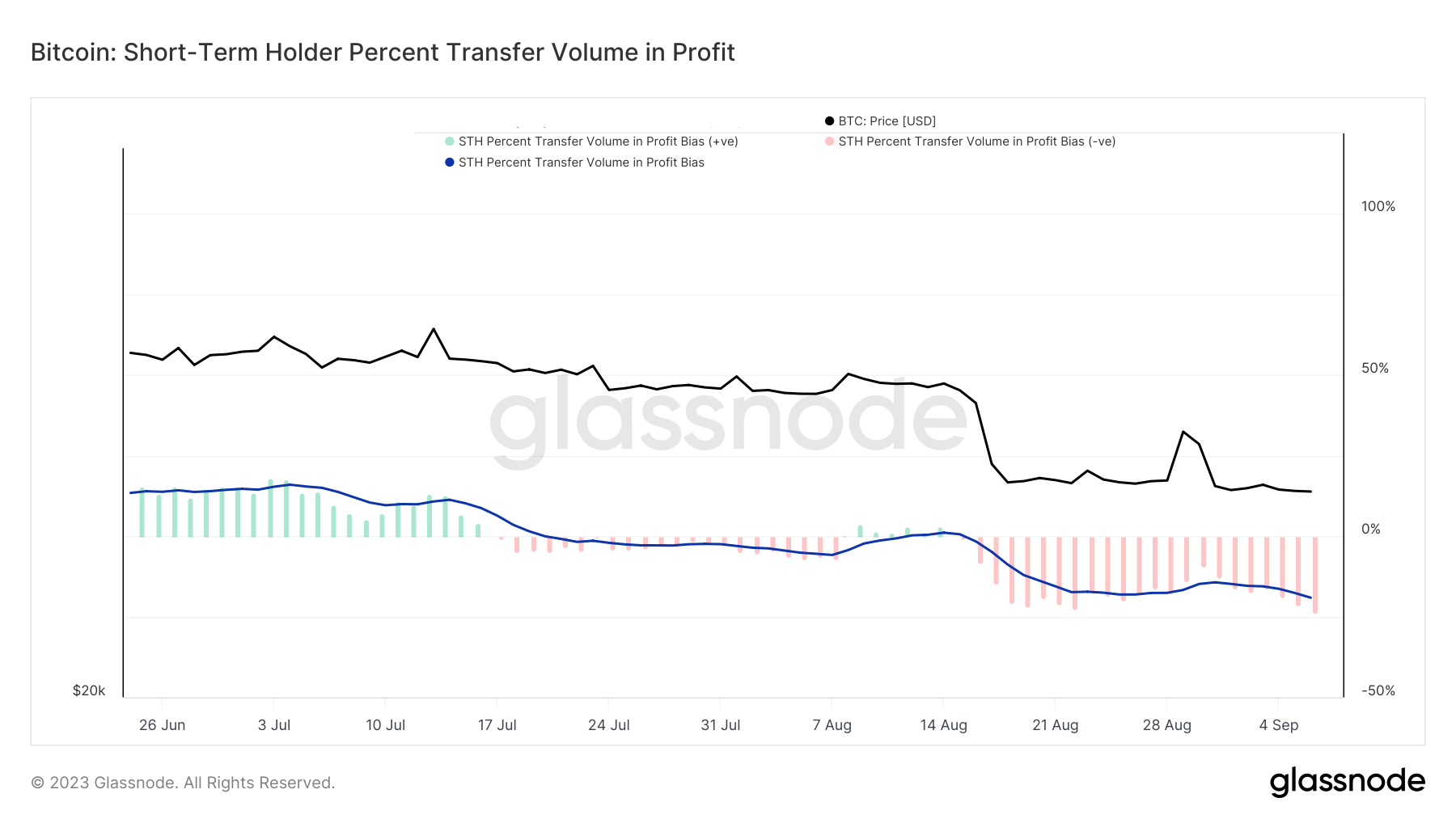

One of the key indicators in this context is the short-term holder percent transfer volume in profit. This metric provides insights into the on-chain value settled by short-term holders, whether it is in profit or loss.

A positive figure suggests that more than 50% of the short-term holder transfer volume is profitable, while a negative figure indicates that over half of the transfer volume is at a loss.

Data from Glassnode reveals a decline in the STH transfer volume profit that coincides with Bitcoin’s drop from $29,400. As of Sep. 6, the STH transfer volume bias was at –23.5%, showing that a considerable portion of the transfer volume from short-term holders was at a loss.

Graph depicting the short-term holder percent transfer volume in profit from June to September 2023 (Source: Glassnode)

Graph depicting the short-term holder percent transfer volume in profit from June to September 2023 (Source: Glassnode)

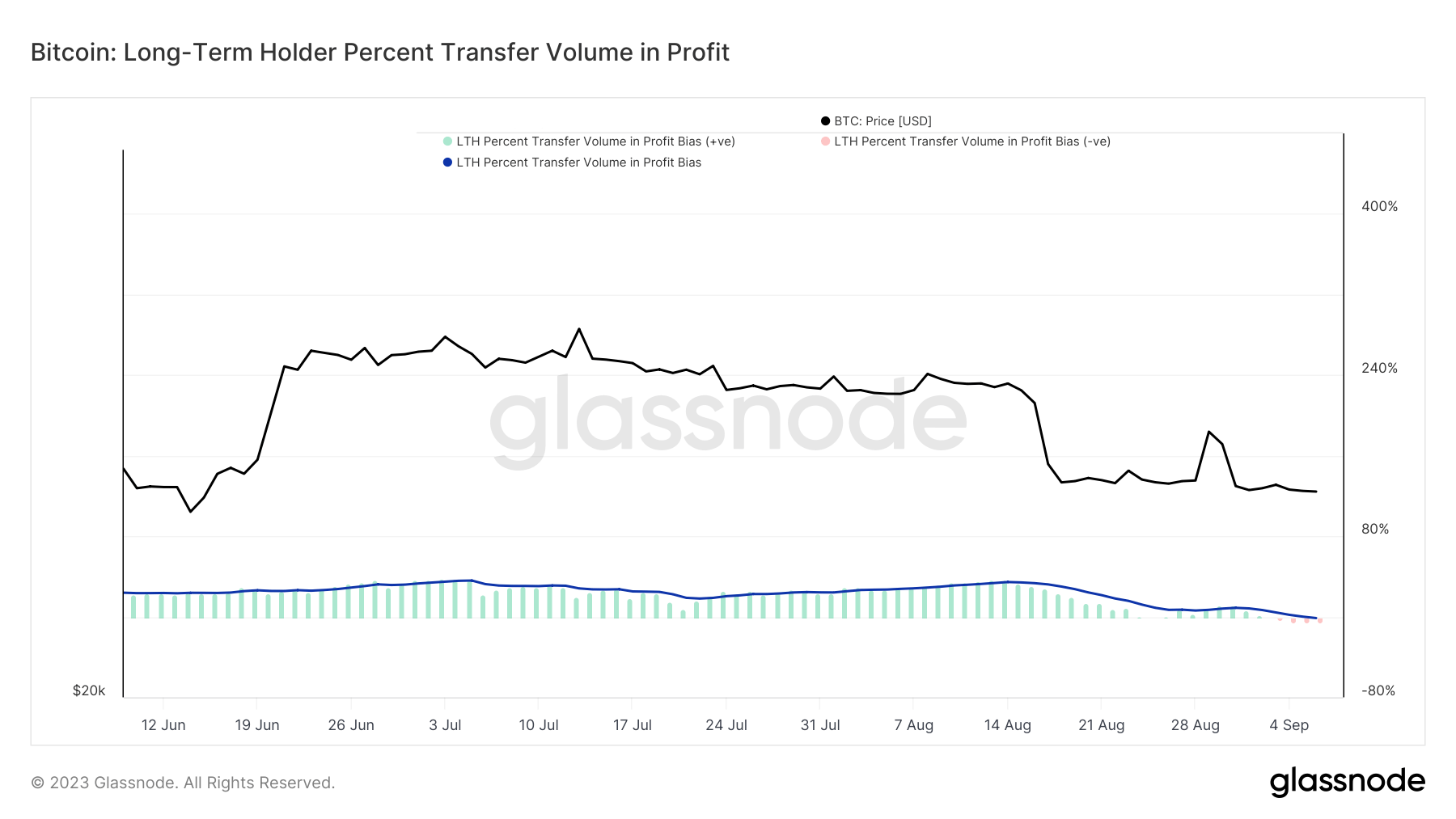

In contrast, long-term holders display a more stable position. Their metrics began to reflect transfers at a loss only from Sep. 3. By Sep. 6, the long-term holder percent transfer volume bias was noted at -5.5%, indicating that the majority of long-term holders remain profitable despite recent market fluctuations.

Graph showing the long-term holder percent transfer volume in profit from June to September 2023 (Source: Glassnode)

Graph showing the long-term holder percent transfer volume in profit from June to September 2023 (Source: Glassnode)

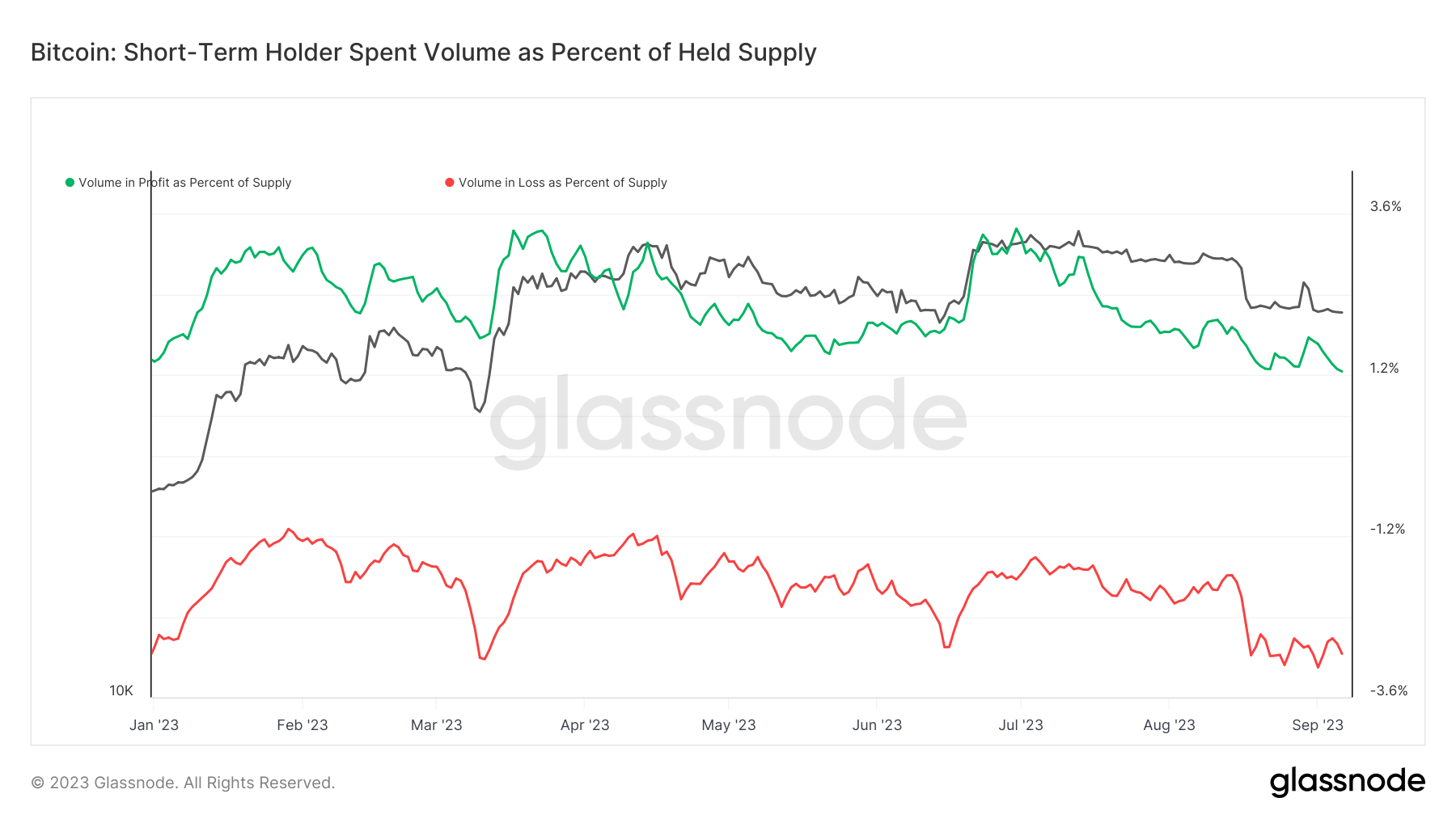

Another important metric is the short-term holder spent volume as a percentage of held supply. This metric illustrates the share of on-chain transfer volume by short-term holders in relation to their total held supply. Historically, significant changes in this metric have been linked to high-volatility events. On Sept. 3, 3.1% of the total short-term holder supply was transacted at a loss. The last time such a high percentage was recorded was in mid-March, coinciding with Bitcoin’s price drop from $23,000 to $20,000.

Graph illustrating short-term holder spent volume as a percent of held supply YTD (Source: Glassnode)

Graph illustrating short-term holder spent volume as a percent of held supply YTD (Source: Glassnode)

The increased selling pressure from short-term holders may reflect a lack of confidence in Bitcoin’s short-term price outlook. Nevertheless, the stability exhibited by long-term holders indicates a sustained belief in Bitcoin’s long-term value.

The post Short-term holders bear the brunt of Bitcoin’s volatility appeared first on CryptoSlate.