Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Sahm Rule suggests a continued likelihood of US recession, while cryptocurrency could be poised for a positive turnaround.

The Sahm Rule, an important indicator of recession, continues to indicate a heightened risk of an economic decline in the United States, contributing to the negative sentiment in crypto markets that are already facing adverse on-chain developments.

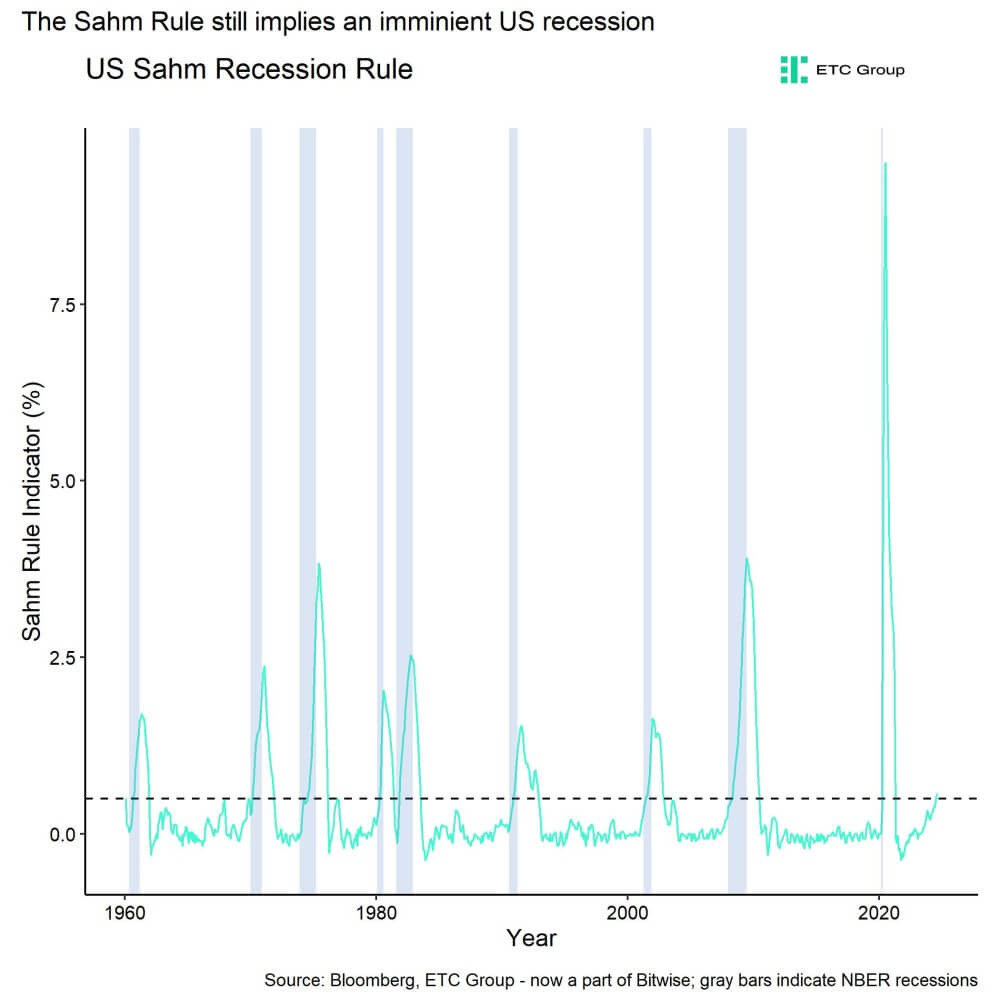

A recent evaluation by ETC Group (now integrated with Bitwise) shows that the Sahm Rule remains active, suggesting a forthcoming recession in the US. Developed by former Federal Reserve economist Claudia Sahm, this indicator signals the beginning of a recession when the three-month moving average unemployment rate increases by 0.50 percentage points or more compared to its low from the preceding 12 months.

Current data indicates that the Sahm recession indicator was at 0.53 in July 2024, a slight increase from the prior month. This persistent level above the necessary threshold indicates that recessionary pressures continue to exist, despite the resilience exhibited by the US economy thus far.

Recession possibility in the US (ETC Group)

Recession possibility in the US (ETC Group)

The ongoing risk of recession coincides with the challenges faced by crypto markets. According to ETC Group’s analysis, significant Bitcoin on-chain metrics have continued to trend negatively. Net selling volumes across Bitcoin spot exchanges reached approximately -$606 million over the past week, although the rate of selling has gradually decreased since the beginning of September.

Moreover, Bitcoin whales transferred a net total of 9,477 BTC to exchanges last week, which added to the selling pressure. Consequently, Bitcoin exchange balances have increased over the past week.

The negative on-chain data corresponds with the overall bearish sentiment in crypto markets. ETC Group’s proprietary “Cryptoasset Sentiment Index” continues to reflect pessimistic sentiment, with only 4 out of 15 indicators exceeding their short-term trend.

Nevertheless, some analysts perceive the possibility of a change in market dynamics. ETC Group posits that the combination of macroeconomic and crypto sentiment capitulation in early August may have represented a significant tactical bottom for Bitcoin, potentially indicating the beginning of a renewed bullish phase. This perspective is partly based on expectations of a more accommodative monetary policy from the Federal Reserve, which could serve as a favorable tailwind for cryptocurrencies in the upcoming months.

As the market navigates these mixed signals, recessionary risks and negative on-chain trends remain, while the potential for shifts in monetary policy and oversold conditions could create an environment conducive to a market reversal.

The post Sahm Rule indicates US recession remains likely but crypto may be set for bullish reversal appeared first on CryptoSlate.