Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Report suggests social media bots may be involved in potential manipulation of FTX cryptocurrency prices.

A recent study by the Network Contagion Research Institute (NCRI) indicates that social media engagement, particularly from non-genuine accounts, may have considerably enhanced the value of specific cryptocurrencies associated with the now-defunct FTX exchange.

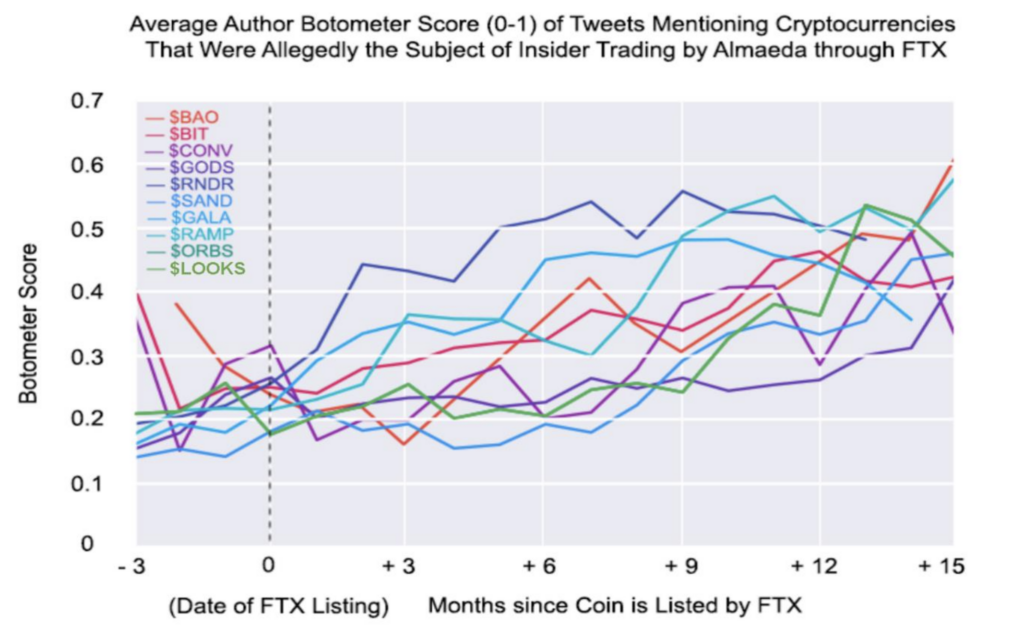

The report highlights that Twitter discussions regarding FTX-listed tokens such as Gala (GALA) and ImmutableX (IMX) frequently included a significant number of bot-like and inauthentic accounts, accounting for approximately 20% of the overall online discourse about these assets.

Further examination showed that for half of the FTX-listed tokens analyzed, this inauthentic Twitter activity seemed to predict subsequent price fluctuations.

Source: NCRI

Source: NCRI

The report states that “inauthentic networks were effectively and intentionally utilized to influence changes in FTX [listed] coin prices.”

Bot activity followed FTX listings.

While the NCRI report does not explicitly accuse FTX of using bots, some findings suggest suspicious behavior surrounding tokens after their listing on the exchange.

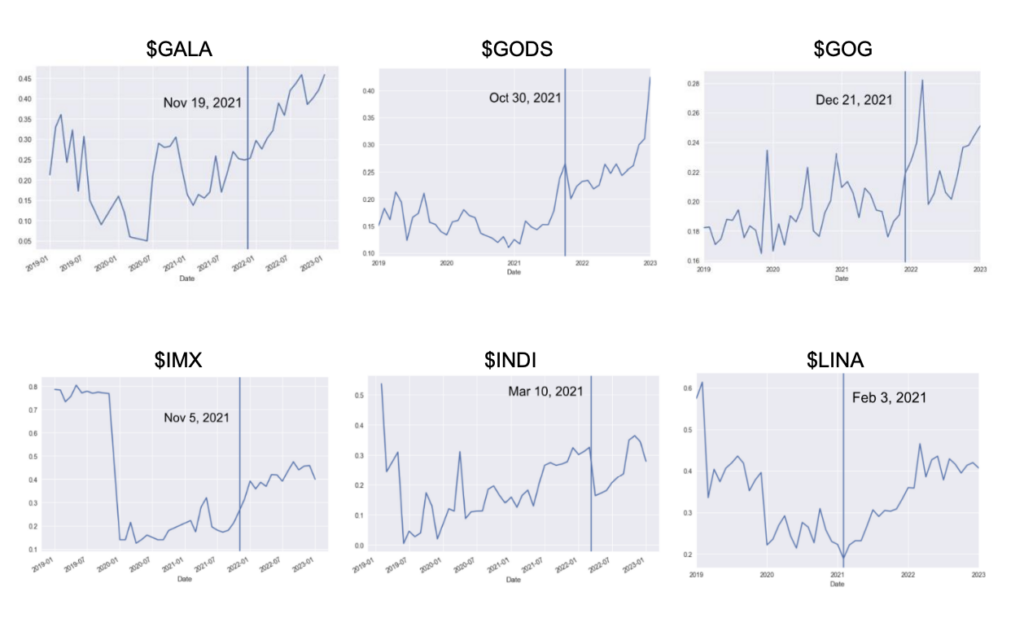

The researchers observed that the promotion of a coin by FTX was typically followed by an increase in average bot scores for accounts tweeting about that coin over time, with inauthentic activity reaching 50% of total volume after 15 months in certain instances. The charts below illustrate how bot activity surged following FTX listings, marked by the vertical line.

Source: NCRI

Source: NCRI

Upon analyzing a selection of FTX-listed tokens, the researchers identified a notable increase in bot-like activity after these assets were promoted by FTX’s Twitter account. For tokens such as GALA, IMX, GODS, LINA, SAND, DODO, and others, the share of tweets from inauthentic, bot-like accounts steadily rose following the announcement of the FTX listing.

The report indicates that across the sample of FTX coins, inauthentic discussions predicted price changes for half of the assets.

While not definitively implicating FTX in the coordinated bot activity, the timing of the increase in inauthentic tweets regarding its listed tokens raises potential concerns. As detailed in the report, promotion by FTX seemed to serve as a catalyst for attracting bot amplification around these tokens.

Whether orchestrated by FTX/Alameda or not, the researchers contend that the data suggests a coordinated effort involving bots to sway market sentiment after the exchange listed and promoted certain cryptocurrencies.

Ongoing bot activity

Nonetheless, the report warns that this issue persists, referencing an analysis of meme coins like PEPE and PSYOP, which have recently achieved billion-dollar market capitalizations. NCRI also detected considerable bot activity surrounding these tokens, with inauthentic discussions appearing to forecast PEPE price changes in some analyses.

While acknowledging that further investigation is necessary, the report concludes that as cryptocurrencies gain wider acceptance, the potential for market manipulation through coordinated social media activity presents significant risks to investors and financial stability.

According to the researchers, enhanced transparency and oversight of cryptocurrency markets are essential. However, recent restrictions on data access for external analysts may hinder the identification of potentially fraudulent activities on social media that could influence prices.

“It’s also worth noting the concerning trend of social media companies, including Twitter and Meta, restricting data access for researchers.

This action may impede external observers from detecting fraudulent and impactful activities, creating a barrier to transparency in financial markets.”

The report recommends that regulators, platforms, and the public remain vigilant regarding the potential for manipulation and develop strategies to counter such tactics.

The post Social media bots suspected in possible FTX crypto price manipulation, reveals report appeared first on CryptoSlate.