Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Price speculators experience largest single-day decline of $774 million this year as Bitcoin rises.

Traders in crypto derivatives experienced considerable losses over the last day, amounting to approximately $774 million, which represents the largest single-day loss of the year due to erratic market fluctuations.

Bitcoin, the leading digital currency, reached its peak since November 2021, exceeding the $63,000 threshold in an impressive rally. However, the excitement was fleeting as the price quickly dropped below $60,000, partly due to anxiety stemming from technical issues on major exchanges such as Coinbase and Binance.

Compounding the volatility, analysts observed significant Bitcoin transfers from wallets associated with funds confiscated by US authorities in the Bitfinex hack. The nearly $1 billion transfer to undisclosed addresses sparked speculation that authorities might take advantage of the market upswing to divest their holdings. Nonetheless, analysis from CryptoSlate indicates that the transfer was likely related to UTXO management.

In spite of the fluctuations, Bitcoin managed to recover, climbing to $62,530 at the time of reporting, reflecting a 7% increase from the previous day.

At the same time, other major cryptocurrencies also recorded notable gains. Ethereum, for example, rose 5% to nearly $3,500, achieving its highest price since April 2022. Solana also saw a resurgence, reaching around $130, its highest point in 22 months, according to data from CryptoSlate.

Among the top 10 cryptocurrencies by market capitalization, Cardano and Dogecoin distinguished themselves with impressive double-digit increases of 11.78% and 39.16%, respectively.

Nearly 190,000 traders liquidated for $774 million

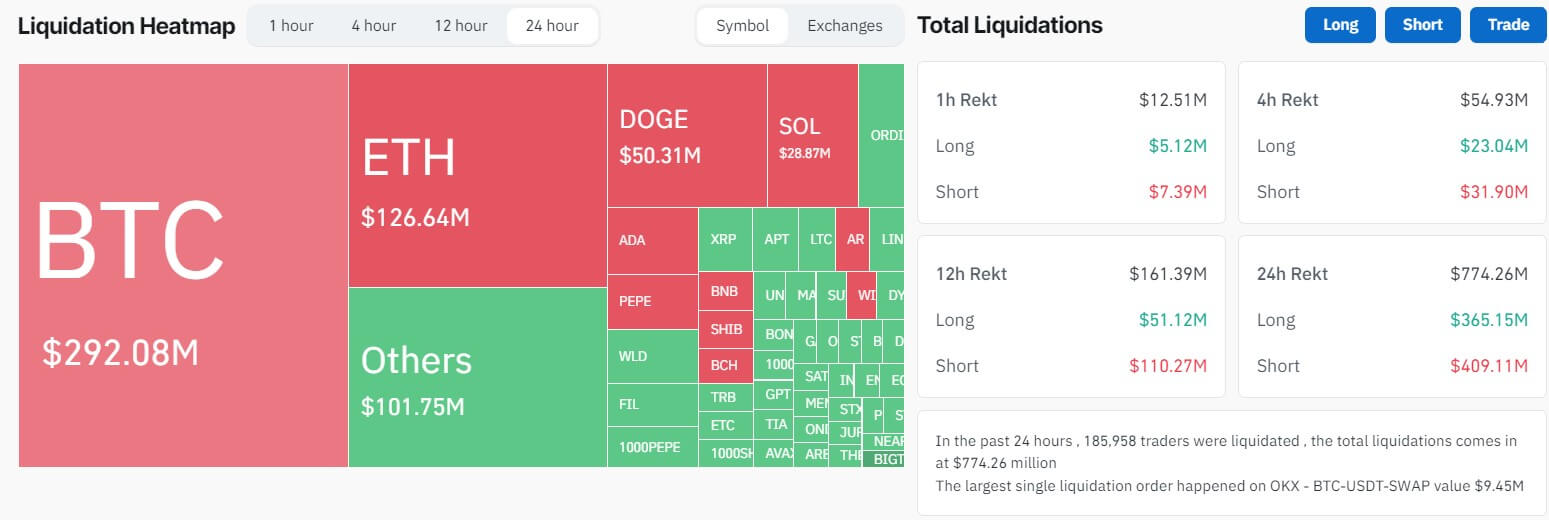

In the last 24 hours, the strong performance of the market led to the liquidation of 189,679 traders, resulting in an astonishing $774 million, according to Coinglass data.

Short traders are predominant in the current liquidation scenario, representing a significant share of the total losses. Those betting against price increases faced a combined loss of $409 million, while long traders, who anticipated price rises, suffered losses of about $365.48 million.

Crypto market liquidation heat map (Source: Coinglass)

Crypto market liquidation heat map (Source: Coinglass)

Bitcoin traders experienced the largest losses during this timeframe, with a notable downturn of $292.09 million. Short traders faced losses of $187.83 million, while long traders recorded a decline of $104.26 million.

Similarly, Ethereum traders incurred losses totaling $126.64 million, while those trading DOGE and Solana faced losses of $50.3 million and approximately $29 million, respectively.

Additionally, the largest individual liquidation occurred on OKX, amounting to $9.45 million from a BTC–USDT-SWAP.

Across various exchanges, Binance and OKX reported the highest liquidations, accounting for 35.57% and 35.31% of the total, respectively. These losses equated to $275.46 million and $275.43 million, as per Coinglass. In contrast, Huobi, Bybit, and Bitmex experienced liquidations of $79.40 million, $72.21 million, and $51.75 million, respectively.

The post Price speculators see highest single-day loss of $774 million YTD amid Bitcoin upward trajectory appeared first on CryptoSlate.