Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Market downturn triggered by Binance results in over $200M loss for cryptocurrency traders.

In the past 24 hours, events surrounding the cryptocurrency exchange Binance and various U.S. federal agencies, including the Commodity Futures Trading Commission (CFTC) and the Department of Justice, resulted in a loss exceeding $200 million for crypto traders holding market positions.

Data from CryptoSlate indicated that the overall market capitalization of digital assets fell by 2.04% to $1.38 trillion in light of these events.

Over $200M in the last 24 hours

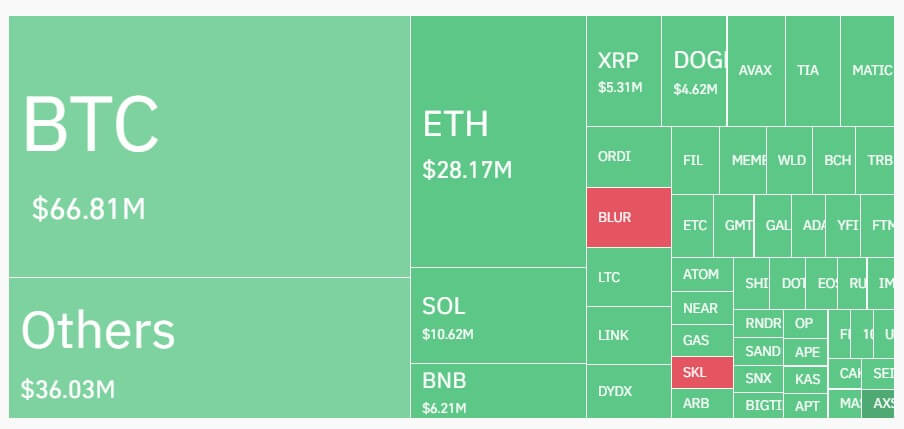

The cryptocurrency market experienced liquidations totaling $226.88 million within the last 24 hours, impacting nearly 93,000 traders.

Information from Coinglass revealed that long traders incurred losses of $175.55 million, with Bitcoin and Ethereum contributing $69.02 million to these losses.

Crypto Market Liquidation Heatmap (Source: Coinglass)

Crypto Market Liquidation Heatmap (Source: Coinglass)

Short traders faced liquidations amounting to $51.31 million, with the two leading digital assets representing over 50% of these losses.

Moreover, traders with positions in Solana suffered losses exceeding $10 million, while those in BNB lost more than $6 million. Other cryptocurrencies such as Dogecoin, Chainlink, XRP, and Litecoin saw liquidations of less than $3 million each.

Across various exchanges, the majority of liquidations took place on Binance, OKX, and ByBit, which collectively accounted for nearly 90% of the total liquidations, with 78% being long positions. Other platforms like Huobi, Deribit, and Bitmex also reported a significant portion of the overall liquidations.

The largest liquidation was recorded on Bybit, with BTCUSD valued at $2.35 million.

Binance issues rekt market

Market analysts have linked the downturn to Binance’s settlement exceeding $4 billion with U.S. authorities and the subsequent resignation of its founder Changpeng ‘CZ’ Zhao as CEO after admitting guilt to money laundering charges.

On November 21, several U.S. federal agencies, including the DOJ and CFTC, outlined how Binance breached multiple financial regulations. These breaches were due to the platform’s inability to prevent transactions involving sanctioned users and individuals from restricted areas.

In response, Binance admitted to the charges and released a statement recognizing its failures. The company agreed to pay over $4 billion in penalties, appoint a monitor for three years, and commit to improving compliance protocols.

Additionally, Richard Teng, the former Global Head of Regional Markets, was appointed as the new CEO.

The post Binance-induced market rout wipes more than $200M from crypto traders appeared first on CryptoSlate.