Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Managing Bitcoin’s lateral movement amid increasing realized losses

The cryptocurrency market experienced a significant sell-off, causing Bitcoin’s price to drop to $25,000. Although there has been a slight recovery over the past week, with the price stabilizing around $25,900 during the weekend, it remains in a vulnerable state. Various on-chain indicators imply that Bitcoin may be stuck in a phase of lateral movement in the weeks ahead. One such indicator is the realized profit/loss momentum, a novel metric recently developed by Glassnode.

This metric aims to pinpoint crucial market turning points, such as peaks or troughs in market trends. It is calculated from the Short-Term Holder (STH) Realized Profit/Loss Ratio, which is then compared to its one-year moving average.

Short-term holders are crucial to market dynamics. They tend to be active throughout market cycles and are statistically more inclined to respond to market fluctuations. This tendency arises because recent transactions or coin purchases are likely affected by recency bias regarding the coin’s cost basis. Consequently, any price movement above or below this threshold is more likely to elicit a reaction.

Additionally, market extremes frequently result in wealth redistribution, leading to a higher proportion of wealth held by STHs. Observing the momentum shifts for STHs realizing profit or loss can indicate potential turning points in broader market trends.

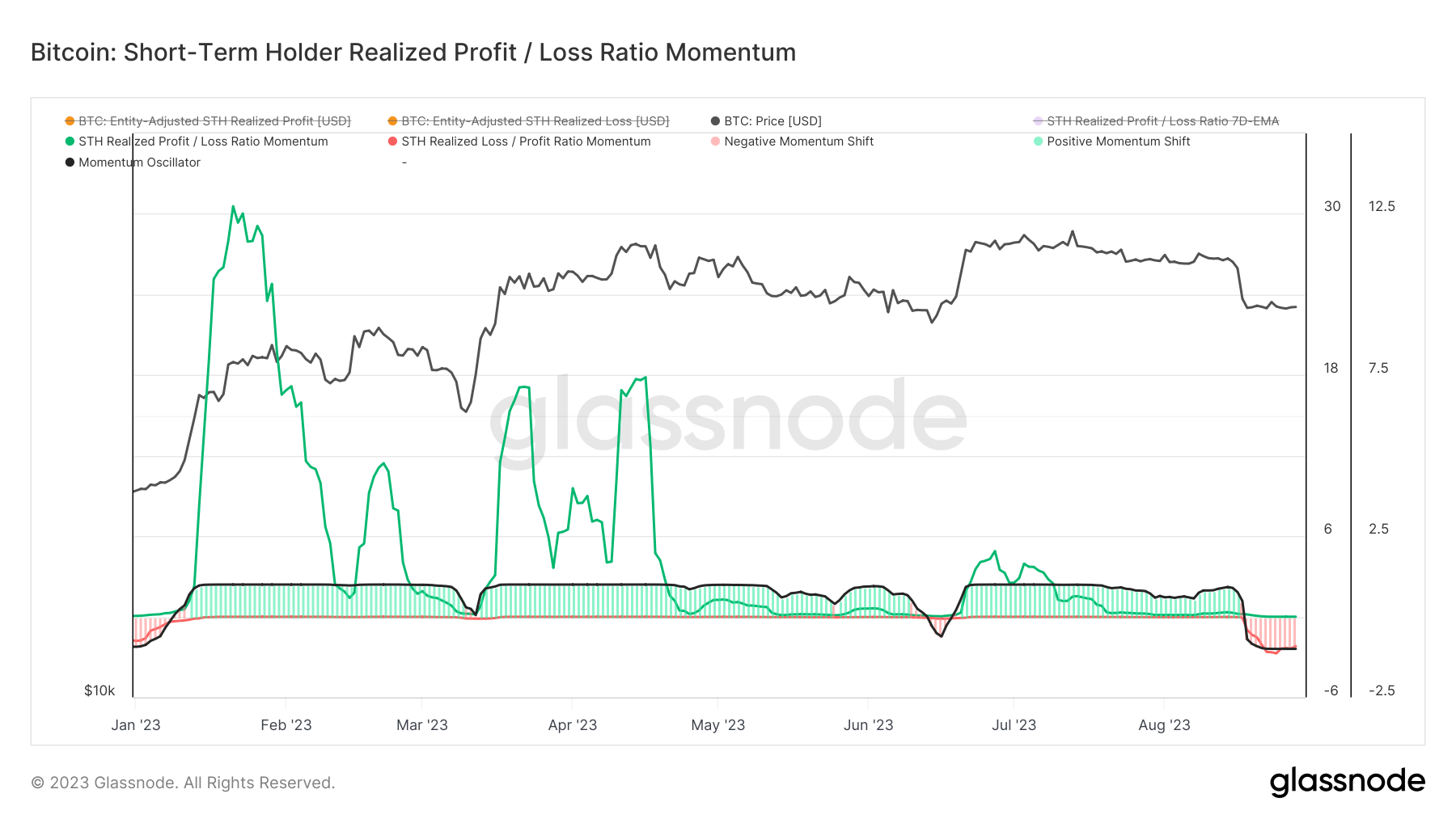

The momentum of the short-term holders’ realized profit/loss ratio indicates that these holders have experienced a decline in profit dominance since January. The brief rise to over $30,000 in June resulted in a slight increase in profit-taking momentum. However, this upward trend was short-lived.

Graph showing the STH realized profit/loss momentum YTD (Source: Glassnode)

Graph showing the STH realized profit/loss momentum YTD (Source: Glassnode)

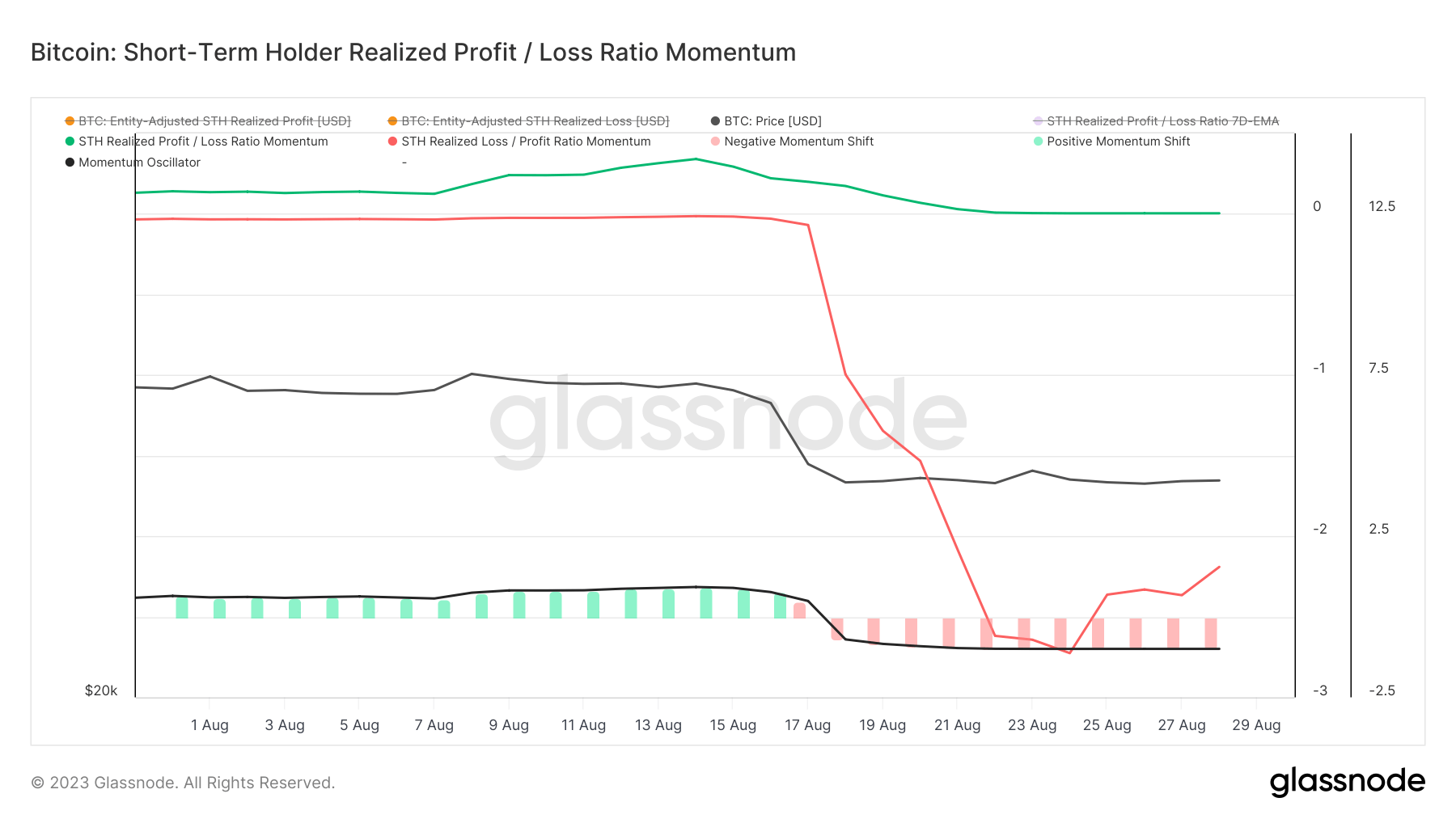

Shortly thereafter, the realized profit dominance began to decline rapidly, shifting to a loss-dominant regime on Aug. 17, which coincided with Bitcoin’s drop to $26,000. By Aug. 24, the momentum fell to its lowest point in a year, remaining firmly in a loss-dominant phase.

Graph showing the STH realized profit/loss momentum from July 28 to Aug. 28 (Source: Glassnode)

Graph showing the STH realized profit/loss momentum from July 28 to Aug. 28 (Source: Glassnode)

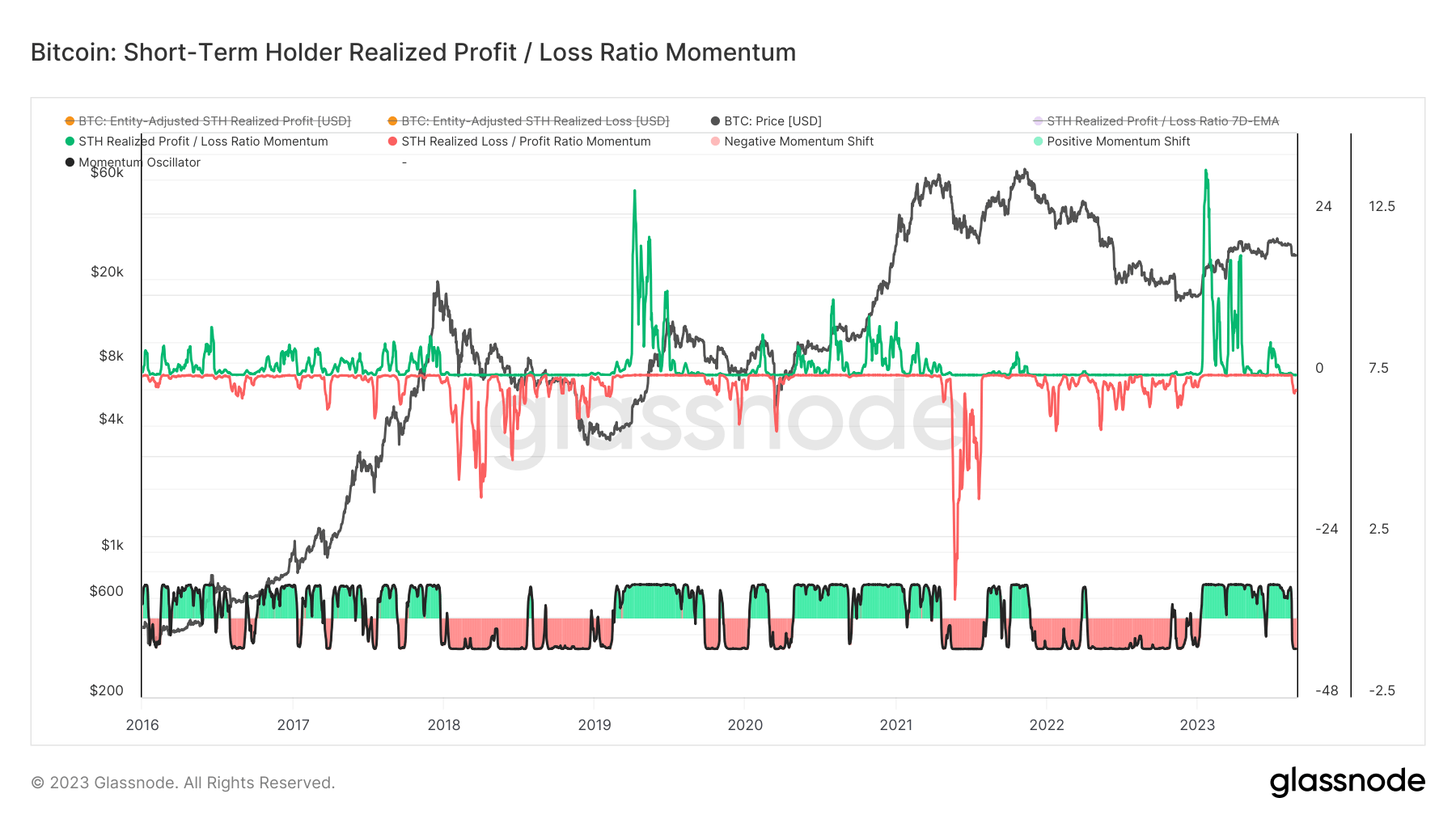

Historically, increases in realized loss momentum following periods of substantial profit-taking momentum have lasted several months. During market rallies, realized profit accelerates as STHs who recently acquired coins enter a profit phase. In contrast, market corrections lead to a surge in realized loss, pushing STHs who recently purchased coins into a loss, which can induce panic.

Graph showing the STH realized profit/loss momentum from 2016 to 2023 (Source: Glassnode)

Graph showing the STH realized profit/loss momentum from 2016 to 2023 (Source: Glassnode)

Considering the historical data and current trends, Bitcoin may encounter a volatile few weeks if it adheres to historical patterns. The ongoing decline in profit dominance, combined with the recent sell-off, could lead to a turbulent September.

The post Navigating Bitcoin’s sideways trend with realized loss momentum appeared first on CryptoSlate.