Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Increasing unrealized gains suggest a more positive outlook for the Bitcoin market.

The cryptocurrency market represents a multifaceted ecosystem, necessitating various metrics and indicators to assess its condition and forecast upcoming trends. One such metric, the Net Unrealized Profit/Loss (NUPL), offers a detailed perspective on market sentiment.

NUPL reflects market sentiment by emphasizing the disparity between unrealized profits and unrealized losses within the Bitcoin supply.

The term ‘unrealized’ pertains to gains or losses that have not been actualized through the sale of the asset. The realized cap assesses the value of all coins based on the price at which they last changed hands, effectively capturing the net investment of coin holders.

NUPL is derived by subtracting the realized cap from the market cap and dividing the outcome by the market cap. It serves as a useful tool that provides insights into the overall market sentiment.

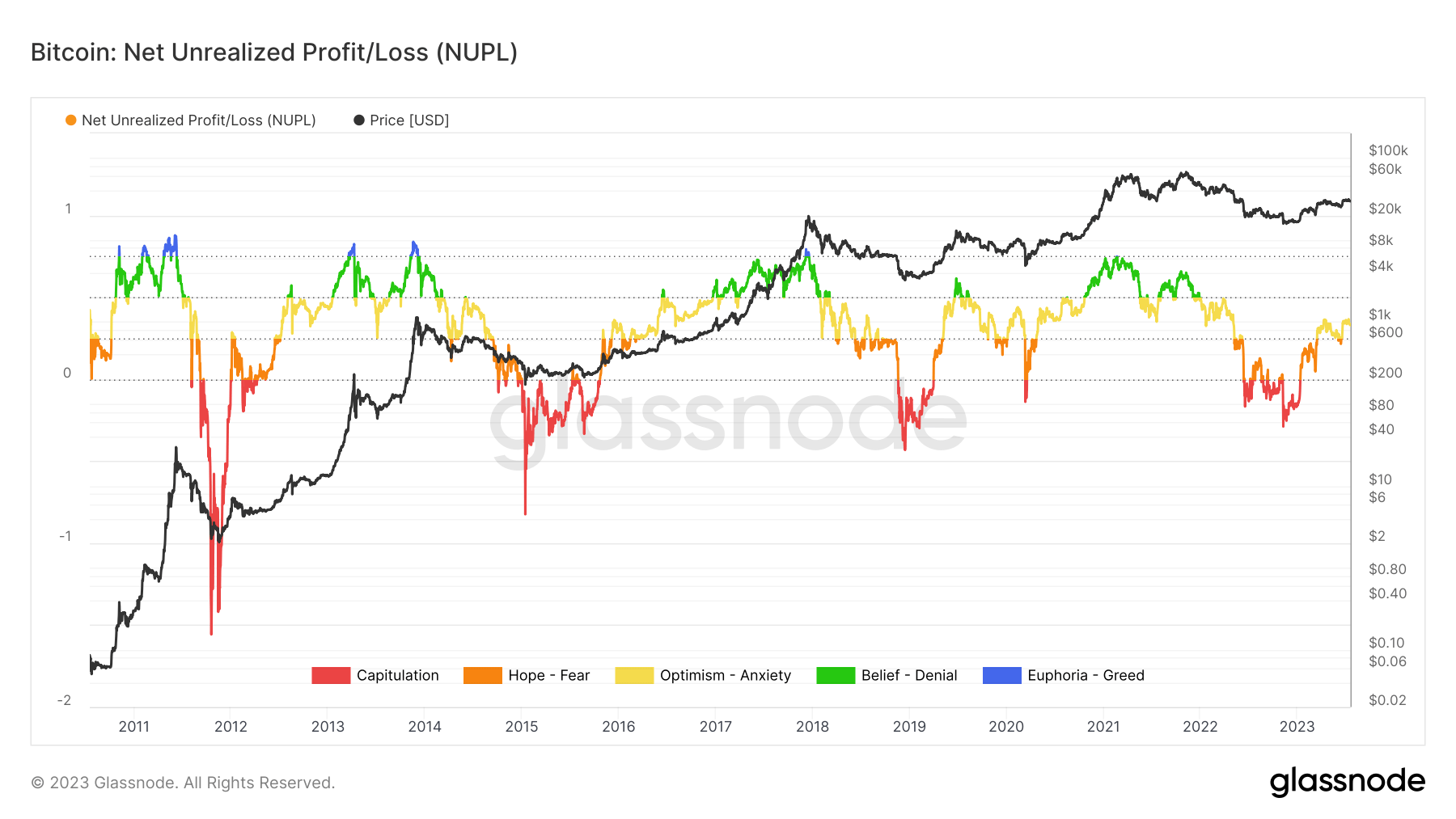

A NUPL score below 0 has historically been associated with phases of price capitulation, signifying a bearish market sentiment.

On the other hand, a NUPL score exceeding 0.75 generally aligns with periods of extreme greed and euphoria, indicating a bullish market sentiment. Transitional phases, where the NUPL fluctuates between 0 and 0.25, have historically signified fear during downturns and hope during recoveries.

A NUPL score ranging from 0.5 to 0.75 has been linked to periods of strong confidence in Bitcoin’s upward movement.

Graph illustrating Bitcoin’s NUPL from 2010 to 2023 (Source: Glassnode)

Graph illustrating Bitcoin’s NUPL from 2010 to 2023 (Source: Glassnode)

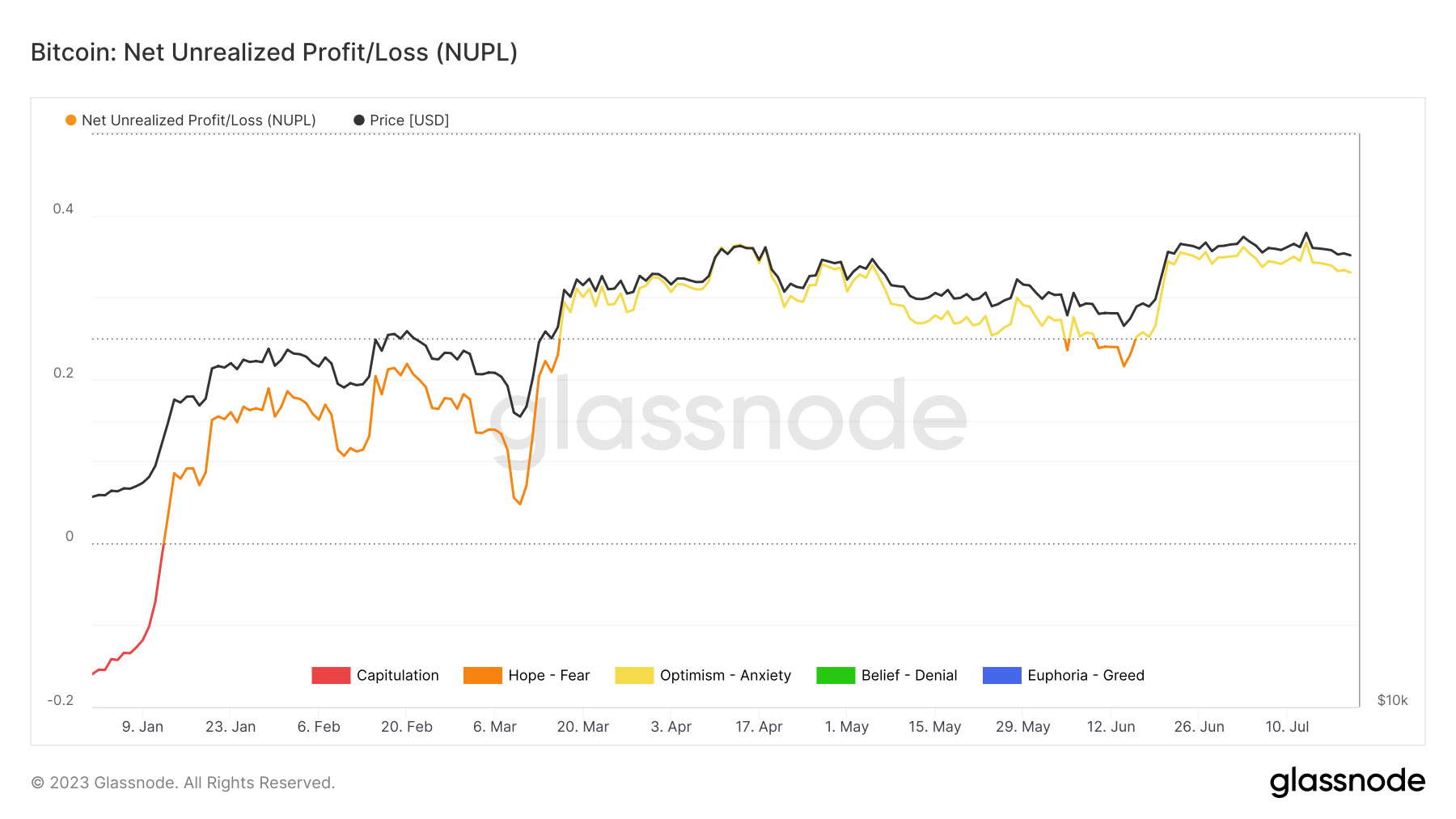

Since the start of the year, NUPL has consistently increased, rising to 0.33 on July 20 from -0.15 on January 1. This suggests that Bitcoin emerged from capitulation in mid-January and remained in the hope phase for two months.

From mid-March onward, NUPL has experienced significant growth, indicating a rise in market optimism. Following a brief decline below 0.25 on July 13, NUPL had surged by 31% by July 20.

Graph depicting Bitcoin’s NUPL YTD (Source: Glassnode)

Graph depicting Bitcoin’s NUPL YTD (Source: Glassnode)

This upward movement in NUPL implies that the market is becoming increasingly optimistic, which may lead to heightened buying pressure and elevated prices.

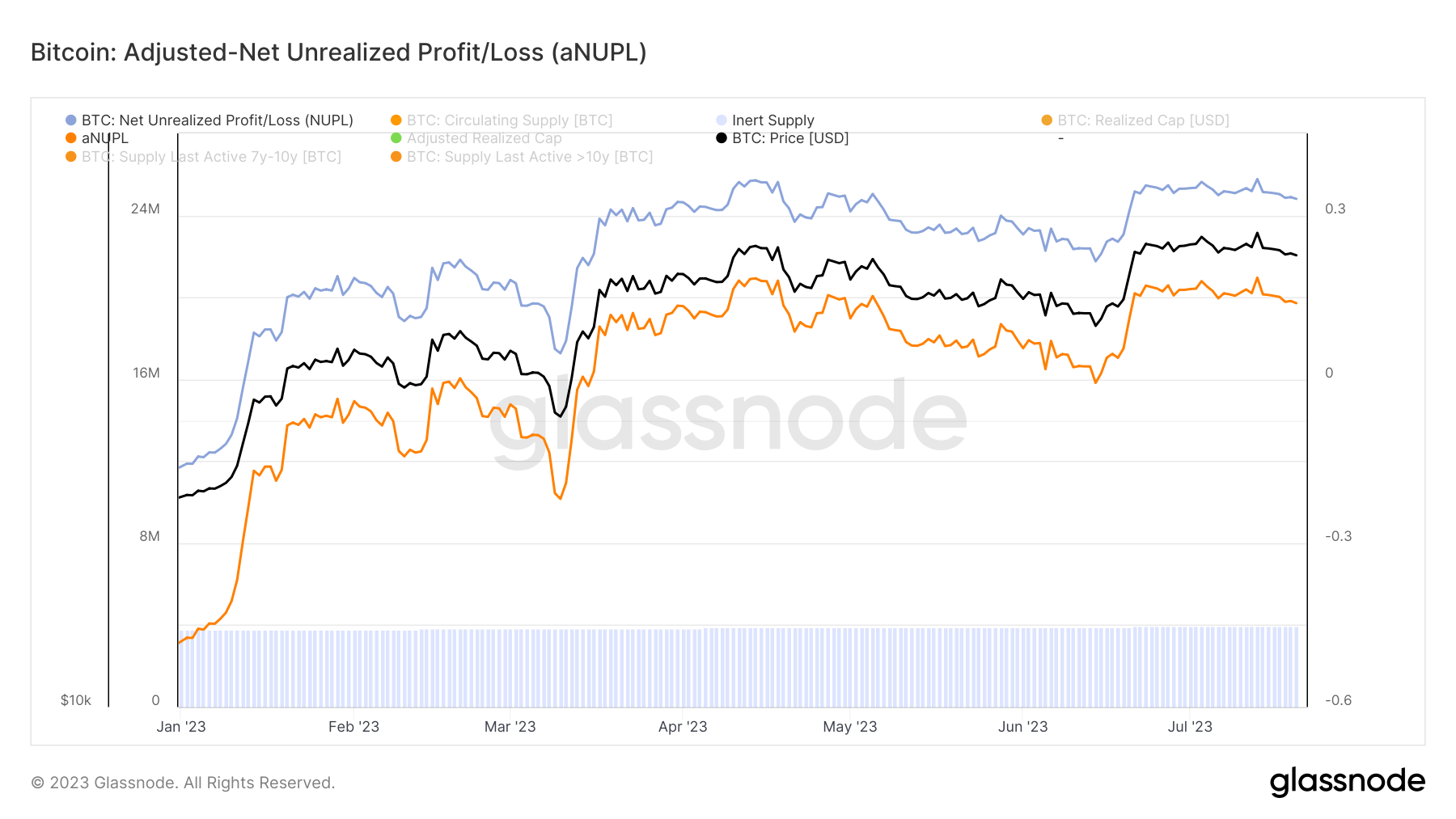

Nonetheless, the NUPL can occasionally be distorted by dormant or lost coins. The adjusted NUPL (aNUPL) is utilized to address this skewed data. This metric modifies the market cap and NUPL to account for the influence of such coins, presuming that coins that have not been transacted for over seven years are akin to an inactive supply.

The aNUPL has also experienced a notable rise, increasing by nearly 130% since the year’s outset.

Graph showing Bitcoin’s aNUPL YTD (Source: Glassnode)

Graph showing Bitcoin’s aNUPL YTD (Source: Glassnode)

The rising NUPL and aNUPL suggest a more positive market sentiment. This could potentially result in increased buying pressure and higher prices in the short term. However, it is crucial to recognize that NUPL is a relative measure, meaning it can be affected by extreme market fluctuations, rendering it less dependable during times of high volatility.

While NUPL offers valuable insights, it should be considered alongside other metrics and fundamental analysis for a more thorough understanding, primarily because NUPL alone, like all indicators, may not serve as a robust predictor of long-term price trends.

The post Rising unrealized profits indicate a more optimistic Bitcoin market appeared first on CryptoSlate.