Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

February sees reduction in Bitcoin network congestion as mempool empties.

Bitcoin’s mempool serves as a repository for transactions that have been broadcast to the network but are yet to be included in a block. Examining the mempool offers valuable insights into network congestion, transaction demand, and fee trends, providing a distinct perspective on the current state of the Bitcoin ecosystem.

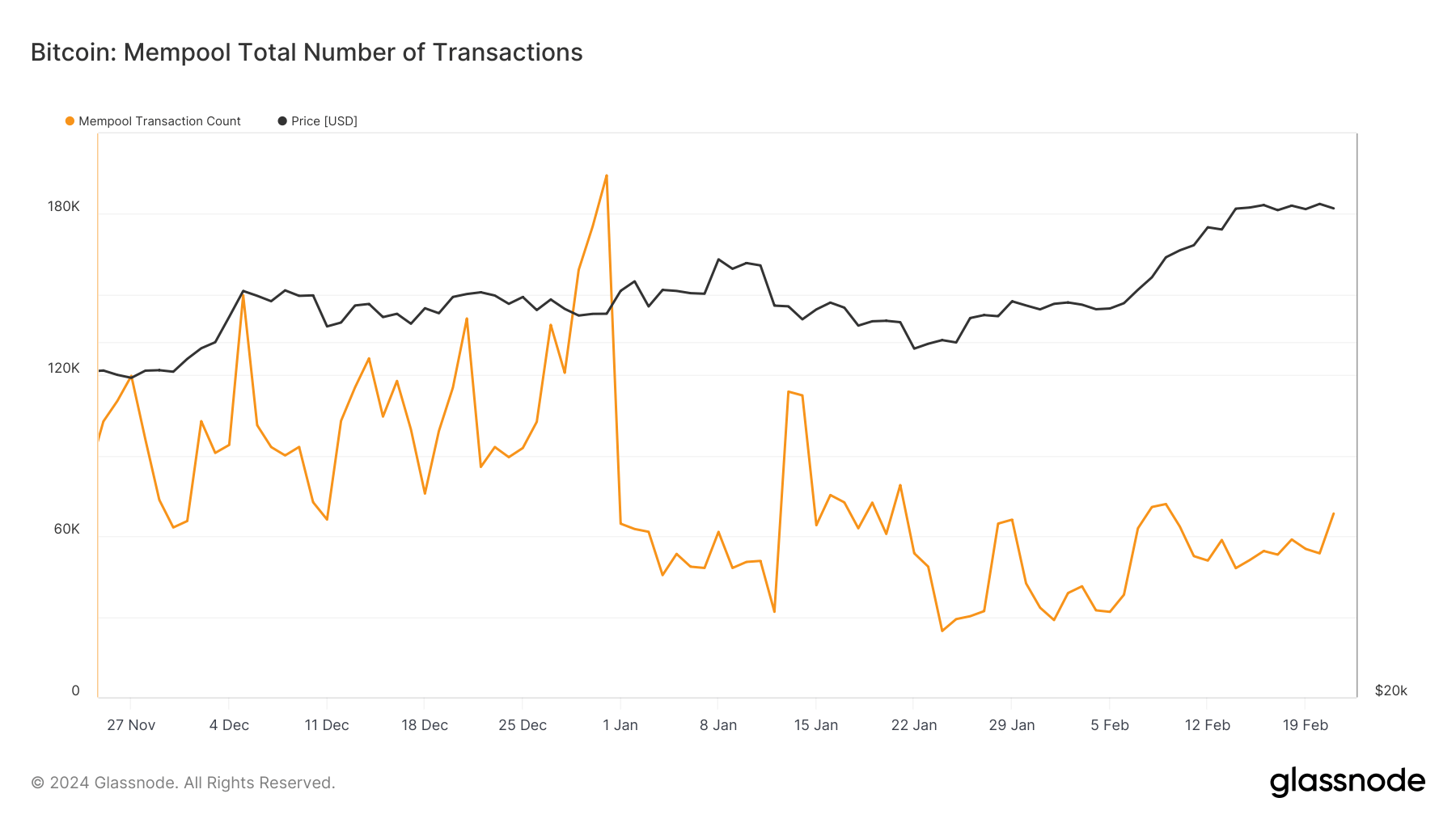

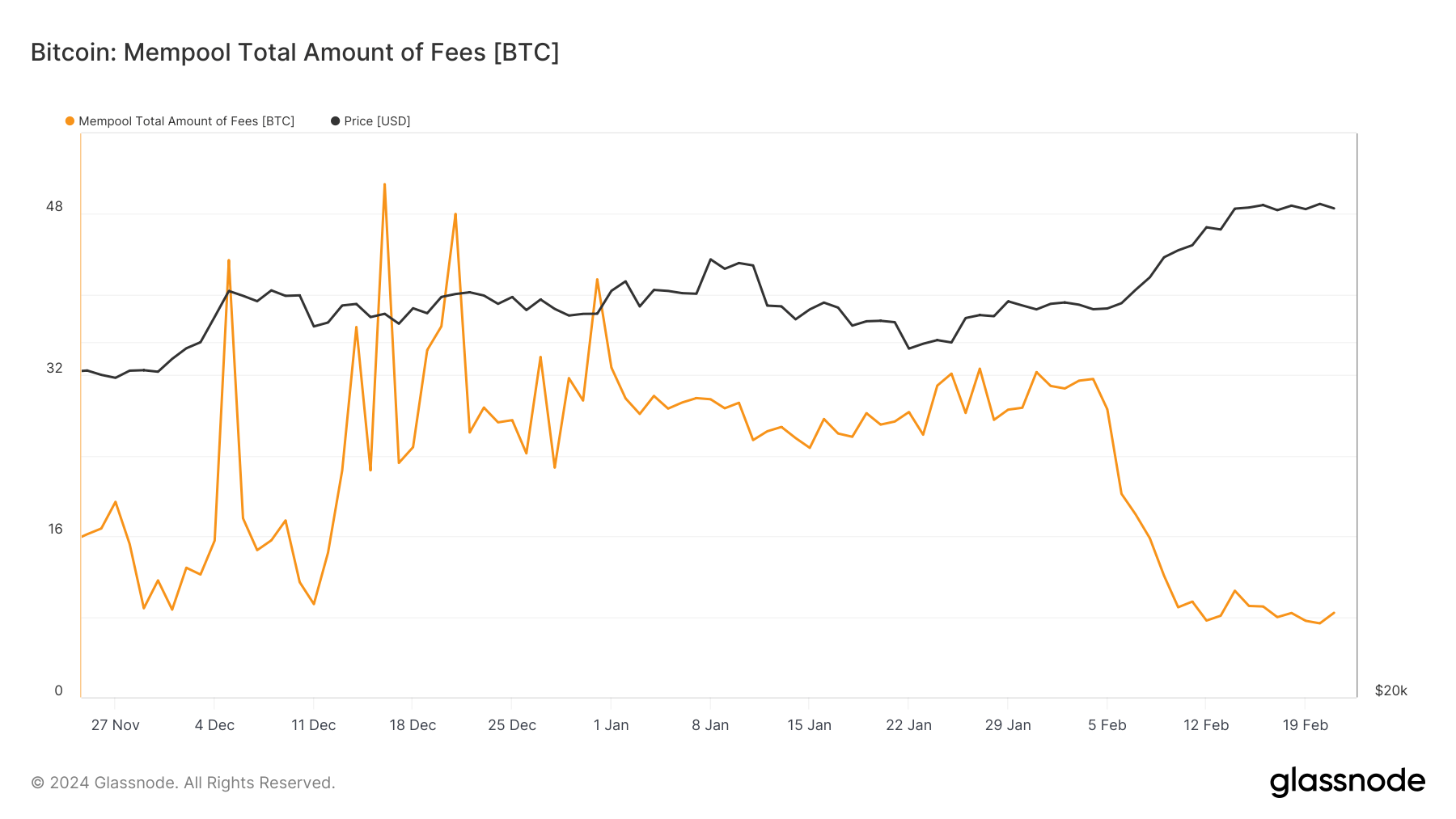

In the latter part of 2023 and the initial weeks of 2024, the Bitcoin network faced considerable congestion, as indicated by the increasing size of the mempool. By mid-December, the mempool held 117,813 transactions awaiting processing, with transaction fees amounting to 50.9 BTC.

This congestion indicated a strong demand for block space and underscored the network’s difficulties in managing rising transaction volumes. By the end of December, the situation worsened, with the mempool size growing to 194,374 transactions, signaling a peak in network activity and user participation.

Graph illustrating the total number of transactions pending in the Bitcoin mempool from Nov. 25, 2023, to Feb. 21, 2024 (Source: Glassnode)

Graph illustrating the total number of transactions pending in the Bitcoin mempool from Nov. 25, 2023, to Feb. 21, 2024 (Source: Glassnode)

This congestion had minimal effect on Bitcoin’s price, which hovered around $42,000 for most of December. The continuation of high transaction volumes and fees into early January, with the mempool containing 64,664 transactions and 32.7 BTC in fees on the first day of the year, highlighted the network’s pressure under the burden of unprocessed transactions.

The overall size of transactions awaiting confirmation in the mempool further surged to 106.369 million bytes, peaking at 139.457 million by late January, reflecting a backlog of transactions and an increase in the complexity or size of the transactions.

Graph depicting the total number of fees in the Bitcoin mempool from Nov. 25, 2023, to Feb. 21, 2024 (Source: Glassnode)

Graph depicting the total number of fees in the Bitcoin mempool from Nov. 25, 2023, to Feb. 21, 2024 (Source: Glassnode)

The turning point for the extended period of congestion occurred in February. By Feb. 21, the mempool had significantly cleared, with total transaction fees falling to 8.3 BTC and the number of pending transactions reduced to 68,433. The total size of transactions in the mempool also decreased to 90.439 million bytes, indicating a notable reduction in network congestion.

This phase of diminished congestion followed Bitcoin’s bullish rally, which saw its price exceed $52,000 before stabilizing around the $51,800 mark.

The alleviation of mempool congestion in February, despite Bitcoin’s rising price, suggests an enhancement in the network’s ability to process transactions, potentially due to miners prioritizing transactions with higher fees or the implementation of efficiency-improving measures by users, such as transaction batching or the use of off-chain solutions.

Additionally, the decrease in congestion and fees likely contributed to a favorable shift in investor sentiment, perceiving the improved network performance as a positive sign of Bitcoin’s usability and scalability.

The post Bitcoin network congestion eases as mempool clears in February appeared first on CryptoSlate.