Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Demand for Ripple XRP in the US returns to pre-SEC lawsuit levels, accounting for 14% of global volume.

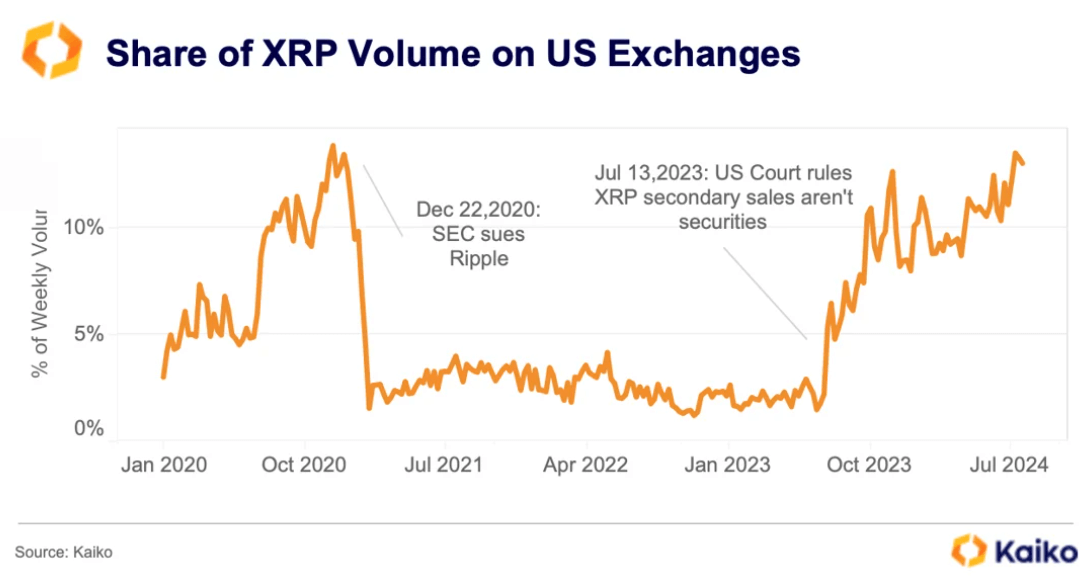

Demand for Ripple’s XRP in the United States has reached its highest point in four years, achieving levels not seen since before the Securities and Exchange Commission (SEC) claimed the token was a security in 2020.

Data from Kaiko indicates that XRP’s trading volume on US centralized exchanges has risen to 14% of the global XRP volume, an increase from under 2% a year prior. This signifies a return to the levels observed before the SEC lawsuit when the digital asset was among the top three by market capitalization.

Share of Ripple XRP Volume on US Exchanges (Source: Kaiko)

Share of Ripple XRP Volume on US Exchanges (Source: Kaiko)

During the prolonged legal dispute with the SEC, XRP experienced a significant drop in interest as numerous crypto platforms removed it from their offerings. However, the situation began to shift last year after Ripple achieved a ruling that determined XRP sales on secondary trading platforms were not securities transactions.

In the wake of the ruling, prominent US exchanges such as Coinbase and Gemini reinstated XRP, releasing considerable demand from American traders.

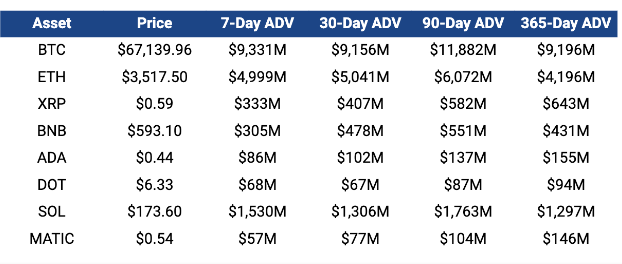

XRP spot volume

Importantly, Ripple’s quarterly report confirmed that interest in the XRP token remained robust.

The company noted that the digital asset’s spot trading volume ranked among the top three in the sector during the second quarter.

It stated:

“[XRP] traded volumes remained elevated throughout the first half of the quarter…The latter half of Q2 maintained consistently high traded volumes across the major exchanges.”

Ripple XRP Spot Volume in Q2 (Source: Ripple)

Ripple XRP Spot Volume in Q2 (Source: Ripple)

This increase in interest is not surprising, given that XRP has garnered significant attention amid speculation regarding a possible settlement with the SEC. Last month, XRP was the top-performing asset among the leading ten digital currencies, achieving a 35% increase, surpassing Bitcoin and others.

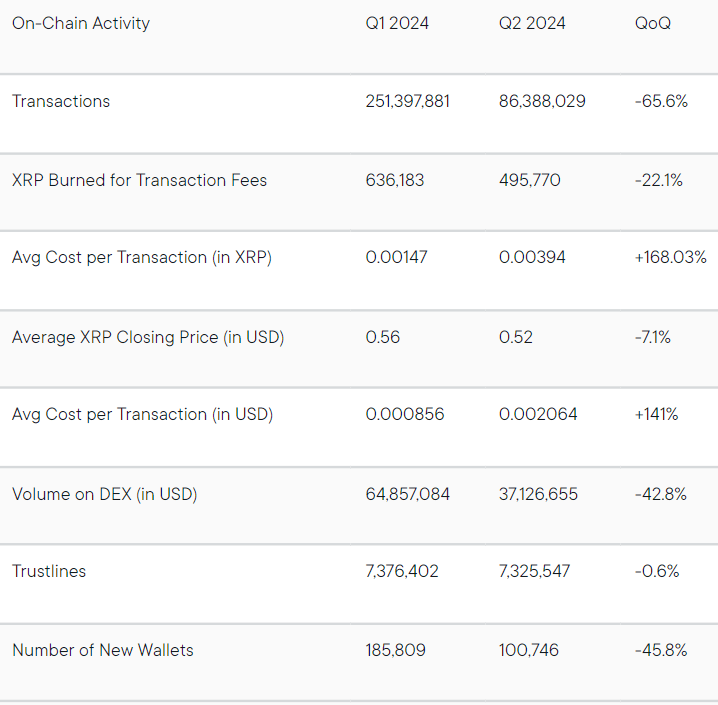

XRPL volume down

In contrast, Ripple’s XRP Ledger (XRPL) network saw a notable decline in transaction volume during the second quarter, dropping to 86.39 million transactions—a 65.6% reduction from the previous quarter.

Ripple attributes this decrease to a broader trend impacting major blockchain protocols, with XRPL mirroring a similar downturn. Significantly, the average transaction fees on the network surged by 168% to 0.00394 XRP during this period.

XRPL On-chain activity (Source: Ripple)

XRPL On-chain activity (Source: Ripple)

Nevertheless, Ripple remains optimistic about the future of XRPL, expecting an increase in network activity with features such as the XRPL Ethereum Virtual Machine (EVM) sidechain, Axelar interoperability, and the new Oracle and Multi-Purpose Token (MPT) standard.

Furthermore, the company believes that the introduction of tokenized real asset platforms like OpenEden and the forthcoming launch of the Ripple USD (RLUSD) stablecoin will further stimulate growth for the blockchain.

The post Ripple XRP demand in the US hits pre-SEC lawsuit levels with 14% of global volume appeared first on CryptoSlate.