Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto investment products market achieves year-to-date net inflow.

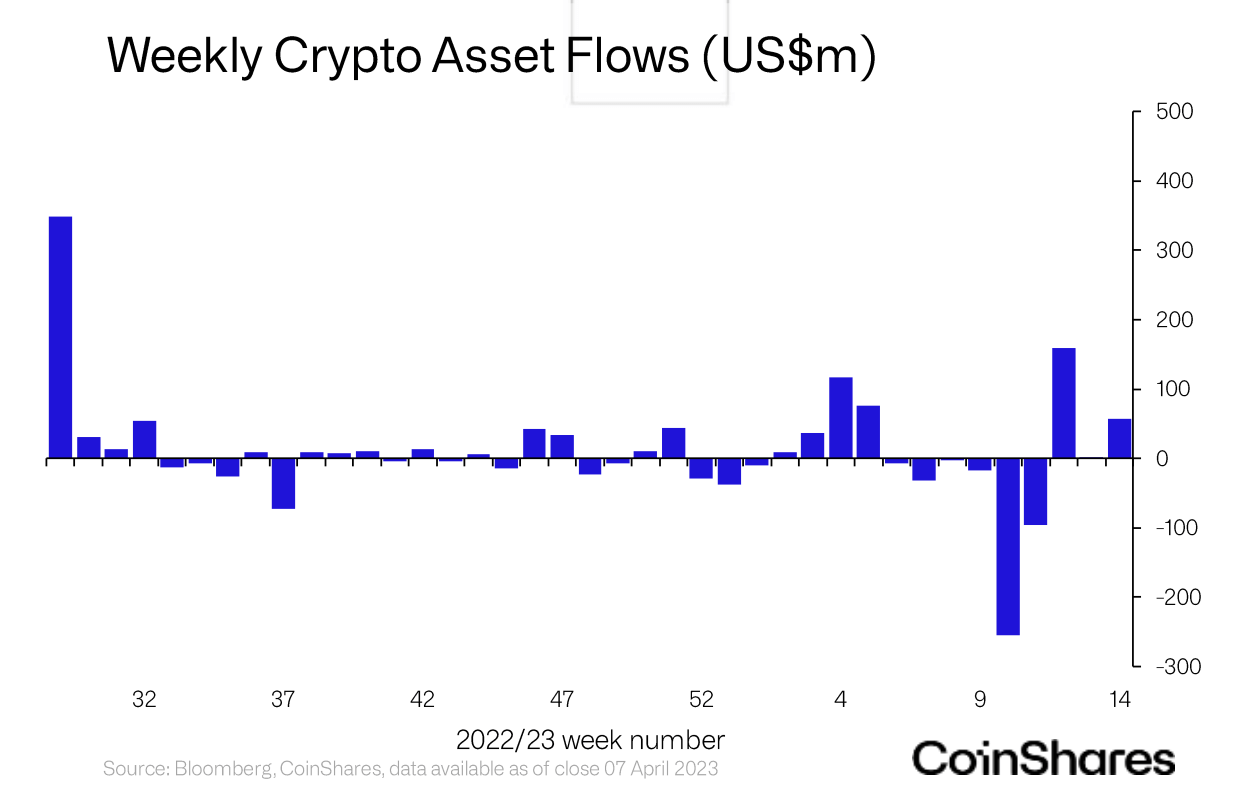

The market for crypto investment products saw inflows of $57 million during the week of April 3, as reported by CoinShares.

This influx positioned the crypto investment products market into a net inflow status for the year-to-date, as highlighted in the CoinShares report.

Weekly flows (Source: CoinShares)

Weekly flows (Source: CoinShares)

Prior to the week of March 20, the crypto investment products market experienced six consecutive weeks of outflows, accumulating total losses of $408 million during this period.

The most significant outflow in these six weeks occurred during the week of March 6, when the market experienced a loss of $255 million, representing 1% of the market at that time.

Flows by asset

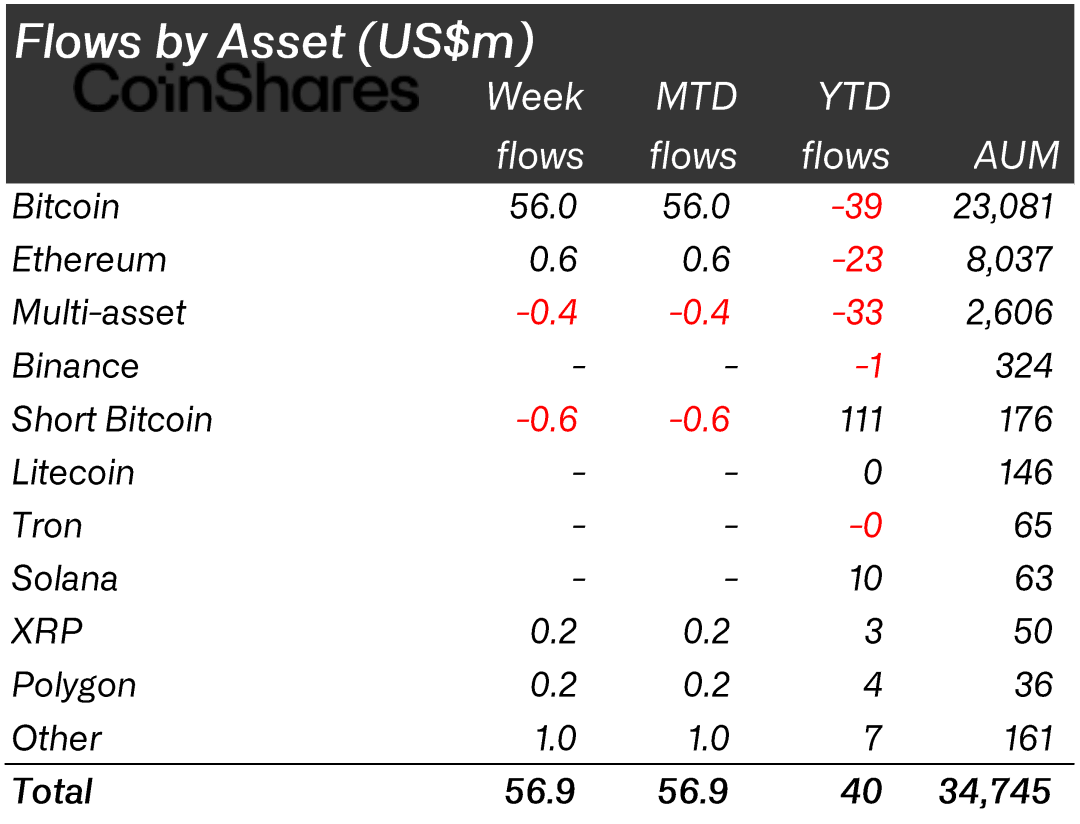

Investment products based on Bitcoin (BTC) nearly comprised the entirety of the inflow recorded for the week. Out of the total inflows of $57 million, BTC products accounted for $56 million.

Flows by asset (Source: CoinShares)

Flows by asset (Source: CoinShares)

Ethereum (ETH) based products contributed the second largest inflow, totaling $600,000. Ripple (XRP) and Polygon (MATIC) each added $200,000 in inflows.

Conversely, short-BTC-based products and multi-asset products experienced outflows of $600,000 and $400,000, respectively.

Flows by provider

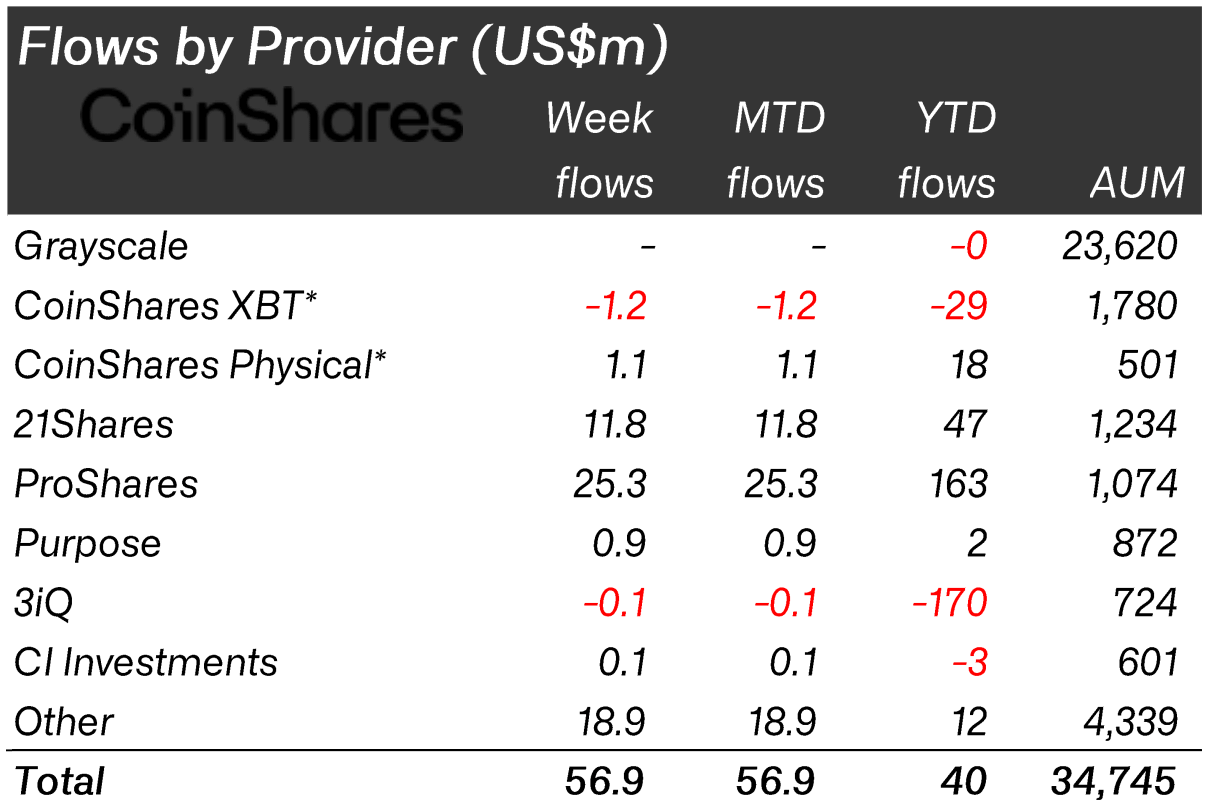

When analyzing the flows by provider, ProShares emerged as the entity with the highest inflow, totaling $25.3 million, which represents over 44% of the overall amount.

Flows by provider (Source: CoinShares)

Flows by provider (Source: CoinShares)

Following ProShares, 21Shares was the second largest contributor to inflows with $11.8 million. CoinShares Physical recorded inflows of $1.1 million, while CoinShares XBT faced outflows of $1.2 million, resulting in a net outflow of $100,000 for CoinShares.

Additionally, Purpose and CI Investments reported inflows of $900,000 and $100,000, respectively, while 3Qi experienced outflows of $100,000.

US leads in inflows

The data indicates that the U.S. accounted for $26.8 million in inflows, nearly 50% of the total.

Germany and Switzerland followed, contributing the second and third largest shares of inflows with $16.6 million and $12.8 million, respectively. Canada also added $2.2 million in inflows, ranking fourth.

In contrast, Sweden and Brazil recorded outflows of $1.2 million and $300,000, respectively.

The post Crypto investment products market reaches YTD net inflow appeared first on CryptoSlate.