Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Centralized exchanges thrive in Q1 2023: TokenInsights data indicates potential recovery from crypto winter.

Research organization TokenInsight published its Q1 Crypto Exchange Report, indicating that centralized platforms experienced a strong beginning to 2023.

The report highlighted that, within the quarter, the overall crypto market capitalization rose from $831.8 billion to $1.24 trillion — representing an almost 50% increase. Bitcoin (BTC) surged nearly 100% from $16,000 to a peak of $30,000 during this timeframe.

In light of this, TokenInsight proposed that the crypto winter might be easing — advising readers to utilize exchange metrics to inform their decisions.

“With Bitcoin’s price climbing from $16,000 at the start of the year to a peak of $30,000, it appears that winter has ended for the crypto sector. However, when will the bull market truly commence? Perhaps the most straightforward answer can be derived from the data available on the exchanges.”

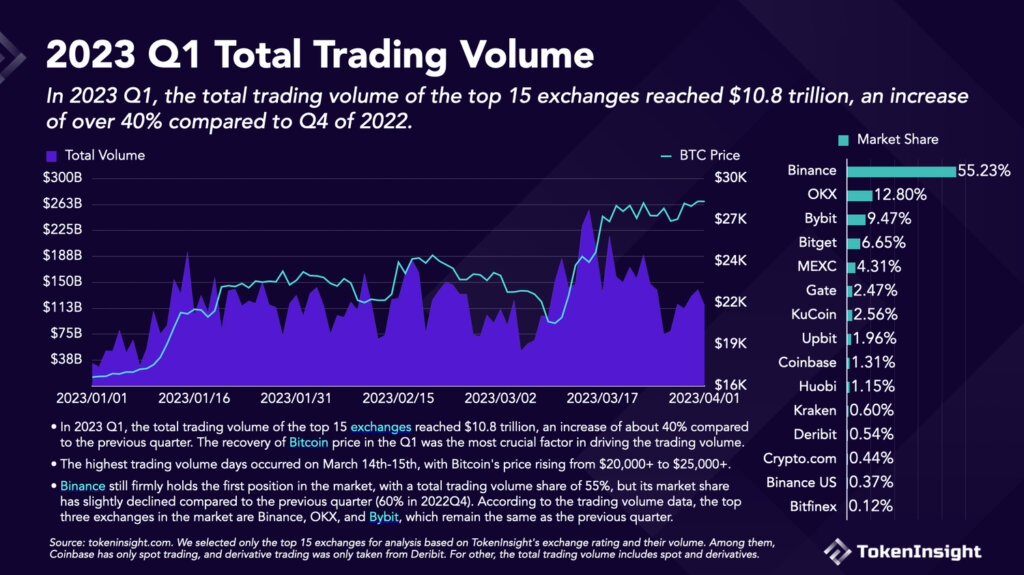

Crypto Trading Volume

The total trading volume for the top 15 crypto exchanges in Q1 2023 exhibited a 40% rise to $10.8 billion compared to the previous quarter.

The period around March 14-15 experienced the most notable increases in daily volume — as Bitcoin’s price rebounded from the repercussions of the banking crisis — likely influenced by realizations of fiat vulnerability and the appetite for more stable assets.

Binance retained its leading position throughout the quarter, capturing over half the market share at 55%. However, TokenInsight noted that in Q4 2022, Binance commanded a 60% market share — indicating that recent regulatory actions and insolvency rumors have had an effect.

Source: TokenInsight.com

Source: TokenInsight.com

Other exchange metrics

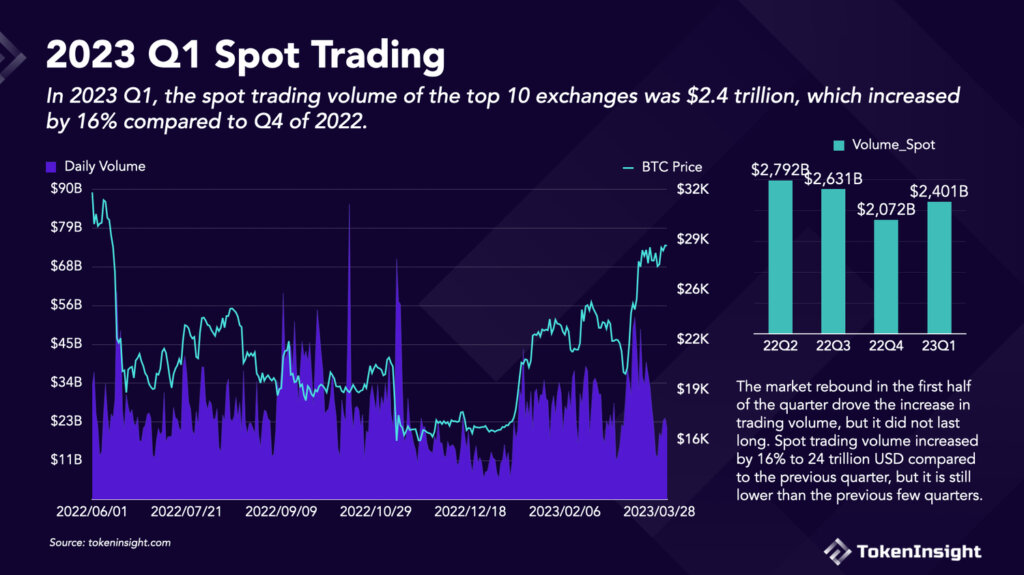

Spot volume for the top 10 crypto exchanges rose by 16% from the previous quarter to $2.4 trillion. Nevertheless, this figure remains lower than Q3 and Q2 2022, which recorded $2.6 trillion and $2.8 trillion, respectively.

Source: TokenInsight.com

Source: TokenInsight.com

A similar trend was observed in derivatives volume, with Q1 2023 reflecting a 30% increase over the prior quarter to $7.8 trillion. However, this is still lower than Q3 2022, which was at $8.4 trillion, and Q2 2022, which reached $10 trillion.

Source: TokenInsights.com

Source: TokenInsights.com

Exchange tokens

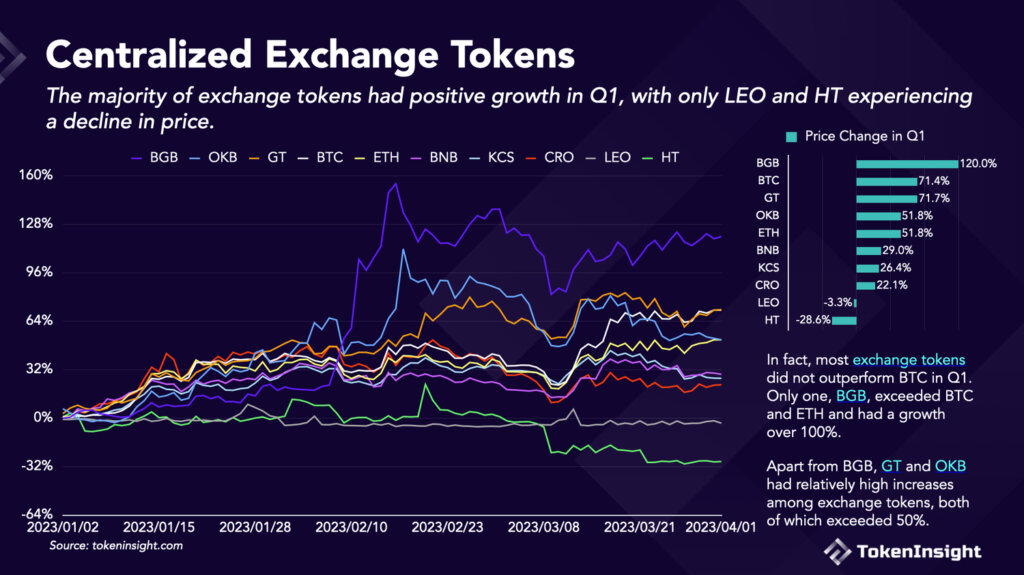

In light of the series of centralized finance (CeFi) bankruptcies in 2022, exchange tokens had developed a negative reputation.

For instance, FTX’s FTT token was utilized to support the exchange’s balance sheet — allowing the company to secure loans against the token. This strategy functioned effectively until panic selling diminished the value of FTT, resulting in FTT-collateralized loans losing their support and becoming worthless.

Despite this, the chart below illustrates a resurgence of confidence in exchange tokens. TokenInsight discovered that all but UNUS SED LEO and Huobi Token experienced price increases — with the Bitget Token achieving 120% growth during the period, surpassing Bitcoin’s performance.

GateToken ranked second, closely aligning with Bitcoin’s growth, with a 72% increase in value during the quarter — while the other exchange tokens lagged behind the market leader.

Source: TokenInsight.com

Source: TokenInsight.com

The post Centralized exchanges flourish in Q1’23: TokenInsights data reveals crypto winter may be thawing appeared first on CryptoSlate.