Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin’s rise past $35,000 accompanied by unexpectedly calm market response

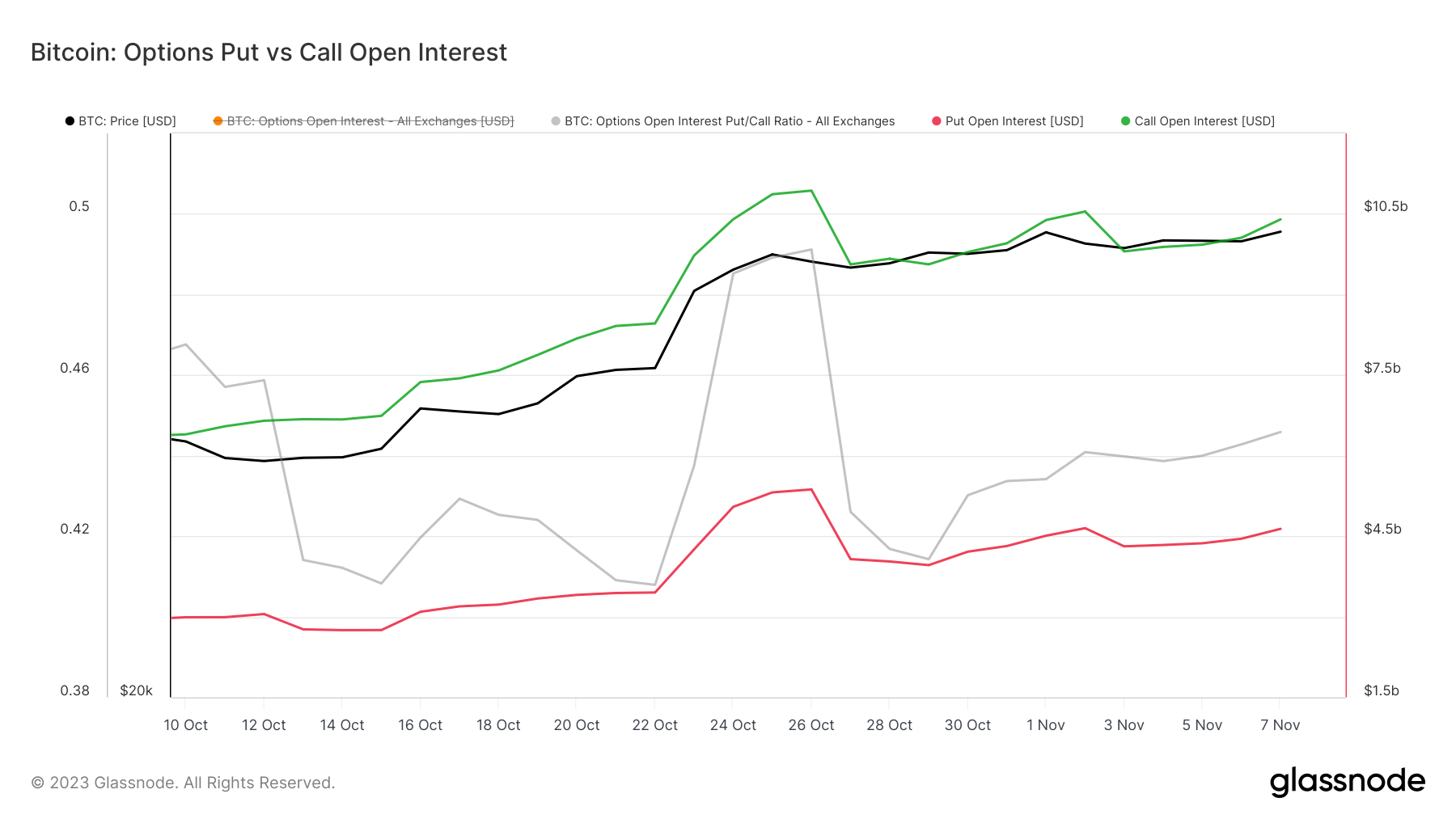

Options play a crucial role in assessing market expectations, enabling traders to obtain the right to purchase (call options) or sell (put options) Bitcoin at a set price. The open interest – the total of all active option contracts – along with the ratio of puts to calls can indicate the market’s sentiment and confidence. Simultaneously, volume highlights the urgency of trading activities.

Building on our earlier CryptoSlate analysis, the Bitcoin options market has shown subtle changes in sentiment since the start of November.

There has been a slight uptick in call open interest to $10.40 billion and an increase in put open interest to $4.63 billion. While the upward trend has been ongoing since October, the rate suggests a more cautious optimism among traders.

Graph illustrating the open interest on Bitcoin put and call options from Oct. 10 to Nov. 7, 2023 (Source: Glassnode)

Graph illustrating the open interest on Bitcoin put and call options from Oct. 10 to Nov. 7, 2023 (Source: Glassnode)

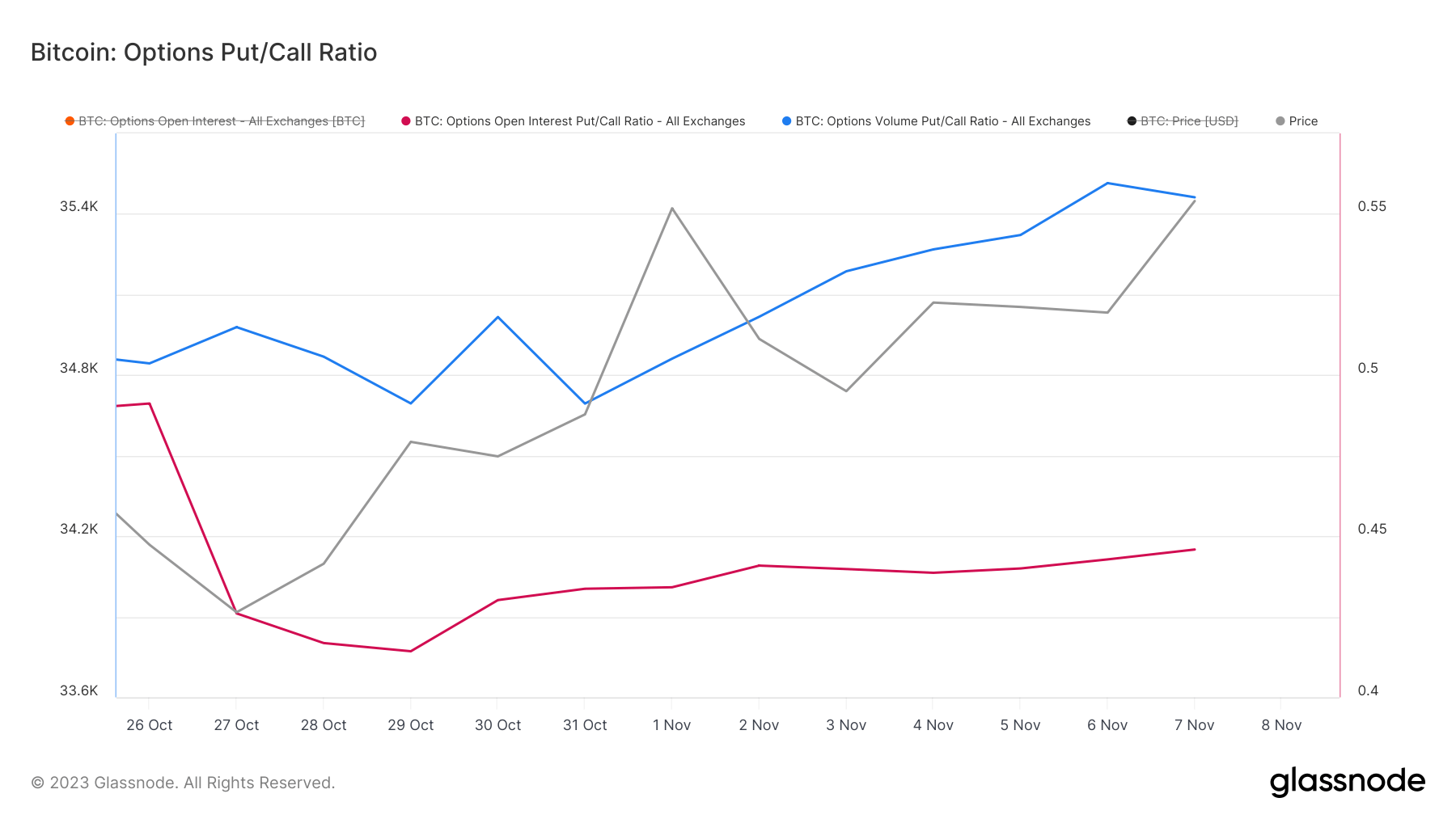

The put/call ratio of open interest has experienced a minor rise from 0.433 to 0.445, signifying a slight but perceptible change. An increase in the put/call ratio typically signals a bearish sentiment. However, since the ratio still remains significantly below 1, it more accurately reflects heightened hedging activity.

Graph depicting the put/call ratio for Bitcoin options from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)

Graph depicting the put/call ratio for Bitcoin options from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)

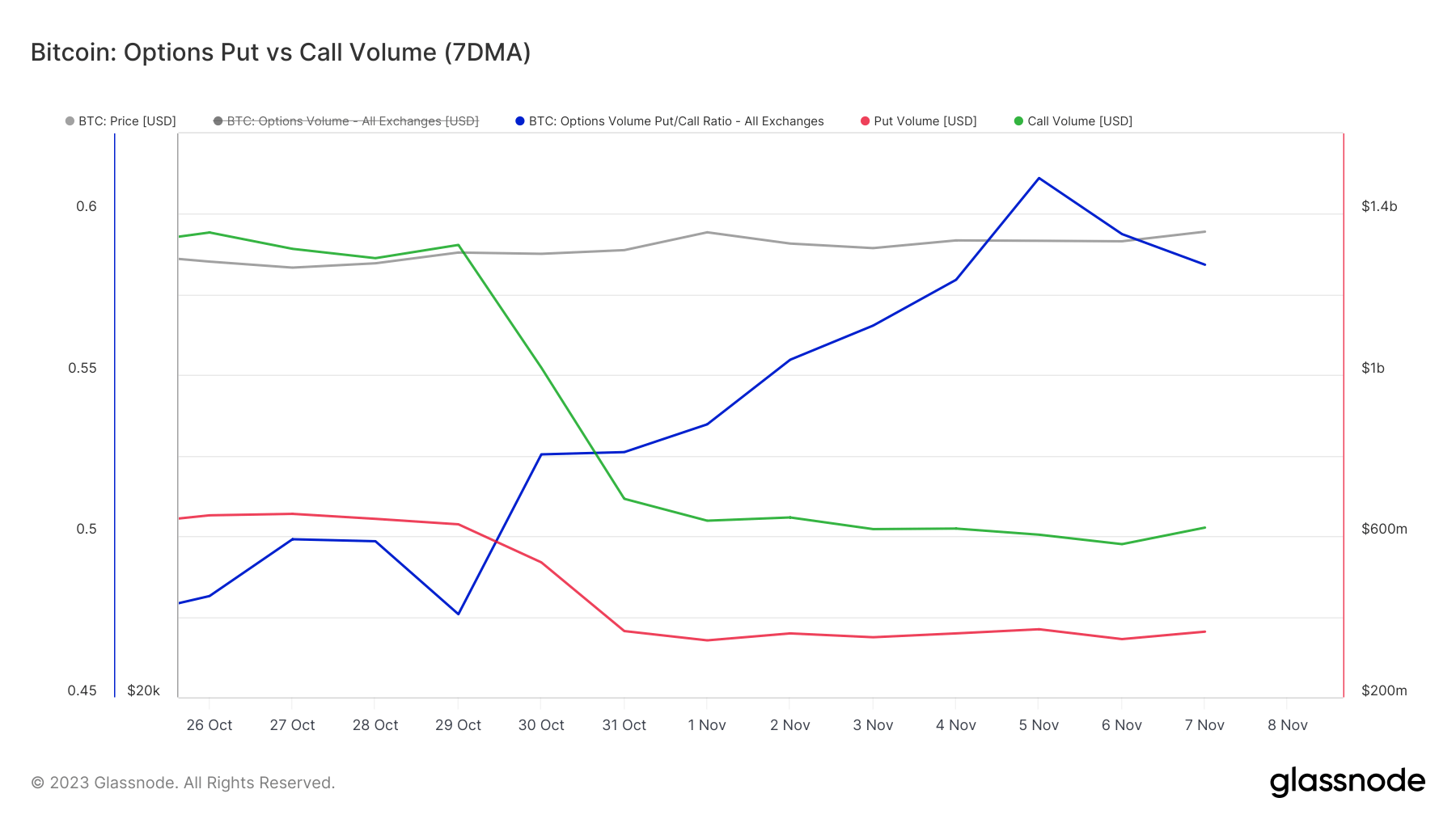

This is further supported by the progression of the volume ratio from 0.526 to 0.584, which underscores a defensive posture within an overall bullish market.

Graph showing the volume of Bitcoin put (red) and call (green) options, along with the options volume put/call ratio (blue) from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)

Graph showing the volume of Bitcoin put (red) and call (green) options, along with the options volume put/call ratio (blue) from Oct. 26 to Nov. 7, 2023 (Source: Glassnode)

Since the start of the month, Bitcoin’s price has risen from $34,600 and surpassed $35,400, reinforcing this sentiment.

In contrast to the record high call open interest from CryptoSlate’s previous analysis, the current statistics indicate a market that is optimistic yet more restrained. The gradual rise in the put/call ratio reflects a market that, while still bullish, is becoming increasingly cautious. The steady growth in both call and put open interests points to an engaged market, with traders preparing for possible price surges while simultaneously protecting against downward risks.

Examining strike prices indicates that optimism remains, but traders are also readying for scenarios where the price might not align with their bullish expectations.

The post Bitcoin’s climb above $35,000 followed by surprisingly measured market appeared first on CryptoSlate.