Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

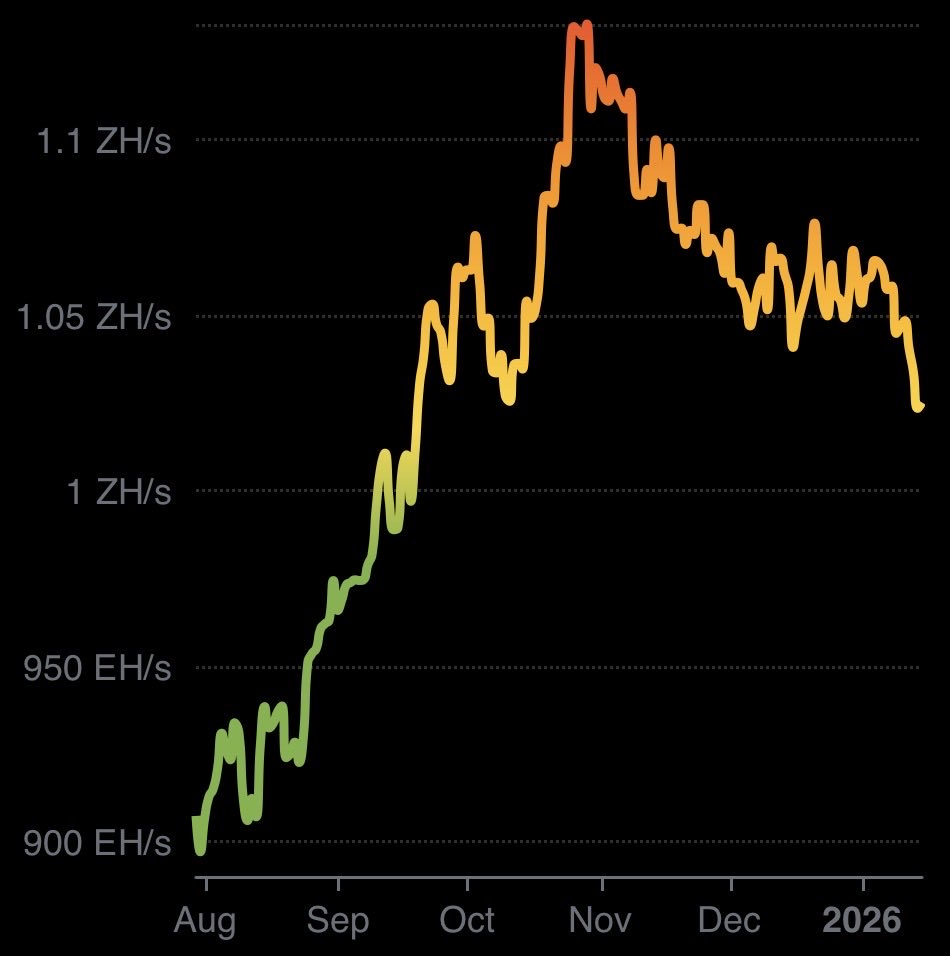

Bitcoin’s hashrate declines as price surge fails to persuade miners to reactivate equipment.

Bitcoin miners commenced early 2026 under a familiar yet increasingly harsh environment: the network hashrate is declining from the late-2025 peaks, difficulty adjustments are lagging, and energy expenses remain the critical factor that determines which mining operations remain active and which cease operations.

This leads to a market that may seem robust at first glance, particularly when Bitcoin experiences a rebound, yet remains delicate at the edges, where a single increase in difficulty or a surge in regional power costs can swiftly shift the status from “operating” to “curtailing.”

Hashrate is diminishing after late-2025 highs

Bitcoin’s network hashrate has decreased from its late-2025 maximum levels and has not reliably returned to those figures even during instances of strong spot performance.

Bitcoin hashrate decline (Source: BitcoinIsaiah)

Bitcoin hashrate decline (Source: BitcoinIsaiah)

JPMorgan projected that Bitcoin’s monthly average network hashrate increased by 5% in October to 1,082 EH/s, marking a record monthly average in its series. November recorded an estimated 1,074 EH/s, reflecting a slight month-over-month decrease rather than a straightforward continuation.

Daily estimates since late December have shown volatility, with figures fluctuating above and below the 1,000 EH/s mark, indicating that miners are managing uptime rather than expanding seamlessly.

YCharts’ network series, sourced from Blockchain.com, indicated both sub-1,000 EH/s readings and recoveries above that level during the mid-January rebound.

| Metric | Point | Value | What it anchors |

|---|---|---|---|

| Monthly-average hashrate | Oct. 2025 | 1,082 EH/s | Record monthly average (JPMorgan estimate) |

| Monthly-average hashrate | Nov. 2025 | 1,074 EH/s | Minor pullback after the record (JPMorgan estimate) |

| 7-day hashrate average | Jan. 2026 | 1,024 EH/s | Short-term cooling following late-2025 stress |

Hashprice, not Bitcoin price alone, is influencing shutdown decisions

Miner behavior is increasingly reliant on hashprice, the anticipated daily revenue generated per unit of hashrate, rather than solely on spot Bitcoin prices. This metric determines whether the least efficient rigs can operate without incurring losses.

In Luxor’s weekly update dated Jan. 12, USD hashprice dropped week-over-week from $40.23 to $39.53 per PH/s/day, a level characterized as “close to, or at, breakeven for many miners.”

In essence, the network can remain volatile even during a spot recovery because miner profitability may remain constrained.

Luxor also noted that Bitcoin decreased 2.9% last week to approximately $91,132 as hashprice tightened, increasing pressure on miners whose cost structures do not adjust alongside spot BTC.

In the same update, Luxor’s 7-day simple moving average for hashrate declined 2.8% from 1,054 EH/s to 1,024 EH/s.

Context from late 2025 is significant. Luxor’s research division previously documented difficulty reaching an all-time high following a positive adjustment of 6.31% on Oct. 29, which raised difficulty to 155.97T.

Hashprice subsequently weakened in November as fees and prices failed to counterbalance the heightened difficulty, with Hashrate Index data revealing hashprice falling to an all-time low near $36 per PH/day.

Hashprice chart (Source: Luxor)

Hashprice chart (Source: Luxor)

The market has moved beyond that low into early 2026, albeit not significantly. This explains why the hashrate recovery since October has been inconsistent: many operators are teetering at the boundary where “on” and “off” are differentiated by a narrow power-cost margin.

Related Reading

Related Reading

Bitcoin hashprice stabilizes after hitting quarterly low, but miner risk remains

Stabilized hashprice in March indicates temporary relief, yet ongoing pressures challenge miner profit margins.

Mar 28, 2025 · Andjela Radmilac

A quick reality check at the machine level

The sensitivity becomes apparent when translating hashprice into revenue per rig and comparing it with electricity costs.

Bitmain lists the Antminer S19j Pro at 92 TH/s and 2,714 watts, while its S21 listing shows 200 TH/s and 3,500 watts.

The table below employs a hashprice input of $38.2 per PH/s/day, roughly aligning with Luxor’s mentioned six-month forward average.

For power, it utilizes the U.S. Energy Information Administration’s September 2025 industrial average electricity price of 9.02 cents/kWh as a benchmark for delivered prices. Wholesale prices can vary (either lower or higher), but miners’ total costs hinge on contracts, congestion, fees, and curtailment conditions.

| Rig (spec source) | Hashrate | Power | Revenue/day (at $38.2 per PH/s/day) | Energy/day (at 9.02¢/kWh) |

|---|---|---|---|---|

| S19j Pro | 92 TH/s | 2,714 W | ~$3.51 | ~$5.88 |

| S21 | 200 TH/s | 3,500 W | ~$7.64 | ~$7.58 |

The implication is not that every miner is unprofitable; many have significantly better power rates, demand response income, and operational efficiency.

The key point is that the marginal miner drives turnover, and at these hashprice levels, marginal fleets increasingly function like flexible loads rather than “always on” infrastructure.

Related Reading

Related Reading

Bitcoin miners are bleeding at $90,000, but the “death spiral” math hits a hard ceiling

Stop worrying about infinite selling pressure; structural limits dictate exactly how many coins can realistically enter the market before operations collapse.

Dec 21, 2025 · Andjela Radmilac

Difficulty is the lagging lever that can catch miners off guard

Difficulty adjusts only every 2,016 blocks (approximately every two weeks), meaning it does not react immediately to fluctuations in spot BTC or hashrate.

This delay can compel miners to endure unfavorable hashprice conditions for an entire epoch prior to the protocol recalibrating, compressing margins during downturns and postponing the profitability recovery that some operators anticipate will occur immediately.

This timing risk is why miners can be caught off guard by difficulty: a fleet may appear viable during a BTC surge, only to be pressured when difficulty rises in the next interval and the expected revenue per hash fails to keep pace.

Related Reading

Related Reading

Bitcoin difficulty predicted to fall 5% as hashrate dips

Hashrate instability sets the stage for a significant drop in the Bitcoin network’s mining difficulty.

Jul 31, 2025 · Liam 'Akiba' Wright

Early January difficulty data has also indicated a decrease of 1.20% to 146.4T in the first adjustment of 2026. Projections suggest a potential rise to ~148.20T in the Jan. 22 adjustment.

Forward pricing suggests limited relief unless conditions change.

Luxor indicated the forward market is pricing an average hashprice of $38.19 over the next six months. With the spot hashprice around $39.53, that curve indicates limited immediate relief unless one of the key factors shifts: higher BTC, increased fees, easing difficulty, or lower power costs.

The emerging pattern resembles a form of network whiplash: hashrate declines when hashprice compresses, difficulty lags in response, and miners are compelled to endure weaker economics for an entire epoch before protocol-level relief arrives.

A spot rally, such as the recent rise to $97,000, can temporarily conceal stress; however, if the next difficulty window occurs at a higher level than operators anticipated, the pressure can quickly return.

Related Reading

Related Reading

Bitcoin just touched a critical price point but this order book signal suggests the move to $100k might backfire

Options hedging may amplify fluctuations between $95,000 and $104,000. However, order-book depth is down approximately 30% from 2025 peaks.

Jan 16, 2026 · Gino Matos

Power costs are where the squeeze intensifies

If hashprice indicates what the network is compensating miners, electricity costs dictate what the real-world operator can retain.

Luxor’s summary translated compute revenue into implied revenue per MWh across different fleet-efficiency categories:

| Fleet efficiency | Compute revenue (per MWh) |

|---|---|

| Under 19 J/TH | $97/MWh |

| 19–25 J/TH | $75/MWh |

| 25–38 J/TH | $51/MWh |

This hierarchy is important because electricity pricing does not clear uniformly across regions or contract types.

The International Energy Agency noted that U.S. wholesale electricity prices averaged around $48/MWh in the first half of 2025, while the European Union averaged about $90/MWh.

The IEA also projected EU 2026 electricity futures around $80/MWh.

Wholesale benchmarks do not correspond precisely to delivered industrial rates, but they help outline direction and volatility by region.

For miners operating in Luxor’s 25–38 J/TH category, implied compute revenue near $51/MWh indicates that many sites can quickly face curtailment if delivered energy prices rise, if hedges are unfavorable, or if local congestion and fees increase the overall price.

Negative pricing introduces another dimension: it can reward adaptable loads and penalize rigid procurement.

The IEA reported that negative prices are becoming increasingly prevalent in Europe, with the proportion of negative-price hours reaching 8–9% in the first half of 2025 in countries like Germany, the Netherlands, and Spain.

This scenario favors miners capable of adjusting operations quickly, capturing demand response payments, or utilizing behind-the-meter generation.

Operators lacking this flexibility may encounter higher effective costs during tight periods, even if overall wholesale prices decrease.

Texas remains a crucial mining jurisdiction and a policy wildcard

Texas continues to be one of the most crucial jurisdictions to monitor, as grid policies and interconnection competition influence the economics of large mining operations.

Texas law Senate Bill 6 grants ERCOT the authority to instruct certain large electricity consumers to shut down or utilize backup generation during emergencies.

Reports on the bill indicated that this applies to new large loads of 75 MW or more connecting after Dec. 31, 2025, while existing facilities are exempt from this requirement.

Meanwhile, ERCOT’s load request pipeline surpassed 230 GW in 2025, with over 70% connected to data centers, as per reports regarding the queue.

The International Energy Agency has also highlighted data centers as a significant factor driving electricity demand growth through 2026.

For Bitcoin miners, this combination increases the value of current interconnections and stable contracts, making expansion considerably more challenging unless curtailment terms and grid access are negotiated beforehand.

What to keep an eye on next

- The upcoming one to two difficulty epochs: The lag in difficulty can either alleviate the pressure (if it decreases) or exacerbate it (if it increases while hashprice remains unchanged).

- Hashprice stability: Luxor’s $39–$40 per PH/s/day range is close to breakeven for many miners, while the forward curve around $38 suggests little margin for error.

- Power volatility: Fleets in the 25–38 J/TH category are particularly vulnerable if delivered costs approach or surpass implied compute revenue per MWh, or if local basis risk escalates overall pricing.

- ERCOT curtailment risk: Emergency authority under SB 6 could result in sudden, event-driven hashrate declines that are independent of Bitcoin price movements.

- Data center competition: Ongoing growth in grid demand may limit miners’ access to the lowest-cost capacity and reinforce regional differences in profitability.

Currently, the measurable baseline is a spot hashprice Luxor has set at $39.53 per PH/s/day, alongside a weekly Bitcoin decline to around $91,132 and a 7-day hashrate average reduced to 1,024 EH/s.

This combination establishes the reference point as the network nears the next difficulty adjustment, where miners will once again determine whether to operate, curtail, or await a recalibration that will only arrive after the protocol’s inherent delay.

With JPMorgan’s 1,082 EH/s October monthly benchmark still holding as a recent high in its series, the next crucial question is clear:

Can miner economics sustain enough consistent uptime to return toward that level, or will the lag in difficulty and energy constraints keep the network in a stop-start pattern even if BTC remains strong?

The post Bitcoin’s hashrate continues to fall as the price spike doesn’t convince miners to turn machines back on appeared first on CryptoSlate.