Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin supply overview: Timing of sales by holders, challenges for miners, and the impact of ETFs

Bitcoin supply guide: cost-basis bands, miner stress, and ETF flow signals

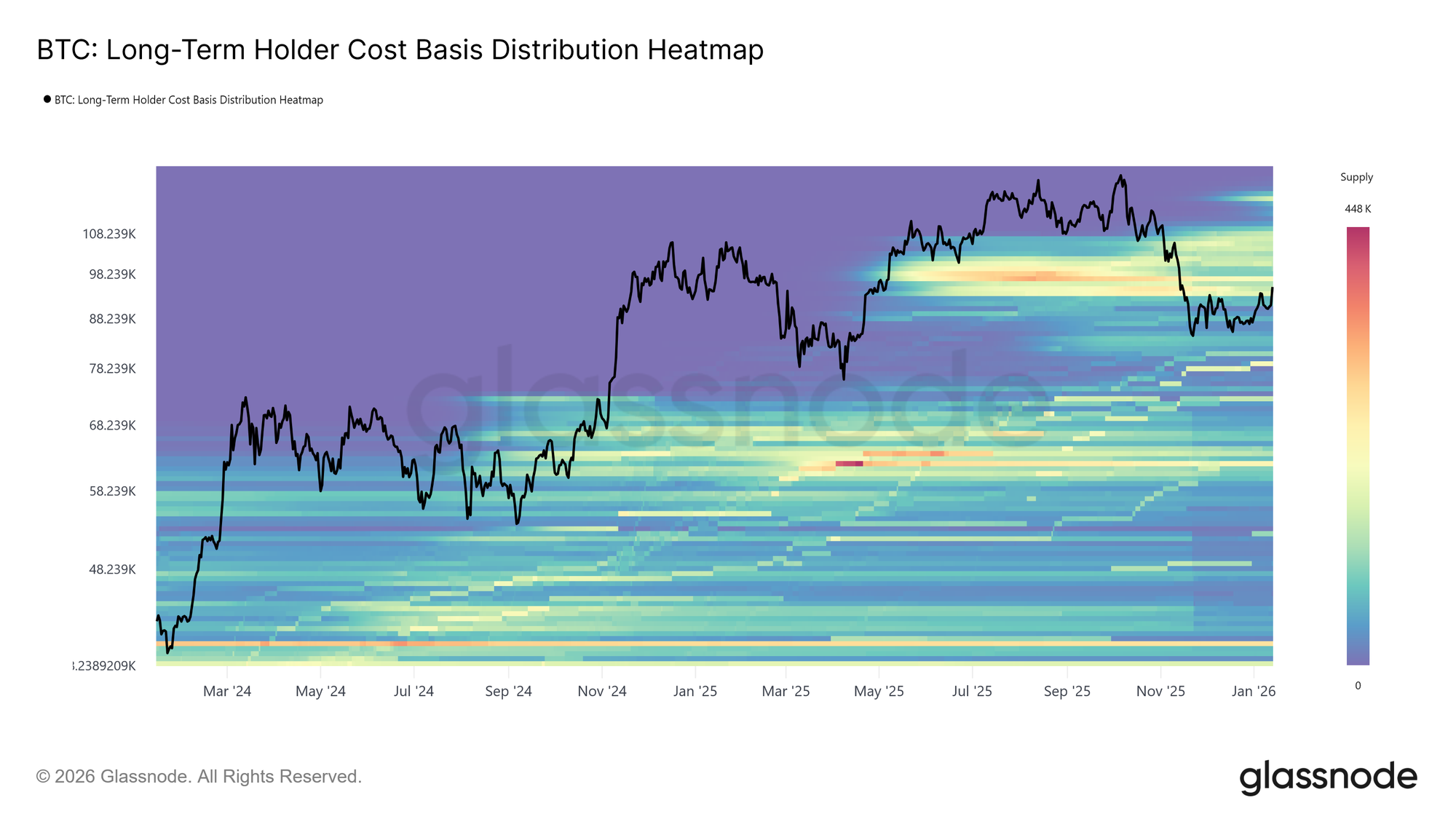

Bitcoin is presently trading outside a cost-basis range of $93,000–$110,000, which Glassnode identifies as an “overhead supply” area.

BTC long term holder cost basis distribution heatmap (Source: Glassnode)

BTC long term holder cost basis distribution heatmap (Source: Glassnode)

This scenario shifts the focus for the upcoming quarter’s supply narrative towards miner cash flow and holder actions rather than the issuance timeline. As per Glassnode’s Week On-chain W02 2026, the Short-Term Holder (STH) cost basis is approximately $98,300.

This figure frequently serves as a benchmark for assessing whether recent purchasers will increase their positions or sell during price recoveries.

Concurrently, mining markets are reflecting a slim profitability environment.

The Hashrate Index summary from January 26, 2026, indicated that the six-month hashprice forward curve is around $33.25 per PH/s per day (approximately 0.00041 BTC), which is below the breakeven point identified for many miners ($39.50), contingent on operational costs and equipment types.

Related CryptoSlate context: narratives surrounding miner stress often revolve around the same profitability/difficulty cycle, as Bitcoin’s hashrate continues to decline while price increases do not incentivize miners to reactivate their machines.

This quarter’s additional factor is whether ETF flows will act as a sink for tradable supply or a release mechanism.

SoSoValue data recorded $681 million in net outflows from spot Bitcoin ETFs during the first complete trading week of 2026, amid a risk-off environment linked to interest rate expectations and macroeconomic news. Last week, net flows reached -$1.3 billion, marking the worst week since May 2025.

For further CryptoSlate reporting context on that same early-2026 flow situation, refer to Bitcoin breaking $126,000 has clear 3 year pathway but a brutal $1.3 billion exodus changes everything today.

Related Reading

Related Reading

Bitcoin breaking $126,000 has clear 3 year pathway but a brutal $1.3 billion exodus changes everything today

As the Fed prepares for its next significant policy decision, the opportunity for a 2026 breakout is rapidly closing for investors.

Jan 26, 2026 · Liam 'Akiba' Wright

Key takeaways

- Bitcoin’s issuance schedule is predetermined by the protocol, with a cap of 21 million and reward halvings occurring every 210,000 blocks. Short-term “supply shocks” typically arise from tradable float and incentives, as indicated by Blockchain.com’s supply chart.

- Glassnode identifies the current overhead supply between $93,000 and $110,000, with the STH cost basis around $98,300. This range serves as a demand-absorption test for the quarter, according to Glassnode W02 2026.

- Hashrate and difficulty have already adjusted to stress, with the 7-day SMA hashrate decreasing from 1,003 EH/s to 966 EH/s and difficulty dropping 3.28% to 141.67T on January 22, according to Hashrate Index (January 26, 2026). For context, see Bitcoin hashrate hits new high of 943 EH/s as difficulty adjusted down 0.45%.

- Mining forwards suggesting approximately $39.50/PH/s/day over six months keep focus on miner treasury management and shutdown risks. “Breakeven” is contingent on operational expenses and fleet efficiency, as noted by Hashrate Index.

- ETF flow direction remains a critical factor following a challenging month to start the year, with $1 billion in net outflows.

Who this is for

- Long-term investors monitoring cohort supply, cost-basis bands, and maturation dynamics

- Swing traders concentrating on the STH cost basis and reactions to overhead supply

- Institutional teams observing ETF flow patterns and miner-driven liquidity

- Mining and infrastructure operators managing hashprice exposure and timing of difficulty adjustments

What to watch this quarter

- Price movements around the STH cost basis near $98,300 and efforts to regain a position within the $93,000–$110,000 overhead band (Glassnode W02 2026)

- Six-month hashprice expectations recovering to around $39.50/PH/s/day and divergence of spot hashprice from the curve (Hashrate Index)

- Difficulty adjustment cadence following the January 22, 3.28% drop to 141.67T (Hashrate Index).

- Venue flow mix, including Glassnode’s observation that Binance and aggregate exchange flows shifted into buy-dominant patterns while Coinbase sell pressure diminished (Glassnode W02 2026)

- Weekly spot Bitcoin ETF net flows following last week’s $1.3 billion outflows.

Issuance basics + halving (what is fixed vs what is variable)

Bitcoin’s total supply trajectory is deterministic at the protocol level, with a maximum of 21 million BTC and block-subsidy halvings occurring every 210,000 blocks.

This limitation is significant for long-term valuation and for quarterly issuance calculations. New supply is introduced on a schedule that the market can anticipate.

The more pressing question for the next quarter is the supply available in the market.

This refers to the inventory that can be accessed by spot venues through miner sales, holder distribution, and ETF creations or redemptions. This is where “supply shocks” frequently arise, as the issuance curve is established while liquidity decisions are contingent.

Most quarter-scale volatility corresponds to the latter.

Miner economics & sell pressure (why hashprice is the live supply lever)

Mining serves as an elastic supply lever since miner BTC sales represent one of the few structural sources of ongoing distribution.

This elasticity was evident in late January. Hashrate Index reported that the 7-day SMA hashrate decreased from 1,003 EH/s to 966 EH/s, and network difficulty adjusted down 3.28% to 141.67T on January 22.

Forward markets also indicate constrained miner margins.

The same summary noted that the hashprice forward curve is pricing an average of about $33.25 per PH/s per day over the next six months. Hashrate Index has separately indicated that $39–$40/PH/s/day is close to breakeven for many miners, while emphasizing that it varies based on operational costs and machine types.

A forward-looking perspective for this quarter utilizes three conditional paths based on these data points:

- Near-breakeven grind: If hashprice recovers to the forward-implied ~$33.25/PH/s/day, higher-cost fleets may encounter tighter treasury conditions.

- This could lead to occasional hashrate declines and sporadic spot selling to fund operations, according to Hashrate Index.

- Difficulty-driven relief: If hashrate weakens further, subsequent difficulty reductions can enhance revenue per unit hash even with a stable BTC price.

- This would lessen forced selling at the margin, as illustrated by the January 22 adjustment.

- Macro-driven compression: If a broader risk-off trend pressures BTC price while hashprice remains near breakeven, shutdowns could accelerate.

- This feeds into the same difficulty-relief cycle with uncertain timing.

Miner balance sheet policies can alter realized sell pressure within a quarter.

Related CryptoSlate miner-stress framing: Bitcoin faces potential miner capitulation as hash rate continues to drop.

Related Reading

Related Reading

Bitcoin's hashrate continues to fall as the price spike doesn't convince miners to turn machines back on

Even during a rally, Bitcoin miners are experiencing financial losses as this crucial profit metric reaches a level that necessitates significant shutdowns.

Jan 16, 2026 · Liam 'Akiba' Wright

Long-term vs short-term holders (where overhead supply actually comes from)

Glassnode’s current map depicts the supply overhang as a cost-basis band rather than a singular price point.

In Week On-chain W02 2026, it characterized the market as testing supply ranging from approximately $93,000–$110,000, while placing the STH cost basis at $98,300.

For this quarter, this perspective is important as it indicates where previous buyers might utilize price increases to exit.

It also delineates where new demand must absorb inventory to prevent renewed distribution.

Holder behavior has softened compared to late 2025 without transitioning into accumulation.

Glassnode noted that Long-Term Holder (LTH) supply continues to decline, although the rate of decrease has significantly slowed compared to the distribution observed throughout Q3 and Q4 2025. It also indicated that LTH net realized profit is approximately 12.8k BTC per week, down from cycle peaks exceeding 100k BTC per week.

The regime-change condition identified by Glassnode for a more sustainable rally is a transition where maturation supply surpasses LTH spending.

This would elevate LTH supply. In quarterly terms, the overhead band can only clear if selling pressure diminishes more rapidly than new and returning demand.

One technical note is relevant when readers compare dashboards.

Glassnode’s supply endpoints do not consider 155 days as a strict cutoff. Its cohorts apply a logistic weighting centered at 155 days with a 10-day transition width.

Common myths (supply narratives that fail under measurement)

- Myth: The halving creates immediate scarcity in tradable supply. Changes in issuance are block-based and known, while quarter-scale supply pressure is frequently influenced by miner profitability and holder distribution choices.

- Myth: 155 days is a strict boundary for LTH classification. Glassnode’s supply cohorts employ a logistic weighting centered at 155 days with a 10-day transition width, which impacts interpretation near inflection points.

- Myth: Miner capitulation is a single event. The hashrate and difficulty system can gradually decrease and then normalize profitability per unit hash, as demonstrated in the January 22 difficulty reduction following a hashrate decline.

Metrics dashboard (the minimum set to monitor for the next 6 months)

| Area | Metric | Current reference from sources | Why it matters this quarter | Source |

|---|---|---|---|---|

| Protocol | Supply cap and halving cadence | 21M max supply, halving every 210,000 blocks | Anchors issuance math, shifts focus to tradable float | Blockchain.com |

| Mining | Hashrate (7-day SMA) | 1,003 EH/s to 966 EH/s (late Jan. 2026) | Shutdown risk and miner revenue stress proxy | Hashrate Index (Jan. 26, 2026) |

| Mining | Difficulty adjustments | -3.28% to 141.67T on Jan. 22, 2026 | Mechanical relief valve for miner margins | Hashrate Index (Jan. 26, 2026) |

| Mining | Hashprice forward curve (6 months) | ~$33.25/PH/s/day | Frames treasury pressure and forced-sell probability | Hashrate Index (Feb. 3, 2026) |

| Holders | Overhead supply band | ~$93k to $110k | Defines where prior cost basis can convert rallies into sell flow | Glassnode W02 2026 |

| Holders | STH cost basis | ~$98.3k | Confidence threshold for recent buyers near overhead supply | Glassnode W02 2026 |

| Holders | LTH distribution pacing | ~12.8k BTC per week net realized profit, slower than prior peaks | Tracks whether distribution is fading or resuming into strength | Glassnode W02 2026 |

| Liquidity | Venue flow dominance | Binance and aggregate flows buy-dominant, Coinbase sell pressure eased | Absorption capacity at overhead supply depends on routing | Glassnode W02 2026 |

| ETFs | Weekly net flows | -$1B in first month of 2026 | Net outflows can return inventory to the market via redemptions | SoSoValue via reporting |

Red flags & invalidation

- Any assertion that exchange balances are “down X% recently” without a current-dated dataset should be regarded as invalid.

- “Breakeven hashprice” should remain conditional on operational expenses and hardware, since Hashrate Index indicates $39–$40/PH/s/day as near breakeven for many miners based on those factors.

Action checklist, monitoring routine

- Weekly: Document ETF net flow sign and magnitude following the -$681 million outflow week, utilizing SoSoValue-linked reporting for consistency.

- Each difficulty epoch: Monitor whether difficulty continues to decline after the January 22’s 3.28% reduction, and compare with hashrate direction for miner stress context.

- Daily/rolling: Compare spot hashprice to the six-month forward average near $33.25/PH/s/day to assess whether miners are facing tightening or relief.

- Regime check: Observe whether LTH supply remains net declining or begins to rise under Glassnode’s “maturation exceeds spending” condition.

- Price context: Monitor market reactions around $98,300 and within $93,000–$110,000, as these levels correspond to STH and overhead supply cost basis in the current Glassnode framework.

These inputs should be linked back to the fixed Bitcoin issuance schedule.

The post Bitcoin supply guide: When holders sell, miners strain, and ETFs add pressure appeared first on CryptoSlate.