Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin signals crucial $40k alert, indicating a potential 42% decline before a new upward trend may commence.

Bitcoin has returned to a familiar situation where the chart appears unfavorable, the atmosphere is noisy, and everyone is attempting to predict if the next movement will finally alter the sentiment.

Today, Bitcoin dipped below $70,000 for the first time in over a year.

Historically, this price remains robust, particularly when viewed from any point prior to 2024. An investor in Bitcoin from 2020 would have been eager to see a BTC price of $69,000.

Bitcoin price chart 2024 to present (Source: TradingView)

Bitcoin price chart 2024 to present (Source: TradingView)

In this context, the situation feels different as this phase of the cycle focuses less on “high prices” and more on “who is truly under pressure.”

This is why metrics for long-term holders are significant, and why the possibility of Bitcoin retracing to around $40,000 should be taken seriously.

Long-term holders are the individuals least likely to react impulsively. They endure market fluctuations, media narratives, and declines that would unsettle most traders.

When this group begins to experience genuine distress, the market is typically nearing the end of its remaining bearish momentum.

A clear way to illustrate that distress is through the cost basis.

On-chain cost basis trends suggest long-term holders remain resilient as short-term momentum fades. (Source: CryptoQuant)

On-chain cost basis trends suggest long-term holders remain resilient as short-term momentum fades. (Source: CryptoQuant)

Most of the time, Bitcoin trades above the average price that long-term holders paid. When it approaches that average, the market begins to test conviction in a manner that is difficult to feign.

A useful reference point is the realized price for long-term holders, which essentially represents the average acquisition price of coins held by long-term holders, typically defined as coins that have remained stationary for at least 155 days.

The realized price serves as a proxy for this cohort’s cost basis. BitBo also presents this concept, framing it as a historically significant support level during bear markets.

Why $40-$50k keeps appearing

The reason I frequently return to the $40,000 – $50,000 range is that long-term holders have recognized that the price has been increasing over time. It is now in the vicinity of that level. Viewed through this perspective, $40,000 transitions from being a mere round number to a stress test.

Related Reading

Related Reading

Akiba's medium term $49k Bitcoin bear thesis – why this winter will be the shortest yet

Shorter bear markets, sharper floors: why $49k could materialize early, and what could change the trend.

Nov 24, 2025 · Liam 'Akiba' Wright

It is a scenario where the market can observe the consequences when the strongest hands cease to feel secure.

Related Reading

Related Reading

I predicted Bitcoin falling to $49k this year and January delivered some very concerning red flags

Bitcoin heading to $49k? The “dip” appears more severe when the underlying structure is already faltering – Akiba's 2026 bear thesis update

Jan 30, 2026 · Liam 'Akiba' Wright

This leads us to the two CryptoQuant charts below, which effectively illustrate what “bottom conditions” typically resemble on-chain without much speculation.

The first is the adjusted long-term holder MVRV compared to the realized price chart.

Long-term holder MVRV stays above 1, suggesting BTC has not yet reached classic cycle-bottom conditions. (Source: CryptoQuant)

Long-term holder MVRV stays above 1, suggesting BTC has not yet reached classic cycle-bottom conditions. (Source: CryptoQuant)

In simple terms, MVRV compares market value to realized value.

When adjusted for a specific cohort, it poses a more precise question: Is this group sitting on profits or losses relative to its cost basis?

When the adjusted long-term holder MVRV falls below 1.0, it indicates that the cohort is, on average, underwater.

On the chart, those periods are represented as deep-shaded blocks. They align closely with significant bear market lows across various cycles.

This is the most important takeaway. The second takeaway pertains to what it indicates about our current position.

The chart reveals that the Bitcoin price remains well above the long-term holder realized price line, and the adjusted LTH MVRV is still above 1.0.

This is significant because it implies that the market has not yet entered the historical phase where the long-term cohort is underwater in aggregate.

If we continue to decline and that ratio keeps tightening, the chart supports the notion that we are approaching a historically significant zone.

It does not confirm that we are already there.

The second chart, long-term holder SOPR, provides a different type of signal.

Long-term holder SOPR remains above 1, indicating BTC holders are still realizing profits despite the drawdown. (Source: CryptoQuant)

Long-term holder SOPR remains above 1, indicating BTC holders are still realizing profits despite the drawdown. (Source: CryptoQuant)

SOPR pertains to behavior at the moment coins are spent. It assesses whether coins are sold for a profit or a loss.

CryptoQuant’s own guide is straightforward: values above 1 indicate profit-taking, while values below 1 signify that the cohort is realizing losses.

On the chart, the LTH SOPR line remains above 1 and has been gradually declining. This suggests a diminishing profit cushion.

Long-term holders are still primarily spending into profits, and the market is trending toward a point where that will no longer be true for an increasing portion of the cohort.

Historically, true capitulation moments tend to occur when LTH SOPR drops below 1 and remains there for an extended period.

That is when long-term holders begin to lock in losses, creating a very different emotional environment compared to mild profit-taking.

What on-chain loss pressure indicates now

This is where the On Chain Mind “LTH Loss Risk Metric” fits seamlessly into the overall picture.

Their framework is straightforward: it tracks the percentage of long-term holder supply held at a loss and treats it as a type of distress oscillator, a risk indicator.

Bitcoin’s long-term holder loss risk sits near 37%, far from levels seen at prior cycle lows. (Source: OnChainMind)

Bitcoin’s long-term holder loss risk sits near 37%, far from levels seen at prior cycle lows. (Source: OnChainMind)

In their analysis, they emphasize previous peaks during significant lows and note that the current reading is around 37%.

The implication is that we are not yet in widespread underwater territory. Historically, a quicker “bottoming process” tends to accelerate when that percentage exceeds the mid-50s into the 60s.

The most profound capitulation zones in past cycles have been even higher.

When you combine these three perspectives, a coherent narrative emerges.

Prices are declining, the crowd is anxious, and that resembles a bear market.

The long-term cohort remains predominantly above water, indicating that demand has not yet compelled the most severe selling. The charts corroborate this.

The adjusted long-term holder MVRV chart shows that the clearest bottoms occurred when long-term holders were, on average, underwater.

The SOPR chart indicates that the cohort is not yet broadly realizing losses.

The loss risk is around 37%, conveying the same message in different terms.

So does the data “support Bitcoin falling to $40k before a new bull run can commence” as a strict requirement?

I do not believe the data warrants that level of certainty. What the data does support is a more conditional interpretation of the argument that remains compelling and easier to substantiate.

If Bitcoin continues to decline, and if the market requires a complete psychological reset, then a move toward the long-term holder cost basis zone becomes more plausible.

Bitcoin underperforms risk assets and commodities as the drawdown deepens below $70K. (Source: TradingView)

Bitcoin underperforms risk assets and commodities as the drawdown deepens below $70K. (Source: TradingView)

This is where long-term holders cease to feel secure, where MVRV compresses toward 1, where SOPR risks falling below 1, and where the share of losses begins to rise rapidly.

If the market stabilizes above that zone and ETF flows start to act as a consistent bid, the necessity for a significant washout diminishes.

The bottom can be established gradually rather than through distress.

The ETF flow dashboards are significant here as they indicate whether institutions are consistently absorbing supply or withdrawing from it.

Macro factors still loom in the background like gravity.

The Federal Reserve maintained the target range at 3.50–3.75% in late January, which keeps financial conditions relatively tight by recent standards.

The 10-year yield was approximately 4.26% at the end of January.

This indicates that cash currently offers a reasonable alternative return, influencing the level of risk the market is willing to accept.

Why the path matters as much as the level

Next, you consider positioning and market structure.

Glassnode’s Week On Chain notes that profit-taking pressure had subsided into early 2026, and it also highlighted overhead supply levels that can make rallies feel burdensome until they are absorbed.

It also pointed out that options open interest experienced a significant reset. This can alter how dramatically the market moves when it reaches specific price zones, as dealer positioning and gamma can amplify momentum once a range is breached.

However, that relief was short-lived, as the beginning of February has witnessed substantial profit-taking, with traders transferring over $4 billion BTC to sell on Binance alone.

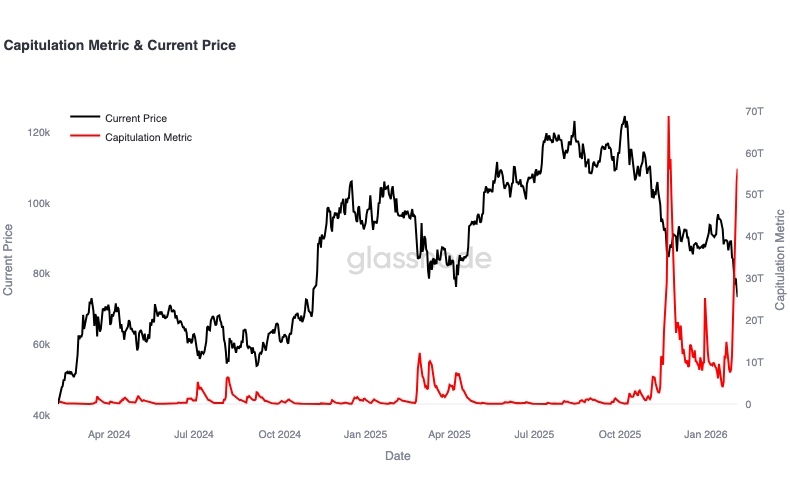

Today, Glassnode announced,

The BTC capitulation metric has recorded its second-largest spike in two years, indicating a sharp increase in forced selling.

These stress events typically coincide with accelerated de-risking and heightened volatility as market participants reset their positions.

This is significant because the journey to $40,000 – $50,000 is not merely a straight descent.

It involves a series of failed recoveries, liquidity pockets, forced selling, and ultimately, indifference.

This is characteristic of bear markets. They do not simply decline until the price appears low enough; they wear individuals down.

Long-term holders are typically the last group anyone anticipates to feel pressured.

The entire narrative surrounding Bitcoin is founded on conviction: enduring through turmoil, purchasing dips, remaining humble during euphoric times, and exercising patience during dark periods.

This narrative is grounded in a genuine pattern.

The strongest cohort tends to capitulate late, and when they do, it often coincides with lasting lows.

Historically, the moments when this cohort is underwater on average have aligned with significant bottoms.

However, we are not there yet.

The indicators that signify the most severe phase of that process, MVRV under 1, SOPR under 1, and an increasing share of long-term supply held at a loss, are still forthcoming if the decline persists.

Thus, the charts support the broader notion that deeper distress is typically present near the cleanest bottoms.

They also provide a crucial element: a checklist that allows you to monitor whether the market is genuinely reaching that phase or merely discussing it.

If we are seeking a sustainable low that can facilitate a new cycle, then $40,000 – $50,000 should be regarded as a zone where serious discussions commence.

This is approximately where long-term holders begin to encounter their own cost basis.

The post Bitcoin flashes critical $40k warning, signaling another 42% drop before the new bull run can start appeared first on CryptoSlate.