Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin returns to significant monthly all-time high support level established in 2021.

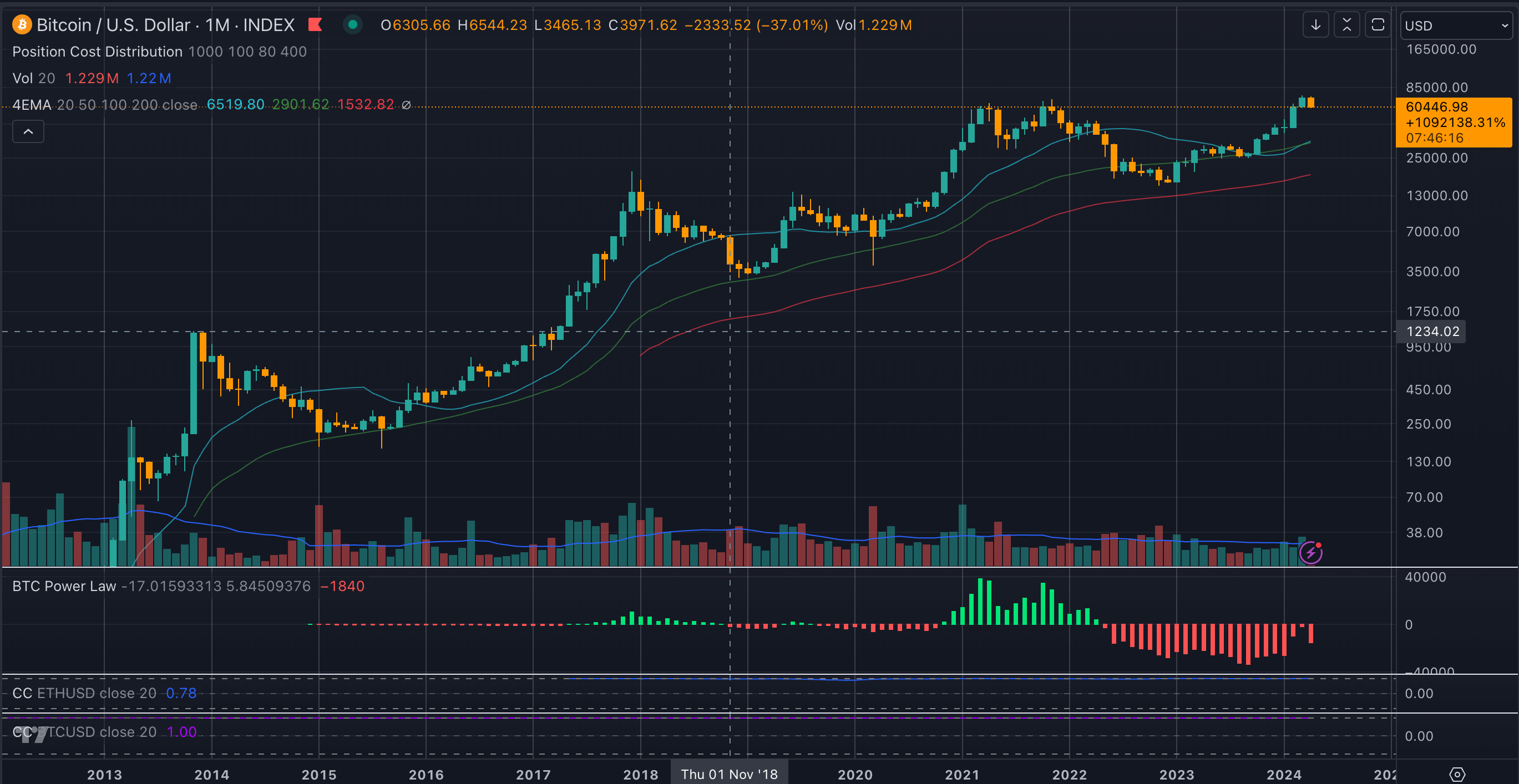

Bitcoin is set to conclude April with a decline of approximately 15% since the beginning of the month. The closing of the monthly candle will signify the end of seven consecutive green candles and the termination of a record-setting streak.

Bitcoin monthly candles since 2013 (TradingView)

Bitcoin monthly candles since 2013 (TradingView)

At the start of the month, Bitcoin achieved a new all-time high for a monthly candle close, reaching around $71,200. The former high was approximately $60,500, established in 2021 when Bitcoin was trading again as of the time of this report.

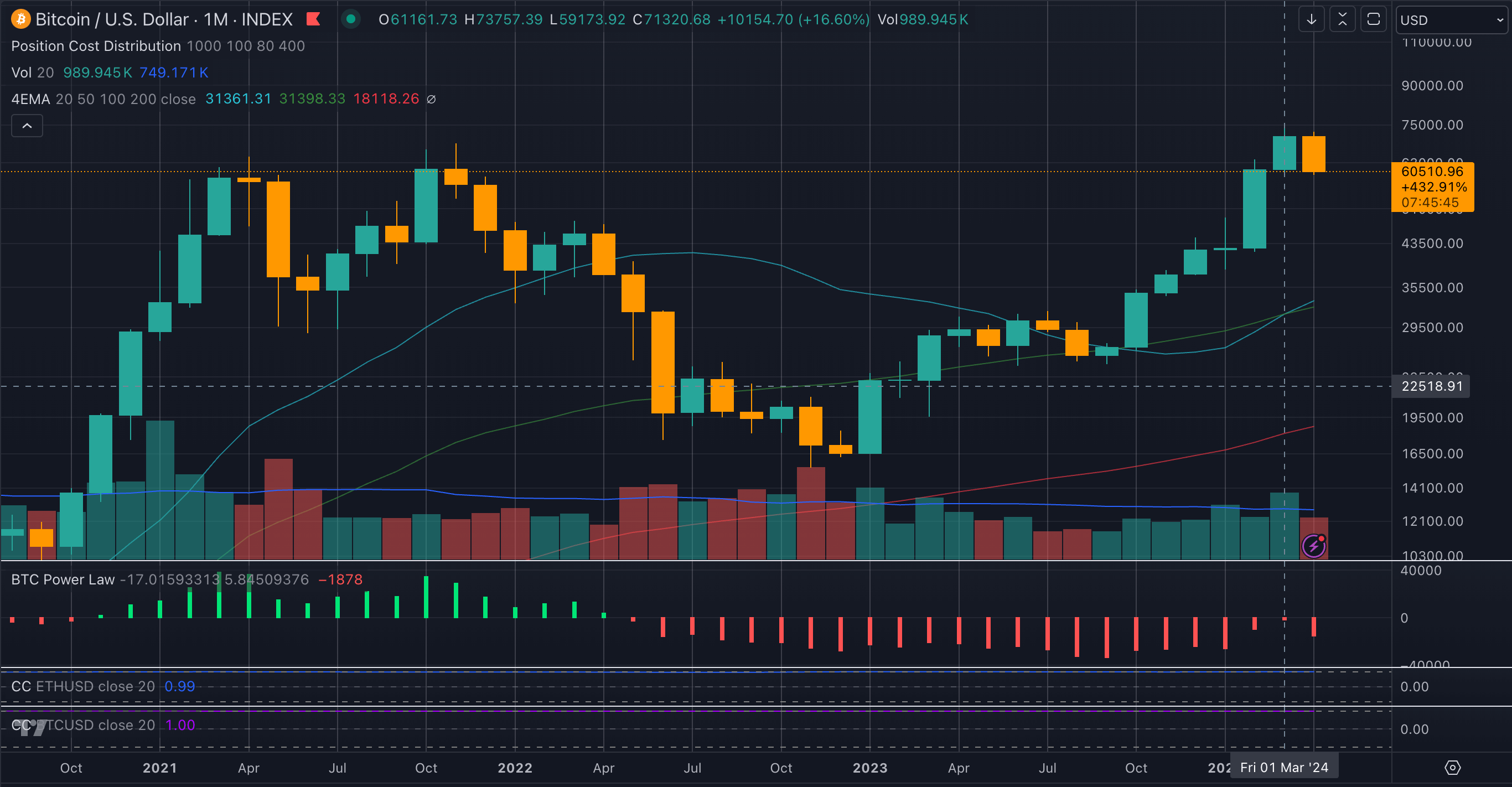

Bitcoin monthly candles since 2021 (TradingView)

Bitcoin monthly candles since 2021 (TradingView)

The psychological support level of $60,000 is anticipated to be a crucial indicator for Bitcoin in the upcoming week. Market sentiment is diminishing due to decreased buying pressure from Bitcoin ETFs in the US and the lackluster launch of Hong Kong ETFs this morning.

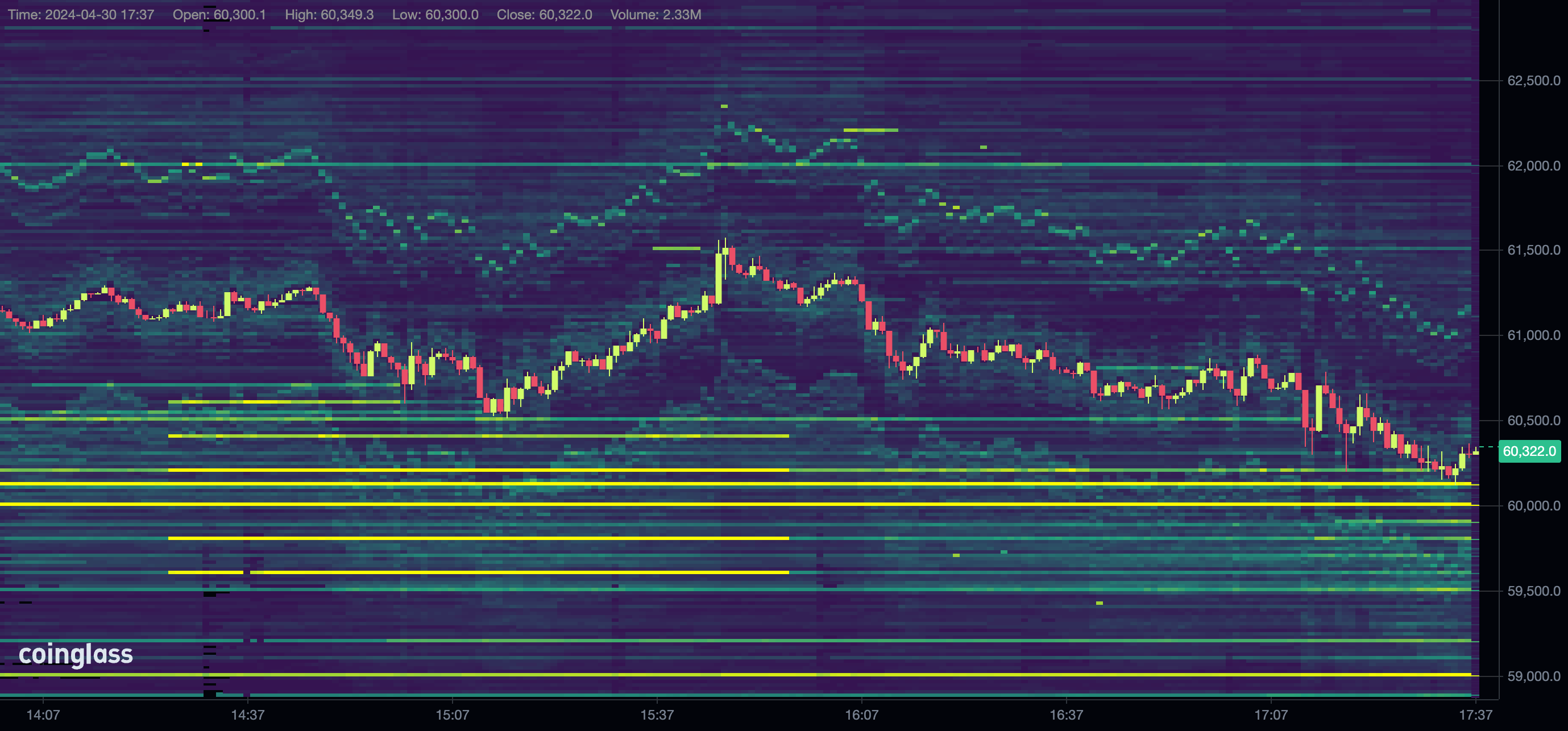

In the last 24 hours, there have been liquidations exceeding $300 million in the crypto market, with the majority stemming from long positions at $257 million and only $58 million from shorts, based on Coinglass data.

Additionally, Binance, the leading exchange for Bitcoin trading, displays substantial buy walls around the $60,000 mark. More than 1,000 BTC ($60 million) in buy orders are positioned on the BTC-USDT pair alone, prepared to absorb a decline to that level. However, the overall liquidity in the order book seems relatively low compared to recent periods in this bull market.

Binance Bitcoin order book (Coinglass)

Binance Bitcoin order book (Coinglass)

With Bitcoin sentiment declining and no forthcoming bullish events anticipated, price discovery is likely to be influenced less by optimism regarding future developments and more by the inherent value of the Bitcoin network. US ETF approvals and launches, the Halving, and now the Hong Kong ETFs have all occurred. Bitcoin has experienced a remarkable surge during this time, with over 90% of holders in profit. Is it time for profit-taking, leading Bitcoin to retest lower levels, or will it maintain its strength at this significant historical and psychological monthly support?

The post Bitcoin retraces back to critical monthly all-time high support level from 2021 appeared first on CryptoSlate.