Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin miners reach highest revenue in 19 months as halving approaches

Tracking miner revenue is vital for grasping the stability and sustainability of the Bitcoin ecosystem. Miner revenue, which consists of a blend of block rewards and transaction fees, offers insights into the economic feasibility of Bitcoin mining. In light of the impending halving, which will reduce block rewards by 50%, the assessment of miner revenue becomes even more significant.

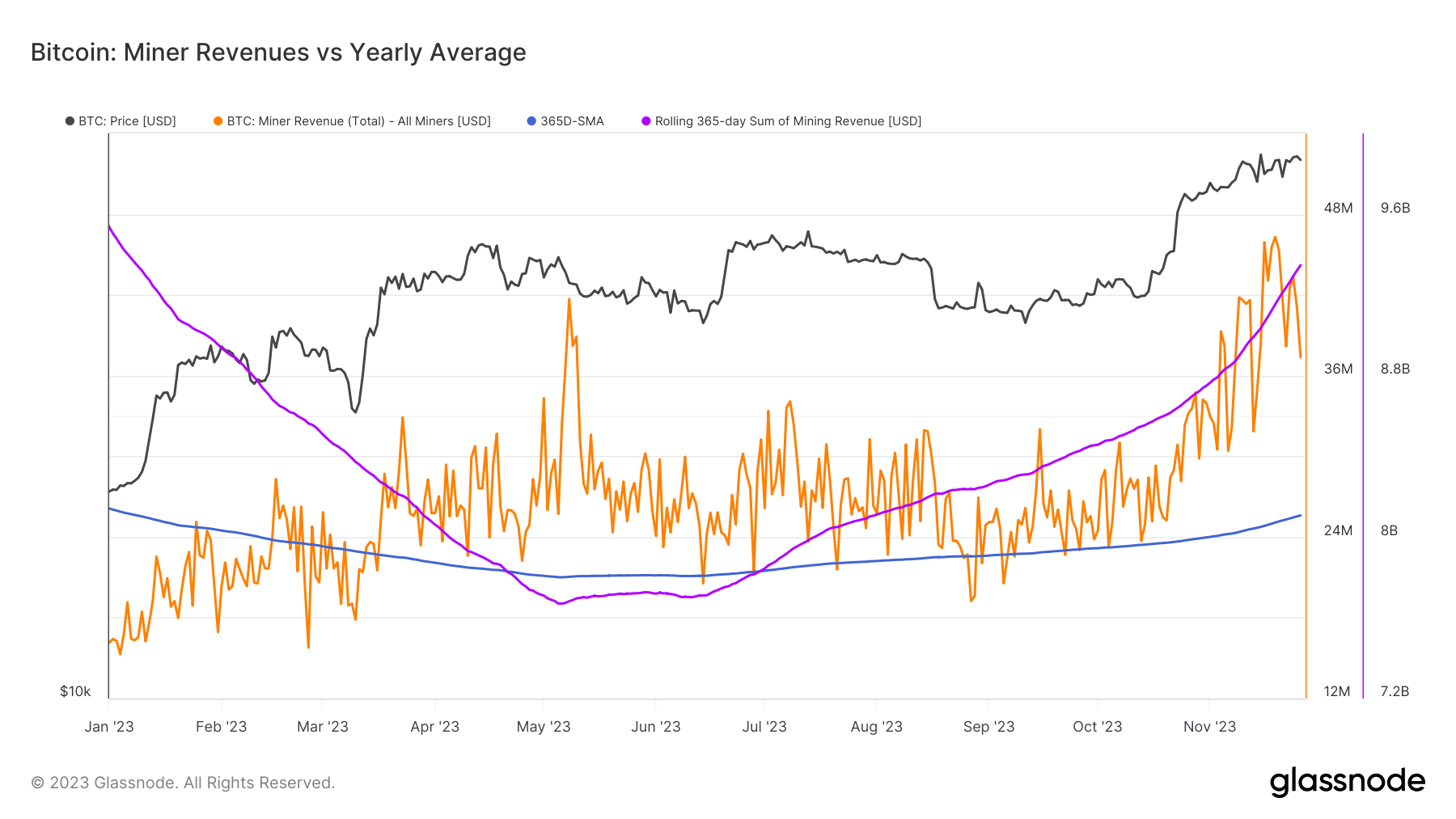

The 365-day Simple Moving Average (SMA) and the 365-day rolling sum are important indicators in this evaluation. The 365-day SMA smoothens daily revenue variations, providing clarity on long-term patterns, while the 365-day rolling sum delivers a comprehensive perspective of miner revenues over the course of a year. These indicators present a thorough understanding of miner revenue trends, which is essential for forecasting future market dynamics.

From January to June 2023, the rolling sum of miner revenues fell from $9.53 billion to $7.7 billion, pointing to a phase of diminished revenue. This decline could be attributed to lower Bitcoin prices, heightened mining difficulty, or decreased transaction fees. Nevertheless, a subsequent rise to $9.34 billion by November indicates a rebound in mining revenue. This variability exemplifies the unpredictable nature of the mining sector and its responsiveness to wider market trends.

In contrast, the 365-day SMA of miner revenues reflects a more gradual enhancement. Increasing from $22.12 million in January to $25.6 million in November, this growth, despite a relatively stable rolling sum, suggests that recent months have been more lucrative for miners. This trend emphasizes the stabilizing influence of the SMA metric, providing a more intricate perspective on the mining environment.

Graph illustrating the daily miner revenue (orange), the annual average revenue (blue), and the total annual sum of miner revenue (purple) for 2023 (Source: Glassnode)

Graph illustrating the daily miner revenue (orange), the annual average revenue (blue), and the total annual sum of miner revenue (purple) for 2023 (Source: Glassnode)

Total daily USD revenue allocated to miners has experienced a notable rise throughout the year, reaching a peak of $46.30 million in November, a 19-month high. This peak, fueled by a combination of elevated Bitcoin prices and increased transaction volumes, indicates a profitable phase for miners. The fluctuations in daily revenues, compared to the steadier SMA and rolling sum, reflect the intrinsic unpredictability of the mining industry.

The strong correlation between mining revenues and Bitcoin prices is apparent. As prices rise, so does mining profitability, affecting miner sentiment. The achievement of a 19-month revenue peak suggests bullish attitudes among miners, potentially resulting in increased investments in mining infrastructure.

With the next Bitcoin halving on the horizon, the rise in the Bitcoin hash rate demonstrates a solid commitment from miners. This enhanced computational power for processing transactions and generating blocks signifies a resilient and secure network. However, it also indicates intensified competition and possible challenges for individual miners.

Moreover, elevated transaction fees within the Bitcoin mempool reflect increased network activity and potential congestion. This rise in fees and network utilization could influence Bitcoin’s market standing, impacting user behavior.

The post Bitcoin miners see 19-month high in revenue as halving nears appeared first on CryptoSlate.