Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin is just 5% short of the “buy zone,” potentially signaling the onset of the next bullish trend.

The Bitcoin “buy zone” meme has resurfaced, here’s its significance in the ETF era

A specific type of Bitcoin post appears right on cue. It typically shows up just after the price ceases to be enjoyable.

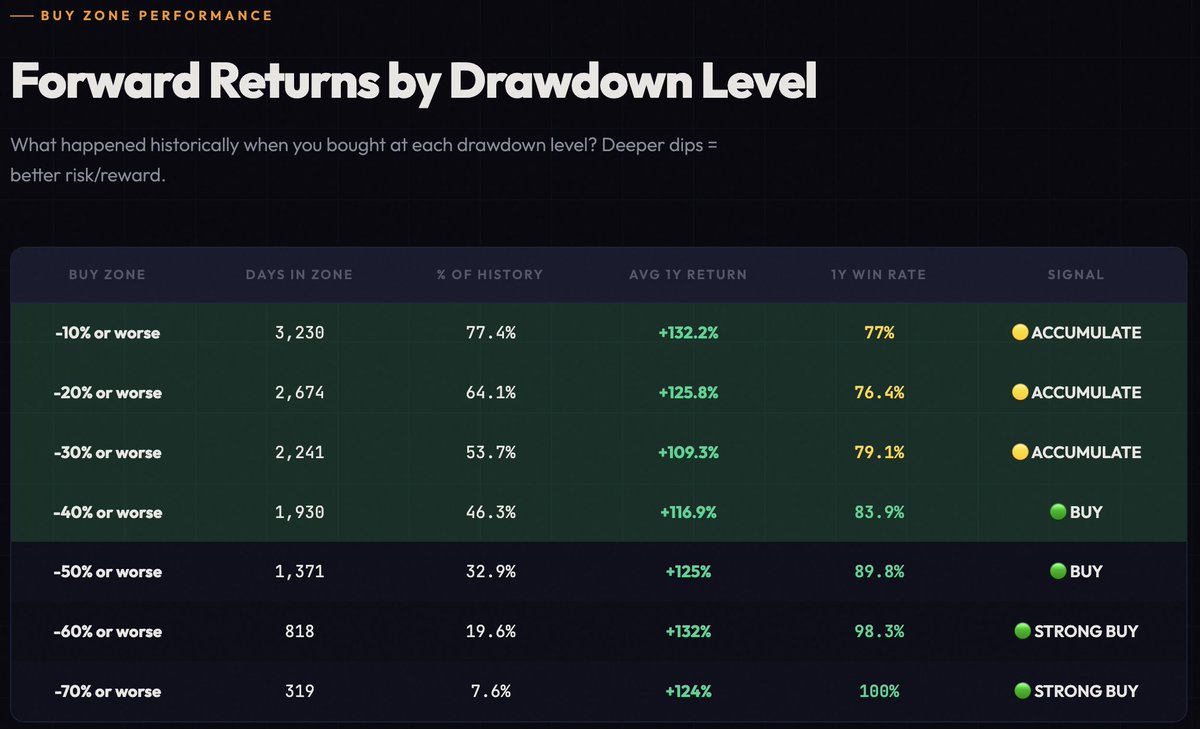

This week, it was shared by PricedinBTC, presented as a tidy table labeled “Forward Returns by Drawdown Level.”

The key figures do the heavy lifting, indicating that purchasing at a 50% drawdown supposedly yields around a 90% success rate over the following year, with average returns nearing 125%. The caption concludes with “LOCK IN,” a phrase that resembles advice and reads like a challenge.

Bitcoin returns from drawdowns (Source: PriceinBTC)

Bitcoin returns from drawdowns (Source: PriceinBTC)

Individuals share these charts for the same reason they save workout plans. Drawdowns can be mentally taxing, even for holders who claim to feel indifferent. A clear guideline provides relief, a definitive boundary, a means to act without revisiting the entire debate each time the price declines.

This chart is circulating at a time when the mathematics aligns closely with the meme. Bitcoin has been trading in the high $60,000s, and the last peak still looms over the market. This places the drawdown in the mid-40% range, sufficiently close that sustained pressure could push it into the minus-50% category.

The chart makes the dip seem like a target, and historical data offers reassurance. However, this same history carries a cautionary note. Research from iShares indicates four drawdowns exceeding 50% since 2014, with the three largest averaging around an 80% decline, and recoveries took nearly three years in three out of four instances.

The disparity between “one year later” and “experiencing it” is where much confidence is tested. Currently, that test involves new infrastructure, spot ETFs, interest rate expectations, the dollar, and options hedging, all observable in real time.

Related Reading

Related Reading

Bitcoin refuses to lose $70,000 this weekend. Was my $49k bottom call wrong?

Bitcoin must reclaim $71,500 before Monday to confirm a local bottom following softening inflation data in the CPI release.

Feb 14, 2026 · Liam 'Akiba' Wright

The minus 50% threshold feels like a commitment, and it is nearby

Using the last peak above $126,000 as a reference, the levels fall into familiar ranges. Minus 50% is approximately $63,000, minus 60% is around $50,000, and minus 70% is about $38,000. With Bitcoin near $68,000, the first threshold is just a few thousand dollars away.

This closeness transforms a number into a strategy. Some individuals begin accumulating cash, anticipating the tag. Others purchase early to avoid missing out. Some hesitate when it finally arrives, as the downward movement feels more pronounced than the chart appeared on their screen.

The meme functions as a psychological mechanism because it condenses chaos into a straightforward trigger.

The lived experience expands again the moment the trigger occurs, and the drawdown continues to evolve. The iShares drawdown history is significant here, as it highlights a deeper truth: many “winning” entries still involved prolonged periods of uncertainty, and sometimes a much steeper decline, before recovery materialized.

Achieving success with Bitcoin isn’t merely about buying Bitcoin early. Anyone who has been involved for over a decade has at least one tale of selling too soon. I certainly do. I have a 7-figure HDMI cable lying around somewhere that I purchased using Dogecoin in 2014.

Related Reading

Related Reading

Bitcoin on track to equal its most bearish period in history – only one price matters now

After over $2 billion in Bitcoin ETF outflows recently, BTC is down 12% month-on-month heading for a new record in March.

Feb 16, 2026 · Liam 'Akiba' Wright

ETFs have transformed the dip into a daily metric

Spot Bitcoin ETFs have introduced a scoreboard that everyone can monitor daily. US spot Bitcoin ETFs held approximately 1.265 million BTC as of market close on Feb. 13, with assets under management around $87 billion.

This scale alters how drawdowns propagate through the market. A substantial wrapper can support price during stable periods, and it can also intensify selling pressure when flows turn negative, as the shift becomes visible, quantifiable, and easy to track.

There have been about 55,665 BTC in net outflows over the past 30 days, a multi-billion dollar shift at current prices. Such a drain can keep prices under pressure even when social feeds remain filled with “buy zone” confidence.

It also provides dip buyers with a new confirmation tool, flow stabilization, since capitulation often manifests as outflows slowing, flattening, and eventually reversing.

Rates and inflation influence the opportunity cost

A significant portion of Bitcoin’s next chapter hinges on macroeconomic factors that may seem unexciting: yields, inflation data, and how investors assess risk across the board.

The Federal Reserve maintained its target range at 3.50% to 3.75% in late January. Inflation has also been declining, with US inflation at 2.4% in January, a data point that supports rate cut expectations and shifts risk appetite.

Cross-market proxies help frame that sentiment. The S&P 500 proxy SPY provides insight into overall risk appetite, long-duration Treasuries via TLT reflect the rate environment, and gold through GLD captures the defensive interest.

When those markets lean toward safety and yield, Bitcoin drawdowns often feel more pronounced, and when the sentiment shifts toward easing conditions, dip buying tends to gain more traction.

Options markets are indicating a broad range

The viral table appears calm on the page, while the options market tends to communicate in broader ranges. On Unusual Whales, Bitcoin options indicate an implied move of about 6.66% into Feb. 20, with implied volatility around 0.5656.

High implied moves influence behavior in clear ways. Dip buyers seek clean levels and swift confirmation. Hedgers remain active when uncertainty remains high.

Short-term fluctuations become part of the baseline, which can transform the minus 50% threshold into a waypoint rather than a floor.

This ties back to the long drawdown record from iShares, as significant recoveries often came with convoluted paths and extended timelines.

A drawdown strategy thrives or fails based on whether the buyer can manage the journey, not just the endpoint.

Three scenarios for the next chapter, with levels to monitor

The most straightforward way to frame the near term is as conditional scenarios, each linked to signals anyone can observe.

- In a grinding base case, Bitcoin maintains the low to mid $60,000s, the market fluctuates, ETF outflows slow toward flat, and volatility decreases. The flow tape becomes the indicator here, as diminishing 30-day outflows typically signal waning sell pressure.

- In a liquidity-friendly scenario, inflation continues to decline, rate cut expectations solidify, and risk appetite improves across markets. ETF flows turn positive and remain positive, which could pull Bitcoin back toward previous highs.

- In a deeper capitulation scenario, outflows persist, macro conditions turn risk-off, and Bitcoin drops below the minus-50% line toward the $50,000 range, with pressure that may extend to deeper drawdown levels.

The buy zone meme presents a straightforward narrative, and the market provides conditions. The practical version of this chart exists alongside the real-time scoreboard, the ETF flow tape, the rates backdrop, and the uncertainty gauge.

This represents the genuine human-interest aspect of this cycle: the emotional desire for a clear rule and the institutional mechanics that now influence how that rule unfolds in real time.

Strategic dollar cost averaging and market timing

Historically, this phase of the cycle is an excellent time to acquire Bitcoin. However, as I have mentioned multiple times in my analysis over the past eight months, “this time is different.”

We can legitimately question the four-year cycle theory; we have 6% of the supply held by US ETF funds, and corporate treasuries have surged.

This is not the same Bitcoin market as in 2012, 2016, 2020, or even 2024.

Personally, I am too emotional a trader, so I ceased attempting to time the market years ago.

One approach that mitigates the risk associated with trying to time the market is strategic DCA.

You purchase BTC daily, but send slightly more BTC to exchanges than the daily buy. This creates a surplus of cash that accumulates over time. Then, when Bitcoin drops to a price that appears attractive, you have funds available to buy the dip. You’ve already designated those funds for Bitcoin; you just haven’t executed the purchase until a dip occurs. This way, you benefit from DCA smoothing, enhanced by larger allocations during drawdowns.

Historically, Bitcoin seldom remains below a previous cycle’s all-time high for an extended period. At $68,000, we are right on target for 2021. In 2022, Bitcoin dipped below the 2017 all-time high for about 30 days before commencing its three-year ascent to $126,000.

Bitcoin price history (Source: Bitbo)

Bitcoin price history (Source: Bitbo)

Once more, none of this is intended as personal investment advice, and there are risks associated with any investment. However, this article addresses some considerations Bitcoin investors should keep in mind when determining when, if, and how to increase their Bitcoin allocations in their portfolios, in my view.

The post Bitcoin is only 5% away from the “buy zone” which could trigger start of the next bull run appeared first on CryptoSlate.