Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin futures reflect regained optimism following price increase.

Earlier this week, Bitcoin surpassed the $27,000 threshold following the announcement of Grayscale’s legal victory against the SEC.

This ruling signifies a crucial triumph for Grayscale and has significant implications for future spot Bitcoin ETF applications. As noted by CryptoSlate previously, the court’s ruling in this matter may impact the results of several spot Bitcoin ETF applications filed earlier this year.

Grayscale’s success appears to have strengthened the confidence of Bitcoin traders. This renewed optimism is reflected in the futures market, where on-chain metrics indicate a marked increase in leverage.

The Estimated Leverage Ratio (ELR) is an important gauge that provides insights into the degree of risk traders are prepared to take. It represents the ratio of open interest in Bitcoin futures contracts to the Bitcoin reserves of the relevant exchange. An increasing ELR indicates that traders are taking on more leveraged positions, suggesting a heightened willingness to embrace risk.

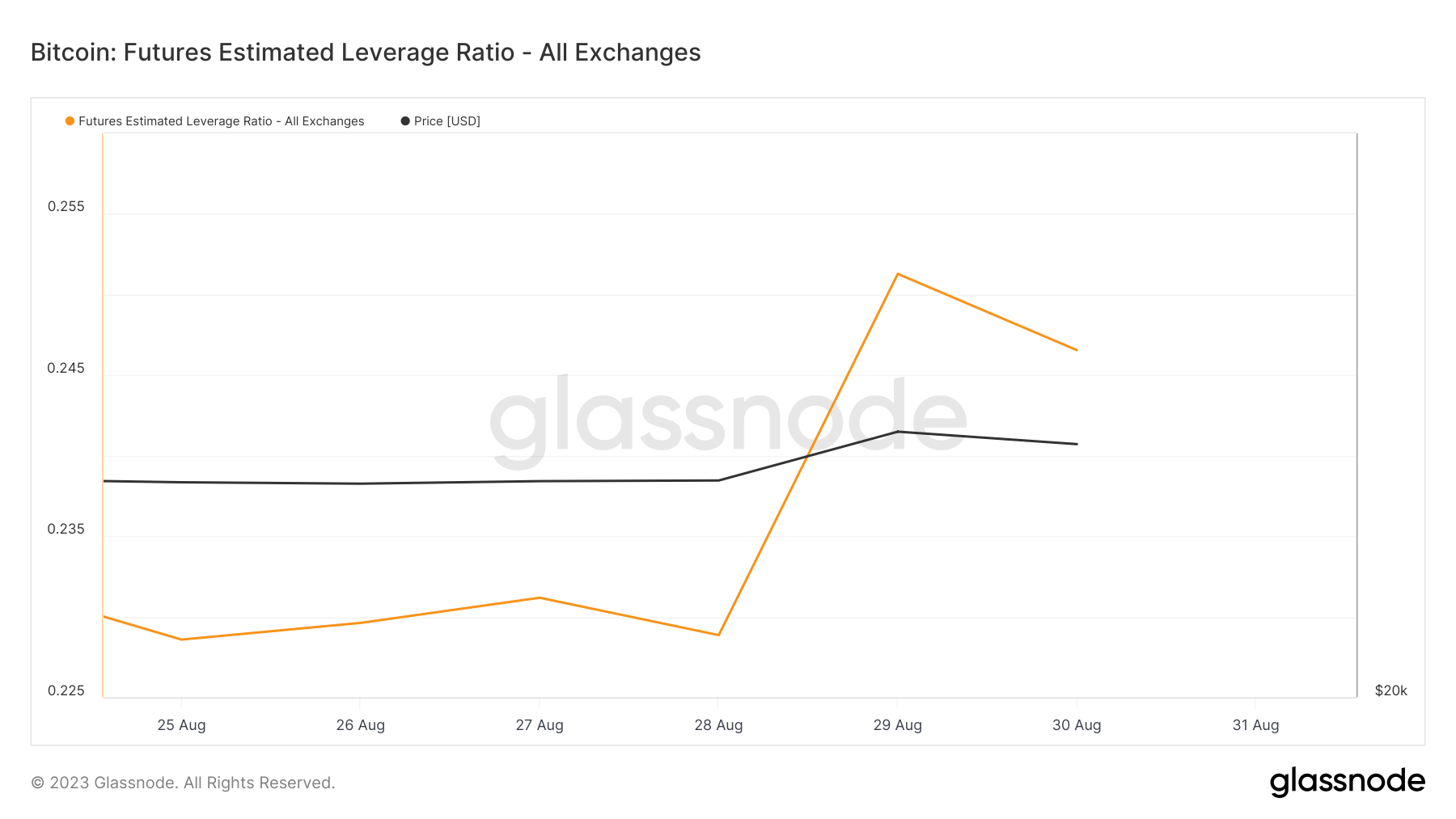

The Estimated Leverage Ratio (ELR) rose from 0.22 to 0.25 on Aug. 30, following Bitcoin’s ascent from $26,100 to $27,700.

Graph illustrating the Estimated Leverage Ratio (ELR) for Bitcoin futures from Aug. 25 to Aug. 31, 2023 (Source: Glassnode)

Graph illustrating the Estimated Leverage Ratio (ELR) for Bitcoin futures from Aug. 25 to Aug. 31, 2023 (Source: Glassnode)

On one hand, the increase in ELR highlights that traders are growing increasingly optimistic. For every Bitcoin held in an exchange, there is a corresponding rise in the futures contracts being traded. This trend implies that traders, buoyed by positive market sentiment, are prepared to take on greater risks in expectation of favorable returns.

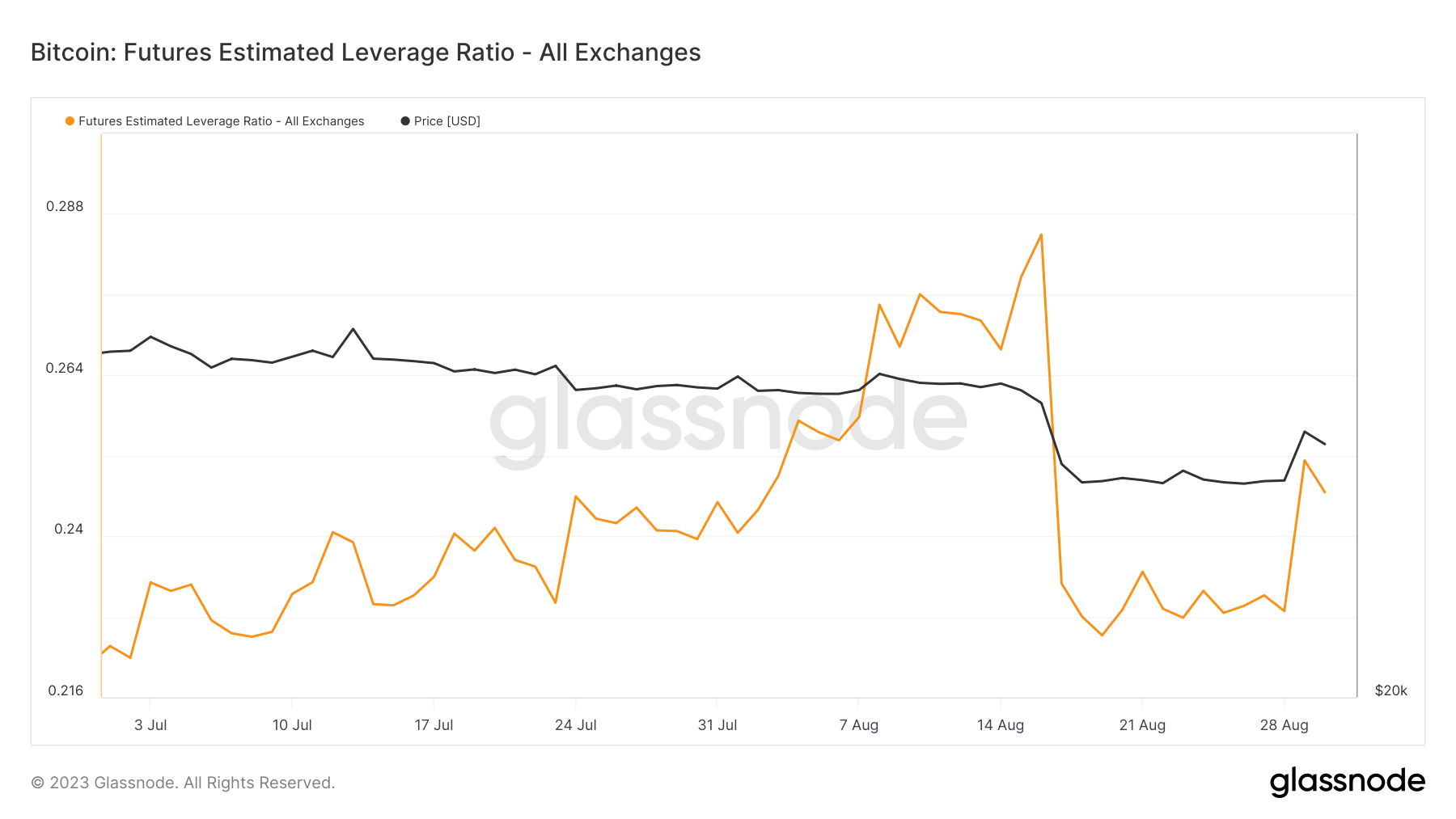

However, a broader analysis reveals another perspective. The current ELR reflects the levels seen at the start of August. In mid-August, the market experienced a notable decrease in the ELR, falling from 0.28 to 0.22. This drop coincided with Bitcoin’s price decline, which fell from $29,000 to $27,000.

Graph depicting the Estimated Leverage Ratio (ELR) for Bitcoin futures from Jul. 1 to Aug. 31, 2023 (Source: Glassnode)

Graph depicting the Estimated Leverage Ratio (ELR) for Bitcoin futures from Jul. 1 to Aug. 31, 2023 (Source: Glassnode)

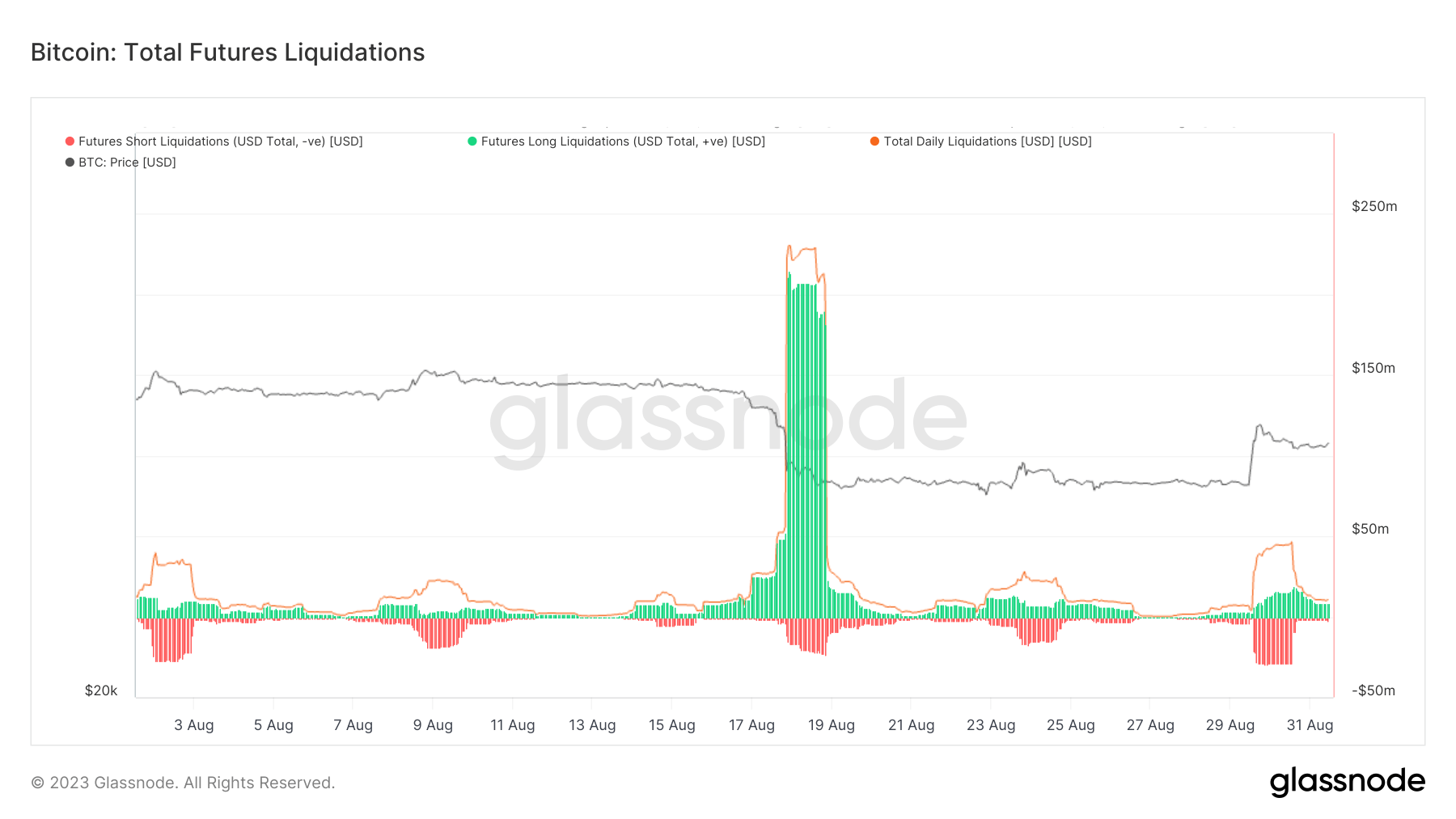

Nonetheless, the current ELR levels suggest a market risk profile similar to early August. This indicates that the market remains susceptible to sharp price fluctuations, akin to those seen earlier in the month. It is important to recall that Bitcoin’s descent below $28,000 in mid-August triggered a series of liquidations. These forced closures of leveraged positions added further volatility to an already unstable market.

Graph showing Bitcoin futures liquidations in August 2023 (Source: Glassnode)

Graph showing Bitcoin futures liquidations in August 2023 (Source: Glassnode)

While Bitcoin’s recent price increase and the accompanying rise in ELR suggest a bullish outlook among traders, it is essential for the market to exercise caution. The current risk profile, resembling that of early August, may still face considerable volatility.

The post Bitcoin futures show renewed confidence amidst price surge appeared first on CryptoSlate.