Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

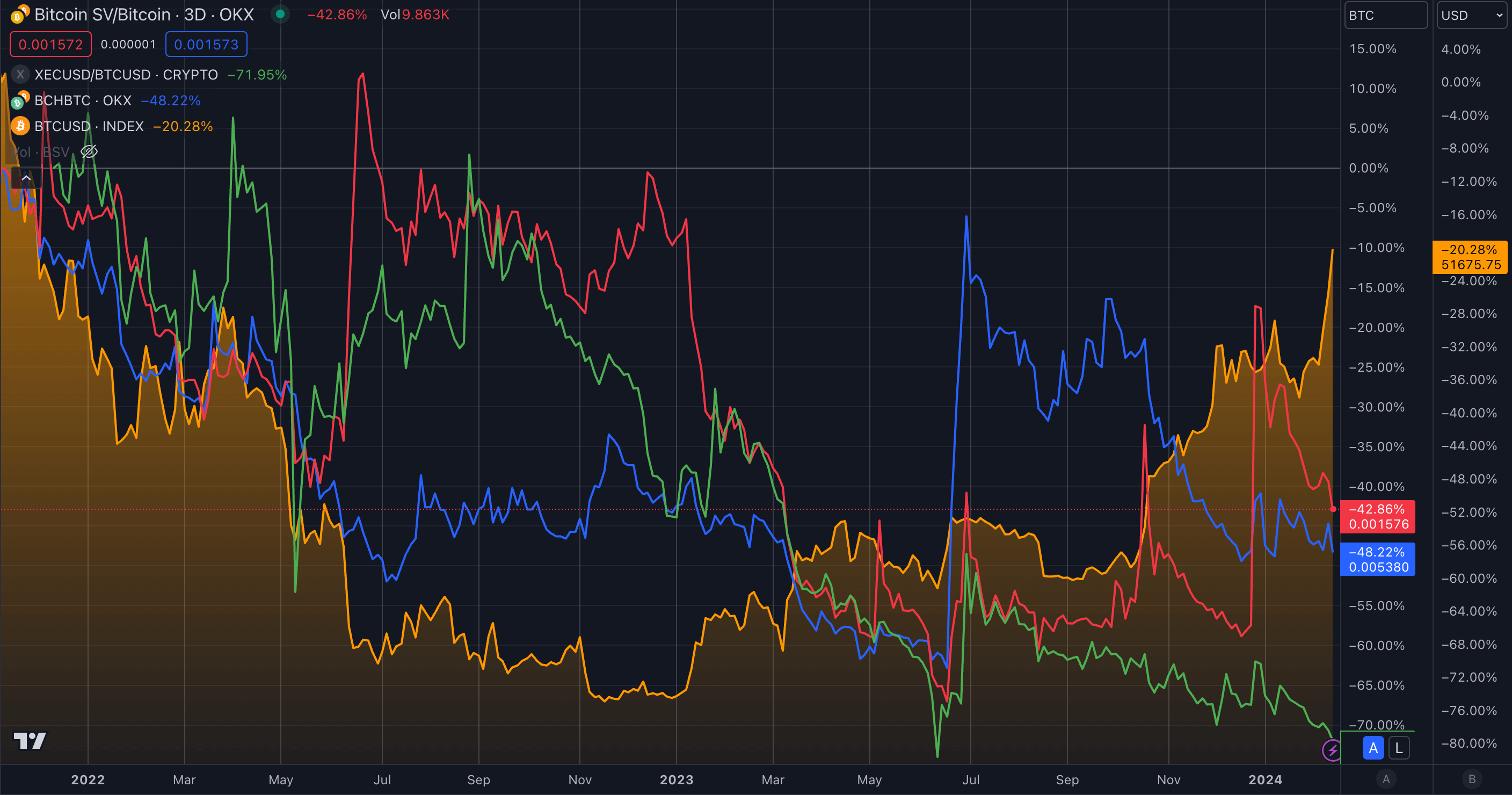

Bitcoin forks decline by as much as 70% compared to BTC since reaching their peak value.

Significant Bitcoin forks, such as Bitcoin Cash (BCH), Bitcoin SV (BSV), and eCash (XEC, previously known as Bitcoin Cash ABC), have seen considerable price declines compared to Bitcoin (BTC) since its peak in November 2021. BCH has fallen by 48%, BSV by 42%, and XEC has experienced a notable 71% decrease against BTC during this period.

Bitcoin Forks (Source: TradingView)

Bitcoin Forks (Source: TradingView)

This downward trend stands in contrast to Bitcoin’s performance, which has shown relative stability, decreasing only 20% in dollar terms after it surged alongside the Newborn Nine’s initial application and subsequent approval of spot Bitcoin ETFs.

The three primary Bitcoin forks exhibit a relatively low beta to BTC, indicating a negative correlation in their price movements. While Bitcoin fell from November 2021 until January 2023, the forks experienced some positive performance in the latter part of 2022. However, as Bitcoin began its recovery in January 2023, the forks subsequently started to decline.

This pattern persisted until June 2023, when all three forks saw significant gains against Bitcoin, with BCH recovering approximately 65%. BSV and XEC also regained around 30% and 20%, respectively, while Bitcoin rose about 8% against the dollar during that time as BlackRock entered the spot Bitcoin ETF competition.

The 65% price increase for BSV can be attributed to a notable rise in trading volume on Upbit, the largest crypto exchange in South Korea, where most of BSV’s trading activity was concentrated. The surge in BCH’s price to a one-year high was driven by a mix of factors, including its listing on EDX Markets, increased trading volumes, and a rise in social media engagement. The XEC mainnet also underwent several updates throughout 2023, which aligned with its price movements.

However, it is likely that BlackRock’s entry into the spot Bitcoin ETF race on June 15 played a significant role in the forks’ price increases. Speculation on social media that Bitcoin’s status as an institutional investment product could positively impact forks may have contributed to the initial trading momentum. Nevertheless, ETF sponsors like BlackRock, Fidelity, Ark Invest, and others issued prospectus updates indicating they would not endorse any future or past forks in their offerings. Consequently, after the initial rise against Bitcoin, all three forks retraced a substantial portion of their gains.

BSV experienced a brief rally in November ahead of the COPA vs. Wright trial concerning the identity of Satoshi Nakamoto, gaining about 40% against BTC. This rally was short-lived as it resumed its downward trend following the release of evidence prior to the court trial set to begin in February 2024.

While broader market dynamics affect the entire cryptocurrency sector, Bitcoin’s strengthening narrative and institutional interest seem to have exacerbated losses for BCH, BSV, and XEC. Additionally, controversies surrounding individuals like Craig Wright, who claims to be the pseudonymous Bitcoin creator Satoshi Nakamoto, may also play a role in BSV’s declining price performance.

This disparity underscores the potentially diminishing market dominance of major Bitcoin forks as investors reassess these projects in a competitive environment where Bitcoin continues to reinforce its position as the leading digital asset.

The post Bitcoin forks down up to 70% against BTC since all-time high appeared first on CryptoSlate.