Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin falls beneath $29,000, leading to $160 million in liquidations within the cryptocurrency market.

Bitcoin’s (BTC) decline beneath $29,000 during the early trading hours led to liquidations amounting to approximately $160 million throughout the cryptocurrency market.

Data from Coinglass indicated that $48 million in liquidations affected investors holding positions in the leading asset, predominantly impacting long traders who faced the majority of the losses.

$160 million liquidated

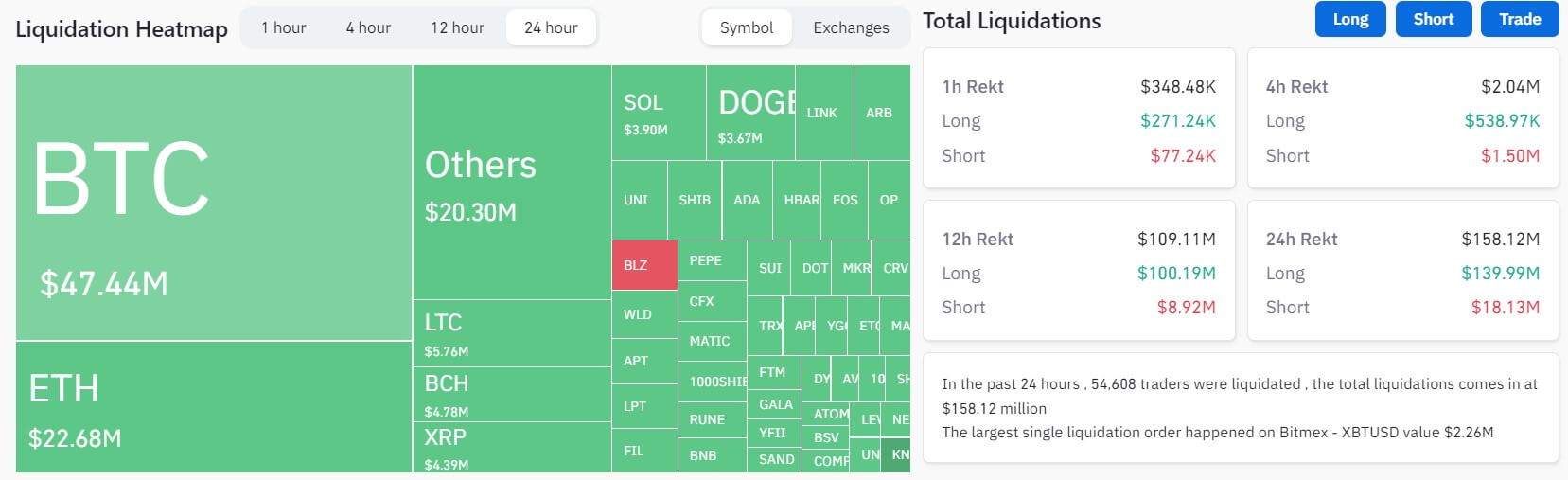

Over the past 24 hours, the cryptocurrency market experienced a significant liquidation totaling $158.12 million, with 54,608 traders affected.

Source: Coinglass

Source: Coinglass

According to Coinglass data, the bulk of the losses were incurred by long traders, who suffered around $140 million. Bitcoin and Ethereum (ETH) played a major role in this total, contributing a combined loss of $62.67 million. Conversely, short traders faced losses of less than $20 million.

Across various exchanges, more than 60% of the overall liquidations occurred on OKX and Binance. During the reporting period, traders on these platforms lost over $100 million. Other exchanges such as Huobi, Deribit, and Bitmex also reported a significant portion of the total liquidations.

The largest single liquidation took place on Bitmex, involving an XBTUSD position valued at $2.26 million.

Bitcoin down to $28k

Earlier today, Bitcoin fell by 2% to a multi-week low of $28,428 after maintaining a position above $29,000 for a prolonged duration.

CryptoSlate Insights attributed the decline to several macroeconomic factors, including U.S. treasury yields reaching their highest close since June 2008 and the U.S. dollar index surpassing 103. According to the report, these elements “create a challenging environment for Bitcoin” to flourish.

Market analyst Willy Woo also expressed similar insights in a recent post on X (formerly Twitter). Woo stated:

“Macro headwinds from US dollar strength. Meanwhile there’s increasing demand on futures market (pro traders) and on-chain fundamentals picking up.”

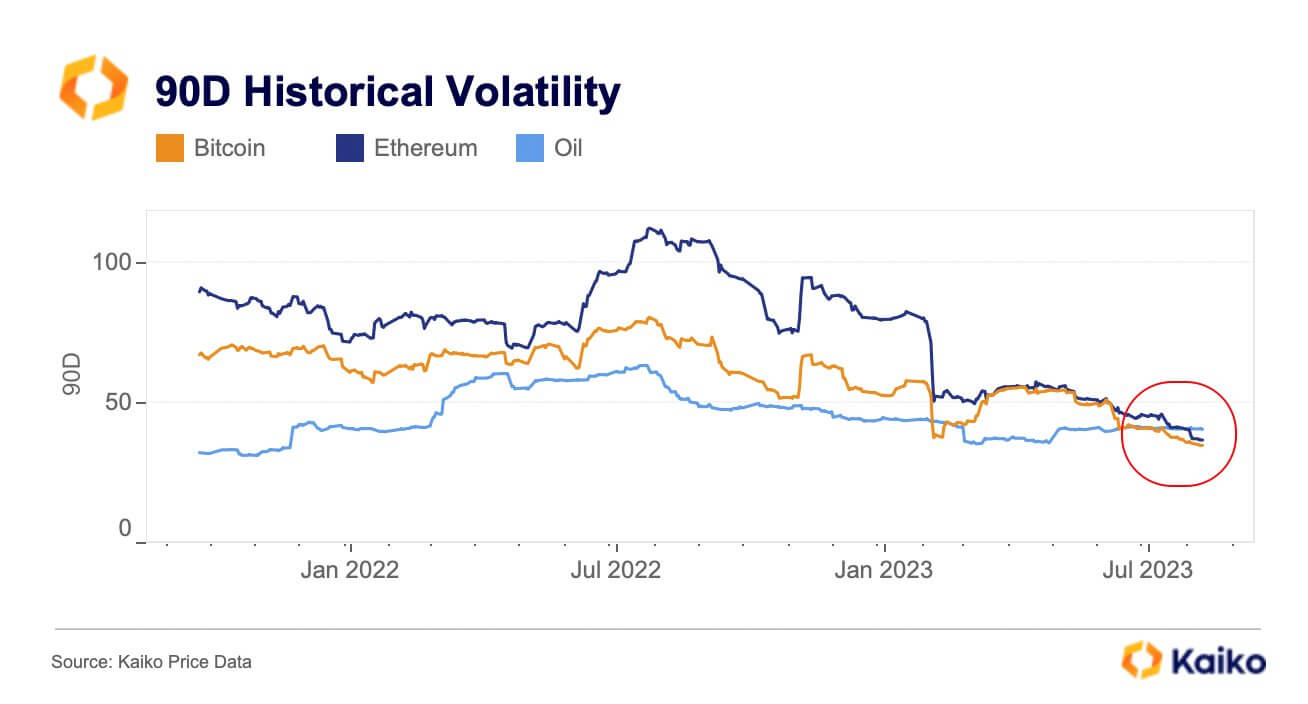

The sudden price fluctuation signifies a marked change from the relatively stable performance noted last month. On Aug. 16, blockchain analytical firm Kaiko reported that BTC’s and ETH’s 90-day volatility had decreased to multi-year lows of 35% and 37% respectively, rendering them less volatile than oil at 41%.

Source: Kaiko

Source: Kaiko

In the meantime, data from CryptoSlate reveals that all top 50 crypto assets, including Ethereum and BNB, experienced losses during the reporting period as the overall market declined by 1.83%.

The post Bitcoin dips below $29k sparking $160M liquidation in crypto market appeared first on CryptoSlate.