Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin drops below $39,000, leading to $115 million in liquidations within one hour.

The decline of Bitcoin (BTC) below the $39,000 threshold led to considerable liquidations amounting to roughly $115 million across the cryptocurrency market in the last hour.

Red market

Over the past 24 hours, BTC has seen a 4% decrease, trading at $38,915 at the time of reporting, as per data from CryptoSlate. This drop has diminished its market capitalization by about $40 billion, bringing it to $767 billion.

Arthur Hayes, co-founder of BitMEX, indicated that Bitcoin’s current price trajectory may continue until the end of the month, influenced by the US Treasury’s quarterly refunding announcement.

At the same time, Ethereum (ETH) experienced a 6% decline, falling to $2,230. The drop in ETH’s value is linked to significant selling pressure from its Foundation and fund movements associated with the troubled crypto firm Celsius.

Celsius moved approximately 13,000 ETH (around $30.87 million) to Coinbase and 2,200 ETH (approximately $5.12 million) to FalconX, while the Ethereum Foundation sold $1.6 million worth of the cryptocurrency.

Long traders stunned

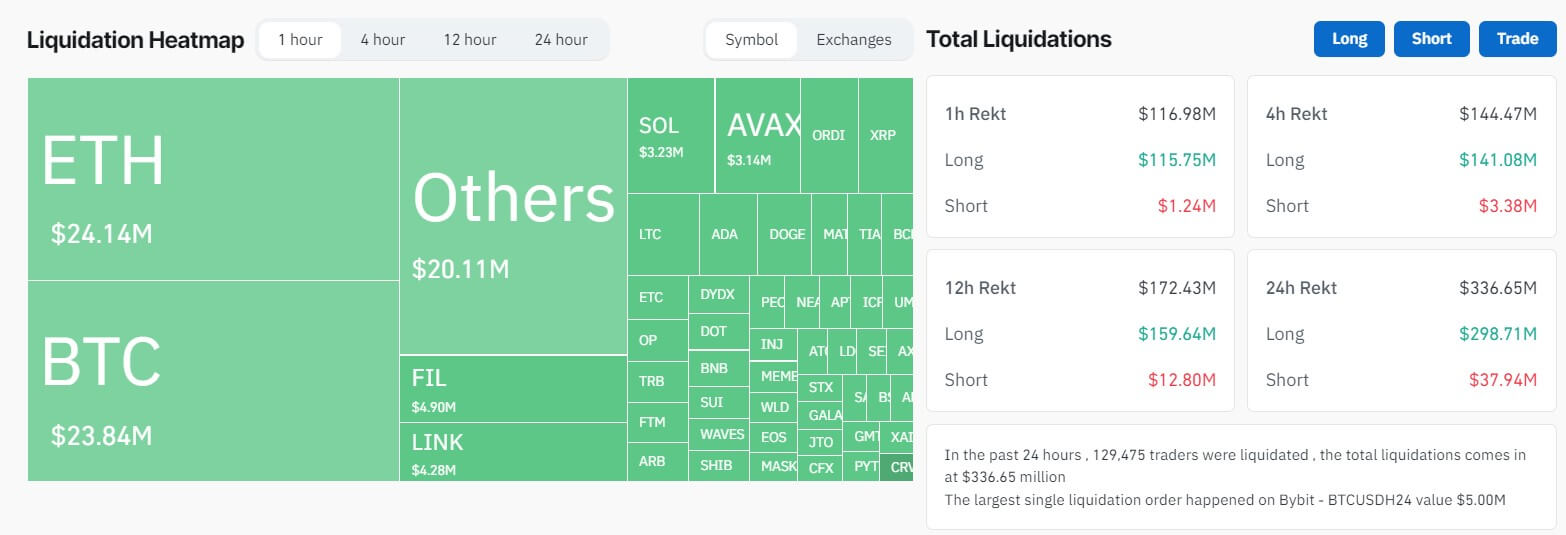

Data from Coinglass shows considerable losses for traders who were expecting further price increases in the market. Specifically, long traders faced losses of $115 million in just the past hour.

When considering a 24-hour period, the losses for long traders total nearly $300 million, whereas those with bearish positions experienced a more modest $38 million in losses during this timeframe.

Crypto Market Liquidation. (Source: Coinglass)

Crypto Market Liquidation. (Source: Coinglass)

Bitcoin traders were particularly affected by the downturn, incurring losses exceeding $80 million, with over 60% of these losses linked to long positions. The largest single liquidation involved a $5 million bet on BTC’s price rise on Bybit.

In a similar vein, Ethereum traders faced total liquidations of about $70 million, with the bulk of losses—around $60 million—originating from those speculating on ETH price increases.

Traders in other prominent digital currencies also suffered significant losses, with Solana, XRP, Dogecoin, and Ordinal experiencing liquidations of $16 million, $4 million, $5 million, and $6 million, respectively.

Looking at exchanges, Binance, the leading cryptocurrency exchange by trading volume, reported a collective loss of $98 million among its traders, while OKX noted liquidations totaling $71 million. Other crypto platforms, including ByBit and HTX, saw a combined loss of $63.52 million among their users.

The post Bitcoin tumbles under $39,000 triggering $115M liquidation in 1 hour appeared first on CryptoSlate.