Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin declines by $20,000, recession likelihood decreases, stocks surge upward — yet early indicators suggest potential bottom signals this year.

Bitcoin bottom signals: ETF outflows, miner stress, and why a 2026 recession looks like the outlier

Bitcoin may be nearing a cycle low as spot Bitcoin ETF flows continue to diminish and miner economics remain strained, despite ongoing discussions about a potential recession.

The key point: a recession or stock market crash in 2026 still appears to be an outlier scenario, suggesting that Bitcoin can reach a bottom based on its own mechanics: forced selling, leverage unwinds, miner stress, and a clearing level where the buyer base shifts.

- TL;DR: ETF flows are still declining, which typically compels price to seek a new clearing level.

- Miner economics appear challenging (fees are minimal compared to revenue), increasing the likelihood of mechanical selling pressure during downturns.

- Macro forecasts and market probabilities continue to view a 2026 recession as a minority outcome, allowing Bitcoin to bottom without a global crash.

The framework I utilize for Bitcoin has not significantly changed since last September, when I discussed it prior to October’s all-time high.

Related Reading

Related Reading

Bitcoin’s cycle clock points to a final high by late October, will ETFs rewrite history?

Investors are presented with a unique opportunity where policy and ETF flows determine the fate of the Bitcoin cycle.

Sep 18, 2025 · Liam 'Akiba' Wright

I reiterated my medium-term $49,000 Bitcoin bear thesis on Nov. 24, 2025, and revisited it on Jan. 30, 2026.

Throughout both discussions, the message remained consistent:

Bitcoin continues to trade in cycles, with the true “this is the low” moment typically occurring when miner economics and institutional flows align, and the eventual bottom print often feels mechanical rather than emotional.

What has shifted is the framing that people are attempting to attach to 2026. The dialogue has settled into a familiar pattern: many are heavily invested in a narrative suggesting that Bitcoin cannot genuinely bottom without a global recession or an equity collapse that drags all risk assets down in a synchronized liquidation.

I comprehend why this narrative gains traction. It is neat. It is dramatic. It provides a single clear culprit.

However, it is beginning to appear less central as Bitcoin has already decreased by over $20,000 since the beginning of the year, while the stock market reaches new all-time highs.

Bitcoin ETF outflows: the cleanest stress gauge in the cycle

The second component of my framework is flow elasticity, and spot ETF flows provide the clearest real-time insight we have ever had into that.

By late January, flows were indicating a narrative of diminishing risk appetite even as price attempted to stabilize.

On Farside, several significant outflow days occurred, including approximately -$708.7 million on Jan. 21 and -$817.8 million on Jan. 29. The year-to-date total was around -$1.095 billion when I last checked on Jan. 30. Since then, yearly flows have reached -$1.8 billion, with $1 billion exiting Fidelity’s FBTC alone.

These are the types of prints that alter how “buy the dip” psychology operates. In the favorable version of the ETF regime, down days are met with consistent net buying as allocators perceive weakness as an opportunity. In the stressed version, the flow turns into a drain, and price must adjust to a clearing level where that drain transforms back into a bid.

The key point: this can occur even if everything else appears stable. Equities can continue to rise, growth forecasts can remain intact, and Bitcoin can still undergo a violent internal reset because its marginal buyer and seller are now visible daily in a flow table.

Miner economics and the Bitcoin security budget already feel like winter

My initial bear case relied on miner economics for a reason: mining represents the intersection of Bitcoin’s real-world cost base and market structure.

On Jan. 29, miners generated approximately $37.22 million per day in revenue. On the same date, total transaction fees collected per day were around $260,550.

This places fees at roughly 0.7% of revenue.

This is significant because it indicates what the chain is actually depending on for security. Fees have been virtually negligible; issuance has been carrying the weight; and issuance continues to decrease on a schedule. When conditions tighten, that shifts the burden back onto price and hash economics.

You can observe the same sentiment in the live fee market. The mempool feed has consistently shown next-block median fee projections remaining low for extended periods, precisely the type of environment where a sharp price movement can occur without any macro headline acting as the catalyst.

This is why the $49,000 to $52,000 range still appears to me as a plausible cycle floor: it’s the area where narrative debates typically transition to inventory transfer, from forced sellers and fatigued holders to allocators who have been waiting for a level they can invest in.

2026 recession odds: why a macro crash still looks like the outlier

The major forecasting agencies continue to use “slowdown” terminology rather than “breakage” language. The IMF projects global growth at 3.3% for 2026.

The World Bank anticipates growth easing to 2.6% in 2026 and still characterizes the system as broadly resilient, even amidst trade-tension noise.

The OECD is in a similar range, estimating global GDP growth to be 2.9% in 2026.

Then there’s the market-implied, crowd-sourced version of that same “risk is real but not dominant” idea. On Polymarket, the likelihood of a U.S. recession by the end of 2026 has been fluctuating in the low-20s, significant enough to matter, but not high enough to represent the consensus baseline.

Where this discussion becomes relevant for the general public is jobs, as labor markets are how “macro” translates into lived experiences.

And here, the latest data provided both a cautionary sign and a reminder that “grind” and “crash” are not synonymous.

Jobs data: the macro stress test still points to a grind

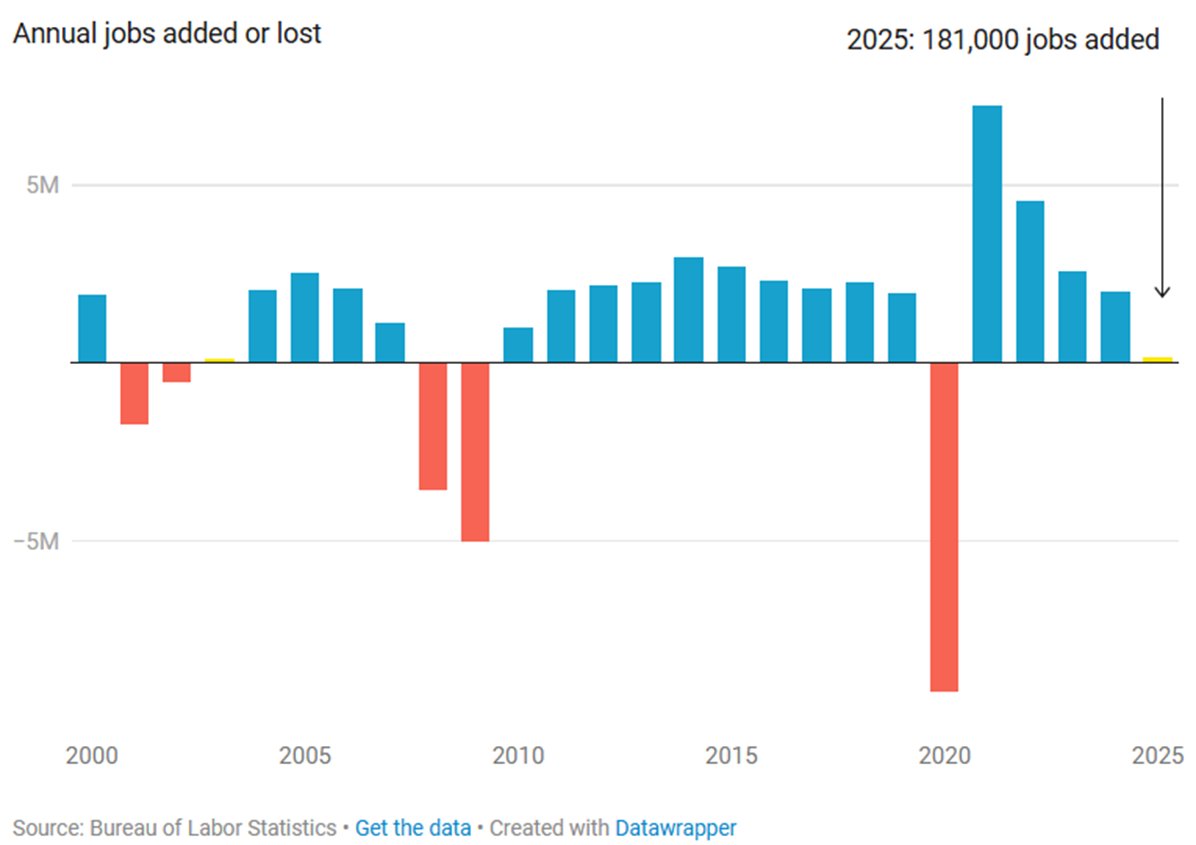

The BLS benchmark revision reduced 2025 nonfarm job growth to 181,000 from 584,000. This type of adjustment alters the tone of the entire conversation. It also aligns with how 2025 felt: slower hiring, fewer easy job transitions, and a noticeable cooling in white-collar momentum.

Annual U.S. job gains and losses since 2000, highlighting the sharp pandemic-driven contraction in 2020 and a slowdown to 181,000 jobs added in 2025. (Source: BLS)

Annual U.S. job gains and losses since 2000, highlighting the sharp pandemic-driven contraction in 2020 and a slowdown to 181,000 jobs added in 2025. (Source: BLS)

Simultaneously, that same BLS release indicates unemployment at 4.3% in January 2026, with payrolls increasing by 130,000, primarily driven by health care and social assistance. That reflects a cooling market, but it remains a market with forward momentum. It also helps clarify the unusual split screen: stocks can continue to rise while households discuss “recession” at the dinner table.

This disconnect is precisely why I continue to differentiate Bitcoin’s internal cycle mechanics from the global-doom narrative. A recession could still occur in 2026, but markets are still treating it as a minority outcome.

And that is significant for Bitcoin because it implies that a worldwide catastrophe is not necessary to trigger a major drawdown. A localized issue is sufficient: leverage unwinds, miners are compelled into mechanical selling, ETF flows persist, and price declines until the buyer base shifts.

Bitcoin has already dropped into the high $60,000s while equities continue to reach new highs. That divergence is the narrative. The chart resembles a standard cooling phase; the internals have felt like winter for weeks.

Thus, when I assert that “a 2026 recession or stock crash looks like the outlier,” I am not suggesting that risk has vanished. I am indicating that the base case has shifted toward friction that the system can absorb, including messy politics.

This results in a straightforward setup: Bitcoin can still establish a cycle low based on Bitcoin-specific mechanics.

Debt, delinquencies, and corporate bankruptcies: stress can rise without a recession label

There is another macro aspect that is important here, even if it ranks lower than GDP forecasts and stock indexes in most people’s mental hierarchy.

Corporate bankruptcies have been increasing, and the figures are now significant enough to alter the “feel” of the cycle even while the headline economy continues to progress. S&P data indicated that qualifying U.S. corporate bankruptcy filings reached 785 in 2025, the highest since 2010, with December alone accounting for 72 filings.

The month-to-month narrative is clear: refinancing has become more challenging, interest costs remain high, and the weakest balance sheets are beginning to falter sequentially. Market Intelligence indicated that the pace was already elevated by mid-year, with first-half 2025 filings at the highest level since 2010.

For households, stress is even more tangible as it manifests at the register. The NY Fed reported total household debt at $18.8 trillion in Q4 2025, an increase of $191 billion for the quarter, with credit card balances at $1.28 trillion.

Credit card strain has also been rising. The NY Fed charts indicate that approximately 13% of card balances were 90+ days delinquent in Q4 2025, with the quarterly transition rate into 90+ day delinquency for credit cards around 7% of balances.

The most pronounced strain appears among younger borrowers. The same NY Fed age breakdown shows 18–29 in the ~9–10% range for serious delinquency transitions on credit cards, with 30–39 not far behind.

When combined, this resembles a late-cycle slog: cracks emerging in weaker sectors, while policy is pulled closer to easing as the year progresses.

This is relevant for Bitcoin because it effectively serves as a trade on liquidity, risk appetite, and forced selling, well before an “official recession” label is applied.

2026 macro outlook: friction, not collapse

The reason I continue to resist the “everything must crash together” narrative is straightforward: most forward-looking indicators still suggest a muddle-through environment.

The IMF describes a stable global economy, with technology investment and adaptation counterbalancing trade policy challenges. The World Bank uses “resilient” and explicitly notes easing financial conditions as a buffer. The OECD highlights vulnerabilities but remains in a scenario where growth persists.

At a higher frequency, the J.P. Morgan Global Composite PMI recorded 52.5 for January, and S&P Global’s read-through correlates that level historically to approximately a 2.6% annualized global GDP growth rate. While that is not particularly exciting growth, it is still growth.

Trade is another area where fractures are anticipated to emerge first, and that picture also appears more complex than a ready-to-collapse scenario. The UNCTAD trade update heading into 2026 discusses fragmentation and regulatory pressure, but “pressure” does not equate to “breakdown.” The Kiel Trade Indicator is useful here as it operates closer to real-time than most macro series, distinguishing shipping noise from underlying demand.

Bitcoin miners are operating two businesses now — and drawdowns behave differently

One often-overlooked shift this cycle is that many miners no longer function solely as Bitcoin margin machines.

A growing number now resemble energy and infrastructure enterprises that also mine Bitcoin.

This has two implications.

First, it affects survivability. A secondary revenue stream can sustain operations during low-fee conditions and can assist in financing capital expenditures even when hash economics are tight.

Second, it alters how stress manifests in market behavior. A miner developing a compute roadmap may sell Bitcoin more mechanically, funding expansions, safeguarding liquidity for power contracts, or curtailing in ways that make network conditions more elastic precisely when the market seeks stability.

You can observe the outline of this pivot in public disclosures. TeraWulf announced long-duration AI hosting agreements linked to substantial capacity, with Google involved in the structure according to the company release. DataCenterDynamics reported that Riot has also been exploring options to shift capacity toward AI and HPC.

When viewed from a broader perspective, the operational landscape becomes quite complex: negotiating power, managing shareholders, planning data centers, purchasing machines, all while competing in the most intense hash race globally. More moving parts tend to result in greater reflexivity when prices begin to decline.

This is a significant reason why the market can feel like winter internally even before the chart indicates a complete cathartic flush.

The $49,000 to $52,000 Bitcoin bottom thesis (and why it still fits)

When you piece the inputs together, the path is not complicated.

Macro conditions are resilient enough that the synchronized global risk-event narrative has drifted out of the central lane. The Polymarket recession probabilities reflect this. Additionally, the major forecasters, including the IMF, the World Bank, and the OECD, are generally aligned.

Meanwhile, Bitcoin’s internals appear strained: fees remain a minimal portion of miner revenue, ETF flows have indicated genuine risk-off periods, and the on-chain fee tape in the mempool has been sluggish.

This combination creates pressure.

And pressure typically resolves in a similar manner in crypto: a rapid movement, two or three sharp declines, leverage being eliminated, and a new buyer base entering with conviction.

There is also a real-economy overlay that markets often overlook until it becomes undeniable. The S&P bankruptcy figures and the NY Fed delinquency charts convey the same message: many companies and households are running out of slack at the margin. This can have implications without an equity crash.

It tightens credit, hampers discretionary spending, increases the likelihood that rates will gradually decrease over time, and shortens the timeline for the type of policy response that typically occurs once strain becomes evident in the data.

A final flush can still be driven by Bitcoin-native mechanics: fees remaining low, miner economics tightening, and ETF flow tables remaining disordered. Macro adds a secondary element, a world where stress rises quietly, and the path toward easier conditions becomes shorter.

If the market provides that mechanical reset, the liquidity regime can appear more favorable on the other side, and that is the aspect of the cycle I find most significant.

The $49,000 to $52,000 range remains my base case for that inventory transfer. It is close enough to seem plausible from this point, and it is psychologically clean enough to attract substantial interest, particularly from allocators who have been waiting for sub-$50,000 to consider Bitcoin as inventory.

The wildcards never vanish. Geopolitics can always disrupt the neatly forecasted landscape. The chances of a China-Taiwan escalation have been actively traded on Polymarket, and those prices can shift rapidly when news breaks.

However, my focus remains intentionally straightforward: fees, ETF flows, miner behavior.

If those inputs continue to be weak while price keeps declining, a sharp drop into the $40,000s remains a plausible outcome, even if the global economy continues to progress and equities behave as if nothing is amiss.

Disclosure, this is market commentary, not financial advice. Risk management is more crucial than narratives.

FAQ: Bitcoin bottom, ETF outflows, miner capitulation, and 2026 recession odds

Is Bitcoin near a bottom in 2026?

It’s possible. The “near-bottom” scenario typically emerges when forced selling becomes more mechanical than emotional, and in this cycle, you can observe that in two areas: ongoing spot Bitcoin ETF outflows and tightening miner economics. The critical factor is whether price identifies a clearing level where the buyer base transitions from dip-traders to allocators sizing real inventory.

What are the biggest signs Bitcoin is bottoming?

The most effective “bottom signals” tend to cluster together, rather than appearing in isolation. In this framework, the three key indicators are: (1) ETF flows stabilizing after prolonged outflows, (2) miner stress peaking (or capitulation risk being priced in), and (3) price discovering a level where selling pressure diminishes and bids begin to consistently absorb supply. The bottom often feels “mechanical,” representing an inventory transfer, rather than a clear narrative moment.

How do Bitcoin ETF flows affect Bitcoin’s price?

Spot ETF flows serve as a daily, observable measure of marginal demand. In the “friendly” version of the ETF era, down days are met with net inflows, which supports price and mitigates drawdowns. In the “stressed” version, outflows convert the flow into a drain, and price typically must adjust to a level where those flows cease and demand reemerges.

What is miner capitulation, and why does it matter for a Bitcoin bottom?

Miner capitulation refers to the situation where miners are pressured enough, by price, costs, or revenue conditions, that they are compelled to engage in more aggressive selling or operational shutdowns. It is significant because miners represent a recurring source of structural supply, especially when fees are low and profitability is tight. Bottoms often occur around periods when miner stress peaks and the market clears that supply.

Can Bitcoin bottom without a 2026 recession or stock market crash?

Yes. Bitcoin does not require a synchronized global liquidation to establish a cycle low. A localized issue can suffice: leverage unwinds, ETF outflows persist, miners sell more mechanically, and price declines until the buyer base changes character. A recession could still occur, but it is not necessary for Bitcoin to reach a clearing level.