Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin data indicates an increasing trend of inactivity as holders stay resilient.

The fluctuations, or absence of them, in Bitcoin’s market activity can offer crucial insights into investor behavior and the general condition of the market. When Bitcoin experiences minimal movement, it frequently signifies a strong holding sentiment among investors.

Long-term holders, defined as addresses that have retained their assets for over 155 days, are instrumental in influencing market dynamics. Observing their actions is vital, as it can reflect market confidence, potential price volatility, and overall market stability.

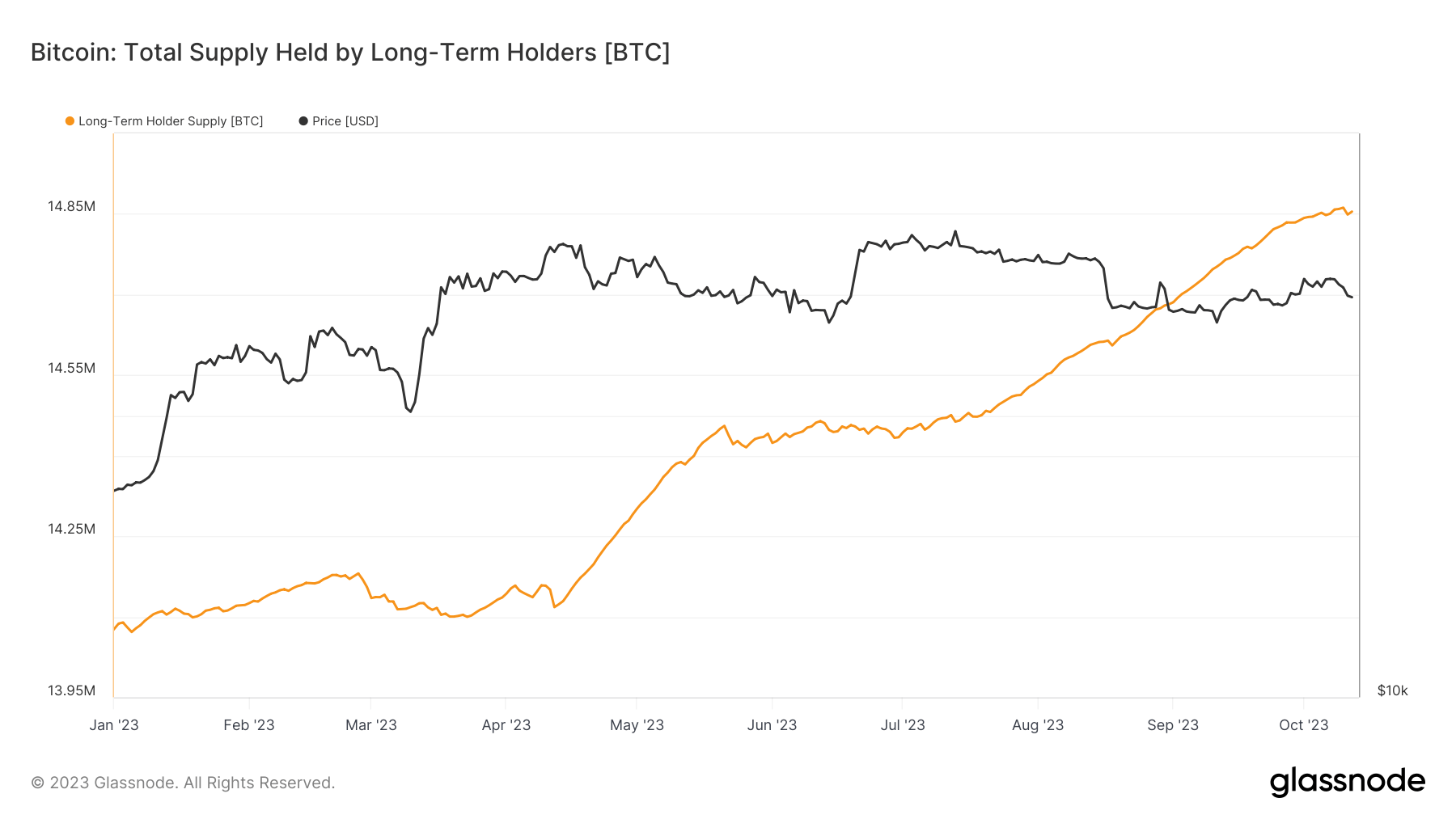

According to the latest data, the quantity of BTC owned by long-term holders has been consistently increasing since the start of the year, now reaching a record high of more than 14.85 million BTC.

Graph illustrating the supply of Bitcoin held by long-term holders in 2023 (Source: Glassnode)

Graph illustrating the supply of Bitcoin held by long-term holders in 2023 (Source: Glassnode)

To provide context, 76.1% of the circulating supply has remained untouched for the past 5 months or longer.

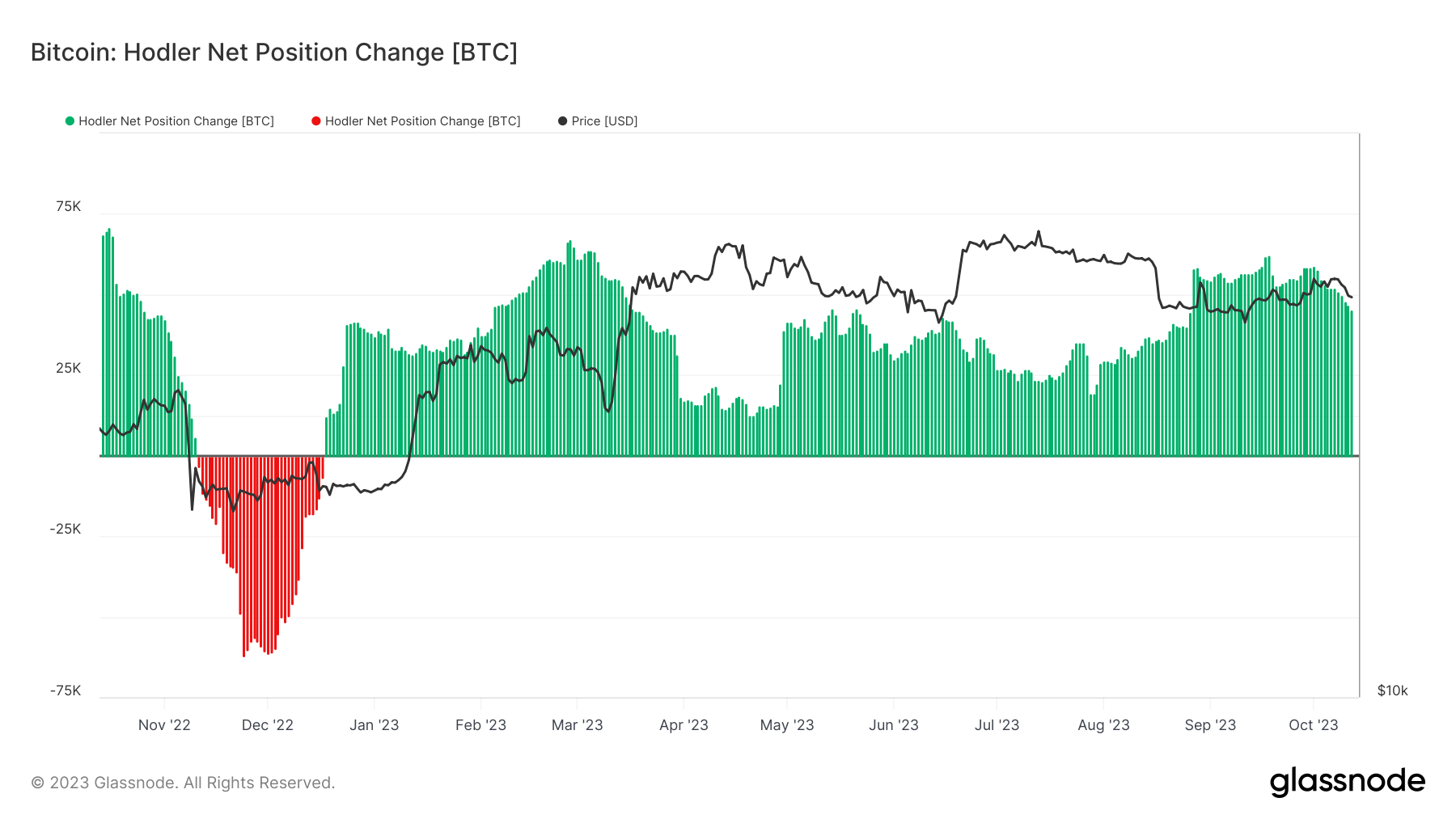

Another key metric that illuminates this trend is the ‘hodler net position change.’ This indicator reveals the extent of coin dormancy in the market, indicating the variations in the portion of Bitcoin’s supply retained by entities least inclined to sell. It demonstrates a persistent state of coin dormancy, with over 50,000 BTC per month being “vaulted” by hodlers.

Graph depicting the ‘hodler’ net position change from October 2022 to October 2023 (Source: Glassnode)

Graph depicting the ‘hodler’ net position change from October 2022 to October 2023 (Source: Glassnode)

Vaulting refers to the act of storing or retaining coins without the intention of conducting transactions or liquidating them in the near future. This pattern denotes a constricting supply and a general hesitance among hodlers to engage in transactions.

The rising trend of hodling and the dormancy of coins imply several things. Firstly, there is a robust sense of confidence among long-term holders regarding Bitcoin’s future value. This tightening supply could lead to heightened demand, potentially elevating Bitcoin’s price. However, it also indicates that the market is currently facing liquidity constraints, making it more challenging for new investors to enter or for existing holders to sell.

The post Bitcoin data shows a growing trend of dormancy as hodlers remain strong appeared first on CryptoSlate.