Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin and Ethereum exchange reserves reach all-time lows as spot ETFs prompt withdrawals.

Bitcoin and Ethereum reserves on centralized exchanges have reached unprecedented lows following the launch of crypto-related spot exchange-traded funds (ETFs) in the United States.

Data from Glassnode indicates that Bitcoin holdings on exchanges have decreased to 11.6%, marking the lowest level since December 2017. Ethereum holdings are even lower at 10.6%, the lowest since October 2015.

Spot ETFs prompt withdrawals

Market analysts have noted that the reduction in exchange balances aligns with the Securities and Exchange Commission’s (SEC) endorsement of ETF products for Bitcoin and 19-b filings for Ethereum.

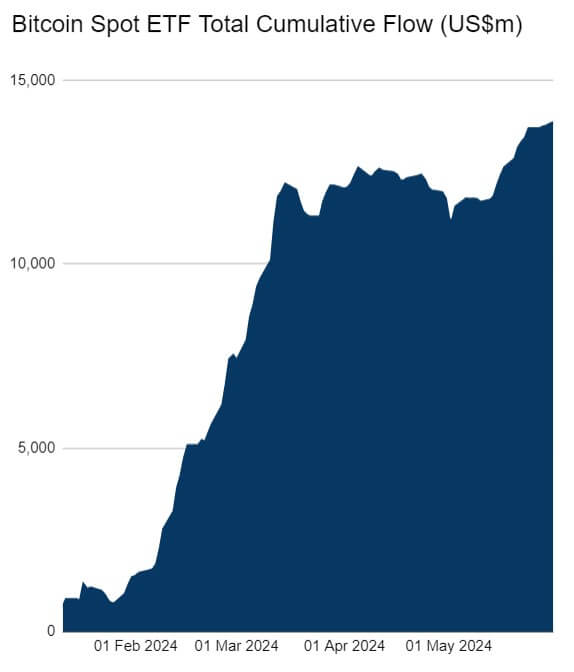

HeyApollo data shows that spot Bitcoin ETFs have amassed 857,700 BTC, valued at $58.5 billion, within just five months. BlackRock’s IBIT ETF is at the forefront of this accumulation with approximately $20 billion in assets, followed by Fidelity’s FBTC, which has around $11 billion.

Spot Bitcoin ETFs Flow. (Source: Farside Investors)

Spot Bitcoin ETFs Flow. (Source: Farside Investors)

Although spot Ethereum ETFs have yet to commence trading, investor expectations have led to considerable withdrawals. According to CryptoQuant data, 777,000 ETH, valued at roughly $3 billion, have been removed from exchanges since the SEC’s approval.

Moreover, the option to stake ETH has contributed to its diminishing exchange balance. Nansen reports that 32.8 million ETH, or 27% of its total supply, are currently staked to bolster the network.

Is a supply crunch imminent?

If the trend of declining exchange balances persists, market analysts have suggested that demand for Bitcoin and Ethereum could result in a supply crunch.

In a recent social media update, BTC Echo editor Leon Waidmaan cautioned investors to prepare for a “supply squeeze” and the potential for “the next significant move.”

Historically, when digital assets are withdrawn from exchanges, it indicates that investors intend to hold rather than sell, reflecting a bullish outlook and expectations for future growth. A supply squeeze could have a notable effect on prices by restricting the available supply, potentially resulting in significant price increases if current accumulation patterns continue.

The post Bitcoin and Ethereum exchange balances hit record lows as spot ETFs drive withdrawals appeared first on CryptoSlate.