Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Analyzing the function of UTXOs in Bitcoin consolidation trends

A fundamental aspect of Bitcoin is the Unspent Transaction Output, commonly referred to as UTXO. Each Bitcoin transaction generates these UTXOs, which signify portions of Bitcoin that can be utilized in subsequent transactions. When sending or receiving Bitcoin, users are essentially managing UTXOs: merging them, dividing them, and generating new ones.

The complete record of Bitcoin transactions is stored on the blockchain, and UTXOs offer a clear representation of which portions of Bitcoin remain unspent, providing a transparent perspective on Bitcoin’s liquidity. Examining the quantity and size of UTXOs can yield insights into network activity, congestion, and users’ spending patterns.

UTXO consolidation is the process of merging several smaller UTXOs into a single, larger UTXO. This is similar to exchanging multiple smaller currency denominations for a larger bill. Consolidation can be advantageous for users as it may simplify and often reduce the costs of future transactions. Nevertheless, it can also be a reaction to particular network or market conditions, such as optimizing fees, managing wallets, or preparing for substantial fund transfers.

Considering the significance of UTXOs within the Bitcoin ecosystem, examining related trends can provide important insights into user behaviors, network vitality, and potential future market shifts.

In recent weeks, the Bitcoin network exhibited notable trends that may indicate UTXO consolidations by its users. An analysis by CryptoSlate of data from 2023 revealed significant changes in transactional behavior.

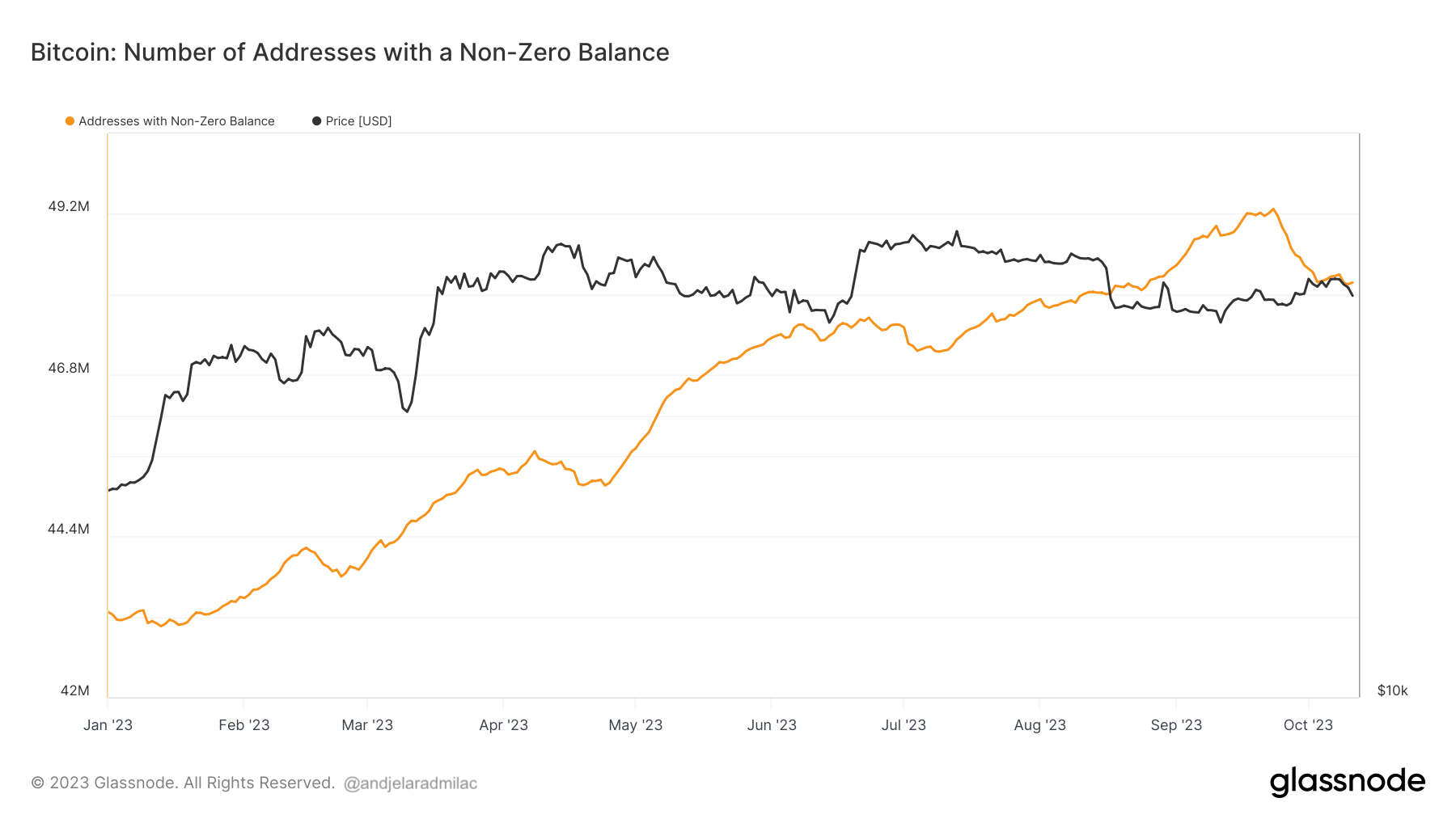

From January to September, there was an increase of 6.01 million new addresses with non-zero balances. However, this trend reversed in October, resulting in a decline of 1.1 million.

Graph illustrating the number of Bitcoin addresses with non-zero balances in 2023 (Source: Glassnode)

Graph illustrating the number of Bitcoin addresses with non-zero balances in 2023 (Source: Glassnode)

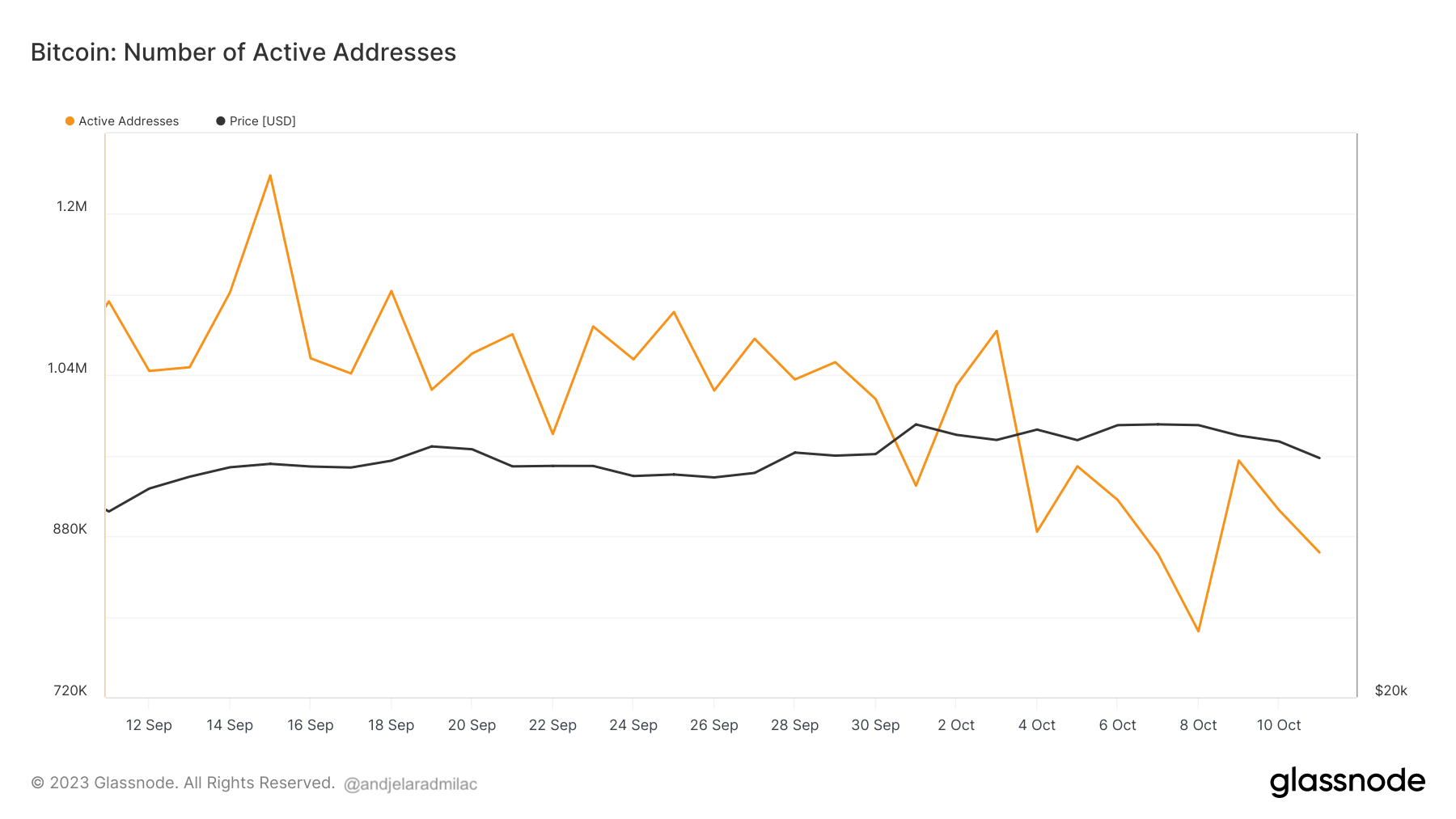

A notable drop of 367,000 active addresses in October suggests possible fund consolidations or transfers away from Bitcoin.

Graph depicting the number of active Bitcoin addresses from Sep. 11 to Oct. 11, 2023 (Source: Glassnode)

Graph depicting the number of active Bitcoin addresses from Sep. 11 to Oct. 11, 2023 (Source: Glassnode)

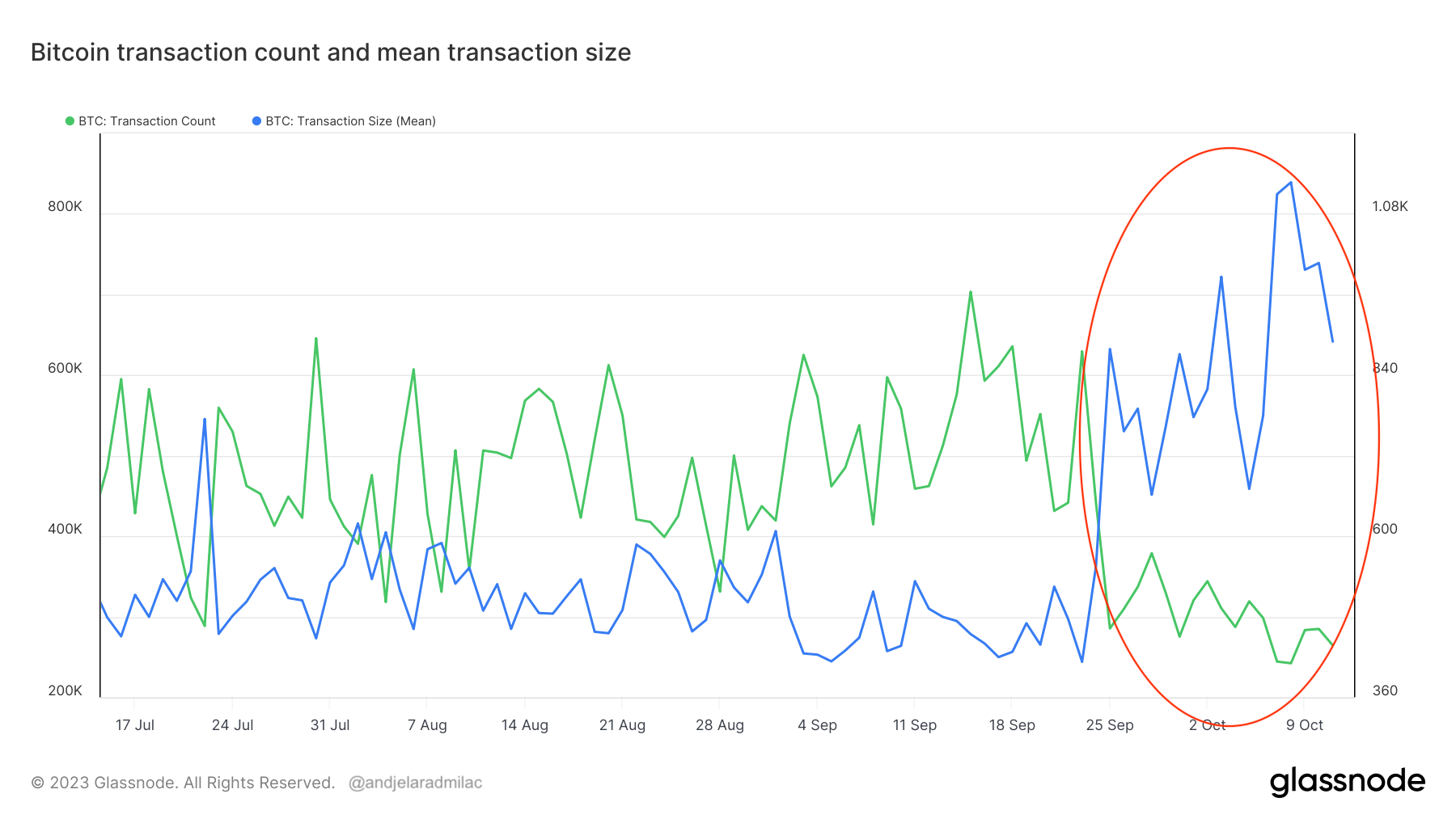

There was also a considerable rise in transaction counts, which increased by over 516,000 from January to September. However, this trend reversed in October, decreasing by 439,000.

During this timeframe, the average transaction size grew significantly. This increase indicates that transactions have become more complex, potentially due to multiple inputs, which suggests fund consolidations.

Graph showing the transaction count and average transaction size from July 11 to Oct. 11, 2023 (Source: Glassnode)

Graph showing the transaction count and average transaction size from July 11 to Oct. 11, 2023 (Source: Glassnode)

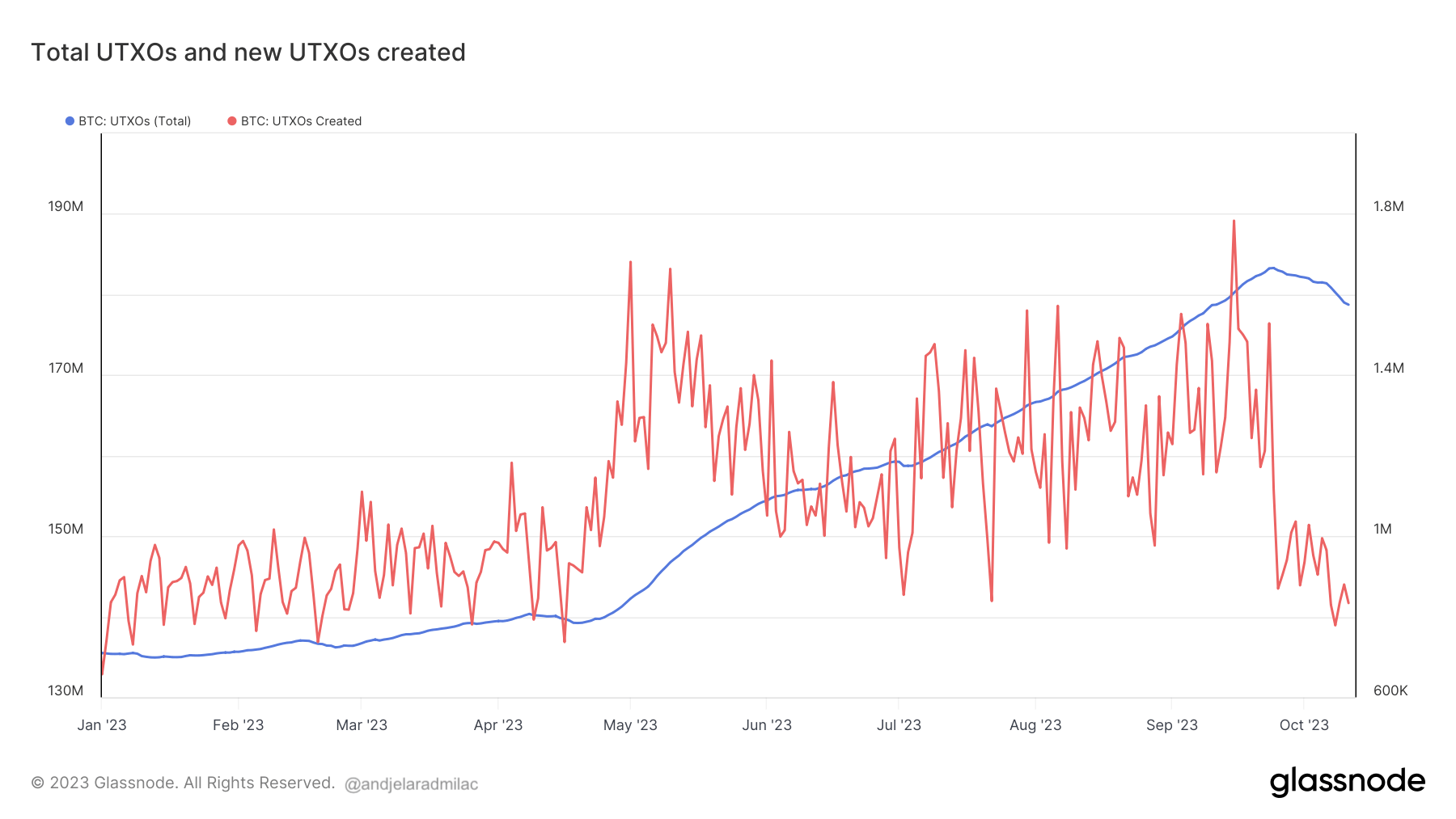

The UTXO data supports this narrative. While there was a significant rise in total UTXOs from January to September, a slight decrease was noted by October. This reduction and the lower number of new UTXOs created in October indicate UTXO consolidation activities.

Graph illustrating the total number of Bitcoin UTXOs and new UTXOs created in 2023 (Glassnode)

Graph illustrating the total number of Bitcoin UTXOs and new UTXOs created in 2023 (Glassnode)

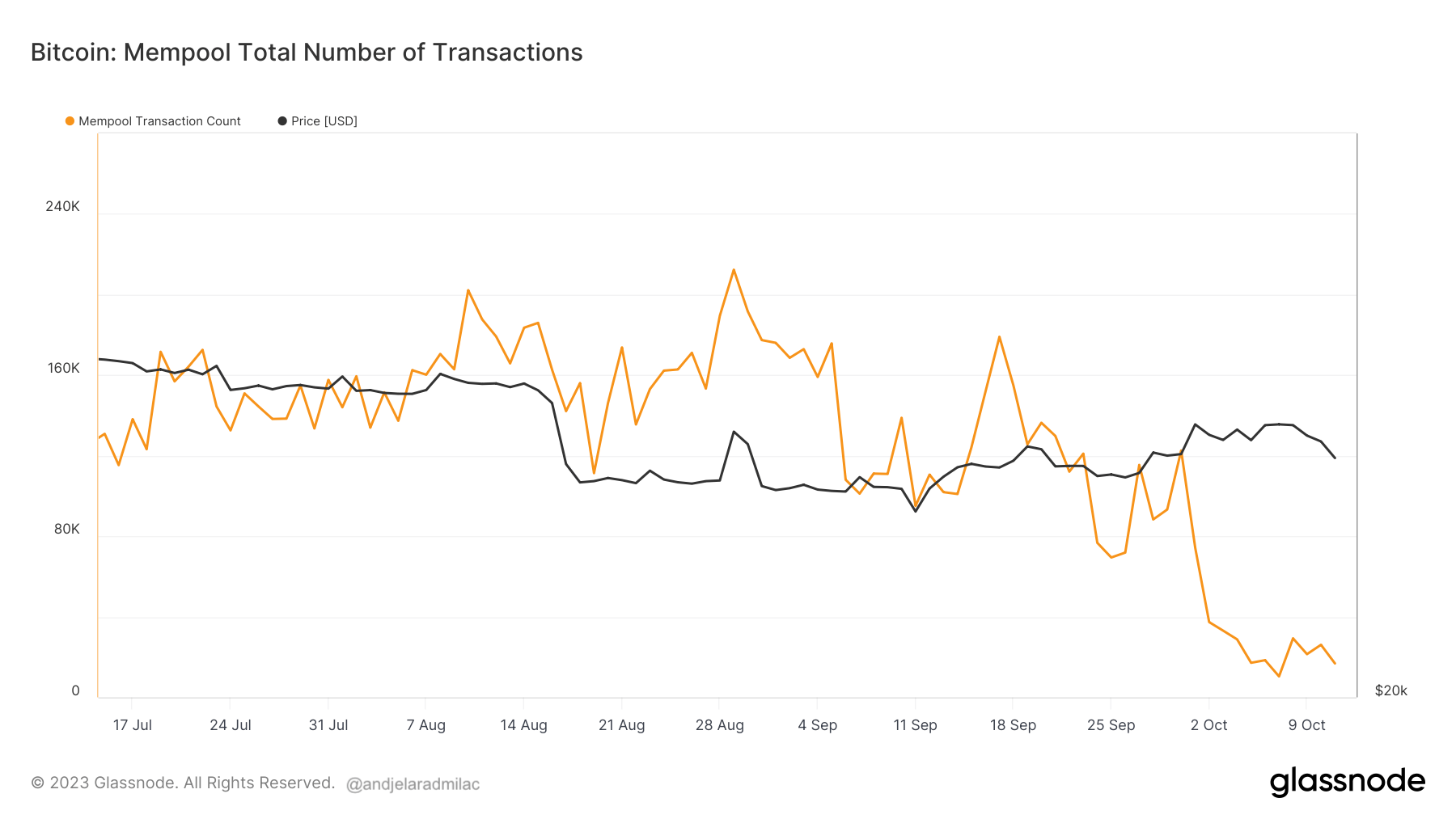

Examining network behaviors further, September 2023 indicated signs of congestion. The mempool, which is Bitcoin’s transaction waiting area, swelled to 120,900 transactions, a significant increase from the 1,500 transactions recorded at the start of the year.

Graph showing the number of transactions pending in the Bitcoin mempool from July 15 to Oct. 11, 2023 (Source: Glassnode)

Graph showing the number of transactions pending in the Bitcoin mempool from July 15 to Oct. 11, 2023 (Source: Glassnode)

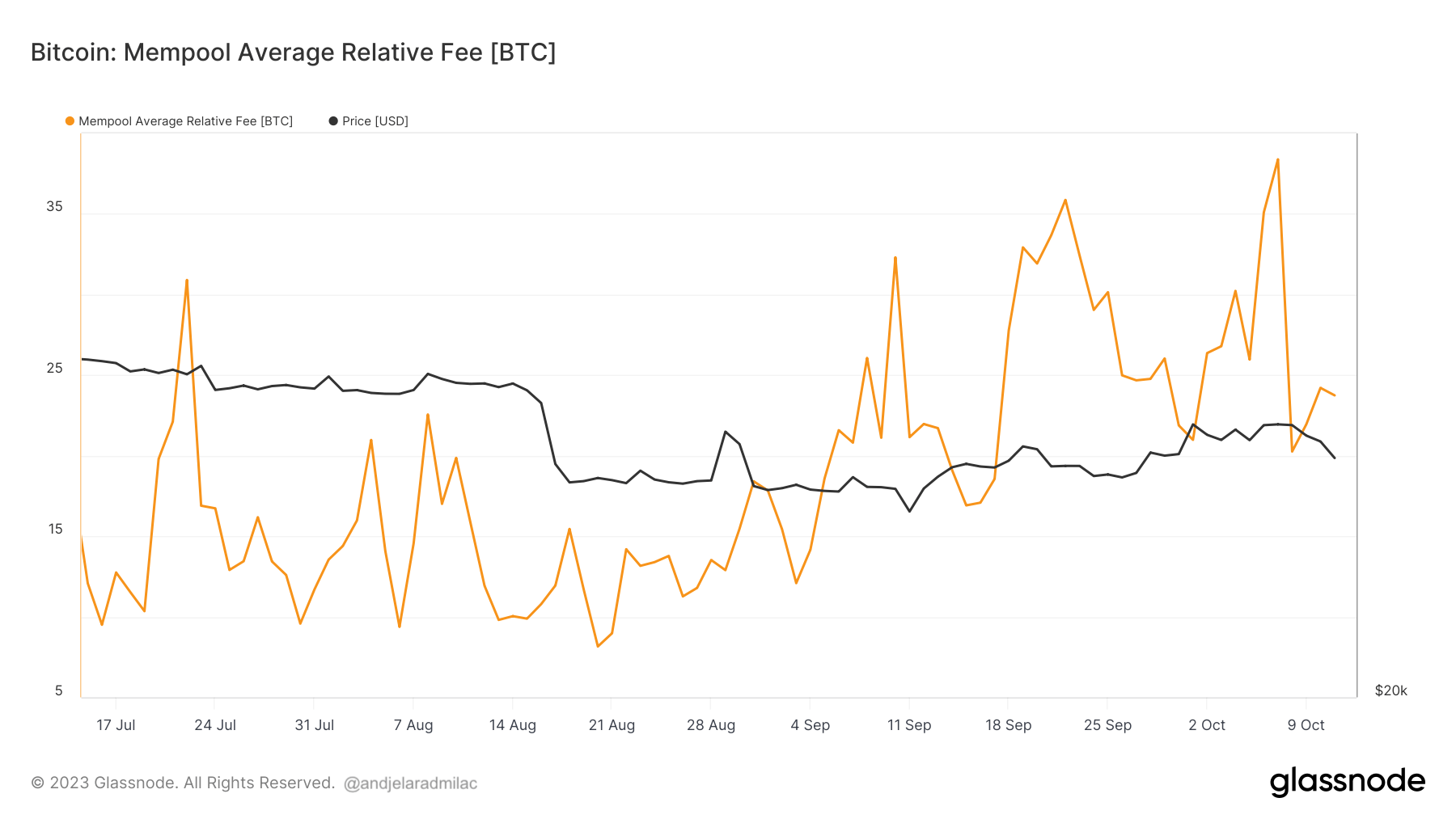

This bottleneck was exacerbated by the elevated average relative fee of 32.4 BTC, indicating users’ readiness to pay more for transaction prioritization. However, October brought relief. The transaction count in the mempool and the associated fees decreased significantly, suggesting a reprieve from the congestion experienced in September.

Graph showing the number of transactions pending in the Bitcoin mempool and the average relative transaction fee from July 15 to Oct. 11, 2023 (Source: Glassnode)

Graph showing the number of transactions pending in the Bitcoin mempool and the average relative transaction fee from July 15 to Oct. 11, 2023 (Source: Glassnode)

The congestion in the Bitcoin network during September 2023 likely discouraged users from engaging in UTXO consolidations. However, with October bringing a period of diminished congestion and lower fees, users appear to have seized the opportunity to consolidate their UTXOs, resulting in reduced transaction costs and quicker confirmations.

The post Deciphering the role of UTXOs in Bitcoin consolidation patterns appeared first on CryptoSlate.