Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Analyzing Solana’s rise amid Bitcoin’s surge

The surge of Bitcoin beyond the $34,000 threshold has similarly ignited a rally within the DeFi sector. Nearly all cryptocurrencies have experienced a significant uptick in prices and increased activity following Bitcoin’s ascent, with Solana enjoying a notable revival. Known for its rapid transaction capabilities, Solana has positioned itself as a crucial entity in the DeFi landscape.

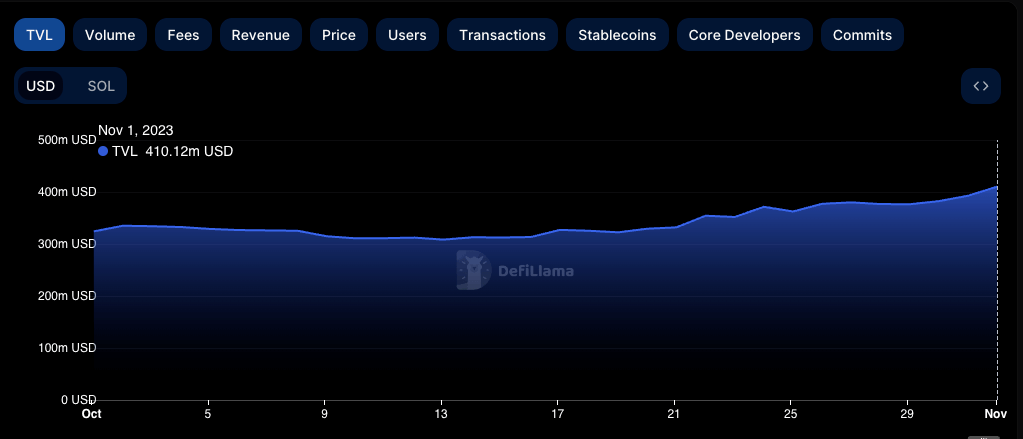

According to data from DefiLlama, Solana’s total value locked (TVL) has seen a remarkable increase. On October 1, the TVL was $324.27 million, which climbed to $410.12 million by November 1, representing a 26.5% rise.

Total value locked (TVL) denotes the cumulative value of assets currently held within a blockchain protocol. This metric reflects the liquidity and appeal of a DeFi platform. In simple terms, a higher TVL indicates greater usage of that specific platform, showcasing its utility.

Graph illustrating the total value locked (TVL) on Solana from October 1 to November 1, 2023, expressed in USD (Source: DeFiLlama)

Graph illustrating the total value locked (TVL) on Solana from October 1 to November 1, 2023, expressed in USD (Source: DeFiLlama)

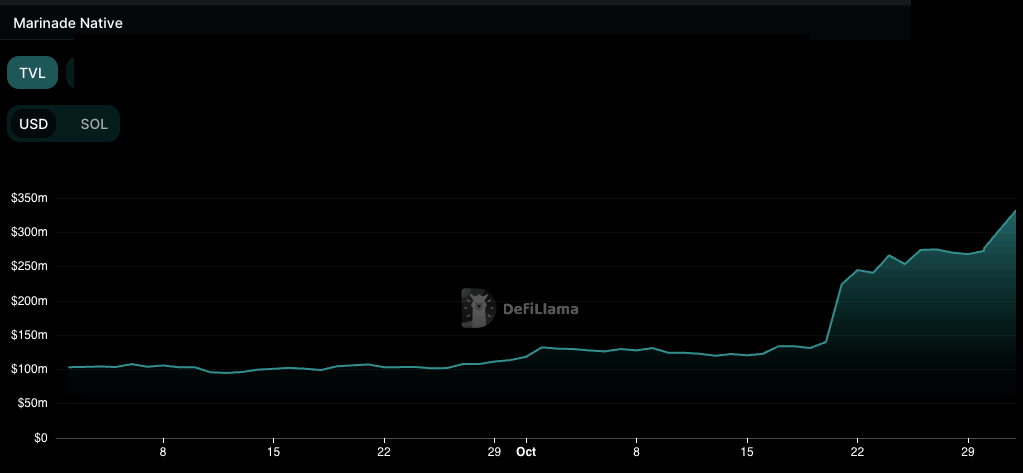

A considerable portion of this TVL growth can be credited to Marinade Finance, a staking protocol introduced earlier this year on Solana. Marinade experienced a 180% increase in TVL during October, escalating from $118.47 million on October 1 to $331.8 million by November 1.

Graph depicting the total value locked (TVL) on Marinade Finance from September 1 to November 1, 2023, in USD (Source: DefiLlama)

Graph depicting the total value locked (TVL) on Marinade Finance from September 1 to November 1, 2023, in USD (Source: DefiLlama)

Marinade Finance provides an enticing staking Annual Percentage Yield (APY) of 8.81%. APY signifies the actual rate of return on an investment, factoring in the effects of compounded interest. It illustrates the potential earnings a user might anticipate over a year from staking their assets. Moreover, Marinade’s rising popularity is apparent, with 74,873 accounts utilizing its services as of November 1.

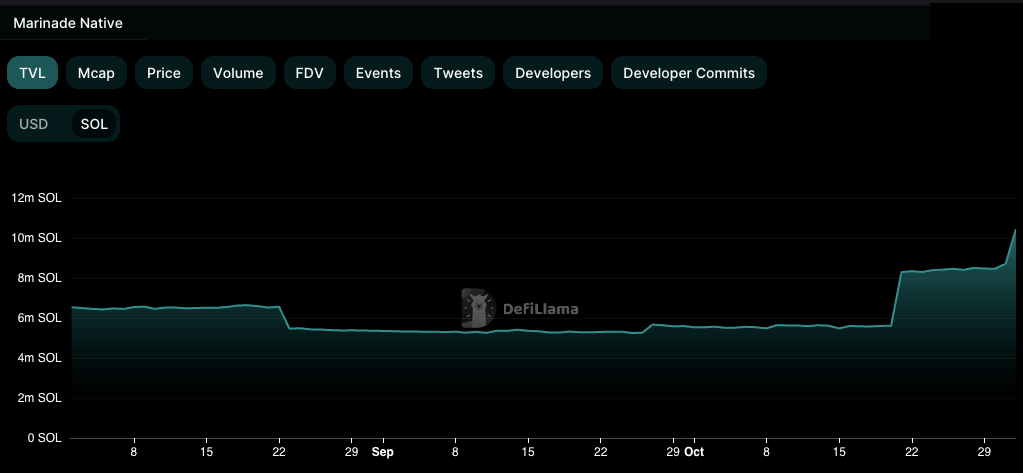

In terms of SOL denomination, Marinade’s TVL saw a striking increase in October, rising from 5.54 million SOL on October 1 to 10.45 million SOL by November 1, nearly doubling its total.

Graph showing the total value locked (TVL) on Marinade Finance from August 1 to November 1, 2023, in SOL (Source: DeFiLlama)

Graph showing the total value locked (TVL) on Marinade Finance from August 1 to November 1, 2023, in SOL (Source: DeFiLlama)

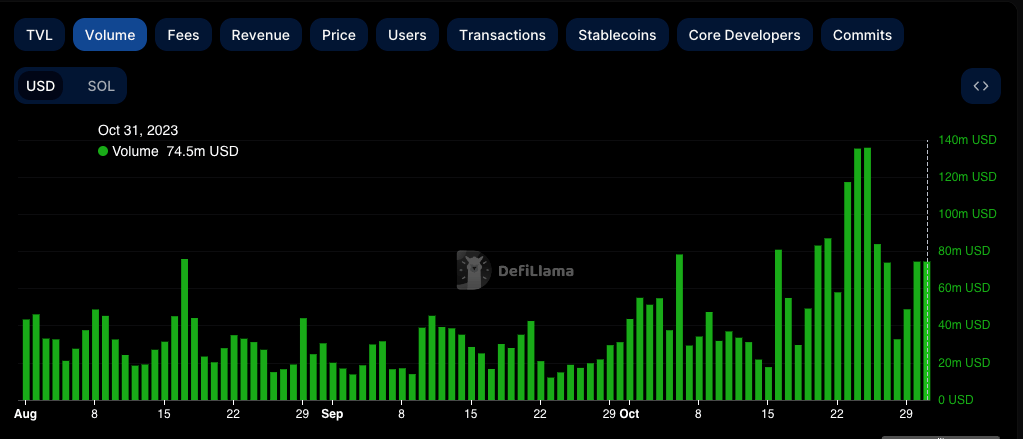

Regarding trading volume, Solana experienced a significant uptick from $43.6 million on October 1 to $135.8 million on October 25, marking a 211% increase. This was the fourth highest volume recorded since the start of the year.

Graph illustrating the trading volume on Solana from August 1 to November 1, 2023 (Source: DeFiLlama)

Graph illustrating the trading volume on Solana from August 1 to November 1, 2023 (Source: DeFiLlama)

Solana’s native token, SOL, also experienced substantial growth. The price of SOL rose from $21.4 on October 1 to $38.5 by November 1, indicating an 80% increase. This price level marked the highest since the downfall of FTX and represented the peak for 2023.

Graph showing the price of SOL from October 2022 to November 2023 (Source: CryptoSlate SOL)

Graph showing the price of SOL from October 2022 to November 2023 (Source: CryptoSlate SOL)

Additionally, Solana witnessed $24 million in inflows during the final week of October. This influx was notably greater than that observed in other altcoins and Ethereum, highlighting the increasing confidence and investment in Solana’s ecosystem.

While the data illustrates Solana’s remarkable advancements within the DeFi sector, it’s important to approach these figures with some skepticism. The notable growth in TVL, primarily driven by Marinade Finance, does underscore Solana’s potential, but it also raises concerns regarding the platform’s dependence on a few key protocols.

The rapid rise in TVL measured in SOL over a month is noteworthy; however, such swift increases often call for scrutiny concerning their sustainability in the volatile crypto environment. The growth in trading volume and the price increase of SOL do reflect rising interest, but whether this indicates long-term confidence or merely a fleeting trend remains to be determined.

Although Bitcoin’s rally has undeniably propelled the entire DeFi sector, including Solana, it is vital to differentiate between authentic growth and simple market exuberance. As the DeFi narrative develops, Solana’s genuine standing and enduring influence will be dictated by its capability to innovate, adapt, and tackle market challenges.

The post Unpacking Solana’s surge in the shadow of Bitcoin rally appeared first on CryptoSlate.