Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

An examination of the fluctuations in stablecoin supply as TUSD increases its market presence.

Although the majority of cryptocurrency market analyses primarily concentrate on Bitcoin and Ethereum due to their prominence as the two largest and most impactful cryptocurrencies, it is essential to highlight that stablecoins represent a significant market influence as well.

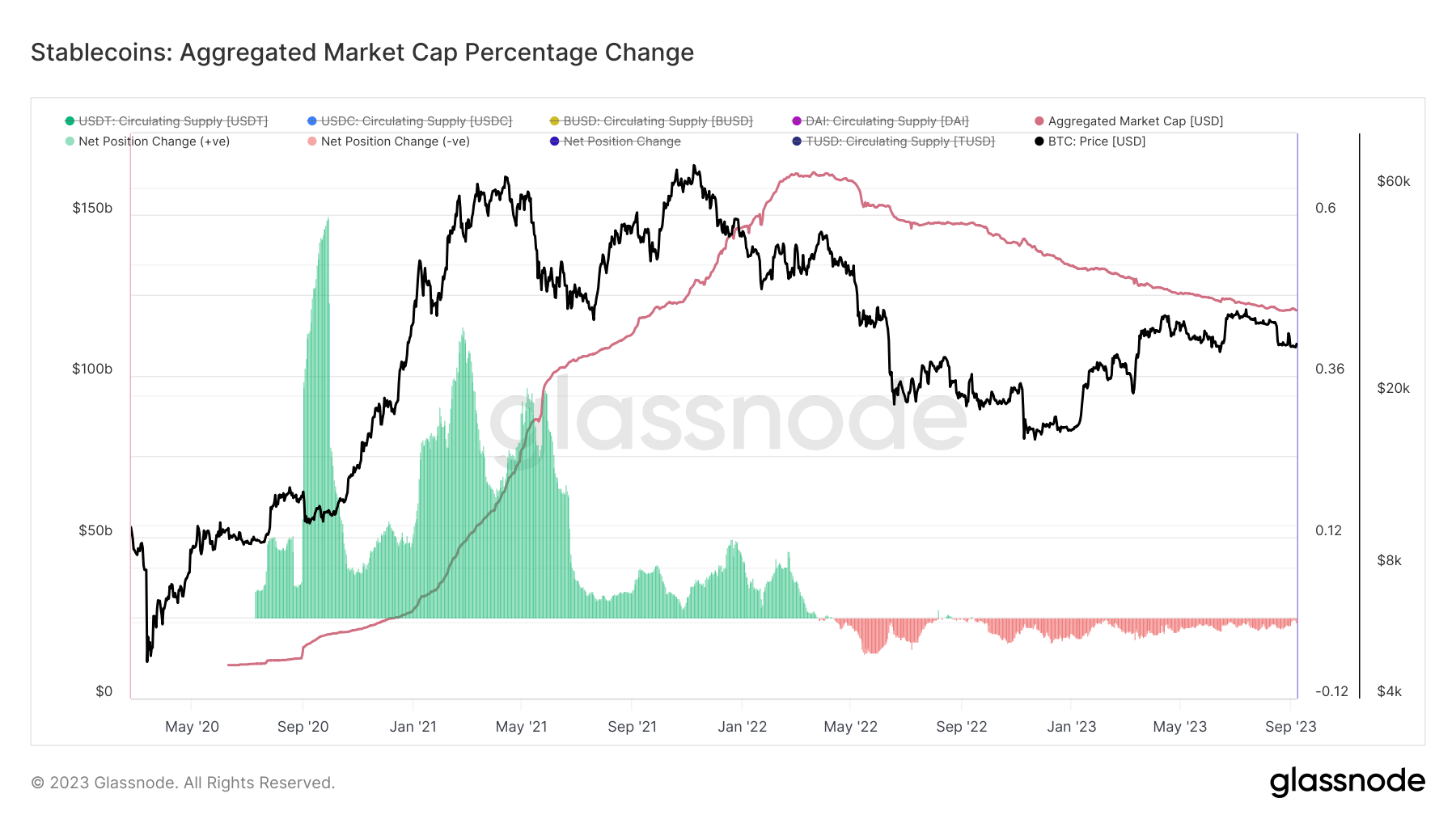

Stablecoins reached their peak in March 2022, when the total market capitalization of the five largest stablecoins hit $162.8 billion. For context, this figure was $55 billion in March 2021. However, a shift began in April 2022, as the overall stablecoin market cap started to decline. Aside from a few brief instances of positive net position changes, this downward trend has continued to the present day.

Graph illustrating the percentage change in aggregate market supply of the top five stablecoins by market cap from 2020 to 2023 (Source: Glassnode)

Graph illustrating the percentage change in aggregate market supply of the top five stablecoins by market cap from 2020 to 2023 (Source: Glassnode)

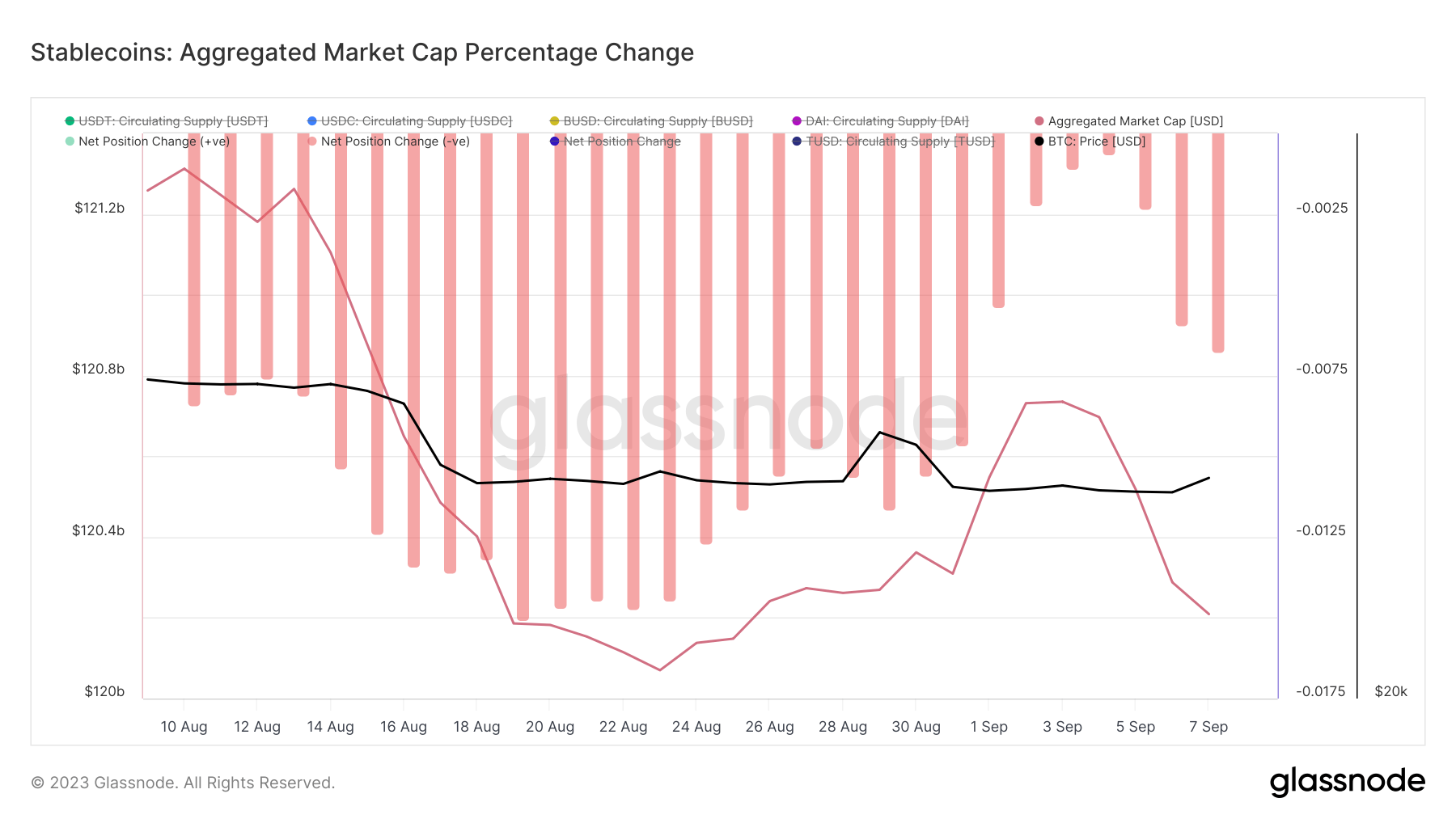

As of September 8, the total market supply of the top five stablecoins is estimated at $120.2 billion. A detailed look at recent changes indicates that from August 23 to September 1, the total stablecoin market cap rose by roughly $661 million. However, this increase was short-lived, with $526 million lost from the market cap since the start of September.

Graph depicting the percentage change in aggregate market supply of the top five stablecoins by market cap from August 8 to September 8, 2023 (Source: Glassnode)

Graph depicting the percentage change in aggregate market supply of the top five stablecoins by market cap from August 8 to September 8, 2023 (Source: Glassnode)

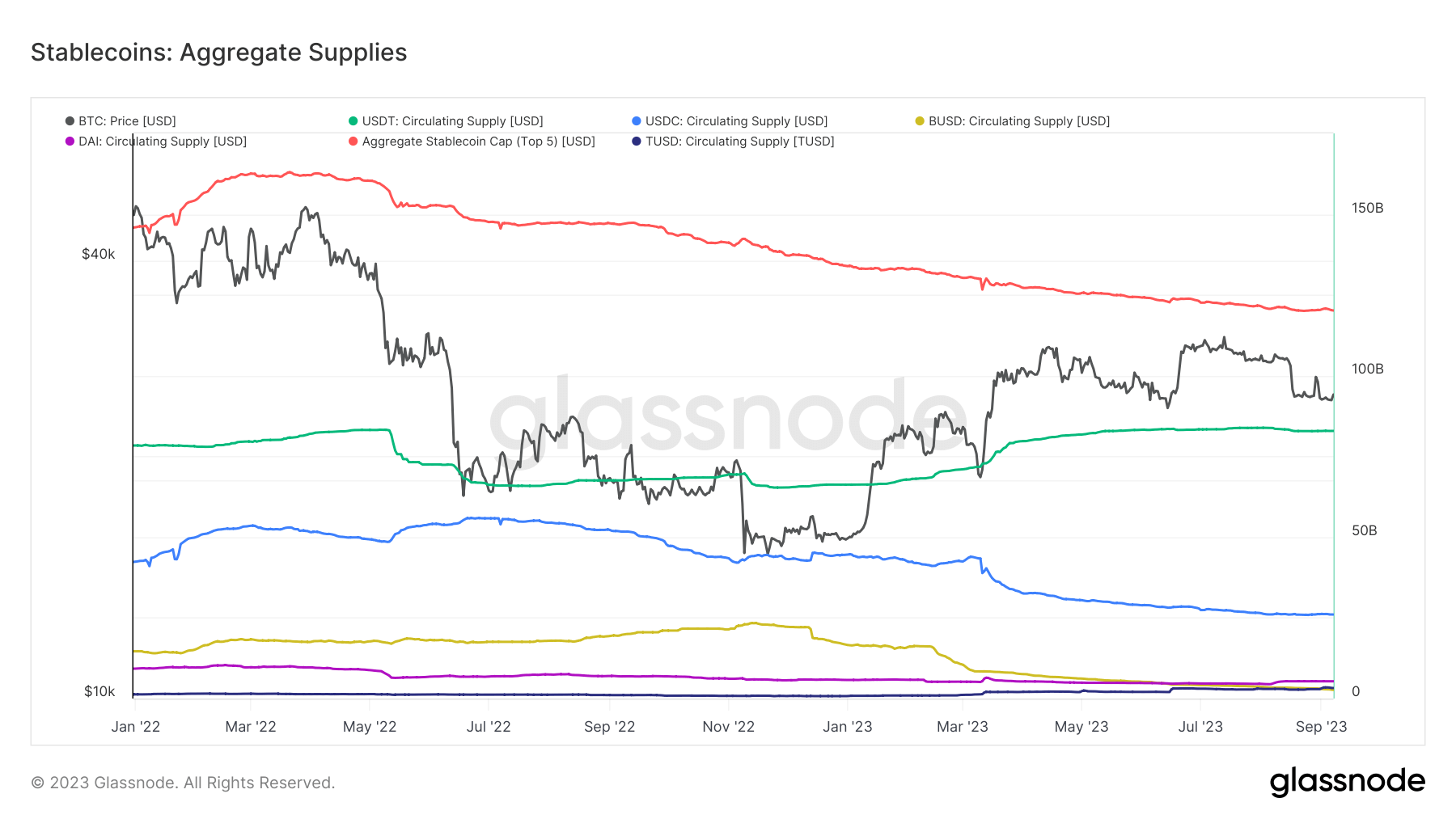

Examining each of the five stablecoins that make up this aggregate figure reveals that Tether (USDT) was the sole stablecoin to experience a net increase in its market cap. Since the start of the year, USDT’s market cap has risen by $16.6 billion, currently totaling $82.8 billion. Importantly, Tether is approaching its all-time high (ATH) of $83.2 billion, reached in May 2022.

TrueUSD (TUSD) has also experienced a significant rise. Beginning the year with a market cap of just over $762.2 million, it has now expanded to $3.26 billion.

Conversely, not all stablecoins have performed well this year. BUSD has seen a considerable decrease in its market cap, dropping from $16.5 billion to $2.6 billion as it began its winding down process. Circle’s USDC has also faced a notable decline, with its market cap falling from $44.5 billion to $26 billion over nine months. In contrast, DAI has maintained its stability, with its market cap consistently around the $5 billion level.

Graph showing the supplies of the top five largest stablecoins by market cap from January 2022 to September 2023 (Source: Glassnode)

Graph showing the supplies of the top five largest stablecoins by market cap from January 2022 to September 2023 (Source: Glassnode)

The variations in stablecoin supply underscore the fluid nature of the cryptocurrency landscape, particularly as they often reflect broader market trends or responses to specific industry events. While some stablecoins like USDT and TUSD are increasing their presence, others such as BUSD and USDC are experiencing significant declines. These shifts can be linked to a variety of factors, including regulatory issues, market sentiment, and the changing environment of decentralized finance (DeFi) platforms.

In summary, while Bitcoin and Ethereum frequently dominate discussions, the significance of stablecoins in influencing the cryptocurrency market should not be overlooked. Their supply dynamics serve as an indicator for assessing market sentiment and liquidity.

The post A closer look at the changes in stablecoin supply as TUSD gains on market appeared first on CryptoSlate.