Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

A rapid change in Ethereum staking is pulling billions away from exchanges to a new corporate elite.

By the conclusion of 2025, a segment of the market that most Ethereum traders seldom monitor had established a position substantial enough to impact everyone else.

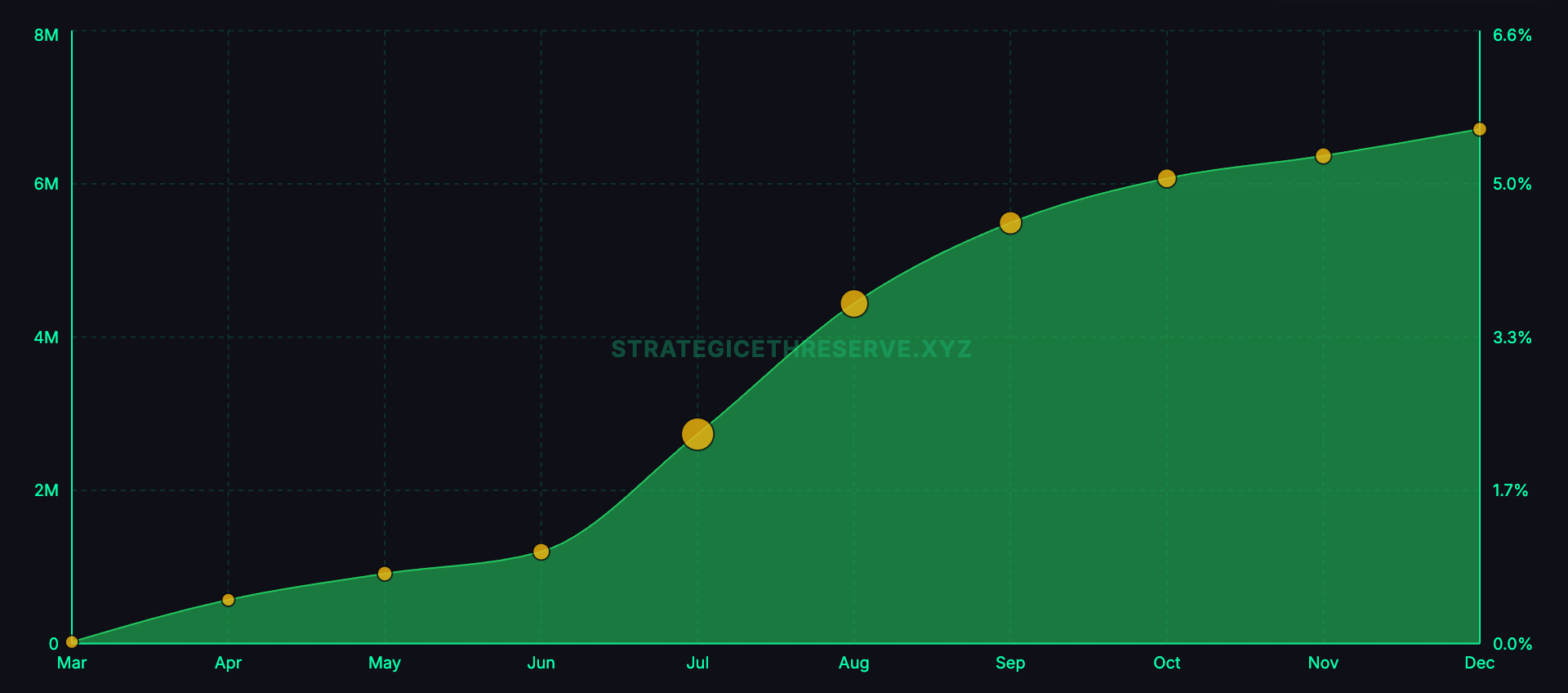

Everstake’s yearly Ethereum staking report estimates that public companies’ “digital asset reserves” held around 6.5–7.0 million ETH by December, representing over 5.5% of the circulating supply.

Graph illustrating the total ETH digital asset treasury holdings by public companies from March 2025 to December 2025 (Source: Everstake)

Graph illustrating the total ETH digital asset treasury holdings by public companies from March 2025 to December 2025 (Source: Everstake)

The figure is considerable, but the more crucial aspect is the rationale behind these companies’ initial choice of ETH.

Bitcoin’s corporate-treasury strategy is founded on scarcity and reflexivity: acquire coins, allow the market to re-evaluate the equity wrapper at a premium, then issue shares to purchase additional coins.

Ethereum introduces a second dimension that Bitcoin lacks. Once ETH is obtained, it can be staked, which means it can generate protocol-native rewards by aiding in network security. Everstake estimates that this reward stream yields approximately 3% APY for treasury-style operators.

A corporate ETH treasury aims to serve as a publicly traded vehicle that holds ETH, generates more ETH through staking, and persuades equity investors to pay for that bundled exposure. The primary wager is that the wrapper can compound its underlying assets over time, and that the public markets will fund the growth phase when sentiment is positive.

Related Reading

Related Reading

Ethereum aims to stop rogue AI agents from stealing trust with new ERC-8004 – but will it?

Three on-chain registries promise transferable identity, reputation, and validation. However, the validator power struggle is the twist.

Jan 29, 2026 · Gino Matos

The fundamental mechanics of staking

Ethereum operates on a proof-of-stake model. Instead of miners competing with computers and energy, Ethereum employs “validators” who lock ETH as collateral and run software that proposes and verifies blocks.

When validators perform their duties accurately, they receive rewards funded by the protocol. If they go offline or act improperly, they risk losing part of their rewards and, in more severe instances, a portion of the locked ETH through slashing.

Staking is appealing to institutions because the rewards are intrinsic to the protocol, not reliant on lending assets to a borrower. While it still carries operational risks, this is mitigated by the fact that the primary source of yield is the network itself.

Everstake’s report indicates that by the end of 2025, about 36.08 million ETH was staked, which it characterizes as 29.3% of supply, with net growth exceeding 1.8 million ETH over the year.

This is significant for treasuries as it demonstrates that staking has evolved into a large, established market rather than remaining a niche activity.

Related Reading

Related Reading

TheDAO’s leftover rescue money sat for a decade now it’s becoming Ethereum’s permanent $220M security budget

Veterans intend to stake 69,420 ETH from leftover 2016 recovery funds, generating millions annually for smart contract security.

Jan 30, 2026 · Gino Matos

The ETH treasury flywheel: premium financing plus protocol yield

Everstake outlines two levers that treasury companies are attempting to utilize.

The first is mNAV arbitrage. If a company’s stock trades at a premium to the market value of its underlying assets, it can issue new shares and use the proceeds to acquire more ETH.

If the premium is sufficiently significant, it can increase ETH per share for existing shareholders even after dilution, as investors are effectively paying more for each unit of Ethereum exposure than it costs to obtain ETH directly.

The cycle functions as long as the premium remains intact and capital markets are accessible.

The second lever is staking rewards. Once the ETH is acquired, the company can stake it and earn additional ETH over time.

Everstake estimates the staking component at roughly 3% APY, noting that the crucial point is low marginal costs once the infrastructure is established. A treasury that stakes aims to compound in token terms, not merely benefit from price appreciation.

In unison, the proposition for treasury staking is straightforward. The premium funds growth when markets are optimistic, and staking facilitates consistent accumulation during quieter market periods.

Both mechanisms target the same outcome: increased ETH per share.

Related Reading

Related Reading

Ethereum’s hidden ‘death spiral’ mechanic could freeze $800 billion in assets regardless of their safety rating

The Bank of Italy cautions of systemic risk as Ethereum’s declining price could lead to network hijacking and asset manipulation.

Jan 12, 2026 · Oluwapelumi Adejumo

The three treasury staking playbooks

Everstake’s report categorizes the sector into three major holders and assigns each a role in the narrative.

It estimates that BitMine holds approximately 4 million ETH, the figure that dominates Everstake’s “hockey stick” chart. Everstake also mentions that BitMine is moving towards staking on an even larger scale, including plans for its own validator infrastructure and disclosing that “hundreds of thousands of ETH” were staked via third-party infrastructure by late December 2025.

SharpLink Gaming possesses about 860,000 ETH, staked as part of an active treasury strategy where staking rewards are considered operating income and remain on the balance sheet.

The Ether Machine holds around 496,000 ETH, with 100% staked. Everstake references a reported 1,350 ETH in net yield during a period as evidence of what a “fully staked” model looks like.

These figures demonstrate that the strategy is becoming institutionalized. These are not minor experiments for the companies. Their positions are substantial enough that staking venue, operational approach, disclosure practices, and risk management become integral parts of the product.

Related Reading

Related Reading

Ethereum faces a dangerous 40-day deadlock after BitMine’s aggressive staking forces a historic liquidity squeeze

Ethereum is facing a $5 billion stress test; what are the three scenarios for 2026?

Jan 14, 2026 · Oluwapelumi Adejumo

Where institutions stake, and why “compliance staking” exists

The most practical insight from Everstake’s report is that staking is splitting into distinct lanes.

Retail often stakes through exchanges for convenience, while DeFi-native users pursue liquidity and composability through liquid staking tokens.

Institutions frequently seek something akin to traditional operational separation: defined roles, multiple operators, auditability, and a structure that aligns with existing compliance expectations. Everstake points to Liquid Collective as a compliance-oriented staking solution and uses its liquid staking token LsETH as a proxy for institutional migration.

The report indicates that LsETH expanded from around 105,000 ETH to approximately 300,000 ETH, linking that growth to outflows from Coinbase exchange balances as a sign of large holders moving away from exchange custody while still favoring “enterprise-grade” staking structures.

It includes an exchange snapshot that reinforces this point. Everstake states that Coinbase’s share decreased by roughly 1.5 million staked ETH, from 10.17% to 5.54%, while Binance increased from 2.02 million to 3.14 million ETH, with the share rising from 5.95% to 8.82%.

The statistics matter less as a judgment on either platform and more as evidence that staking distribution shifts significantly when large players reposition themselves.

For treasury companies, the staking-lane question is structural.

If the strategy relies on staking rewards to support compounding, then operator diversification, slashing protection, downtime risk, custody architecture, and reporting practices transition from being back-office details to essential elements of the investment case.

The infrastructure beneath the trade: stablecoins and tokenized Treasuries

Everstake does not view corporate treasuries as an isolated phenomenon but connects them to Ethereum’s institutional appeal in 2025: stablecoin liquidity and tokenized Treasury issuance.

Regarding stablecoins, Everstake notes that the total stablecoin supply across networks surpassed $300 billion, with Ethereum L1 plus L2s holding 61%–62%, or approximately $184 billion. The assertion is that Ethereum’s security and settlement depth continue to draw the on-chain dollar base that institutions actually utilize.

On tokenized Treasuries, Everstake mentions that the market was nearing $10 billion and estimates Ethereum’s ecosystem share at about 57%. It presents Ethereum L1 as a security anchor for major issuers and cites products such as BlackRock’s BUIDL and Franklin Templeton’s tokenized money fund.

This context is crucial for the treasury trade.

A public company looking to justify a long-term ETH position and a staking program requires a narrative that extends beyond crypto speculation.

Tokenized cash and tokenized Treasuries are more defensible as structural adoption than most other on-chain categories, and their growth simplifies the explanation of why the asset securing the ledger might hold significance over an extended period.

The risks that could disrupt the Ethereum staking model

Everstake includes a cautionary note regarding concentration and correlated failures.

It cites a Prysm client outage in December 2025, stating that validator participation fell to approximately 75% and 248 blocks were missed, using the event to argue that client herding can create network-wide fragility.

This risk is more pronounced if large public treasuries consolidate around similar infrastructure choices, as their staking decisions can influence concentration. It also matters because staking returns are only reliable when operations are resilient.

While downtime, misconfiguration, and slashing may seem abstract to companies, they are as integral to the business as staking itself.

The second risk pertains to capital markets, as mNAV arbitrage is only an effective mechanism when markets are robust. If the equity premium diminishes, issuing stock can become dilutive rather than accretive, halting the cycle.

Staking yield alone does not remedy this, as yield is incremental while equity financing serves as the growth engine.

A third risk involves governance and regulation.

Treasury companies operate within disclosure and custody frameworks that can tighten rapidly. The strategy hinges on maintaining a structure that auditors, boards, and regulators can accept, especially if staking becomes a significant contributor to reported income.

The ETH treasury trade is founded on a straightforward proposition: accumulate ETH, stake it to enhance holdings in token terms, and leverage public-market access to scale more rapidly than a private balance sheet could.

Whether it endures as a sustainable category will rely on two measurable factors: how effectively these companies operationalize staking without introducing hidden fragility, and how consistently their equity wrappers can maintain premiums that enable the financing loop to function.

The post A sudden shift in Ethereum staking is draining billions from exchanges toward a new corporate elite appeared first on CryptoSlate.