Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

$8.5 billion in outflows since October could lead to a rapid decline in Bitcoin ETFs if the trend continues.

The headline may seem sensational, but given the current rate of outflows, it reflects an objective reality. Since Bitcoin reached its all-time high last October, US spot Bitcoin ETFs have experienced outflows on 55 out of 89 days. If this trend does not reverse before the next halving, there will be significantly less BTC held within ETF wrappers on that day.

Before examining how rapidly ETFs could approach zero, let’s consider the “glass half full” viewpoint of the present circumstances (skip ahead if you are only interested in the bearish perspective).

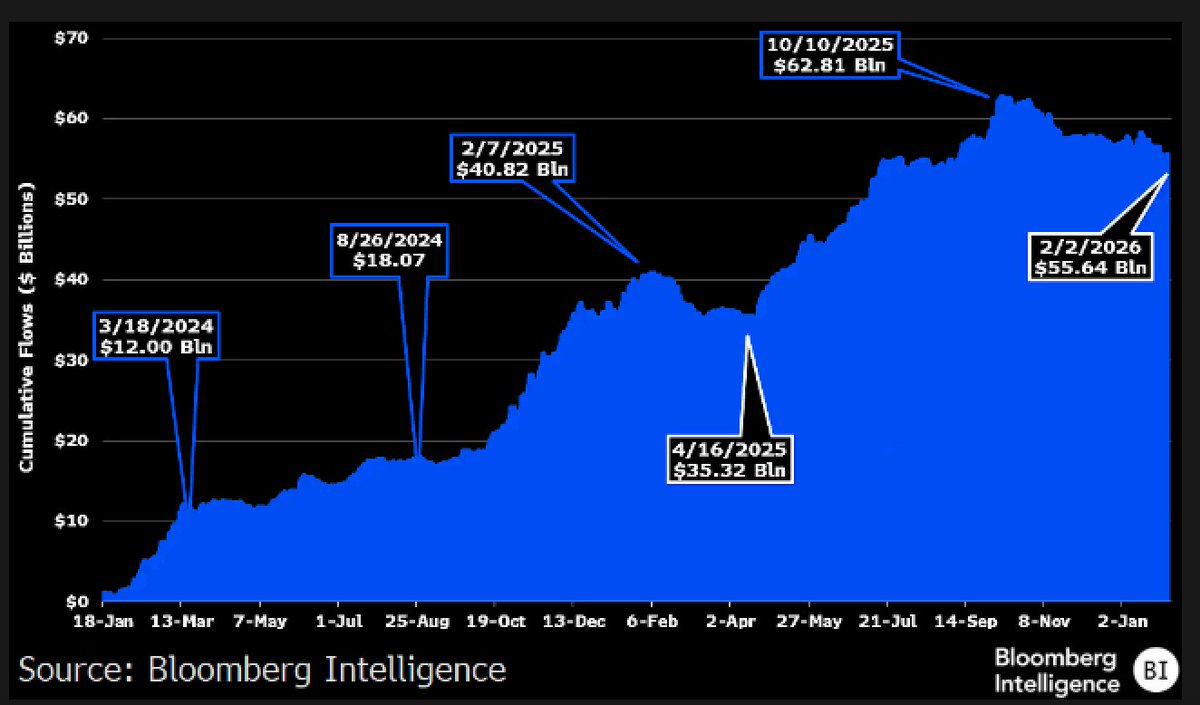

Bloomberg Intelligence ETF analyst Eric Balchunas pointed out today a figure he believes is more significant than most: the cumulative net inflows into US spot Bitcoin ETFs.

He noted that the total reached a peak of approximately $63 billion in October and currently stands at around $53 billion, reflecting roughly $8 billion in outflows during a sharp downturn.

Bitcoin ETF cumulative inflows (Source: Bloomberg)

Bitcoin ETF cumulative inflows (Source: Bloomberg)

The essence of his argument was straightforward; a substantial amount of capital has entered the market, and much of it has remained.

Related Reading

Related Reading

Bitcoin eyes $7.7T sidelined dollars as Wall Street runs out of cash to “buy the dip”

Bitcoin’s movements become increasingly concerning as institutional traders exhaust their “fast cash,” with most funds currently earning yield due to slow traditional finance settlement times.

Feb 16, 2026 · Liam 'Akiba' Wright

This is significant because the narrative surrounding Bitcoin’s relationship with Wall Street has begun to shift.

The simplified version is as follows: ETFs were introduced, institutions entered the scene, and Bitcoin was deemed “mature.” Then the market declined, prompting those same institutions to exit. The reality is more complex and human.

When viewed from a broader perspective, the ETF era still appears to be an astonishing success based on net intake.

Cumulative net inflows for US spot Bitcoin ETFs are approximately $54.31 billion, even after recent losses, which is a substantial figure for a product category that is still relatively new.

However, zooming in reveals that the past few months feel markedly different.

Since the crash in October, $8.66 billion has exited US-listed spot Bitcoin ETFs, and Bitcoin has declined by more than 40% from its October peak near $126,000.

These two realities can coexist and still depict the same environment. Individuals buy for various reasons, and they also sell for different motivations. A polished wrapper transforms Bitcoin into an asset that can be traded in a brokerage account while having lunch, and this single alteration introduces a broader array of motives into the transaction.

This resonates with those outside Wall Street who are part of that mix. “Institutional adoption” manifests as numerous committees, advisors, platforms, and individuals making small decisions that accumulate into a significant, visible trend.

This trend encourages storytelling and can also lead to errors, as a number that updates daily may feel like a judgment.

To grasp the underlying trading dynamics on Wall Street, we must correlate ETF outflows with another indicator: futures exposure on the Chicago Mercantile Exchange. This is important because Authorized Participants (and other institutions) utilize futures to arbitrage risk and profit from their role in supplying BTC for ETF share baskets.

CME exposure has decreased by approximately two-thirds from a late-2024 peak to around $8 billion, aligning with the perception that the largest, most reputable institutional venues are taking on less risk than they did at the peak.

Wall Street’s footprints keep showing up

CME itself provides dashboards for Bitcoin futures volume and activity, and the overarching message is straightforward: participation expands, then contracts, and when it contracts across multiple venues simultaneously, every rally attempt feels distinct.

Coinbase, the platform favored by many US institutions, has traded at a discount compared to the offshore exchange Binance, indicating ongoing US selling. Understanding why Bitcoin appears heavy even when other risk assets attract buyers hinges on this detail.

The flow narrative also has depth, and this depth reveals where the participants are. In mid-January, the spot Bitcoin ETF group attracted approximately $760 million in a single day, marking the largest one-day influx since October, with Fidelity’s FBTC contributing significantly to that total. It has not been a complete washout, but those positive days have been greatly outnumbered by negative ones.

Nonetheless, much of the institutional narrative resides in these overlapping signals, with steady lifetime accumulation alongside sharp selling bursts, and sudden days where buyers appear organized once more.

The challenge lies in determining which signal is indicative of the upcoming month and which reflects the previous month.

Macro still sets the temperature

Sometimes the most straightforward driver is external.

In February, Reuters reported that US equity funds experienced net outflows of approximately $1.42 billion in the week ending February 11, linked to uncertainty surrounding rate cuts following a strong jobs report, along with concerns about significant corporate spending related to AI. In contrast, bond funds attracted capital. This represents a classic risk-sorting moment, and Bitcoin tends to be particularly sensitive to such moments.

Restrictive rates lead to selective portfolios, pushing investors toward clearer narratives. Bitcoin has dropped over 40% from its October peak near $126,000 while stocks and precious metals have found buyers, indicating that the market is treating Bitcoin as a liquidity-sensitive asset during this period.

Balchunas’ flow chart exists within this context. The cumulative figure remains substantial, having arrived faster than most forecasts, and the near-term data illustrates how swiftly conviction can shift when prices decline.

Bitcoin ETFs impending slow death

The latest AUM snapshot indicates a combined total of $98.33 billion.

The focal point is clear: IBIT stands at $57.01 billion alone, with FBTC at $13.94 billion and GBTC at $12.58 billion forming the next tier, followed by a cluster with BITB at $5.79 billion and ARKB at $5.36 billion.

Beyond that, there is a long tail where the figures still hold significance, albeit differently: HODL is at $1.37 billion, EZBC at $728.57 million, BTCO at $696.58 million, BTCW at $462.49 million, and BRRR at $398.00 million.

Bitcoin ETF AUMs (Source: NewHedge)

Bitcoin ETF AUMs (Source: NewHedge)

This distribution tells a human story as much as a market one, illustrating how swiftly liquidity and trust concentrate when institutions designate a product as “the” default option, while others must compete for attention even as the entire category continues to expand.

Since October 10, 2025, $8.66 billion has exited the ETFs, spread over the 89 trading days in that timeframe, averaging about $90 million departing per trading day.

If this pace continues and the current $98 billion AUM is treated as the starting point, it suggests approximately 1,011 trading days until the wrappers are effectively depleted.

In practical terms, this translates to about four years of weekday-sized outflows before the ETF complex reaches a critical point in early January 2030, assuming no changes occur.

In reality, few would anticipate Bitcoin to avoid any form of rally over the next four years. However, sustained pressure throughout the bear market could be observed. Therefore, let’s consider where we might stand if the bear market does not conclude before the next halving.

The next Bitcoin halving is projected to occur around April 11, 2028, which is approximately 558 trading days away, providing a useful timeframe for evaluating what “sticky” demand truly looks like.

Using the same outflow assumption, the calculations suggest around $44 billion of AUM by the next halving.

Translating that into BTC depends on the price, but at a mid-$60k spot level for Bitcoin, it equates to roughly 662k BTC still held within the wrappers.

However, if we consider “no more BTC left in ETFs” as “cumulative net inflows diminish to zero,” the outlook appears even bleaker.

Using the post–October 10 outflow rate, $53B / $90M = 590 trading days, which would occur just after the halving, around mid-2028 (subject to variations based on flows and holiday counts).

What to watch next

With the thought experiment concluded, begin by monitoring the daily ETF flow data.

Cooling outflows into a more stable pattern often brings sentiment along with it. Inflows accumulating over multiple sessions can quickly alter the headlines. For a straightforward triangulation tool beyond major sources, CoinGlass tracks ETF flows in one location, aiding in observing the rhythm of the data.

Next, observe CME participation. Stabilizing and then rising open interest and activity typically indicate that larger players are reintroducing risk in the cleanest US venue. CME’s own pages assist in tracking the direction of movement over time.

Also, keep an eye on the US-versus-offshore spread. Coinbase consistently trading at a discount to Binance reinforces the US selling signal. A narrowing of that discount suggests easing pressure on the US side of the market.

Macro volatility continues to serve as the backdrop. Fund flow data provides a weekly pulse check on the sentiment of the largest capital pools. Shifts in rate-cut expectations, equity fluctuations, and credit tightening tend to impact Bitcoin swiftly.

This collection of signals guarantees little, but it offers a framework for how the next chapter might unfold.

The key takeaway from this ETF narrative is that Bitcoin has a public scoreboard for institutional behavior, which has become an integral part of the market itself.

When the number increases, it attracts new believers. When it decreases, it raises new doubts. When it remains positive over the years, it redefines the baseline, compelling everyone to regard the Wall Street relationship as enduring.

Thus, when we publish articles stating that ETF flows need to reverse soon, there is short-term significance for the ongoing bear market.

However, if they do not reverse at all, the entire narrative surrounding Bitcoin could shift dramatically, leading to potentially severe consequences. Sustaining $53 to $98 billion in selling pressure is not something Bitcoin will manage lightly.

The post Bitcoin ETFs will go to zero sooner than we think if outflows don’t slow down as $8.5B leaves since October appeared first on CryptoSlate.