Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Unibot retains its leading position as the first crypto trading bot on Telegram.

The Unibot token emerged as one of the leading crypto gainers in July, experiencing a price surge of 400% to achieve an all-time high of $199.90 on July 28. This project countered the prevailing negative trend in the market, as both Bitcoin (BTC) and Ether (ETH) saw declines of nearly 4%.

However, by August 3, 2023, the token’s price had retraced by 44% from its peak, raising questions about whether this increase was simply a temporary phenomenon. Nonetheless, it is important to evaluate the project’s fundamentals, which appear to indicate otherwise.

The initiative signals a new bullish narrative surrounding decentralized Telegram bots for trading on decentralized exchanges (DEXs). According to CoinGecko, the total market capitalization of this sector surged past $150 million, up from approximately $20 million at the beginning of July.

While several imitators have entered the market, Unibot (UNIBOT) maintains a commanding market share, holding 72.3% of the overall market for decentralized Telegram bots utilized for trading on DEXs. Since May 2023, Unibot has gained traction with increased usage and price.

It offers features such as limit orders, maximum extractable value protection, and sniping. Sniping allows for the immediate purchase of newly listed token pools on Uniswap, which is favored by high-frequency traders.

Sniping LPs & reading the chain used to give a huge edge for short-term trading

Now that we have tools like $UNIBOT, that edge is fading

What's the edge now?— 0xPajke (@0xPajke) July 26, 2023

Unibot has gained popularity among advanced decentralized finance (DeFi) users, as evidenced by its rising usage. The token boasts a low price-to-earnings (PE) ratio compared to other DeFi protocols, providing fundamental support to its price despite the significant price increase.

Telegram bots trading could be a lucrative DeFi niche

Although Unibot’s design may not be groundbreaking or feature any technological innovations, the Telegram bot delivers an enhanced trading experience on Uniswap, leading to its growing appeal among traders.

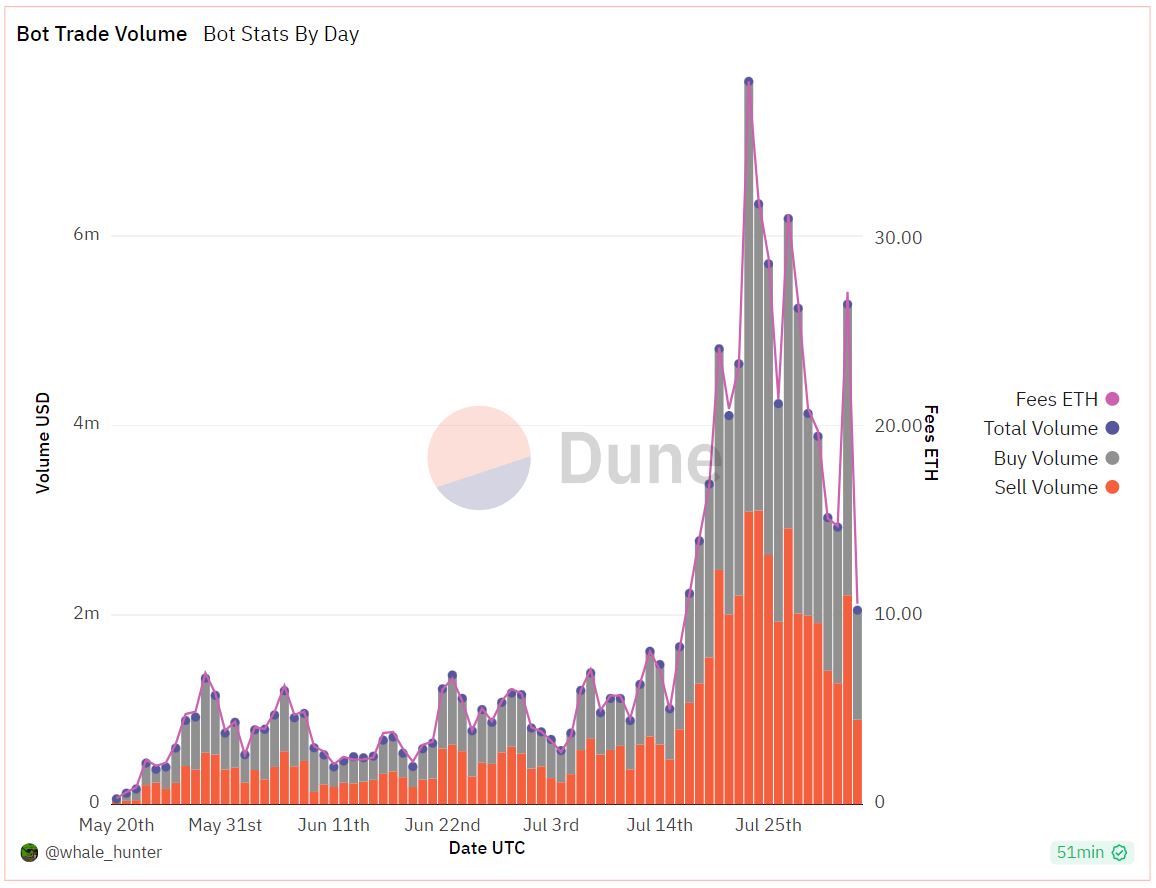

Unibot’s trading volumes nearly tripled in July, peaking at $7.63 million on July 23, according to a Dune dashboard.

Uniswap bot trading volumes. Source: Dune

Uniswap bot trading volumes. Source: Dune

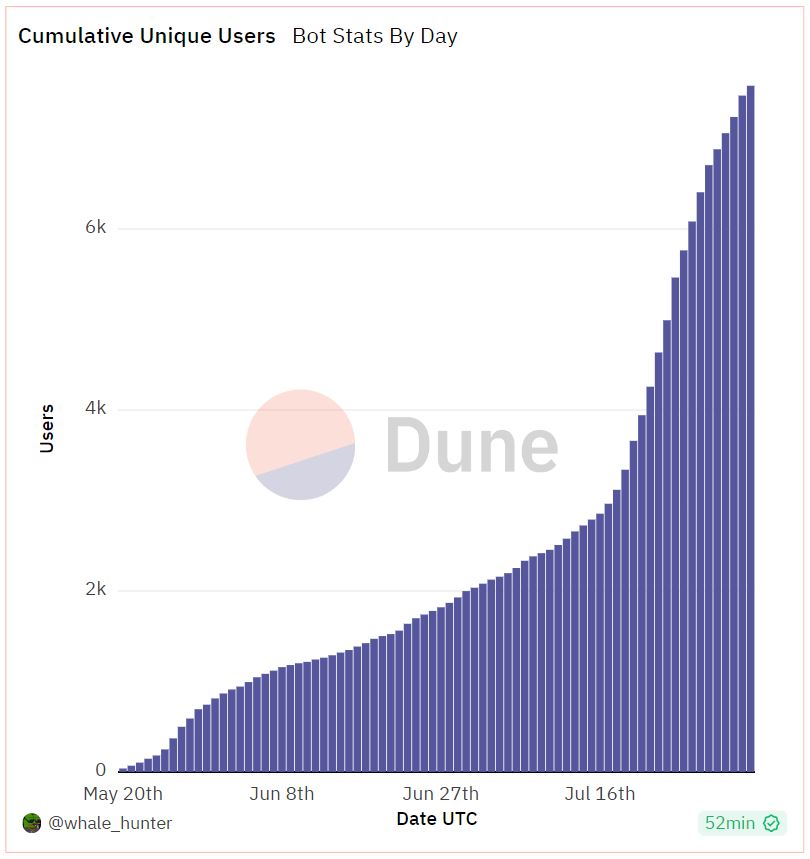

The cumulative user base of Unibot surpassed 7,000 unique wallets as the bot’s usage continued to expand.

The Unibot development team also unveiled a new version of the bot on July 21, Unibot X, which features mobile compatibility, an improved user interface, and advanced functionalities.

The number of unique users interacting with Unibot. Source: Dune

The number of unique users interacting with Unibot. Source: Dune

Additionally, its tokenomics project strong returns for tokenholders due to its revenue-sharing model with a fixed supply of tokens. A fixed supply mitigates dilution risks associated with investor or private sale tokens.

The UNIBOT token serves as a governance token that receives 40% of the bot’s revenue from trading fees and grants access to exclusive features.

Currently, it forecasts an annual yield of 49.1% and has a PE ratio (the ratio of the token’s fully diluted market capitalization to annualized earnings) of 2.91. A lower PE ratio indicates higher earnings relative to market price.

UNIBOT’s PE ratio is more advantageous than most DeFi tokens, which typically have a PE ratio of 20 or higher. For example, MakerDAO (MKR) has a PE ratio of 20, while GMX, a leading real-yield platform, has a PE ratio of 35.85, according to Token Terminal data.

Related: Telegram Wallet bot enables in-app payments in Bitcoin, USDT and TON

However, the project carries smart contract risks, as multiple contracts interact with Uniswap to execute trades via Telegram, increasing potential attack vectors for hackers.

Unibot and other Telegram bots retain the private keys of their users’ wallets, which may be susceptible to theft.

UNIBOT market analysis

Following a peak value of $199.80 on July 28, UNIBOT’s price fell by over 30% within a week, likely due to early investors seeking to take profits and some FOMO buyers engaging in panic selling.

Nonetheless, given the strong fundamentals supporting the token, the uptrend does not appear to resemble a pump-and-dump scheme.

Nansen’s analysis indicates that the UNIBOT token has a “diversified token ownership, long-term holders are taking some profits and smart money is growing.”

The on-chain analytics firm tweeted that “19 smart money addresses own more than 50 Unibot,” reflecting their interest in revenue sharing. Smart money wallets represent prolific and highly profitable traders.

Exchanges such as Huobi, Gate, and Bitget also hold substantial amounts of UNIBOT tokens. Nansen’s tweet further noted that on-chain movements reveal one “address funded by Binance, which has been buying relatively small amounts of UNIBOT consistently,” potentially indicating a future listing on Binance.

UNIBOT has rebounded from support around the July low of $100.86. If buyers continue to establish support above this level, UNIBOT’s positive rally may persist as usage increases.

UNIBOT price action. Source: CoinGecko

UNIBOT price action. Source: CoinGecko

While Unibot’s fundamentals and on-chain distribution of the token appear promising, the project is exposed to potential risks from technical exploits.

However, if adverse scenarios do not materialize, Unibot’s utility and real yield from the UNIBOT token will likely continue to drive its price upward.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.