Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Trader Joe enters the top five decentralized exchanges as the Liquidity Book model succeeds on Arbitrum.

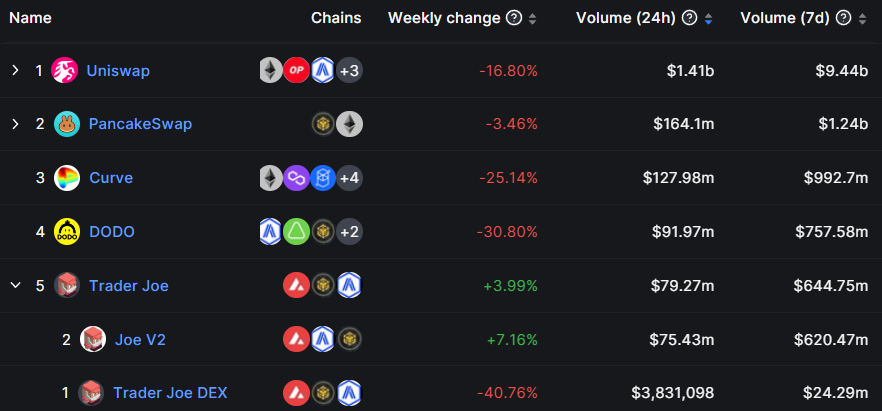

Trader Joe has ascended into the top five decentralized exchanges (DEXs) by trading volume following the introduction of its v2 platform on Arbitrum on February 1.

Top five DEXs by seven-day trading volume. Source: DeFiLlama

Top five DEXs by seven-day trading volume. Source: DeFiLlama

The initiative initiated a liquidity incentive program to enhance deposits for trading ARB, Ether (ETH), and USD Coin (USDC) on Arbitrum, distributing rewards totaling 300,000 JOE, valued at approximately $171,000. This incentive program is set to conclude on April 6.

The project’s social media account indicated that Trader Joe represented 15.7% of the overall ARB trading volume during the initial week.

We do a little trading at Trader Joe's.

Liquidity Book powered 15.7% of all $ARB trading on-chain in the first 7 days pic.twitter.com/qlcYwvXFrp— Trader Joe | (@traderjoe_xyz) April 2, 2023

While JOE incentives contributed to the increase in liquidity for ARB, the team’s innovation in enhancing the capital efficiency of the DEX is the main factor driving its expansion.

Trader Joe rises in the DEX landscape

Trader Joe introduced a Liquidity Book (LB) model with its v2 upgrade in Q4 2022, which competes with Uniswap v3’s liquidity framework.

The model allows liquidity providers (LPs) to supply liquidity in specific “price bins” to enhance capital efficiency. A Delphi report highlighted that its structure offers “zero-slippage” and “provides much more flexibility due to its fungible nature and enhances the experience for LPs.”

Prominent decentralized finance (DeFi) user Yash commended the DEX for its innovation, which is leading to organic growth.

It took 3 months, but here it is. @traderjoe_xyz is at 2nd rank on Arbitrum by volume(7 days).

Ponzinomics can help protocol gain usage & token price go up in short term. But for long-term sustainability, you need innovation at the protocol layer. https://t.co/WVY8joULYn pic.twitter.com/AAWKz2dkOL— yash (@yashcrypto21) April 4, 2023

The objectives of Uniswap v3 and LB models are to concentrate liquidity around active trading ranges to maximize fees for liquidity providers and minimize slippage for traders.

At present, Trader Joe seems well-positioned to capture market share across emerging ecosystems such as Ethereum layer 2s and sidechains. However, in addition to Uniswap, the project faces competition from a significant event triggered by source code licensing policies.

Uniswap v3’s code license expired on April 4, permitting teams to fork its design for their DEXs. PancakeSwap, the leading DEX on BNB Smart Chain, was among the first to fork Uniswap’s model to establish trading desks on BNB Chain, Aptos, and Ethereum-based blockchains.

Related: Arbitrum’s ARB token signifies the start of airdrop season — Here are 5 to look out for

JOE price analysis

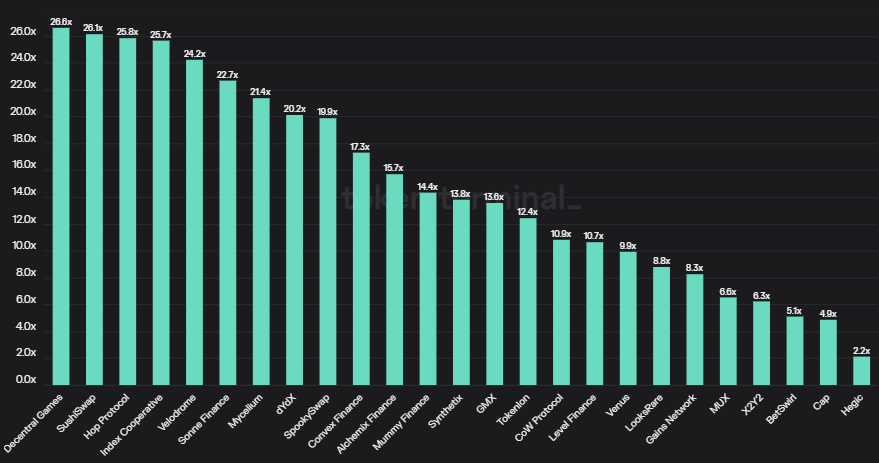

The Delphi report projected a price-to-earnings ratio (P/E) to fall between 15.5 and 7.5 (adjusted for the last trading price of $0.57) for sJOE tokenholders following the launch of V2.1, anticipated in the second week of April.

A P/E ratio below 15.2 would position Trader Joe among the top 15 protocols regarding real earnings for tokenholders, according to Token Terminal data. The P/S ratio, calculated by dividing the fully diluted market capitalization of a token by its annualized revenue for tokenholders, exceeds 15 for well-known DeFi protocols like dYdX, SushiSwap, and Convex Finance.

The P/S ratio of cryptocurrency protocols. Source: Token Terminal

The P/S ratio of cryptocurrency protocols. Source: Token Terminal

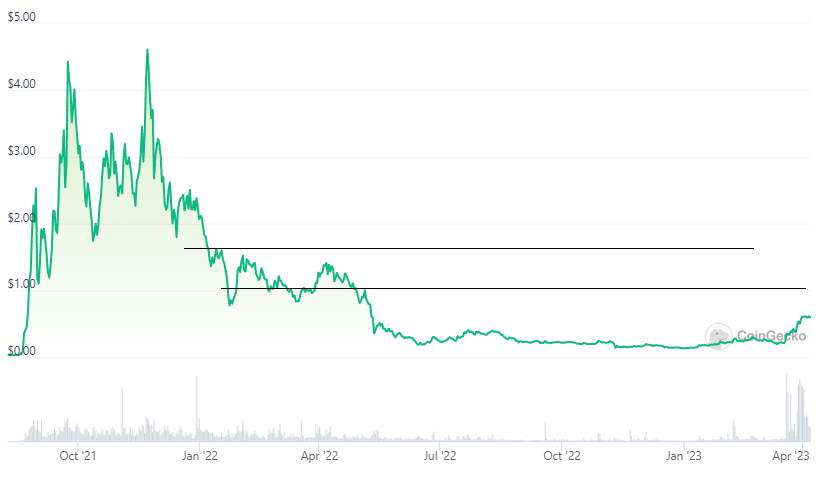

The price of JOE has emerged from its prolonged dormancy from last year due to advancements made with the LB design and migration to additional platforms beyond Avalanche.

JOE price chart. Source: CoinGecko

JOE price chart. Source: CoinGecko

The token currently targets upward movement toward the 2022 breakdown levels around $1.01 and the January 2022 peak of $1.52. On the downside, support is found between the $0.13 to $0.20 range.

The views, thoughts, and opinions expressed here are solely those of the authors and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not provide investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own research before making a decision.