Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Solana on-chain and derivatives information underscore the constraints on SOL’s possible price surge.

Solana experienced two favorable advancements this week with the introduction of the Saga smartphone, which operates on the Solana blockchain, and the retail trading launch of Grayscale’s Solana Trust shares.

These developments, combined with optimism in the wider market, propelled the price of SOL by 29.05% from April 11, reaching a monthly peak of $26.03.

While the mobile launch positively impacts the Solana ecosystem, the Saga phone seems to be priced high at over $1,000 each. Nonetheless, it has garnered favorable reviews regarding user experience and quality.

Independent cryptocurrency investor, Amy Wu, remarked that “Saga-exclusive dApps, games, and rewards will be available as the phone is distributed globally, which will also help justify the $1,000 premium price.” It remains to be observed how the Solana Foundation will manage marketing efforts for the phone in competition with established brands like Samsung and Apple.

The Grayscale fund currently holds only $2.9 million in assets under management (AUM) in the Solana Fund, which is significantly lower than the 24-hour trading volume of SOL, which exceeded $500 million, limiting its impact on price.

There are also indications of stagnation in on-chain metrics and a lack of bullish sentiment in the derivatives market, posing a risk of a sharp correction.

NFTs support the Solana ecosystem

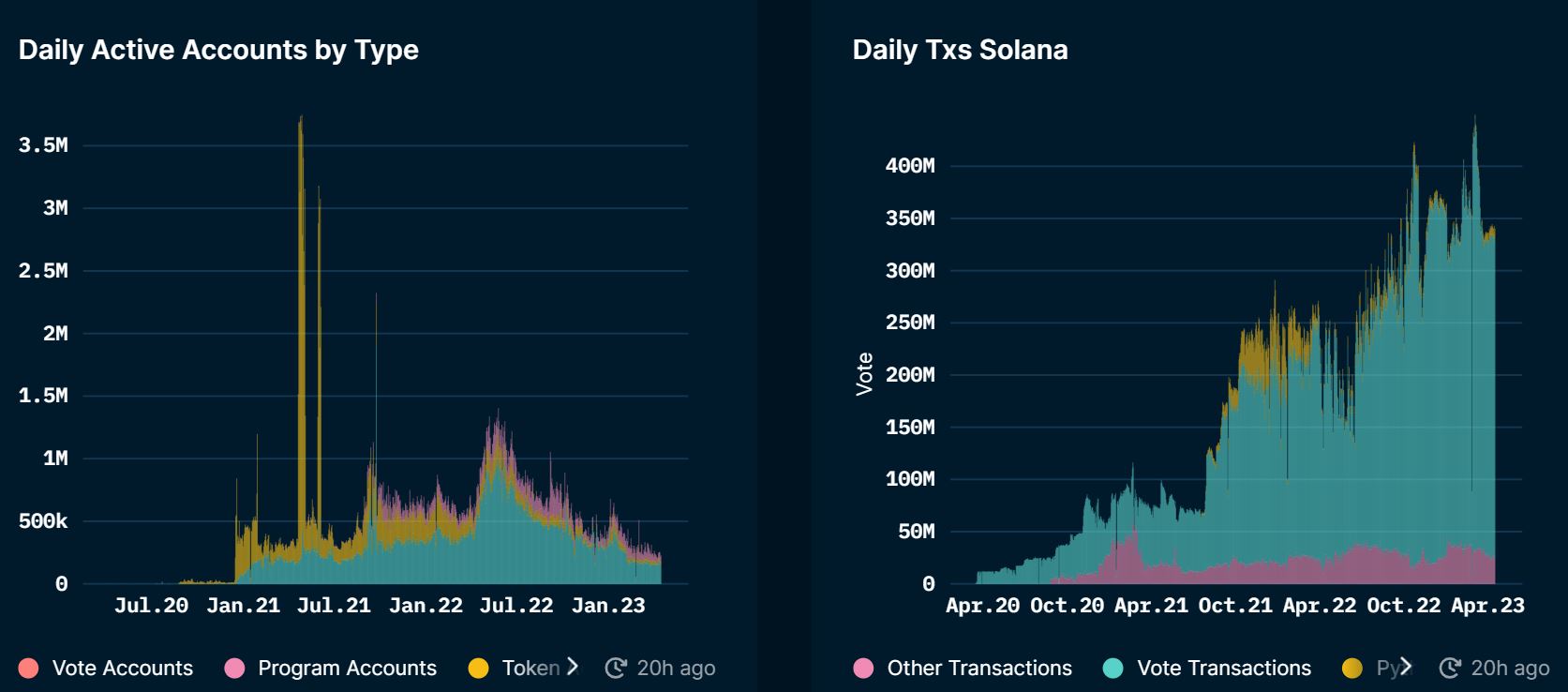

The daily transaction count on Solana reached a new all-time high in April, indicating a steady upward trend. However, the number of daily active accounts has fallen to new lows, raising some concerns.

Solana daily active accounts and number of transactions. Source: Nansen

Solana daily active accounts and number of transactions. Source: Nansen

Solana’s DeFi ecosystem has diminished following the collapse of FTX, with a significant amount of liquidity withdrawn. The total deposits on Solana DeFi applications are below $300 million, resulting in Solana being removed from the top ten DeFi blockchains by liquidity value locked, according to DeFiLlama.

DeFi activity within the Solana ecosystem has been largely restricted to liquidity staking protocols, while decentralized exchanges and lending protocols have seen reduced engagement. It appears that NFTs are sustaining the ecosystem.

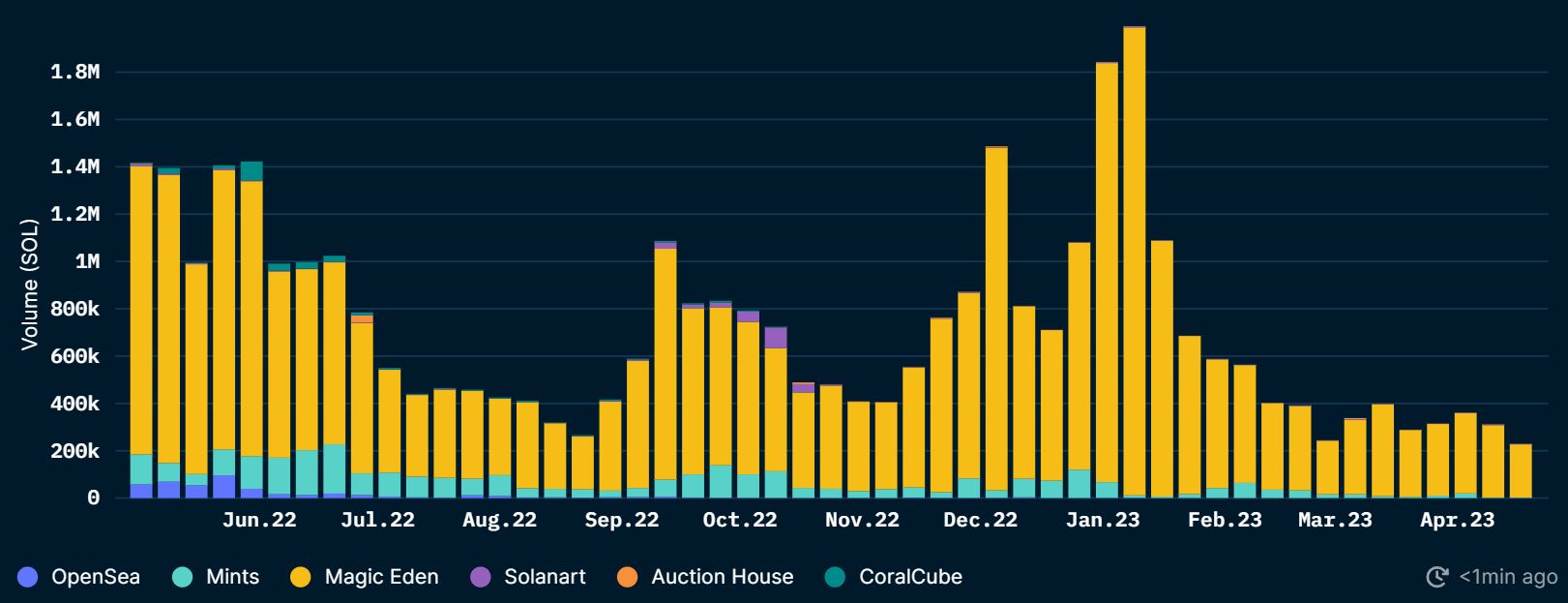

Solana’s market share in NFT trading increased from 6% to 14% of total NFT sales volume in less than a year by February 2023, as reported by Delphi Digital. It is now the second-largest NFT ecosystem after Ethereum. The report noted,

“The Solana NFT ecosystem is propelled by traders who are more financially motivated and engage in trading more frequently compared to Ethereum NFT users.” However, NFT trading volumes have decreased since February 2023, falling below the levels seen in November 2022, which is a concerning indicator.

NFT trading volumes on Solana marketplaces. Source: Nansen

NFT trading volumes on Solana marketplaces. Source: Nansen

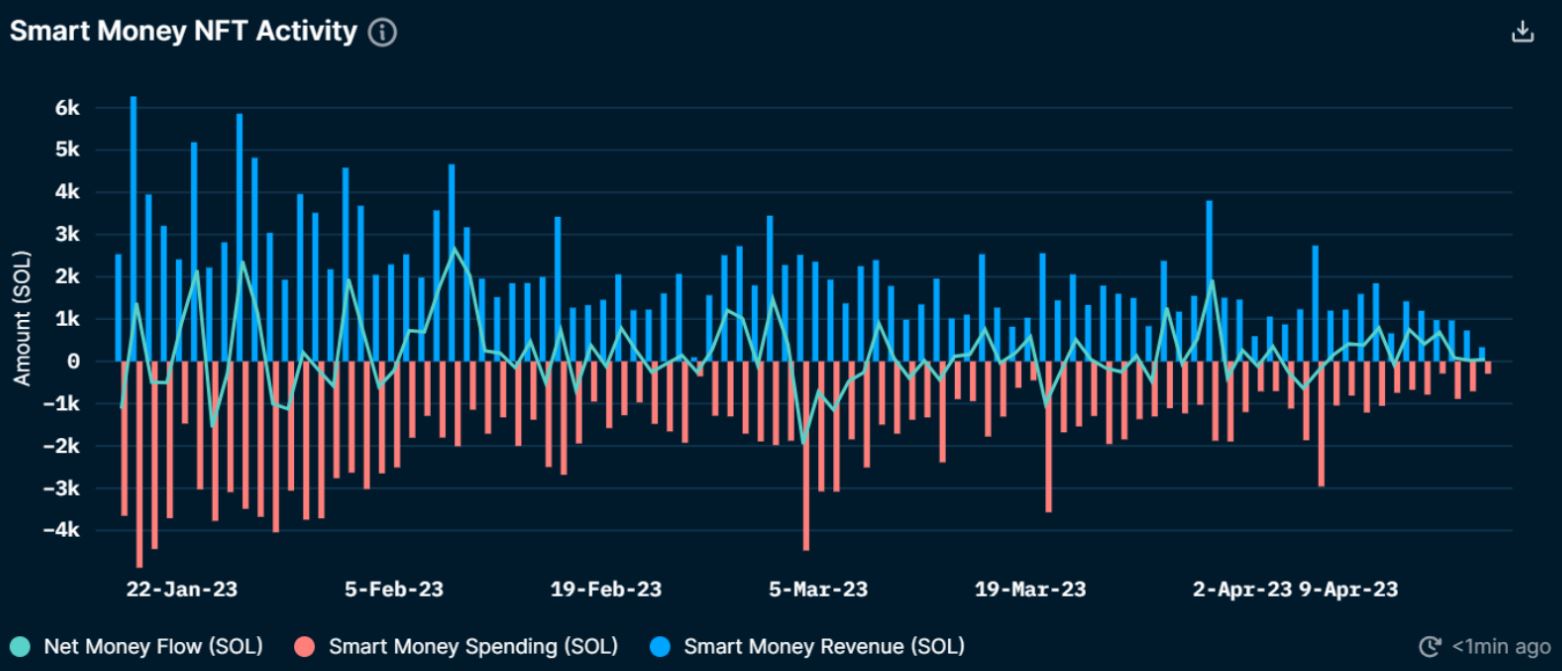

Furthermore, the activity of “smart money” has also significantly contracted, with fewer expenditures and profits recorded by “smart money” wallets. Nansen identifies prolific and active trading addresses as “smart money.”

Smart money revenue (blue), spending (red), and net money flow (green). Source: Nansen

Smart money revenue (blue), spending (red), and net money flow (green). Source: Nansen

Solana price action

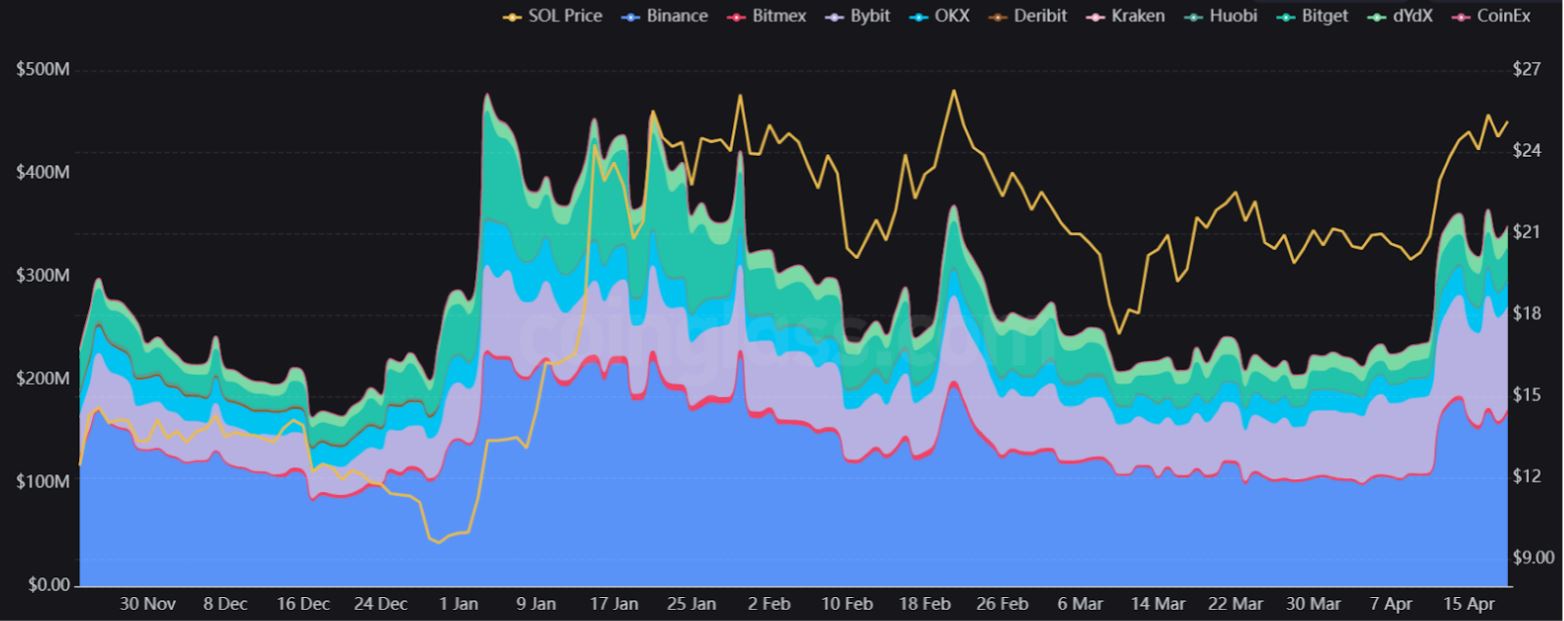

The Open Interest (OI) volumes for SOL futures, which indicate the number of open positions for SOL contracts, surged to a 2023 high, increasing from $239 million to $365 million within 48 hours following April 11, according to data from Coinglass.

The increase in SOL’s price aligns with the rise in OI volume, suggesting that derivatives activity is fueling the recent upward trend.

Open Interest volume for SOL futures contracts. Source: coinglass

Open Interest volume for SOL futures contracts. Source: coinglass

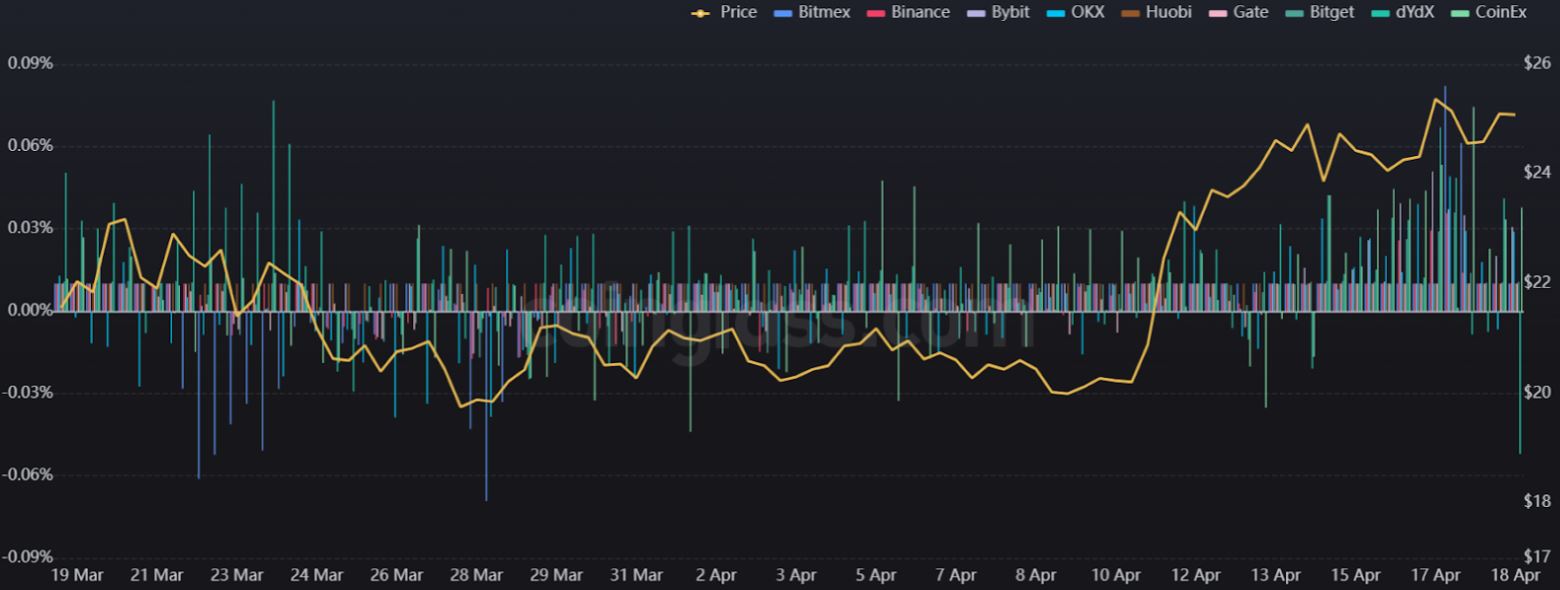

The growth in OI volumes is also accompanied by an increase in funding rates for perpetual swap contracts, indicating that leveraged traders are optimistic about the token. This serves as a bearish contrarian signal, as the market typically targets the stops of crowded perpetual orders.

Funding rate for SOL perpetual swaps. Source: Coinglass

Funding rate for SOL perpetual swaps. Source: Coinglass

The SOL/USD pair encounters resistance from the 50-day exponential moving average (EMA) at $25.40 and the 2022 breakdown levels around $29.76. The Moving Average Convergence Divergence (MACD) indicator, which measures momentum, indicates a divergence between the price increase and the MACD, suggesting a potential pullback. Support for the pair is found around the $20 mark.

Related: SOL price risks 20% drop despite Grayscale Solana Trust’s retail debut

SOL/USD price chart. Source: TradingView

SOL/USD price chart. Source: TradingView

The growth of the Solana ecosystem in NFT trading volumes has been notable, yet it has declined since February 2023, and the activity of smart money has significantly contracted.

The increase in open interest volumes for SOL futures and funding rates for perpetual swap contracts may indicate that derivatives activity is propelling the latest uptrend. Overall, while Solana has experienced positive developments, it remains uncertain how the ecosystem will maintain price growth.

The views, thoughts and opinions expressed here are the authors’ alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.