Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Matrixport executive compares memecoins to Powerball for cryptocurrency enthusiasts.

Buyers of memecoins are engaging in a crypto version of Powerball, with many “playing” in hopes of achieving “life-changing wealth,” though only a select few will secure the jackpot, according to the head of research at Matrixport.

Memecoins have experienced a significant revival over the past week. Tokens like Pepe (PEPE) and Milady (LADYS) have shown remarkable price increases, despite having minimal to no identifiable utility.

In an interview with Cointelegraph on May 10, Markus Thielen from Matrixport indicated that some memecoin purchasers resemble lottery participants.

“Numerous studies have shown that many individuals from lower socio-economic backgrounds engage in the lottery as a means to escape their economic situation,” he stated, adding:

“Those who speculate in the lottery aim to make quick profits, and I believe that’s quite similar in the crypto space.”

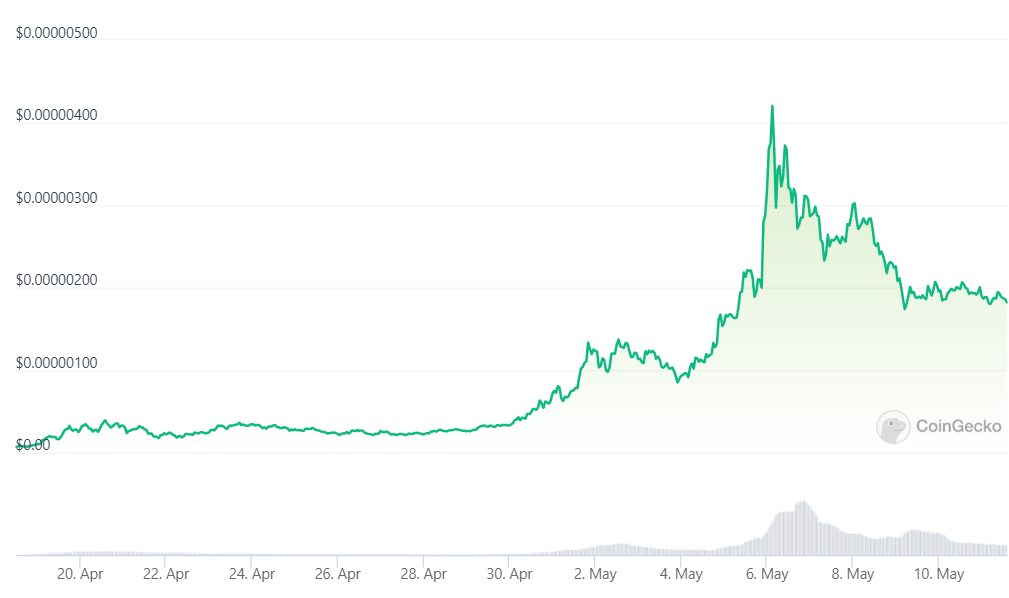

A memecoin that has recently captured the interest of enthusiasts is PEPE, a cryptocurrency leveraging the “Pepe the frog” meme. It was launched on April 14 and reached a peak market capitalization of $1.83 billion just weeks later on May 5.

However, the token’s price fell almost as swiftly as it rose, dropping 57% from its peak within just five days, according to CoinGecko, which now places its market cap significantly below one billion dollars.

Pepe token price since its launch on April 14. Source: CoinGecko

Pepe token price since its launch on April 14. Source: CoinGecko

Nonetheless, the “entertainment” aspect of purchasing memecoins should not be overlooked.

Dr. Anastasia Hronis, a clinical psychologist specializing in gambling addiction, believes that younger investors are often motivated by the “fun, entertainment aspect” of memecoins.

“Many crypto investors may acquire memecoins to feel part of a community or for their entertainment value.”

However, for those hoping to profit from their investments, Hronis warned:

“Memecoins like PEPE can be enjoyable, but they are typically very high-risk investments and may ultimately lack intrinsic value over time. Investors are essentially wagering on its popularity, which undermines the foundational principles of investing.”

In a statement via email, Lucas Kiely, Chief Investment Officer at digital wealth platform Yield App, contended that unlike Bitcoin (BTC), Ether (ETH), and stablecoins, memecoins lack the same foundational elements. Their prices are influenced solely by “arbitrary factors” such as community sentiment and are “nearly impossible to forecast.”

“Even the most advanced models have struggled to identify any clear trends,” Kiely noted.

Pros and whales still experience FOMO too

The unpredictability of memecoins does not imply that there are no opportunities for substantial returns. Professional investors and “crypto whales” have been, and will continue to be, involved in trading them.

Data from blockchain analytics firm Lookonchain reveals that “Machi Big Brother,” the online alias of former tech entrepreneur Jeffrey Huang, acquired a total of 73.4 ETH — approximately $137,000 — worth of Pepe in the last four days.

Related: Coinbase labels PEPE a ‘hate symbol,’ sparking calls for a boycott of the exchange

Three additional whales also began purchasing PEPE on May 9 following a price decline.

3 whales started to buy $PEPE after the price dropped.

0x50C1 withdrew 1.4T $PEPE($2.76M) from #Binance when the price was $0.000002054.

0x2Baa bought 212B $PEPE($429K) with 223 $ETH($412K) at $0.000001942.

0x3AE8 bought 424B $PEPE($864K) with 450 $ETH($831K) at $0.000001957. pic.twitter.com/Y3wFOshkDI— Lookonchain (@lookonchain) May 9, 2023

“When prices are high, it can be logical to invest,” Thielen remarked. “If it suddenly garners significant media attention and numerous stories, then I believe these individuals feel the need to invest as well.”

However, Thielen cautioned investors regarding memecoins like PEPE, where the development team remains anonymous and there is no clear roadmap.

“The goal is to be ahead of others and exit once the momentum shifts. This is why it is crucial to utilize stop-loss orders and limits when trading high-risk assets,” he advised.

“Everyone wants to sell (dunk) on someone in the memecoin space. The only question is who will be left holding the bag?”

Magazine: Cryptocurrency trading addiction — What to look out for and how it is treated