Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Lido Finance states that the Solana wind down is considered essential due to reduced fees.

Decentralized liquid staking platform Lido Finance has declared its intention to halt operations on the Solana blockchain following a community vote within Lido’s decentralized autonomous organization.

The initiative to discontinue Lido on Solana was initially proposed by Lido’s peer-to-peer team on September 5, highlighting unviable financials and minimal fees generated by Lido on Solana. Voting began on September 29 and concluded a week later on October 6.

“Following thorough discussions in the DAO forum and a community vote, the decision to sunset the Lido on Solana protocol was ratified by Lido token holders, and the process will commence soon,” Lido stated in a post on October 16.

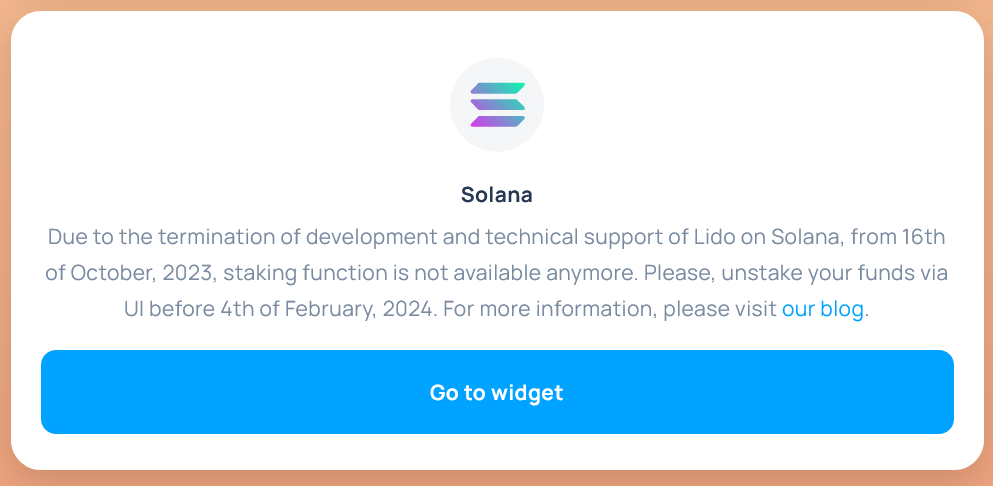

As of October 16, Lido will no longer accept staking requests. The voluntary off-boarding of node operators will start on November 17, and Lido users must unstake via Solana’s frontend by February 4.

“Post this date, unstaking will have to be conducted using the CLI,” Lido added.

After thorough DAO discussions followed by community voting, the sunsetting of Lido on Solana was approved by LDO holders and will commence shortly.

More information here: https://t.co/MyImL1qpap— Lido (@LidoFinance) October 16, 2023

The initial proposal requested $20,000 monthly from Lido DAO to assist with the technical maintenance required for winding down operations on Solana over the next five months.

Lido’s announcement regarding the cessation of services on Solana. Source: Lido.fi

Lido’s announcement regarding the cessation of services on Solana. Source: Lido.fi

Lido’s P2P team has been engaged with the Lido on Solana project since acquiring it in March 2022 from Chorus One.

Since the acquisition, the P2P team has invested approximately $700,000 into Lido on Solana and generated $220,000 in revenue, leading to a net loss of $484,000, as reported by mediakov, the proposal’s author.

The alternative presented in the September 5 proposal was to allocate additional funding to Solana from Lido DAO; however, 65 million (92.7%) of the 70.1 million LDO tokens voted by token holders favored the discontinuation of operations on Solana, according to the open-source voting platform Snapshot.

Lido articulated that the decision was challenging but essential:

“While this decision was difficult given the many strong connections within the Solana ecosystem, it was considered necessary for the ongoing success of the broader Lido protocol ecosystem.”

Lido confirmed that holders of staked-Solana (stSOL) tokens will continue to earn network rewards throughout the sunsetting phase.

Related: Lido Finance reveals 20 slashing incidents due to validator configuration issues

Lido’s staking services are currently available only on Ethereum and Polygon, where $14 billion and $80 million are staked, respectively, as per Lido’s website.

Lido commenced operations on Solana on September 8, 2021, when SOL was valued at $189 — an 87% decline from its current price of $24, according to CoinGecko.

Despite this announcement, SOL has risen by 8.6% in the past 24 hours.

SOL’s price fluctuations over the past week. Source: CoinGecko

SOL’s price fluctuations over the past week. Source: CoinGecko

Magazine: DeFi Dad, Hall of Flame: Ethereum is ‘woefully undervalued’ but gaining strength