Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

FTX’s previous legal firm faces lawsuit claiming it established covert organizations.

Fenwick & West LLP, the former primary legal counsel for FTX, is facing a class-action lawsuit alleging its involvement in the purported multi-billion dollar fraud associated with the crypto exchange.

A filing dated Aug. 7 by a group of FTX customers in a California District Court accused the law firm of establishing various “shadowy entities” that enabled FTX co-founder Sam Bankman-Fried and other executives to implement “creative yet unlawful strategies” to sustain fraudulent activities.

The lawsuit asserts that Fenwick & West delivered services to FTX that “exceeded the typical scope of a law firm’s offerings,” including structuring acquisitions by FTX US in ways that evaded regulatory oversight and providing personnel to carry out strategies proposed by the law firm.

The “shadowy entities” identified in the suit include North Dimension and North Wireless Dimension, which were alleged to have diverted misappropriated funds from FTX customers.

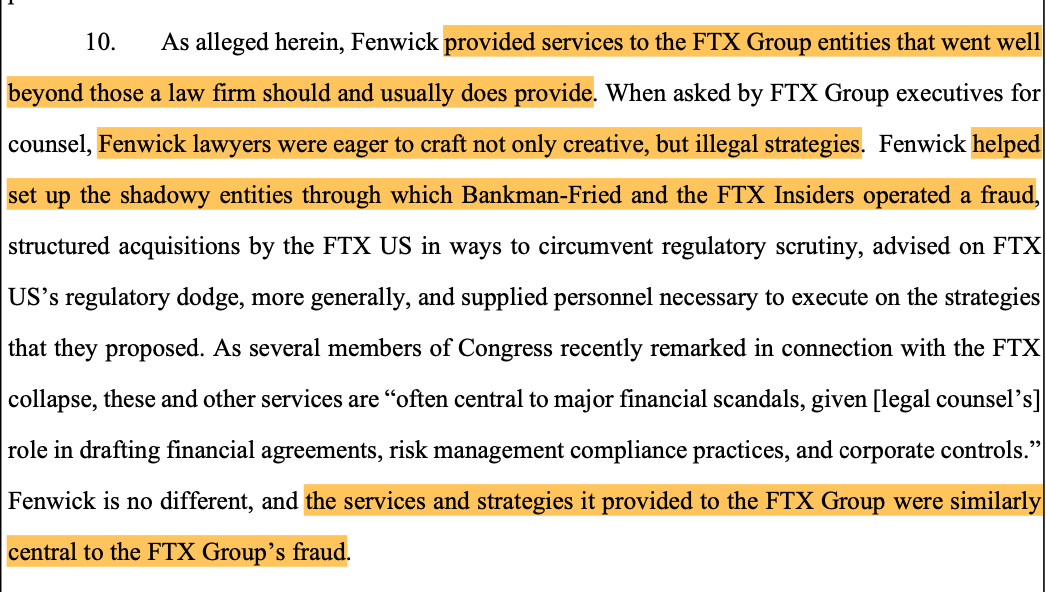

Highlighted excerpt from the class complaint against Fenwick & West. Source: CourtListener

Highlighted excerpt from the class complaint against Fenwick & West. Source: CourtListener

The plaintiffs contended that Fenwick & West facilitated FTX’s alleged fraud by failing to intervene in a series of misrepresentations purportedly made by FTX to its clients.

The class action indicated that there was an implied agreement among FTX US, other FTX affiliates, and Fenwick & West to mislead customers, a situation that was reportedly advantageous for the law firm as it “stood to gain financially” from FTX’s alleged wrongdoing.

The plaintiffs listed four individuals as FTX insiders: Bankman-Fried, former Alameda Research CEO Caroline Ellison, former FTX co-founder Gary Wang, and former FTX engineering lead Nishad Singh.

Fenwick & West was previously named in a similar class-action lawsuit in February, which also claimed it assisted Bankman-Fried and FTX in establishing their operations.

The February lawsuit, which also included FTX investor and venture capital firm Sequoia Capital as a defendant, alleged that the services rendered by Fenwick & West were integral to Bankman-Fried’s fraudulent activities.

According to a report by Reuters on June 21, the law firm has recently engaged peer firm Gibson Dunn to help with legal issues concerning its alleged involvement with FTX.

Related: Prosecutors will still consider Sam Bankman-Fried’s alleged campaign finance scheme at trial

FTX collapsed and filed for bankruptcy in November 2022 after it was unable to handle a significant volume of customer withdrawals.

Bankman-Fried remains under house arrest and faces 12 charges, including wire fraud, conspiracy, and money laundering. He is scheduled for two criminal trials in October and March.

On Aug. 8, prosecutors announced their intention to reinstate a charge related to illegal campaign finance, which had previously been dropped due to potential violations of a treaty obligation with the Bahamas.

Cointelegraph reached out to Fenwick & West for a comment but did not receive an immediate response.

Magazine: Deposit risk: What do crypto exchanges really do with your money?