Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Can large Cardano holders prevent a 20% decline in ADA’s value?

The value of Cardano (ADA) faces the possibility of declining by more than 20% in August as it enters a breakdown phase of a traditional technical formation, which may be counterbalanced by some encouraging fundamentals.

ADA price may drop to June lows

Known as Bump-and-Run-Reversal (BARR), this pattern emerges when excessive speculation propels prices upward rapidly, ultimately resulting in a “bull trap” scenario. The price trend progresses through three phases — Lead-in, Bump, and Run — as illustrated below.

Bump-and-Run-Reversal illustration. Source: Warrior Trading

Bump-and-Run-Reversal illustration. Source: Warrior Trading

During the Lead-in phase, the price moves upward in a systematic manner — free from excessive speculation. However, the Bump phase experiences a sudden surge in prices, which is then followed by a complete reversal of that spike.

In the Run phase, the price falls below the support established by the Lead-in trendline. At present, Cardano seems to have entered the Run stage of its BARR pattern, as depicted below.

ADA/USD daily price chart. Source: TradingView

ADA/USD daily price chart. Source: TradingView

If the pattern is validated, the downside target for BARR is calculated by subtracting the breakdown point at the support line from the maximum height of the pattern. This suggests a price target for ADA around $0.22 in August or early September, representing a 20% decrease from current levels.

On the other hand, a rebound in ADA could reach the 50-day exponential moving average (50-day EMA; the red wave in the chart below) near $0.30 in August, indicating a 5% increase from current prices.

ADA/USD daily price chart. Source: TradingView

ADA/USD daily price chart. Source: TradingView

Moreover, converting the wave into support could lead to a further increase towards the 200-day EMA (the blue wave) near $0.34, reflecting an approximate 30% rise from current price levels.

Whales and sharks purchase ADA price dips

On-chain fundamentals, however, may mitigate the bearish risks associated with Cardano.

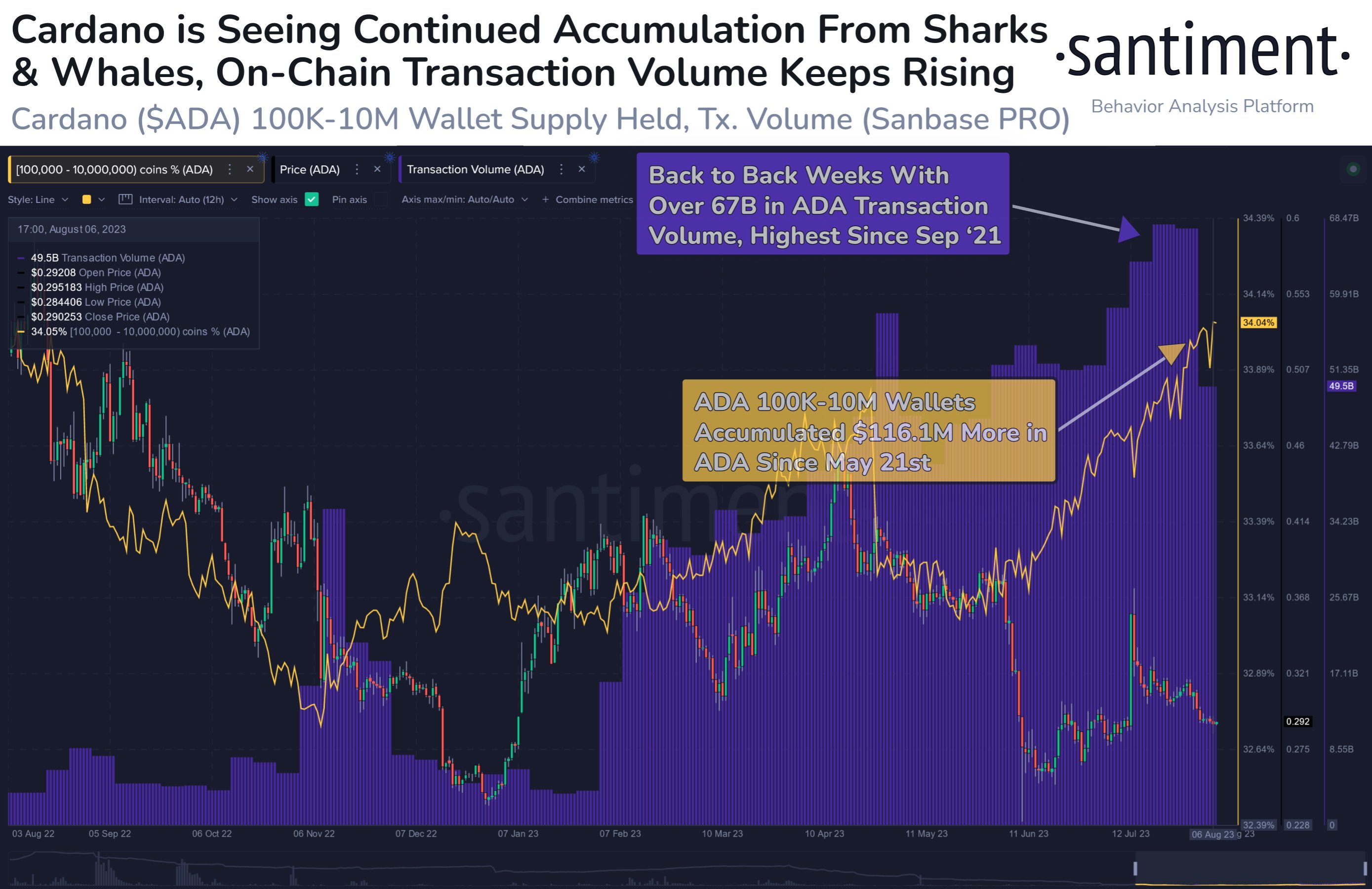

Significantly, whale and shark wallets holding between 100,000 and 1 million ADA have accumulated $116.1 million worth of Cardano since May 2023, elevating their net holdings to the highest levels since September 2022.

Cardano whales and shark accumulation in recent months. Source: Santiment

Cardano whales and shark accumulation in recent months. Source: Santiment

This accumulation phase for Cardano coincides with a 25% price drop attributed to regulatory concerns in the United States.

Related: Here’s what happened in crypto today

In summary, ADA whales and sharks have capitalized on the price dip, anticipating future gains.

Cardano TVL, dapp transactions increase

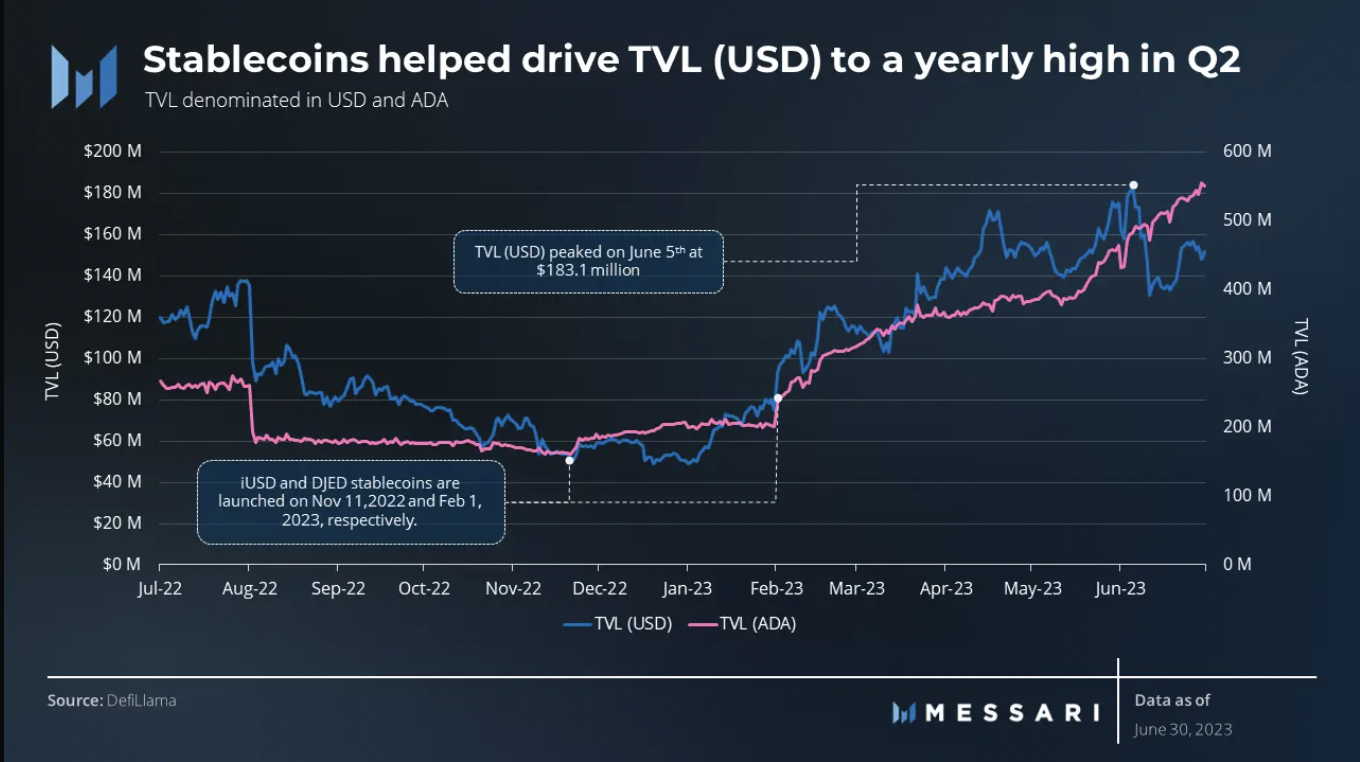

Furthermore, the period of ADA accumulation coincided with an increase in Cardano’s key network metrics during the second quarter. Specifically, the total-value-locked (TVL) rose by 9.7% quarter-on-quarter (QoQ), while average daily dapp transactions surged by 49% QoQ.

Cardano TVL denominated in the U.S. dollar and ADA. Source: Messari

Cardano TVL denominated in the U.S. dollar and ADA. Source: Messari

Stablecoins have driven this TVL and dapp transactions, increasing by 34.9% QoQ — from $10.0 million in Q1 to $13.5 million in Q2. This rise in network activity is expected to contribute to upward pressure on ADA, which functions as a fee settlement and staking token within the Cardano ecosystem.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.