Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin surpasses $31,000 as Ethereum’s rise fuels discussions of an ‘altseason’

On April 14, Bitcoin (BTC) surpassed the $31,000 mark, as bullish investors anticipated that altcoins would soon follow suit.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Analyst considers possible dip below $30,000

Data from Cointelegraph Markets Pro and TradingView recorded new ten-month highs of $31,035 for BTC/USD on Bitstamp.

The pair had gradually increased the previous day following a consolidation phase around new macroeconomic data releases from the United States.

These developments bolstered the bullish narrative for risk assets, as both the Consumer Price Index (CPI) and Producer Price Inflation (PPI) figures indicated that inflation was decreasing more rapidly than anticipated.

Although Bitcoin did not respond immediately, the recent rise strengthened market participants’ beliefs in ongoing resilience and a departure from the long-term downtrend.

“Bitcoin appears robust, but will experience some minor corrections within an upward trend,” Michaël van de Poppe, founder and CEO of trading firm Eight, predicted on that day.

“I’ve identified $31.7-32K as a significant resistance level. However, $25K was the price point everyone aimed to buy at. This will likely shift to $28.5K, at which point interest will wane. I would prefer to concentrate on $29.7K.”

BTC/USD annotated chart. Source: Michaël van de Poppe/ Twitter

BTC/USD annotated chart. Source: Michaël van de Poppe/ Twitter

Van de Poppe referred to earlier worries regarding a more significant correction on BTC/USD, with cautious price targets including the 200-week moving average around $25,500 and even $22,000.

Related: Best and worst countries for crypto taxes — plus crypto tax tips

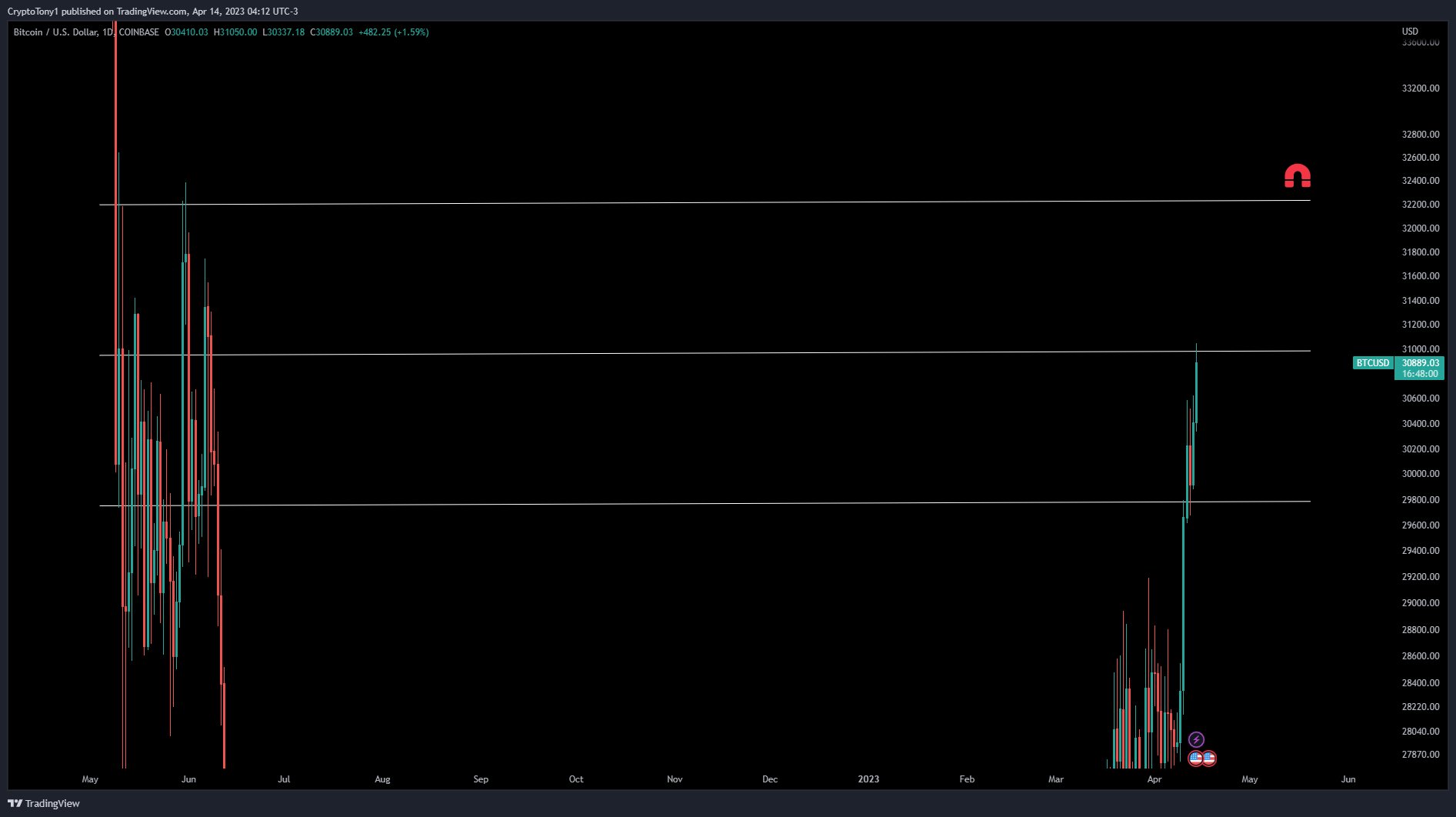

Popular trader Crypto Tony, however, recommended that potential long position entries wait for confirmation of new support levels.

“We have now entered the range of $31,000 EQ and $32,300 Range high,” part of the day’s Twitter analysis noted, accompanied by a chart illustrating the potential high, low, and equilibrium (EQ) level of the new range.

BTC/USD annotated chart. Source: Crypto Tony/ Twitter

BTC/USD annotated chart. Source: Crypto Tony/ Twitter

"Altseason is underway"

Once again, altcoins took center stage, particularly Ethereum (ETH) following its Shanghai upgrade, also referred to as Shapella.

Related: Bitcoin’s dominance knocked by ETH’s post-Shapella rally

After hinting at a reclaim of $2,000 the previous day, ETH/USD surged to $2,130 — marking its highest levels since May 2022.

ETH/USD 1-week candle chart (Bitstamp). Source: TradingView

ETH/USD 1-week candle chart (Bitstamp). Source: TradingView

Reactions were predictably positive regarding the overall strength of the crypto market.

“With the $BTC bottom being in and our final 5th impulse confirmed (in my opinion). I believe that the bottom is likely also in for many (not all) altcoins,” popular trader Credible Crypto summarized, referencing a theory from a recent YouTube video.

“Coins like $ETH and several others have likely reached their lows and have begun the journey toward new all-time highs.”

Credible Crypto acknowledged that Bitcoin was “in the driver’s seat mid-term,” and that a cooling off period for BTC price action would be necessary to trigger rapid growth in altcoins.

Nonetheless, sentiment was filled with mentions of “altseason” that day, including from former BitMEX CEO, Arthur Hayes.

Allow me to reintroduce myself. My name is ALTSZN!!! pic.twitter.com/yIzE7Zxpaw

— Arthur Hayes (@CryptoHayes) April 14, 2023

Financial commentator Tedtalksmacro also declared altseason “underway,” highlighting that the total altcoin market cap had increased by $62 billion in two weeks.

Others referred to “mini altseason” and “altseason 2.0,” suggesting that gains in altcoins would likely follow an initial surge led by Bitcoin.

The views, thoughts, and opinions expressed here are solely those of the authors and do not necessarily reflect or represent the views and opinions of Cointelegraph.