Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin ‘large holders’ drive BTC price to $30K amid increased volatility in cryptocurrency market.

On April 18, Bitcoin (BTC) climbed back above $30,000 as market fluctuations occurred ahead of the Wall Street opening.

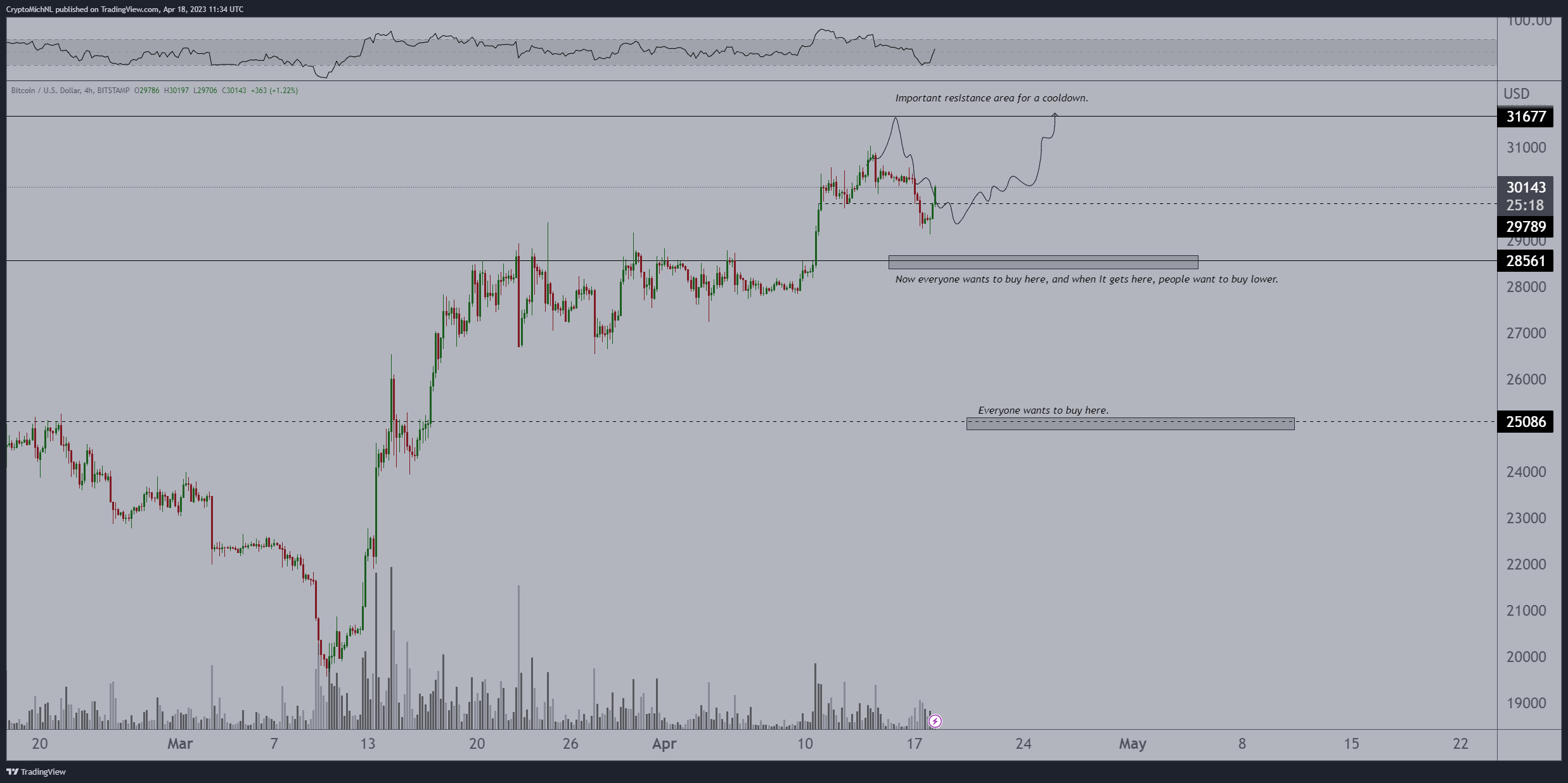

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

Bitcoin recovers from intraday declines

Data from Cointelegraph Markets Pro and TradingView tracked BTC/USD as the pair unexpectedly surged by $500, resulting in daily gains exceeding 3%.

Prior to this increase, traders were concerned as the $30,000 support appeared to be transitioning into a longer-term resistance level.

The fact that #BTC attempted another retest of the Higher High in a short timeframe raised concerns

Ultimately, $BTC Daily Closed below Higher High & may now be reverting it back into resistance

Needs to Daily Close above the HH to regain bullishness#Crypto #Bitcoin https://t.co/zMNvuNjxRH pic.twitter.com/HbsJJ0xszL— Rekt Capital (@rektcapital) April 18, 2023

Before surpassing the $30,000 threshold, Binance order book activity was closely monitored by the resource Material Indicators, which noted that bid liquidity was moving nearer to the spot price.

“Some has already begun to shift closer to the active trading zone. Observing whether more follows or if the price retreats back into the $28s to fill,” part of the accompanying commentary stated.

A later update revealed that the largest category of high-volume traders, referred to as “mega whales,” was driving the upward movement.

#FireCharts indicates approximately $50M in #BTC bid liquidity laddered from the $29k-$28k range that aims to be filled. Some has already started moving closer to the active trading zone. Watching to see if more of it follows or if price drops back into the $28s to fill pic.twitter.com/TvAtL3MU0i

— Material Indicators (@MI_Algos) April 18, 2023

In response to the latest BTC price developments, Michaël van de Poppe, founder and CEO of trading firm Eight, expressed a positive outlook.

“There we go for Bitcoin. Breaks through $30K, indicating that we’re back in the range,” he tweeted alongside a chart highlighting key levels.

“Most preferred a retest at $29.7K would facilitate continuation towards new highs and towards $40K.”

BTC/USD annotated chart. Source: Michaël van de Poppe/ Twitter

BTC/USD annotated chart. Source: Michaël van de Poppe/ Twitter

Further fluctuations were anticipated on lower timeframes ahead of the Wall Street opening.

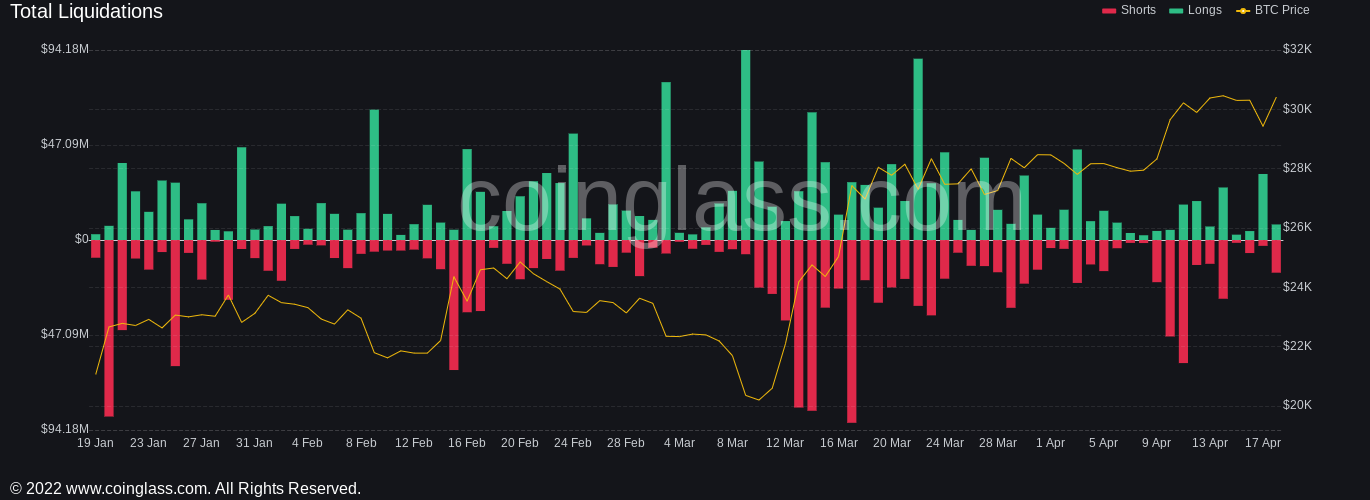

Those anticipating additional declines were already experiencing pressure, with data from Coinglass revealing $16 million in BTC short liquidations for the day.

Bitcoin liquidations chart. Source: Coinglass

Bitcoin liquidations chart. Source: Coinglass

Ethereum drives altcoin recovery

Altcoins also benefited from the abrupt Bitcoin reversal, with Ether (ETH) rising 2% on the day.

Related: BTC price heading under $30K? 5 things to know in Bitcoin this week

The largest altcoin by market capitalization moved back toward the upper end of its intraday trading range, having successfully maintained $2,000 as support.

The bulls’ objective to break remained at $2,140 from April 16, which represents ETH’s highest point since May 2022.

Ether’s 15% gains against Bitcoin since the Shapella upgrade have also been noted.

ETH/USD 1-week candle chart (Bitstamp). Source: TradingView

ETH/USD 1-week candle chart (Bitstamp). Source: TradingView

Magazine: Why join a blockchain gaming guild? Fun, profit and create better games

The views, thoughts, and opinions expressed here are solely those of the authors and do not necessarily reflect or represent the views and opinions of Cointelegraph.