Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Altcoins Display Upward Trend During Cryptocurrency Market Recovery Initiatives

- Bitcoin (BTC) price remains within the $26K range.

- Some altcoins such as XRP, SHIB, and LTC have shown gradual positive price movement.

Following last week’s sell-off, the global cryptocurrency market has been attempting to stabilize. Bitcoin, the leading cryptocurrency, dropped from $29,000 to a two-month low of $25,800 in a single day. Although it has made efforts to rebound, Bitcoin’s value has stayed relatively unchanged, fluctuating around the $26,000 level.

While the downward trend appears to have slowed for many altcoins, the overall recovery of most assets has been lackluster after the significant drop on August 17th. In the midst of this downturn in the broader cryptocurrency market, several altcoins are beginning to display signs of positive momentum in their price movements. Specifically, XRP, SHIB, and LTC have managed to gradually rise by approximately 2% over the last 24 hours.

The strength of these particular altcoins and their capacity to sustain upward movement may suggest a potential shift in sentiment within the cryptocurrency sector.

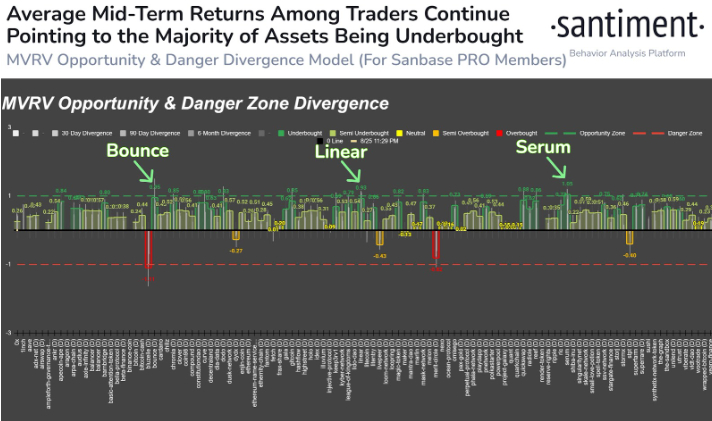

MVRV Divergence Chart (Source: Twitter)

MVRV Divergence Chart (Source: Twitter)

However, according to market data provider Santiment, the average mid-term returns preferred by traders consistently show that a majority of assets are currently in underbought conditions. The divergence between the MVRV opportunity and danger zones is becoming increasingly clear. Market Value to Realized Value (MVRV) is a metric that compares a cryptocurrency’s current market capitalization to its historical average value, aiding in the evaluation of overvaluation or undervaluation.